This version of the form is not currently in use and is provided for reference only. Download this version of

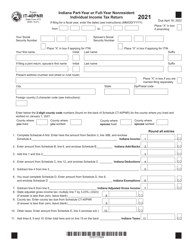

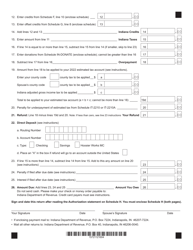

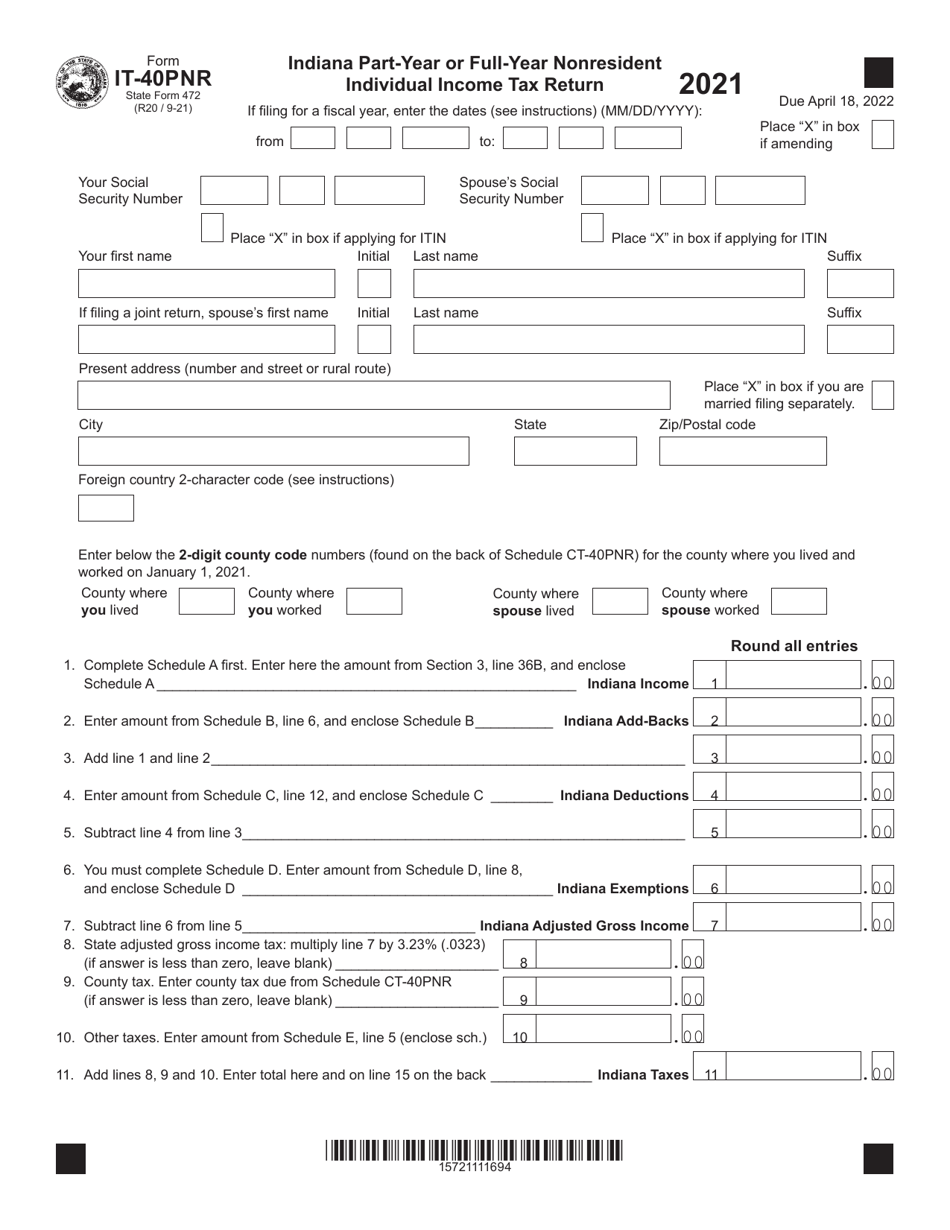

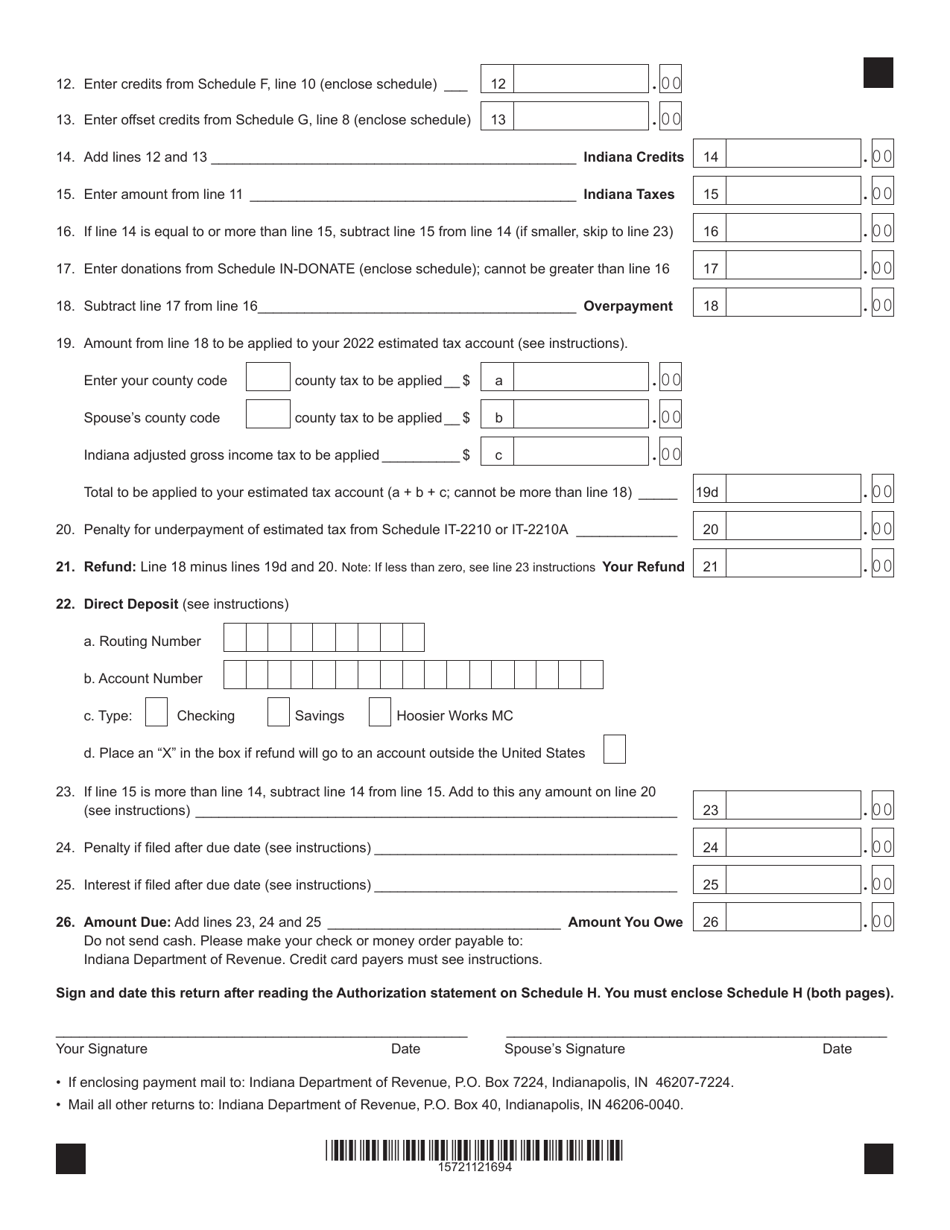

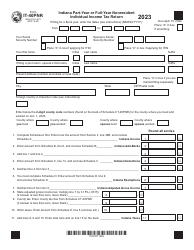

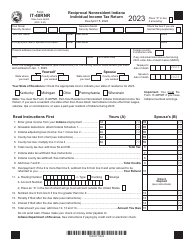

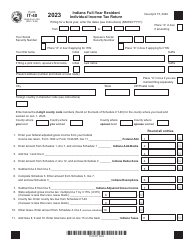

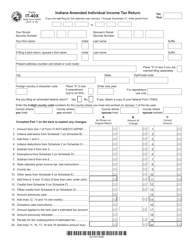

Form IT-40PNR (State Form 472)

for the current year.

Form IT-40PNR (State Form 472) Indiana Part-Year or Full-Year Nonresident Individual Income Tax Return - Indiana

What Is Form IT-40PNR (State Form 472)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-40PNR?

A: Form IT-40PNR is the Indiana Part-Year or Full-Year Nonresident Individual Income Tax Return.

Q: What is the purpose of Form IT-40PNR?

A: Form IT-40PNR is used by individuals who were nonresidents of Indiana for part or all of the tax year to report their income and calculate their Indiana income tax liability.

Q: Who needs to file Form IT-40PNR?

A: Nonresidents of Indiana who earned income in Indiana or had Indiana tax withheld during the tax year need to file Form IT-40PNR.

Q: Can I file Form IT-40PNR if I was a resident of Indiana for the entire tax year?

A: No, residents of Indiana should file Form IT-40 instead.

Q: What information do I need to complete Form IT-40PNR?

A: You will need to gather information about your income, deductions, and any Indiana tax withheld.

Q: When is the due date for filing Form IT-40PNR?

A: The due date for filing Form IT-40PNR is the same as the federal incometax due date, which is typically April 15th.

Q: Can I e-file Form IT-40PNR?

A: Yes, you can e-file Form IT-40PNR using approved tax software or through a qualified tax professional.

Q: Are there any applicable penalties for late filing of Form IT-40PNR?

A: Yes, if you fail to file Form IT-40PNR by the due date, you may be subject to penalties and interest charges on any unpaid tax amount.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40PNR (State Form 472) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.