This version of the form is not currently in use and is provided for reference only. Download this version of

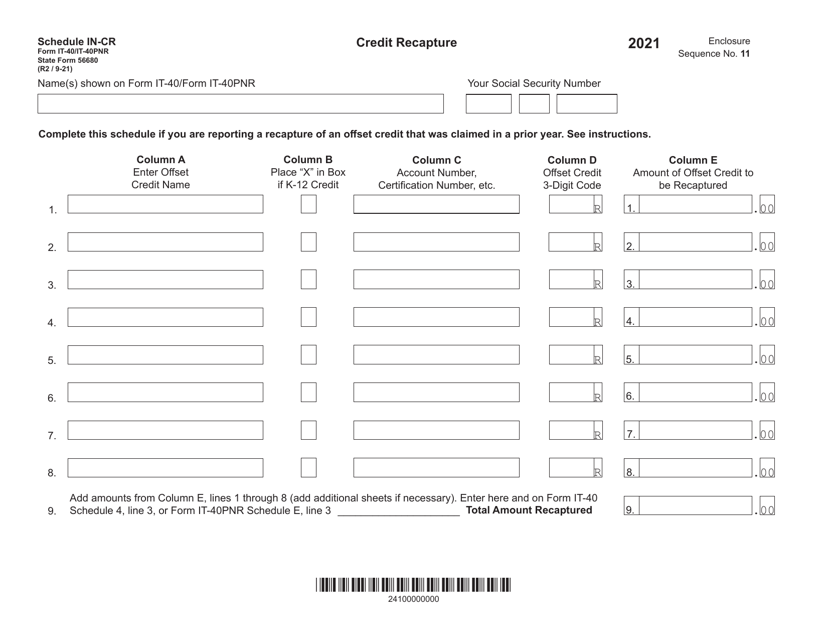

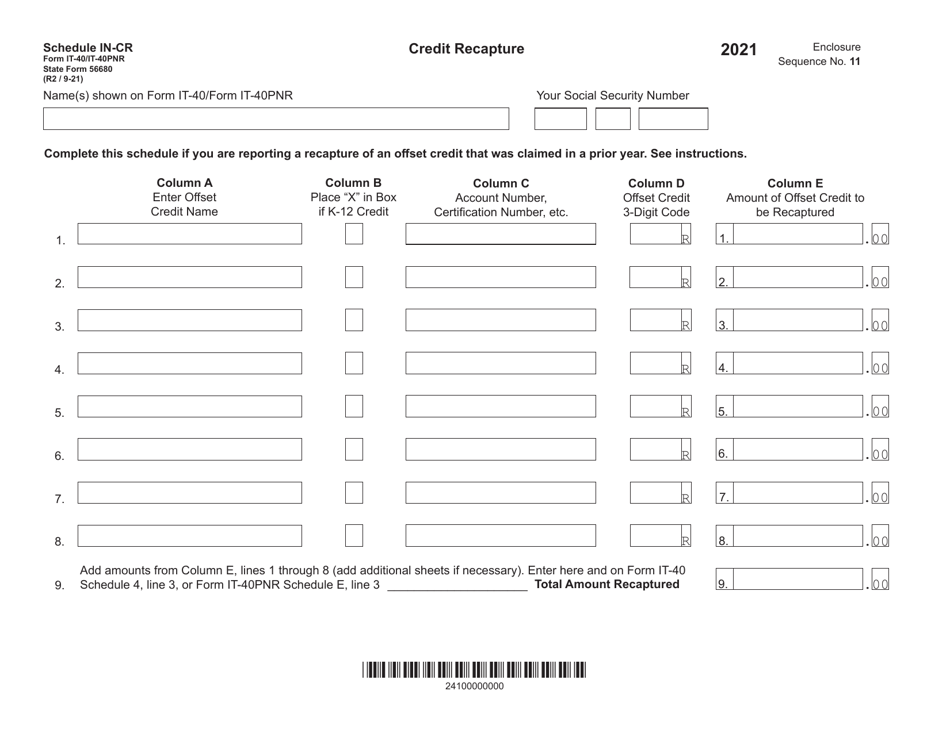

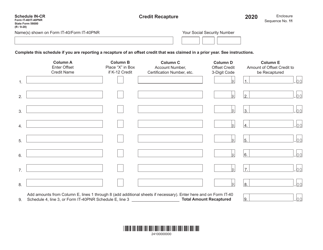

Form IT-40 (IT-40PNR; State Form 56680) Schedule IN-CR

for the current year.

Form IT-40 (IT-40PNR; State Form 56680) Schedule IN-CR Credit Recapture - Indiana

What Is Form IT-40 (IT-40PNR; State Form 56680)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-40?

A: Form IT-40 is a tax form used by residents of Indiana to file their individual income tax return.

Q: What is the purpose of Form IT-40PNR?

A: Form IT-40PNR is used by non-residents of Indiana to file their individual income tax return.

