This version of the form is not currently in use and is provided for reference only. Download this version of

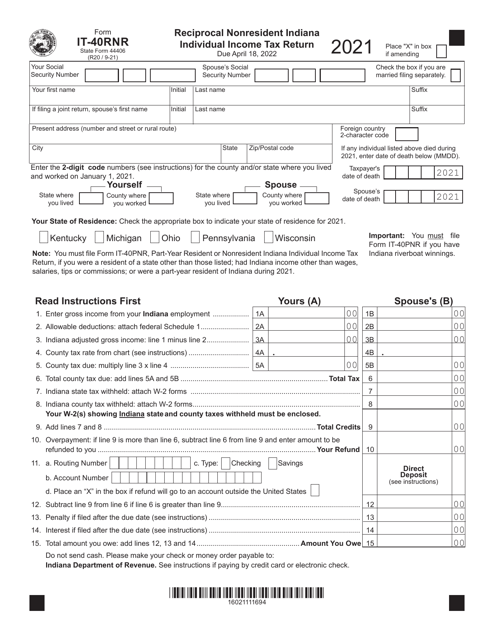

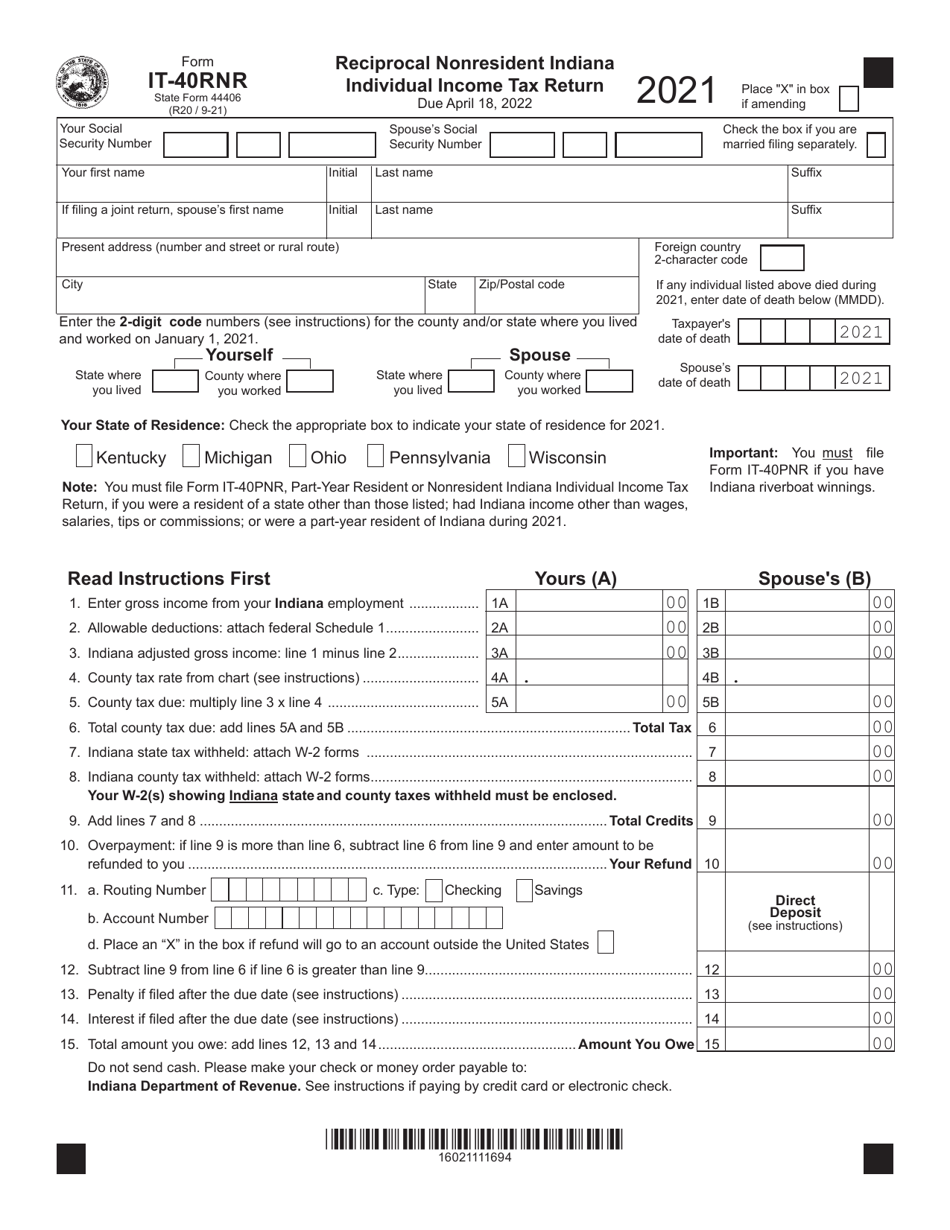

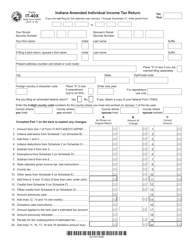

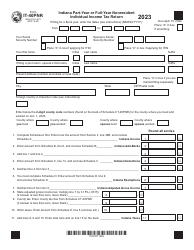

Form IT-40RNR (State Form 44406)

for the current year.

