This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-40 (IT-40PNR; State Form 53385) Schedule IN-529

for the current year.

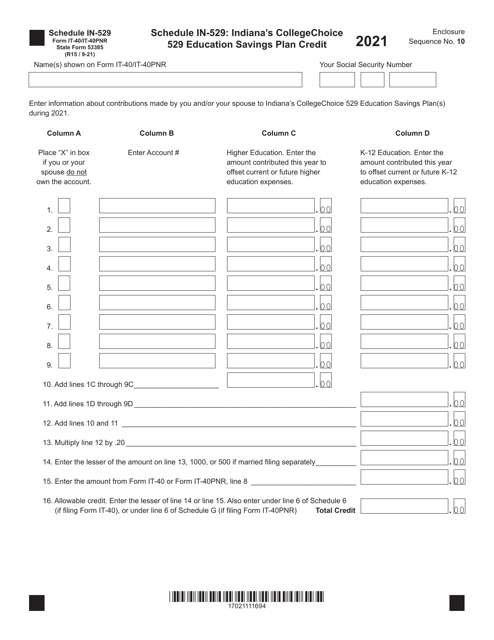

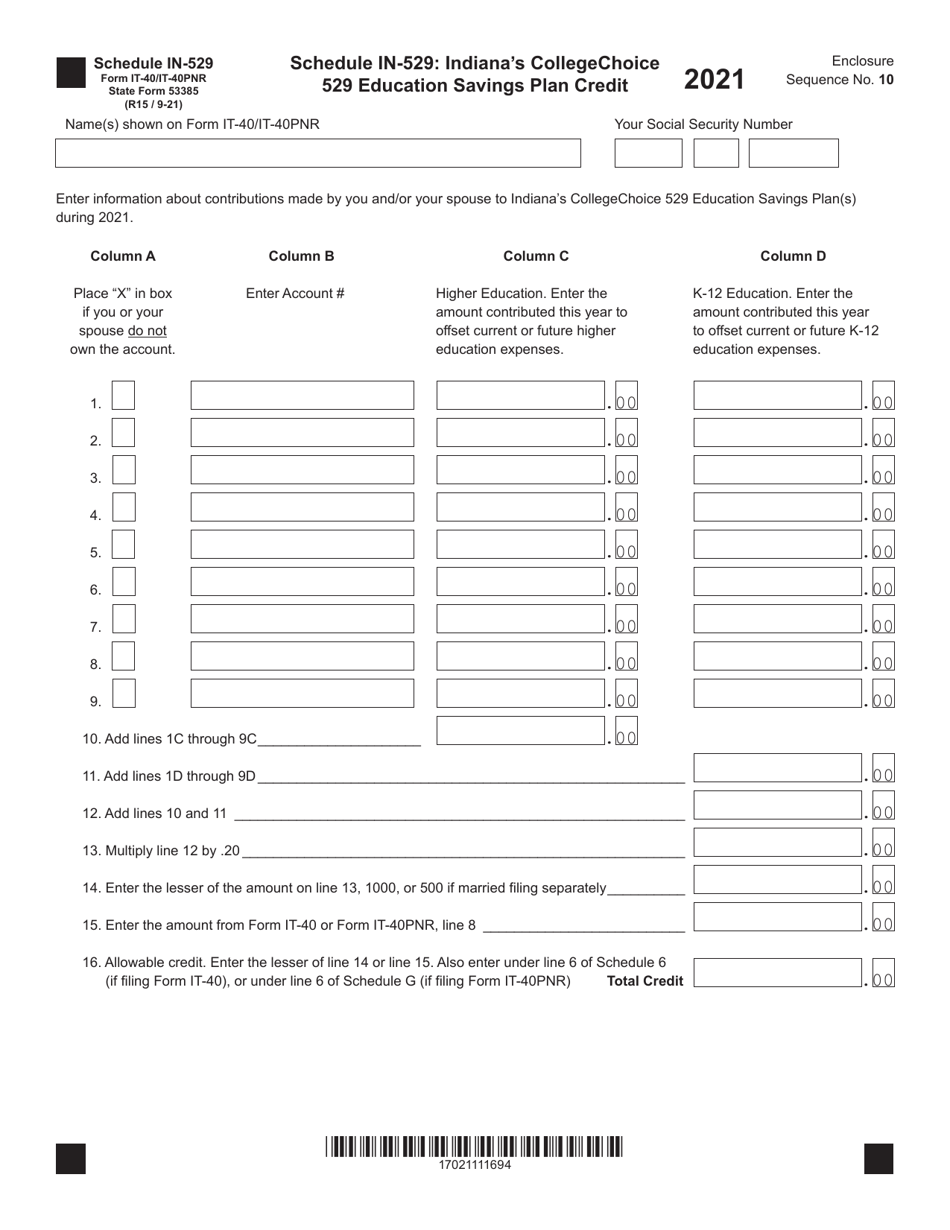

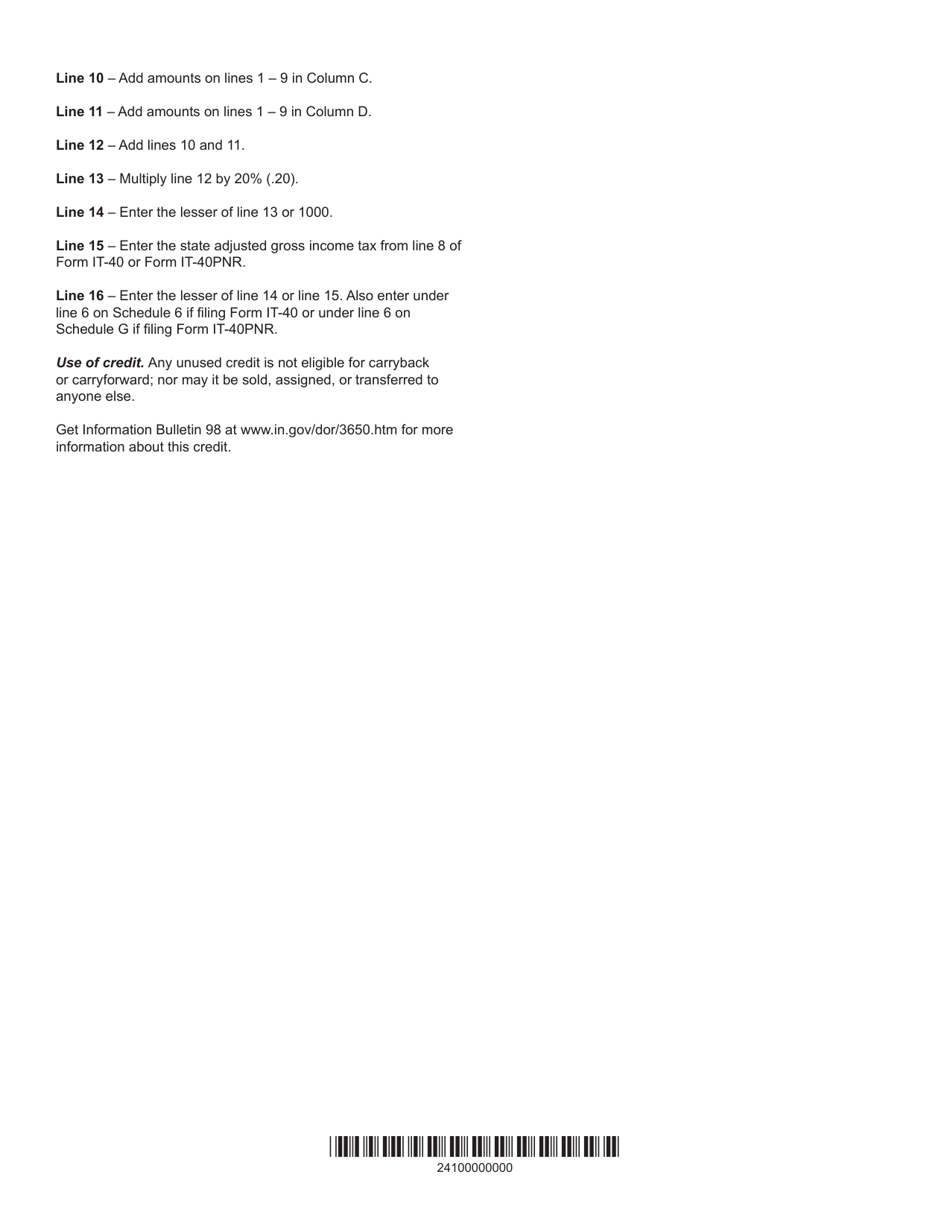

Form IT-40 (IT-40PNR; State Form 53385) Schedule IN-529 Indiana's Collegechoice 529 Education Savings Plan Credit - Indiana

What Is Form IT-40 (IT-40PNR; State Form 53385) Schedule IN-529?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana.The document is a supplement to Form IT-40, and Form IT-40PNR. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-40?

A: Form IT-40 is a tax form used by residents of Indiana to file their state income taxes.

Q: What is IT-40PNR?

A: IT-40PNR is a variant of Form IT-40 used by part-year or nonresident individuals to file their Indiana state income taxes.

Q: What is State Form 53385?