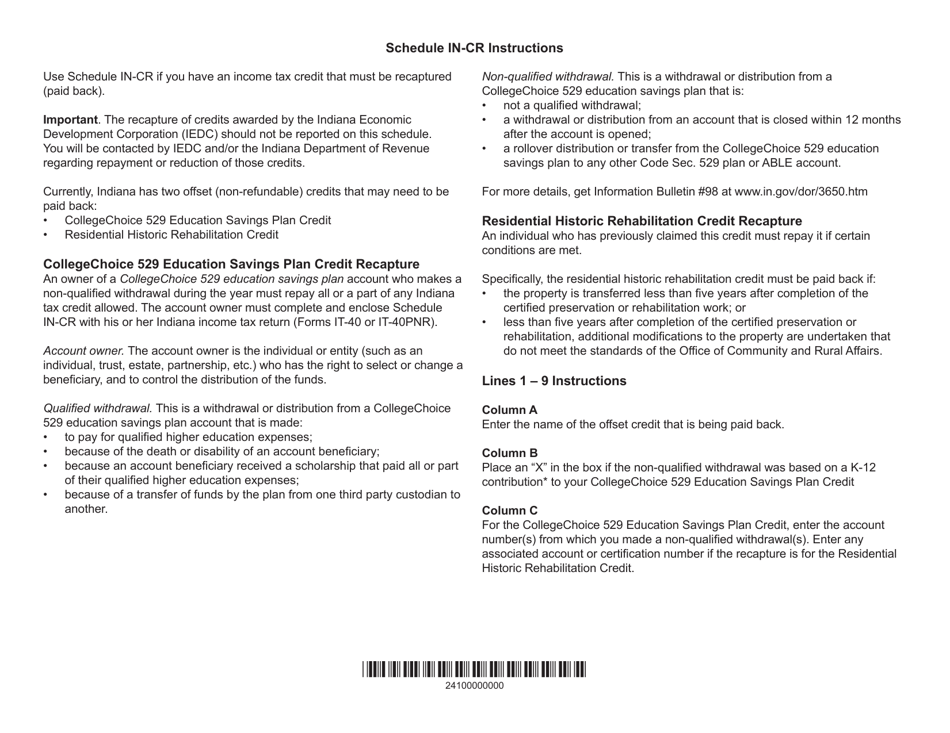

Q: What is a credit recapture?

A: A credit recapture is a situation where a taxpayer received a tax credit in a previous year, but is now required to repay or recapture some or all of that credit.

Q: How do I know if I need to include a credit recapture on my Form IT-40?

A: You should include a credit recapture on your Form IT-40 if you received a tax credit in a previous year and now need to repay or recapture some or all of that credit.

Q: Are there any penalties for failing to include a credit recapture on my Form IT-40?

A: Yes, if you fail to include a required credit recapture on your Form IT-40, you may be subject to penalties and interest on the amount owed.

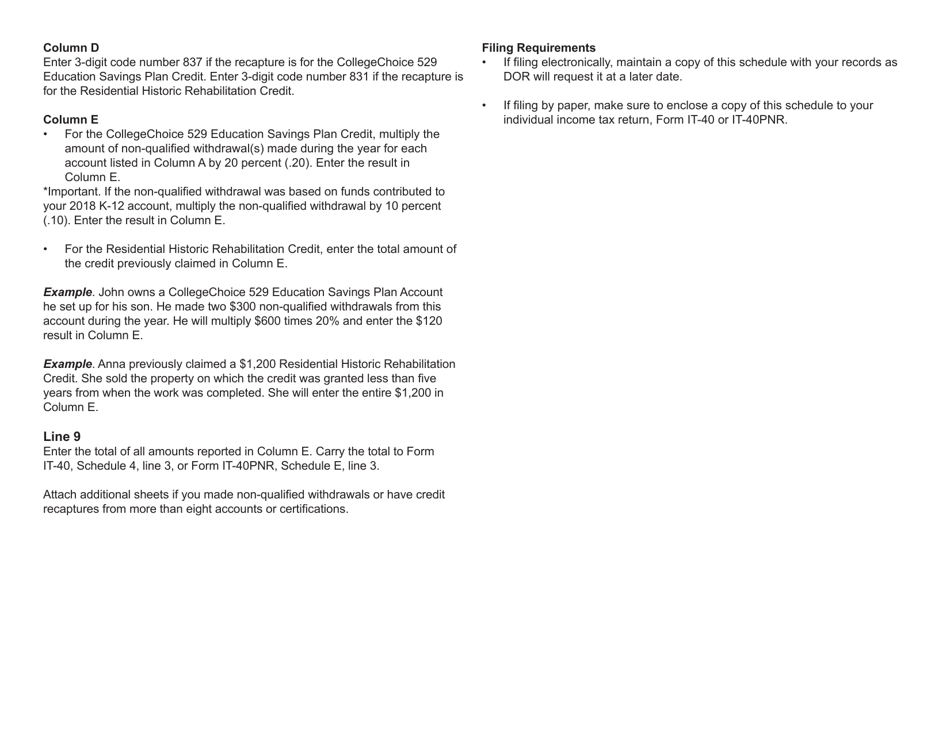

Q: How can I determine the amount of credit recapture I need to include on my Form IT-40?

A: The amount of credit recapture you need to include on your Form IT-40 will depend on the specific circumstances of your previous tax credit. It is recommended to consult the instructions for Form IT-40 or seek the assistance of a tax professional.

Q: Can I e-file Form IT-40 with a credit recapture?

A: Yes, you can e-file Form IT-40 with a credit recapture if you meet the eligibility requirements for electronic filing. Check the instructions for Form IT-40 for more information.

Q: What is the deadline for filing Form IT-40?

A: The deadline for filing Form IT-40 is typically April 15th of each year, unless it falls on a weekend or holiday. In that case, the deadline is the next business day.

Q: Can I file an extension for Form IT-40?

A: Yes, you can file an extension for Form IT-40. The extension will give you additional time to file your tax return, but not to pay any taxes owed. Check the instructions for Form IT-40 for more information on how to request an extension.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40 (IT-40PNR; State Form 56680) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.