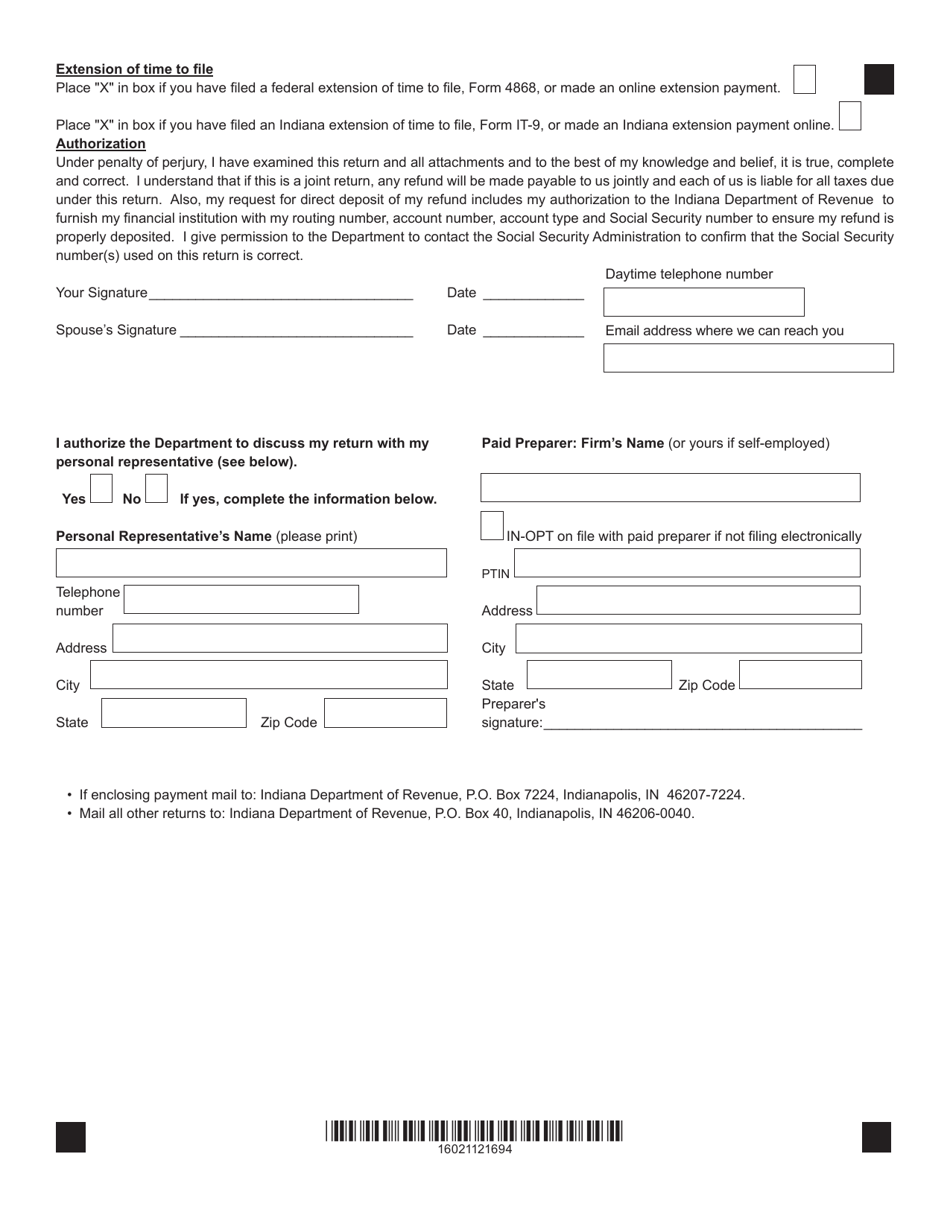

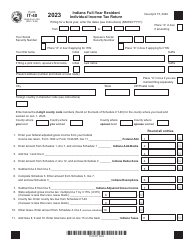

Form IT-40RNR (State Form 44406) Reciprocal Nonresident Indiana Individual Income Tax Return - Indiana

What Is Form IT-40RNR (State Form 44406)?

