This version of the form is not currently in use and is provided for reference only. Download this version of

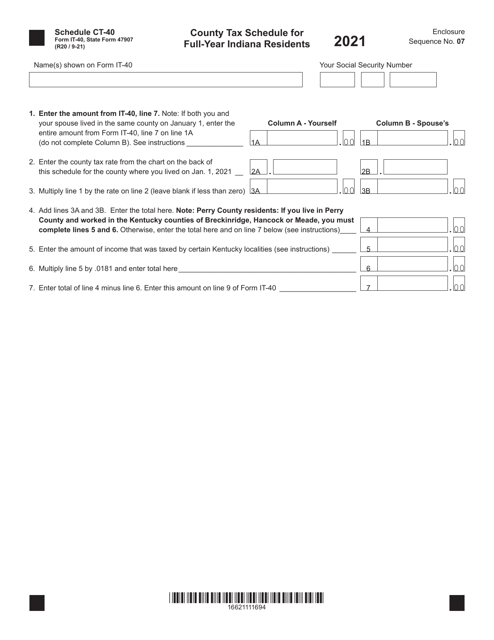

Form IT-40 (State Form 47907) Schedule CT-40

for the current year.

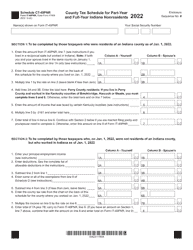

Form IT-40 (State Form 47907) Schedule CT-40 County Tax Schedule for Full-Year Indiana Residents - Indiana

What Is Form IT-40 (State Form 47907) Schedule CT-40?

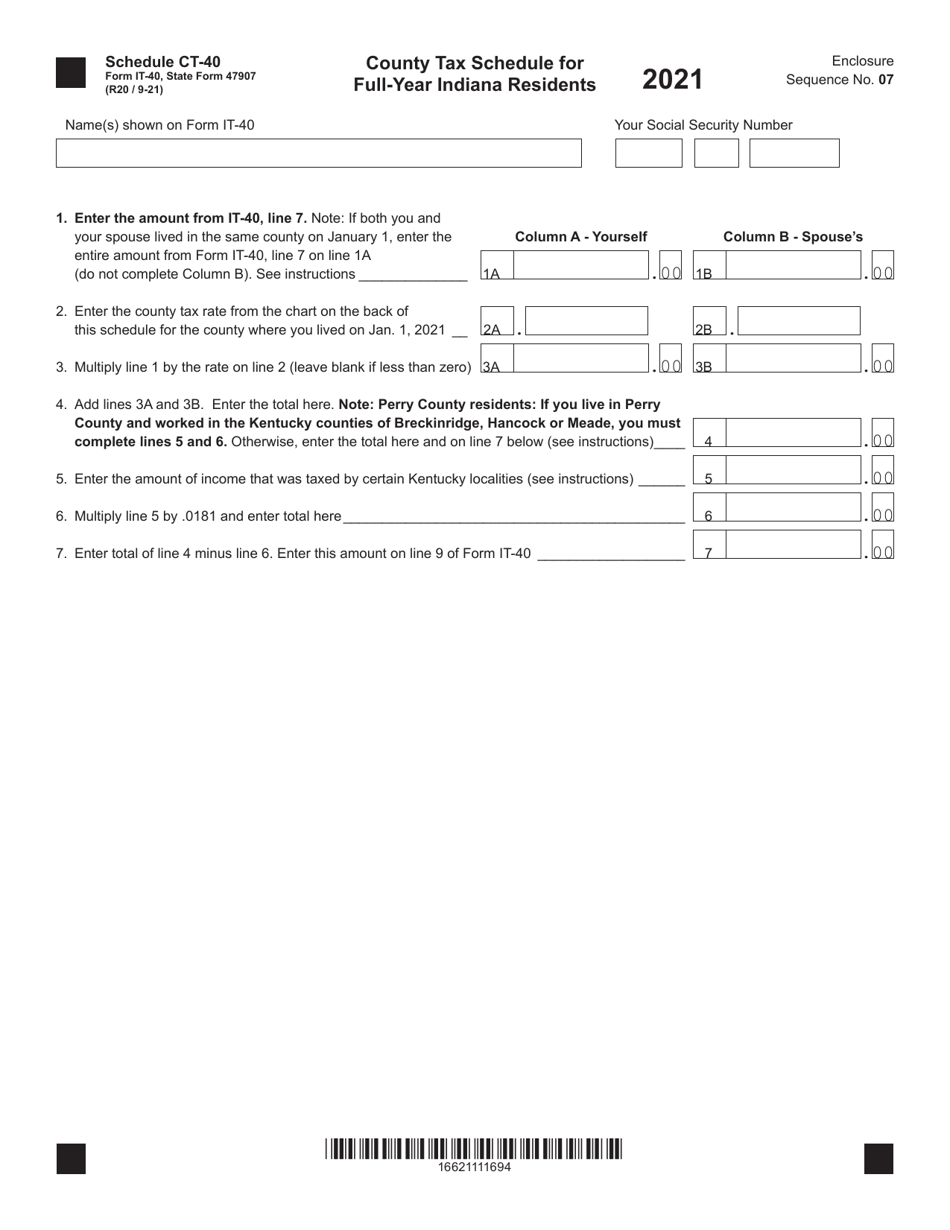

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana.The document is a supplement to Form IT-40, Indiana Full-Year Resident Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule CT-40?

