This version of the form is not currently in use and is provided for reference only. Download this version of

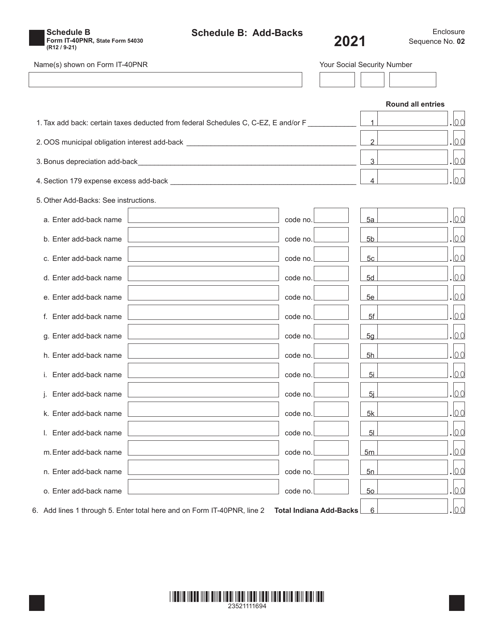

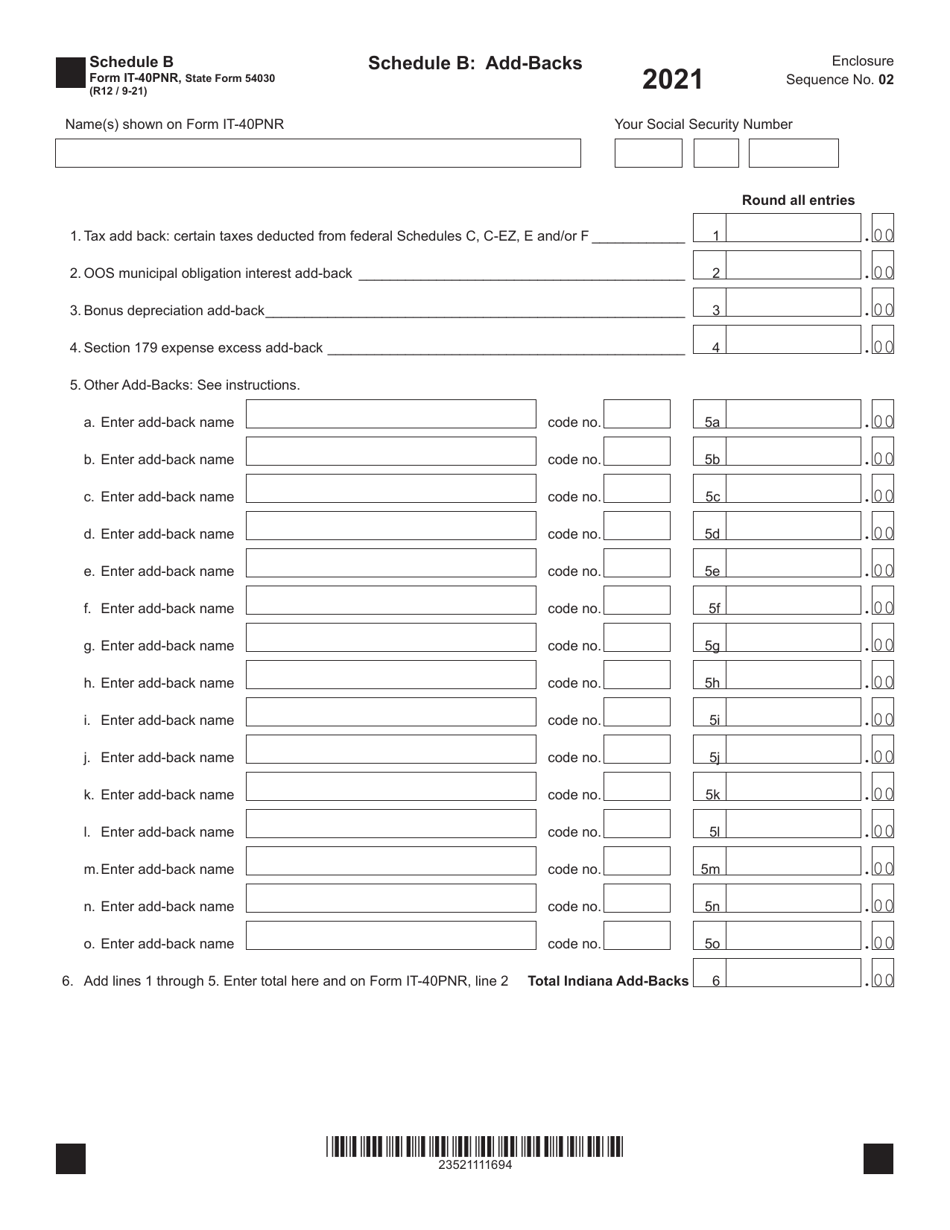

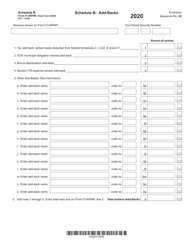

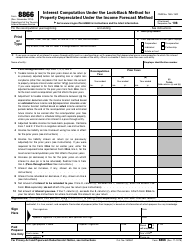

Form IT-40PNR (State Form 54030) Schedule B

for the current year.

Form IT-40PNR (State Form 54030) Schedule B Add-Backs - Indiana

What Is Form IT-40PNR (State Form 54030) Schedule B?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana.The document is a supplement to Form IT-40PNR, Indiana Part-Year or Full-Year Nonresident Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

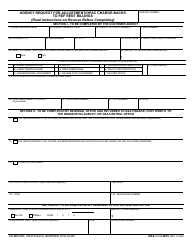

Q: What is Form IT-40PNR?

A: Form IT-40PNR is a state tax form used by residents of Indiana who are also residents of another state.

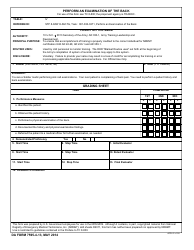

Q: What is Schedule B Add-Backs?

A: Schedule B Add-Backs is a section of Form IT-40PNR that lists adjustments to income that must be made.

Q: What are add-backs?

A: Add-backs are expenses or deductions that are not allowed when calculating Indiana state income tax.

Q: Why do I need to complete Schedule B Add-Backs?

A: You need to complete Schedule B Add-Backs to ensure your Indiana state income tax is calculated correctly.

Q: Are there any specific instructions for completing Schedule B Add-Backs?

A: Yes, specific instructions for completing Schedule B Add-Backs can be found in the Form IT-40PNR instruction booklet.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40PNR (State Form 54030) Schedule B by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.