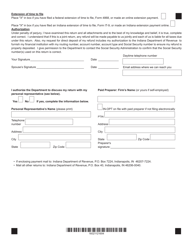

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-40RNR?

A: Form IT-40RNR is the Reciprocal Nonresident Indiana Individual Income Tax Return for the state of Indiana.

Q: Who needs to file Form IT-40RNR?

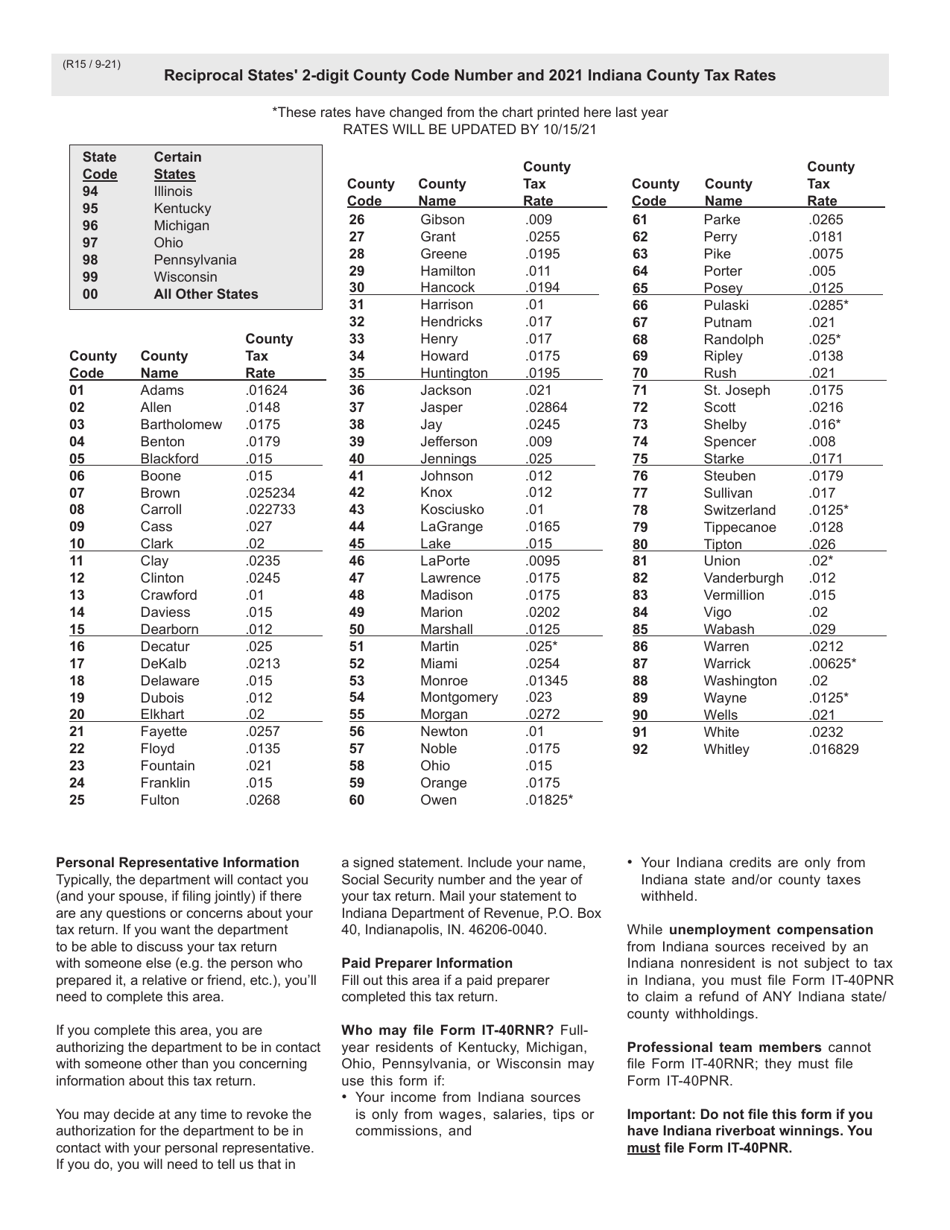

A: Nonresidents of Indiana who have reciprocal agreements with Indiana and earned income in the state need to file Form IT-40RNR.

Q: What is a reciprocal agreement?

A: A reciprocal agreement is an agreement between states that allows residents of one state to only pay income tax to their home state, even if they earn income in another state.

Q: What is the purpose of Form IT-40RNR?

