This version of the form is not currently in use and is provided for reference only. Download this version of

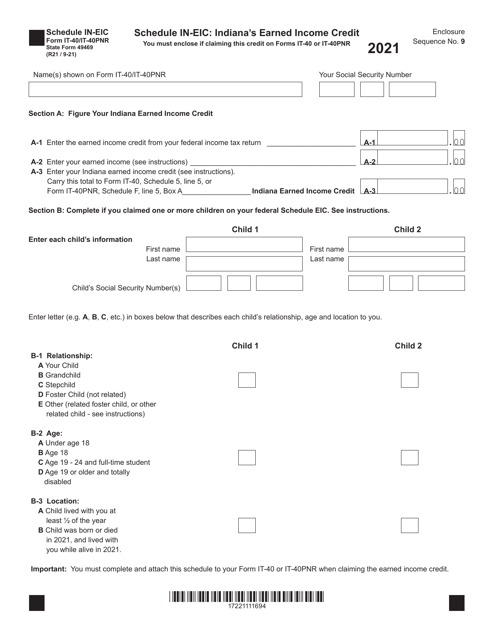

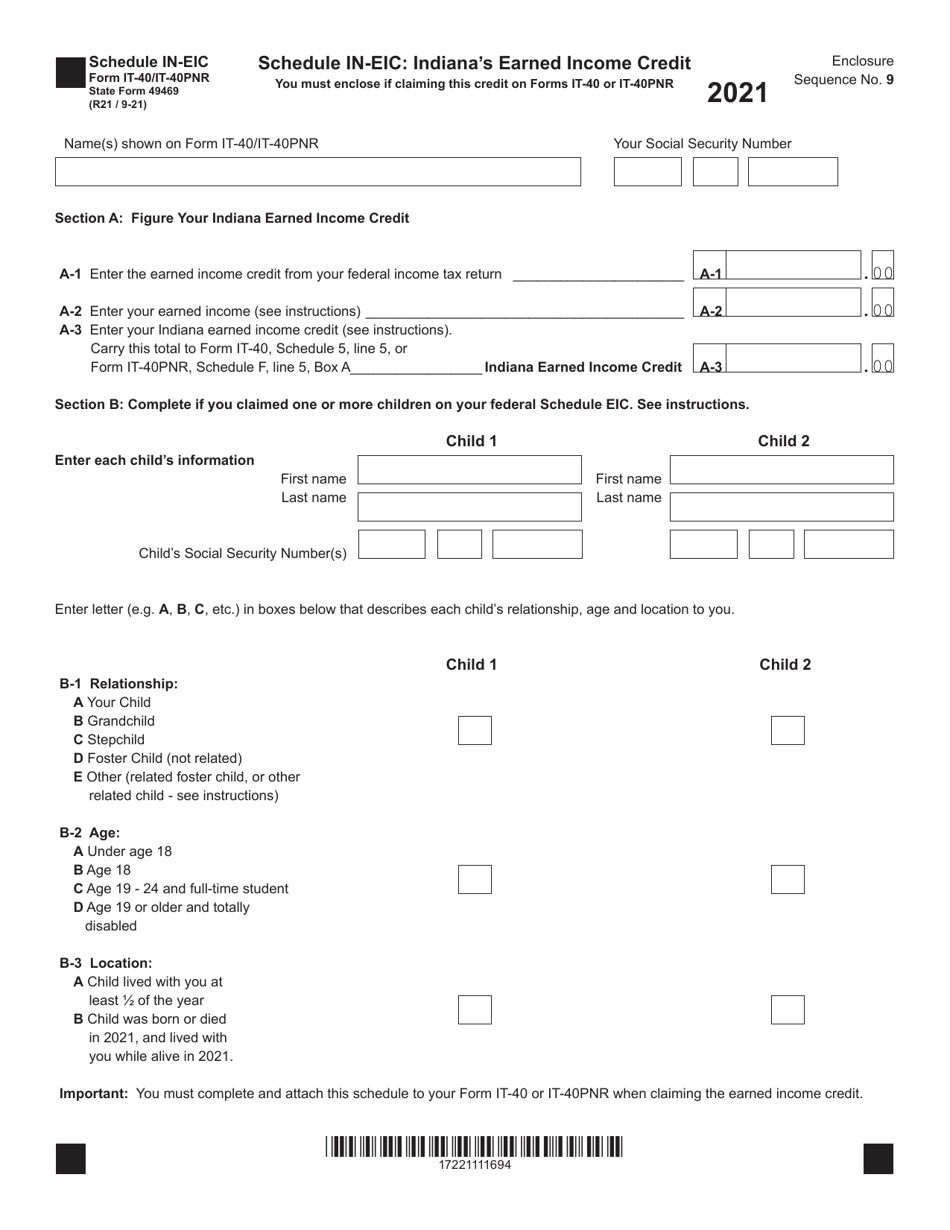

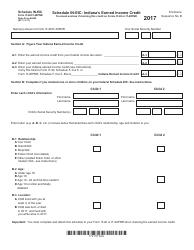

Form IT-40 (IT-40PNR; State Form 49469) Schedule IN-EIC

for the current year.

