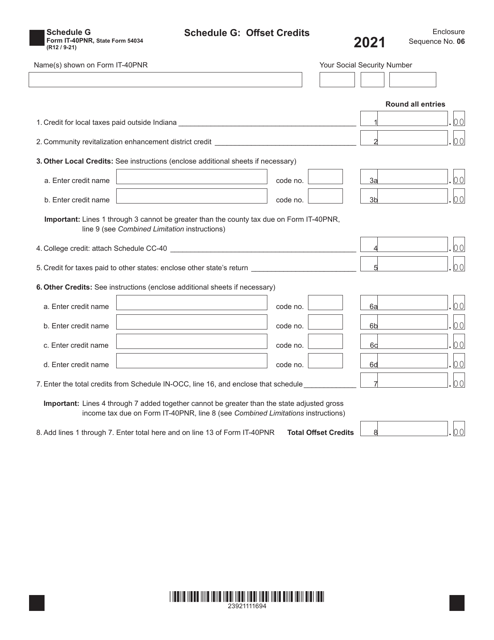

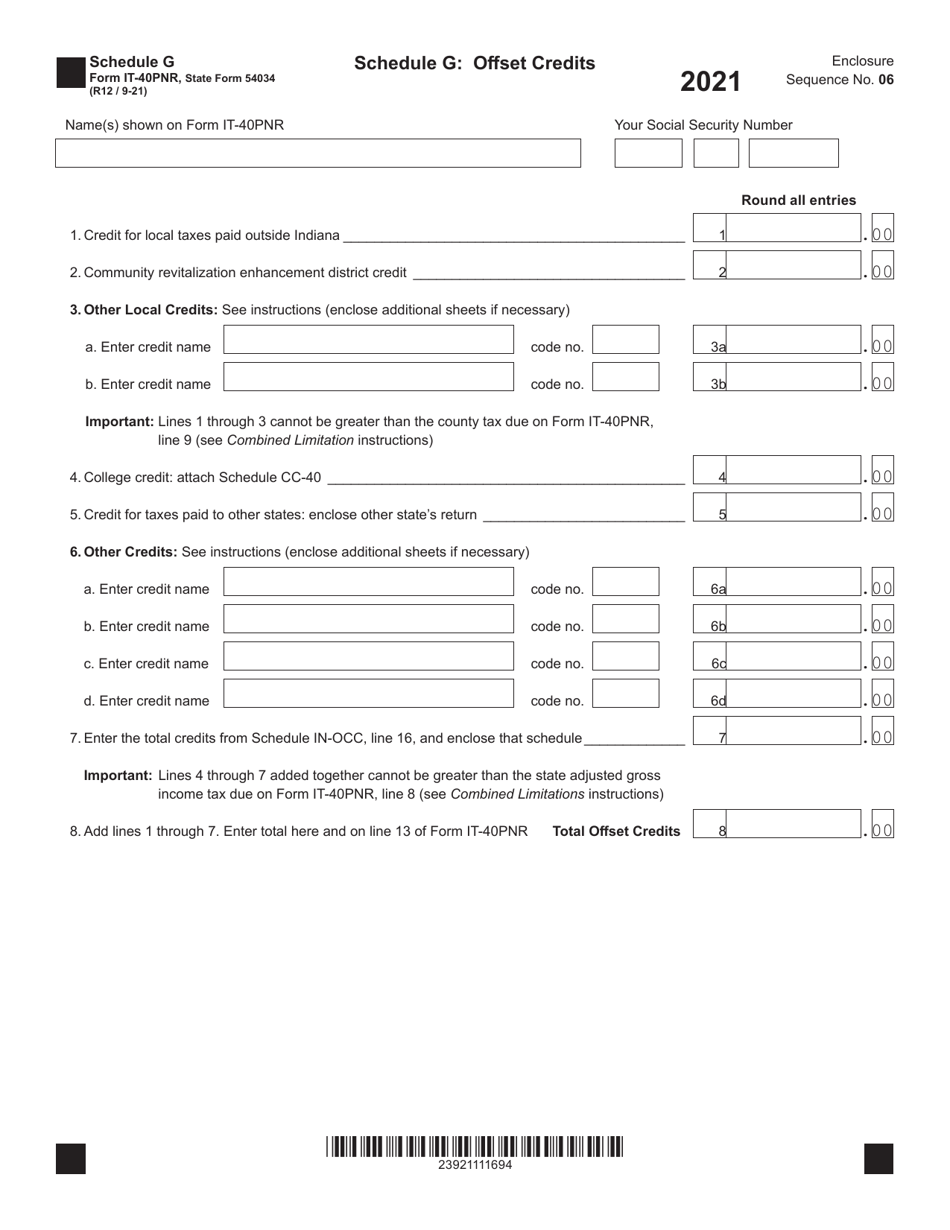

This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-40PNR (State Form 54034) Schedule G

for the current year.

Form IT-40PNR (State Form 54034) Schedule G Offset Credits - Indiana

What Is Form IT-40PNR (State Form 54034) Schedule G?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana.The document is a supplement to Form IT-40PNR, Indiana Part-Year or Full-Year Nonresident Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-40PNR?

A: Form IT-40PNR is an Indiana state tax form for nonresident individuals.

Q: What is Schedule G?

A: Schedule G is a section of Form IT-40PNR used to report offset credits.

Q: What are offset credits?

A: Offset credits are tax credits that can be used to reduce the amount of tax owed.

Q: What types of credits can be reported on Schedule G?

A: Schedule G can be used to report credits such as the Indiana foreign tax credit, the Indiana school scholarship credit, and the Indiana historic rehabilitation credit.

Q: Do I need to file Schedule G?

A: You only need to file Schedule G if you have eligible offset credits to report.

Q: Are there any restrictions or limitations for offset credits?

A: Yes, there may be restrictions and limitations on the amount of offset credits that can be claimed. Refer to the instructions for Form IT-40PNR and Schedule G for more information.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40PNR (State Form 54034) Schedule G by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.