A: Form IT-40RNR is used to report and pay income tax for nonresidents of Indiana with reciprocal agreements who earned income in the state.

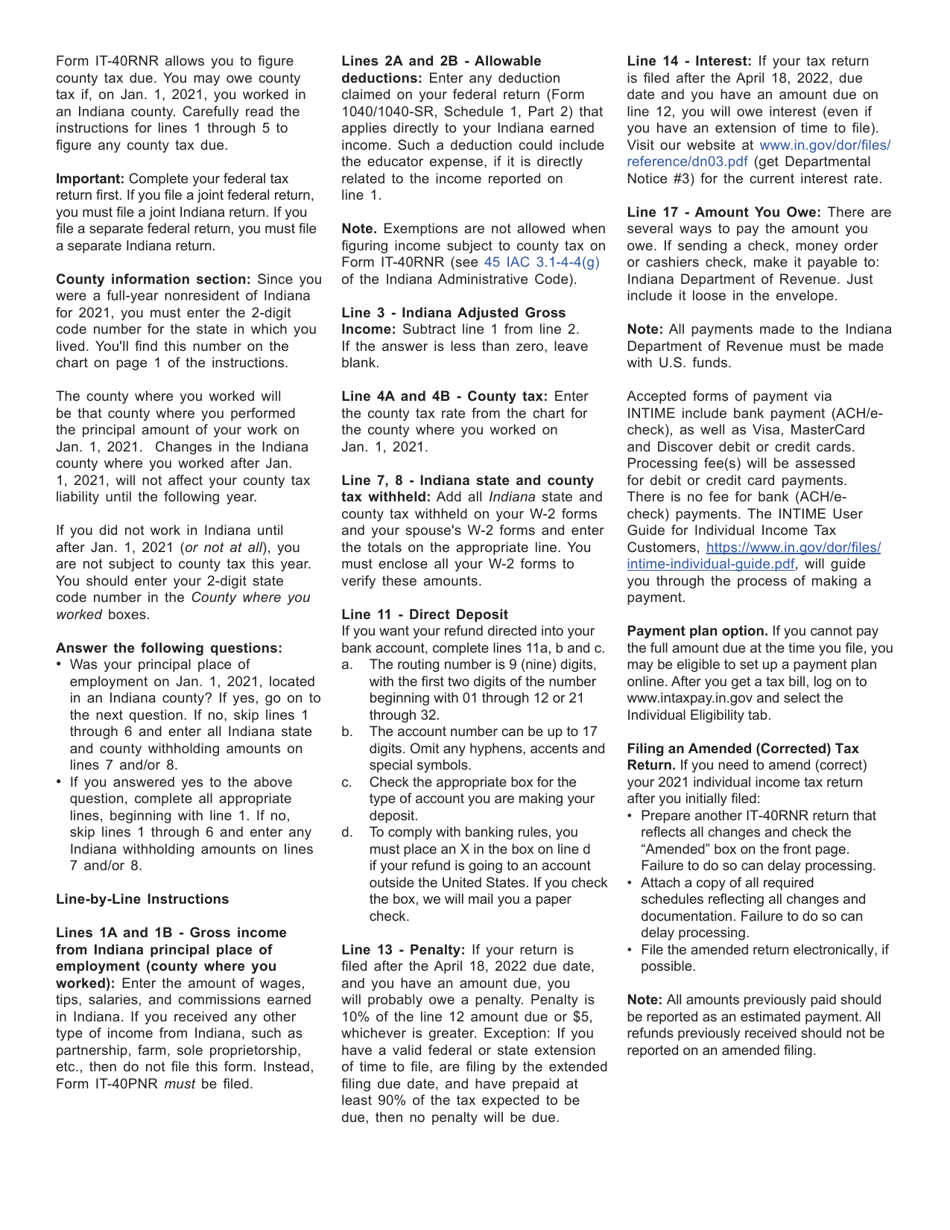

Q: What information do I need to complete Form IT-40RNR?

A: To complete Form IT-40RNR, you will need information about your income earned in Indiana, deductions, and any tax payments made.

Q: When is the deadline to file Form IT-40RNR?

A: The deadline to file Form IT-40RNR is the same as the federal tax deadline, which is usually April 15th of each year.

Q: Do I need to file Form IT-40RNR if I didn't earn any income in Indiana?

A: No, if you didn't earn any income in Indiana, you do not need to file Form IT-40RNR.

Q: What happens if I fail to file Form IT-40RNR?

A: If you fail to file Form IT-40RNR and you owe taxes, you may be subject to penalties and interest on the unpaid amount.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40RNR (State Form 44406) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.