Form IT-40 (IT-40PNR; State Form 49469) Schedule IN-EIC Indiana's Earned Income Credit - Indiana

What Is Form IT-40 (IT-40PNR; State Form 49469) Schedule IN-EIC?

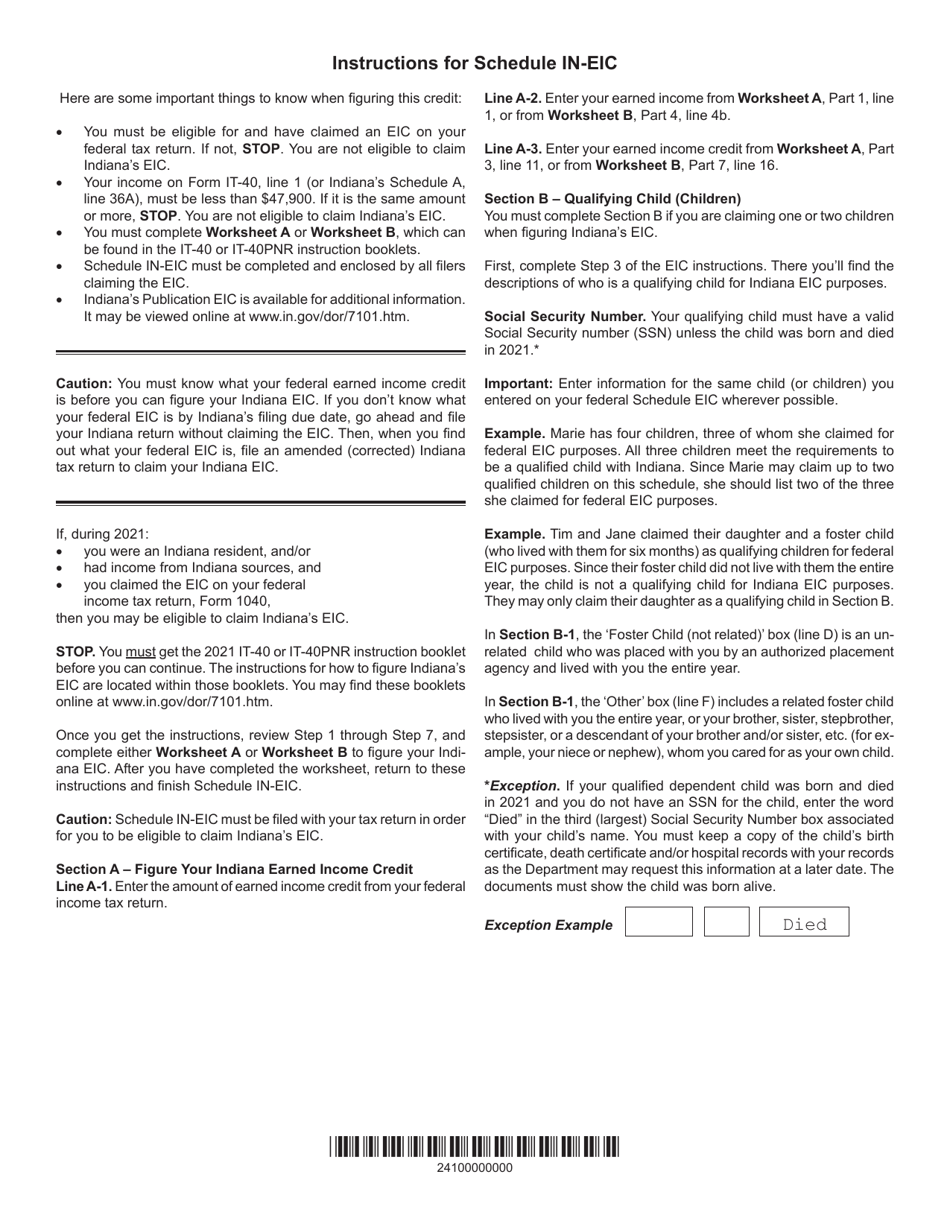

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana.The document is a supplement to Form IT-40, and Form IT-40PNR. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-40?

A: Form IT-40 is a tax form used by residents of Indiana to file their state income tax return.

Q: What is the purpose of Form IT-40?

A: The purpose of Form IT-40 is to report your income, deductions, and calculate the amount of taxes owed or refund due to the state of Indiana.

Q: What is Schedule IN-EIC?

A: Schedule IN-EIC is a supplemental form to Form IT-40 specifically for claiming Indiana's Earned Income Credit.

Q: What is Indiana's Earned Income Credit?

A: Indiana's Earned Income Credit is a tax credit designed to provide relief to low-income individuals and families.

Q: Who is eligible to claim Indiana's Earned Income Credit?

A: To be eligible for Indiana's Earned Income Credit, you must meet certain income limits and have qualifying earned income.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40 (IT-40PNR; State Form 49469) Schedule IN-EIC by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.