This version of the form is not currently in use and is provided for reference only. Download this version of

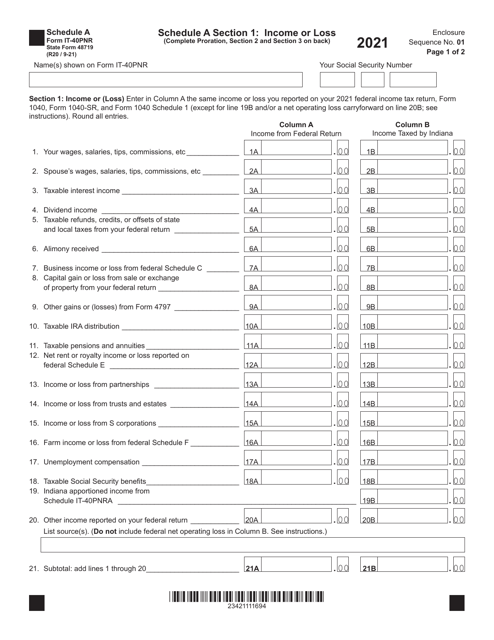

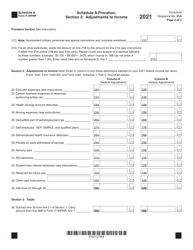

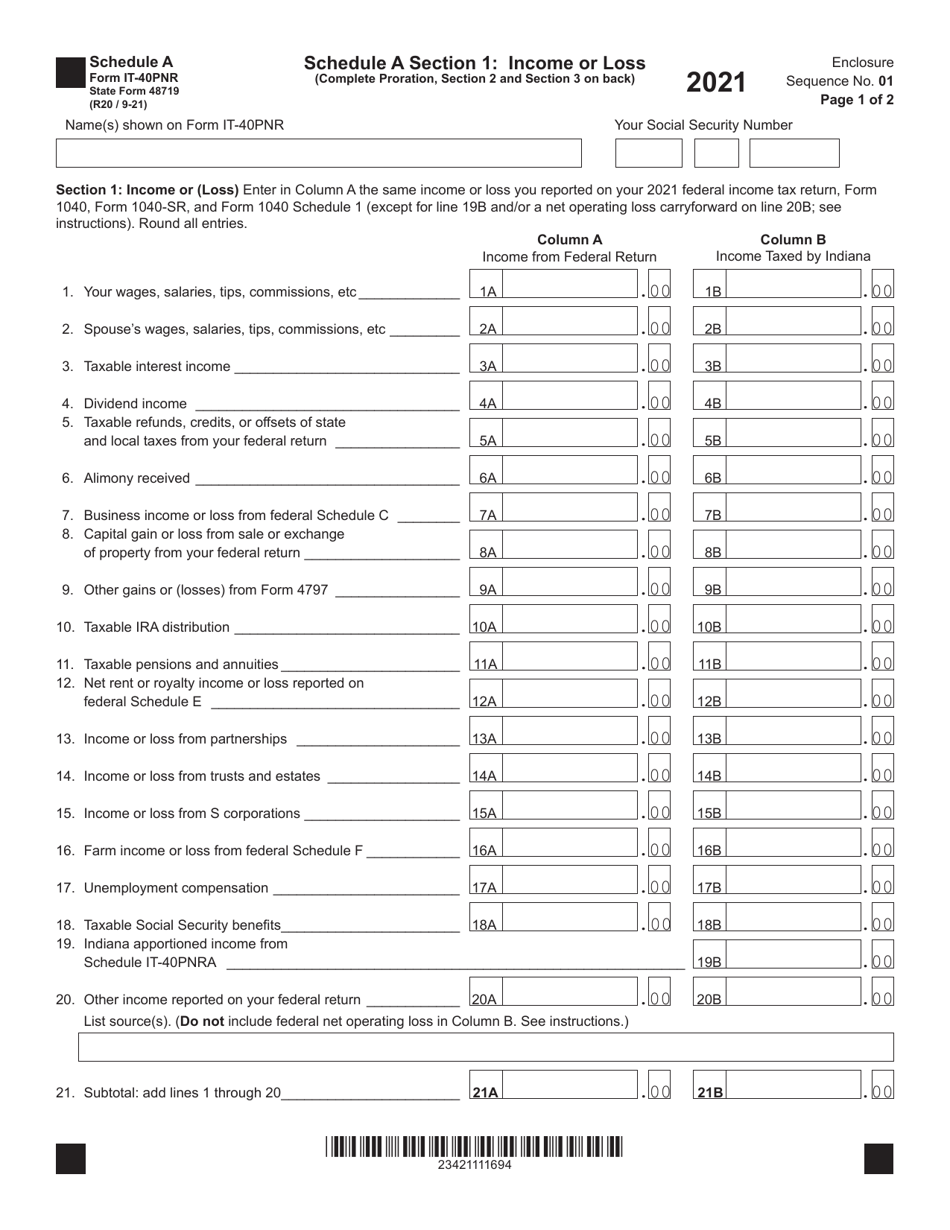

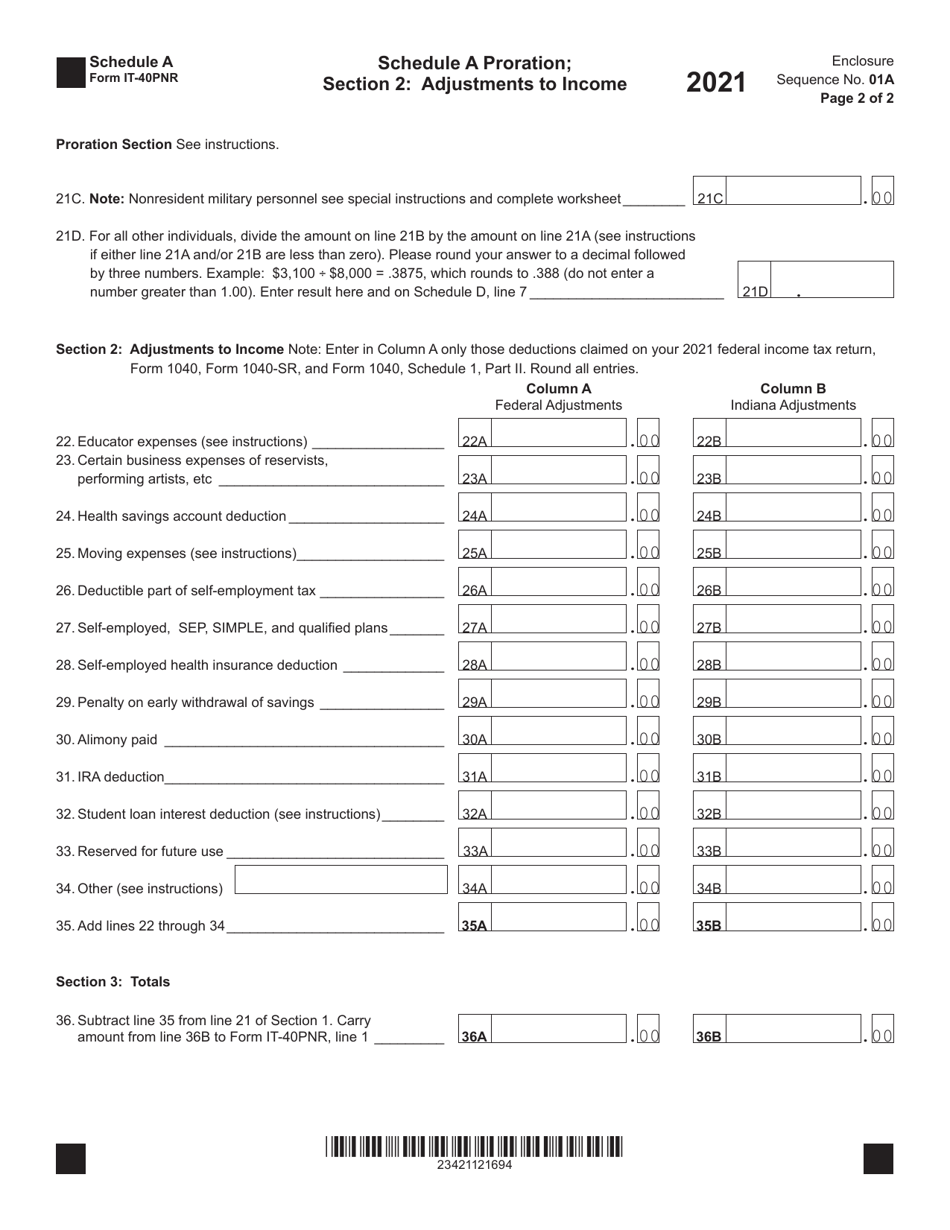

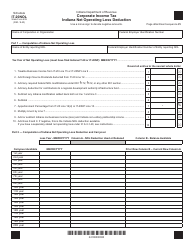

State Form 48719 (IT-40PNR) Schedule A

for the current year.

State Form 48719 (IT-40PNR) Schedule A Income / Loss, Proration & Adjustments to Income - Indiana

What Is State Form 48719 (IT-40PNR) Schedule A?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana.The document is a supplement to Form IT-40PNR, Indiana Part-Year or Full-Year Nonresident Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 48719 (IT-40PNR)?

A: Form 48719 (IT-40PNR) is a tax form used in Indiana to report income/loss, proration, and adjustments to income.

Q: What does Schedule A on Form 48719 (IT-40PNR) refer to?

A: Schedule A on Form 48719 (IT-40PNR) refers to the section where you report your income/loss, proration, and adjustments to income.

Q: What is proration on Form 48719 (IT-40PNR)?

A: Proration on Form 48719 (IT-40PNR) refers to the calculation or allocation of income/loss based on partial-year residency in Indiana.

Q: What are adjustments to income on Form 48719 (IT-40PNR)?

A: Adjustments to income on Form 48719 (IT-40PNR) are deductions or additions that modify your taxable income.

Q: Who needs to fill out Form 48719 (IT-40PNR)?

A: Form 48719 (IT-40PNR) is specifically designed for part-year or non-resident individuals filing their taxes in Indiana.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 48719 (IT-40PNR) Schedule A by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.