A: State Form 53385 is the specific form number assigned to Form IT-40PNR Schedule IN-529.

Q: What is Schedule IN-529?

A: Schedule IN-529 is a part of Form IT-40PNR that is used to claim Indiana's Collegechoice 529 Education Savings Plan Credit.

Q: What is Indiana's Collegechoice 529 Education Savings Plan Credit?

A: Indiana's Collegechoice 529 Education Savings Plan Credit is a tax credit available to Indiana residents who contribute to the state's 529 education savings plan.

Q: What is the purpose of the credit?

A: The credit encourages Indiana residents to save for educational expenses by providing a tax incentive for contributions to the Collegechoice 529 plan.

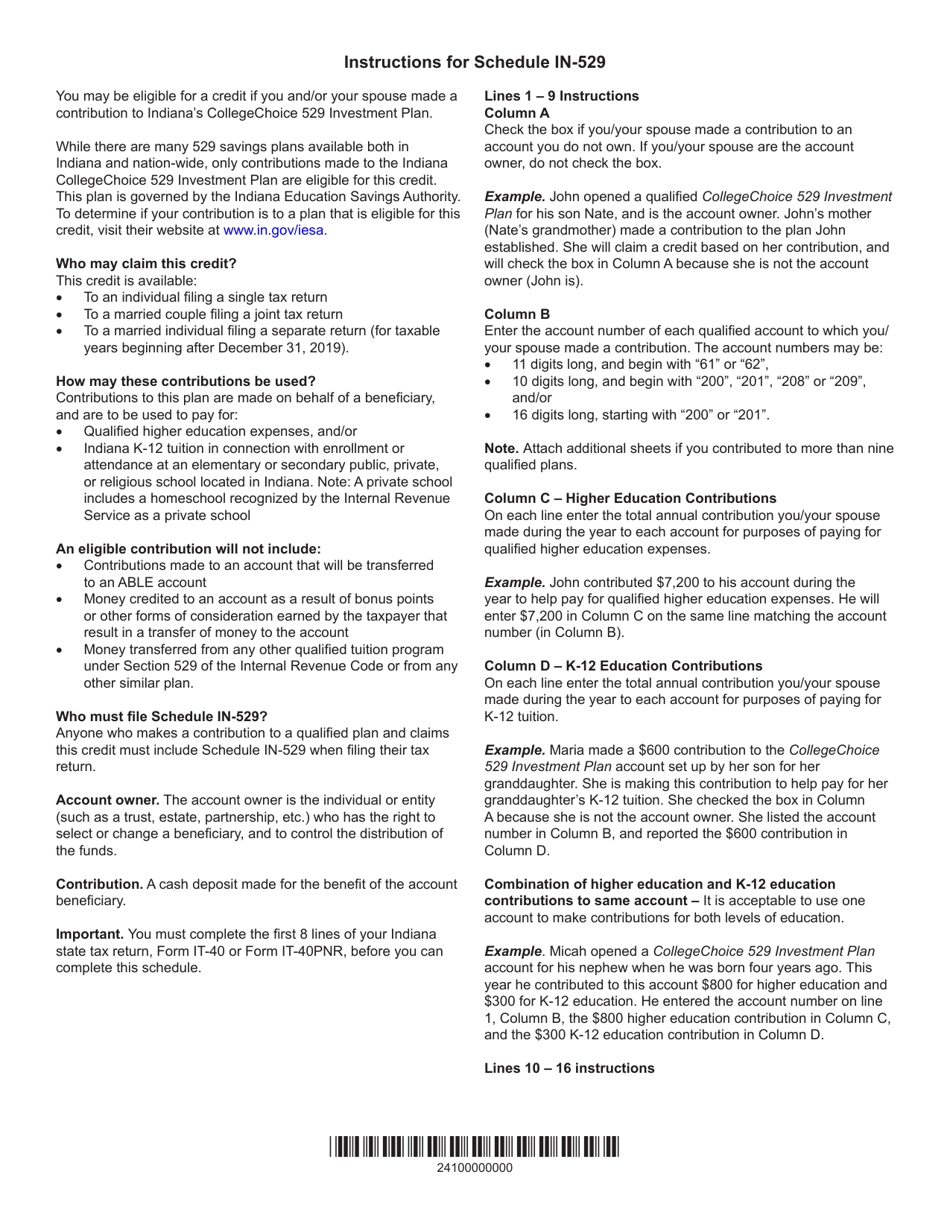

Q: What documentation is needed to claim the credit?

A: Taxpayers claiming the credit should refer to Schedule IN-529 for details on the required documentation and instructions on how to calculate the credit.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40 (IT-40PNR; State Form 53385) Schedule IN-529 by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.