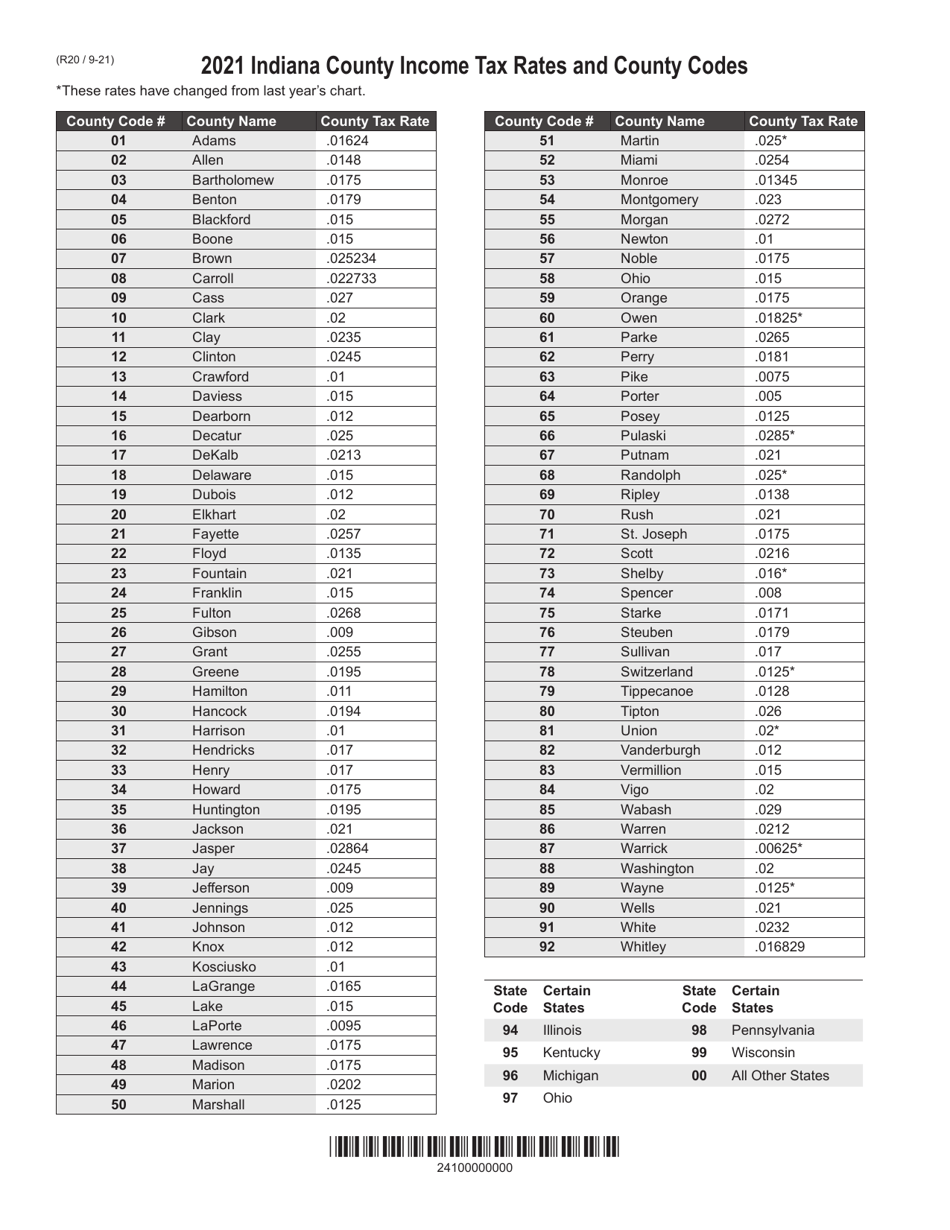

A: Schedule CT-40 is a county tax schedule for full-year Indiana residents.

Q: What is the purpose of Schedule CT-40?

A: The purpose of Schedule CT-40 is to calculate county tax owed by full-year Indiana residents.

Q: Who needs to file Schedule CT-40?

A: Full-year Indiana residents who owe county tax need to file Schedule CT-40.

Q: How do I complete Schedule CT-40?

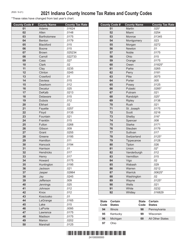

A: You need to provide information about your county of residence, calculate your county tax, and enter the relevant amounts on Schedule CT-40.

Q: Are there any exemptions or deductions on Schedule CT-40?

A: Yes, there may be exemptions and deductions available depending on your county of residence. Refer to the instructions provided with Schedule CT-40 for more details.

Q: When is Schedule CT-40 due?

A: Schedule CT-40 is due at the same time as your Indiana state income tax return, usually on or before April 15th.

Q: Can I file Schedule CT-40 electronically?

A: Yes, Indiana residents can file Schedule CT-40 electronically along with their state income tax return.

Q: What happens if I don't file Schedule CT-40?

A: If you owe county tax and fail to file Schedule CT-40, you may be subject to penalties and interest on unpaid county tax amounts. It's important to file the schedule accurately and on time.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40 (State Form 47907) Schedule CT-40 by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.