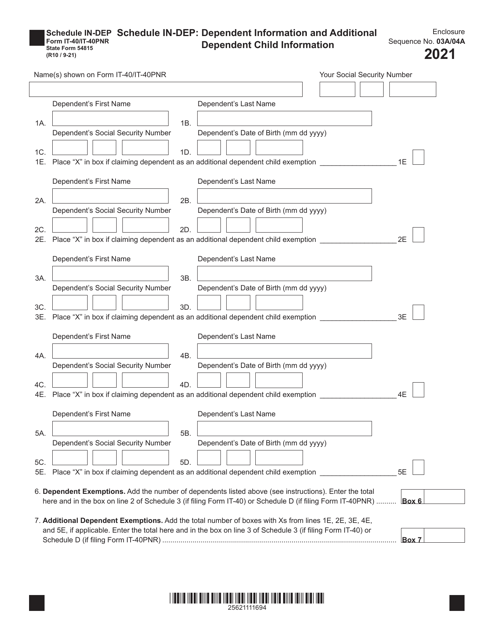

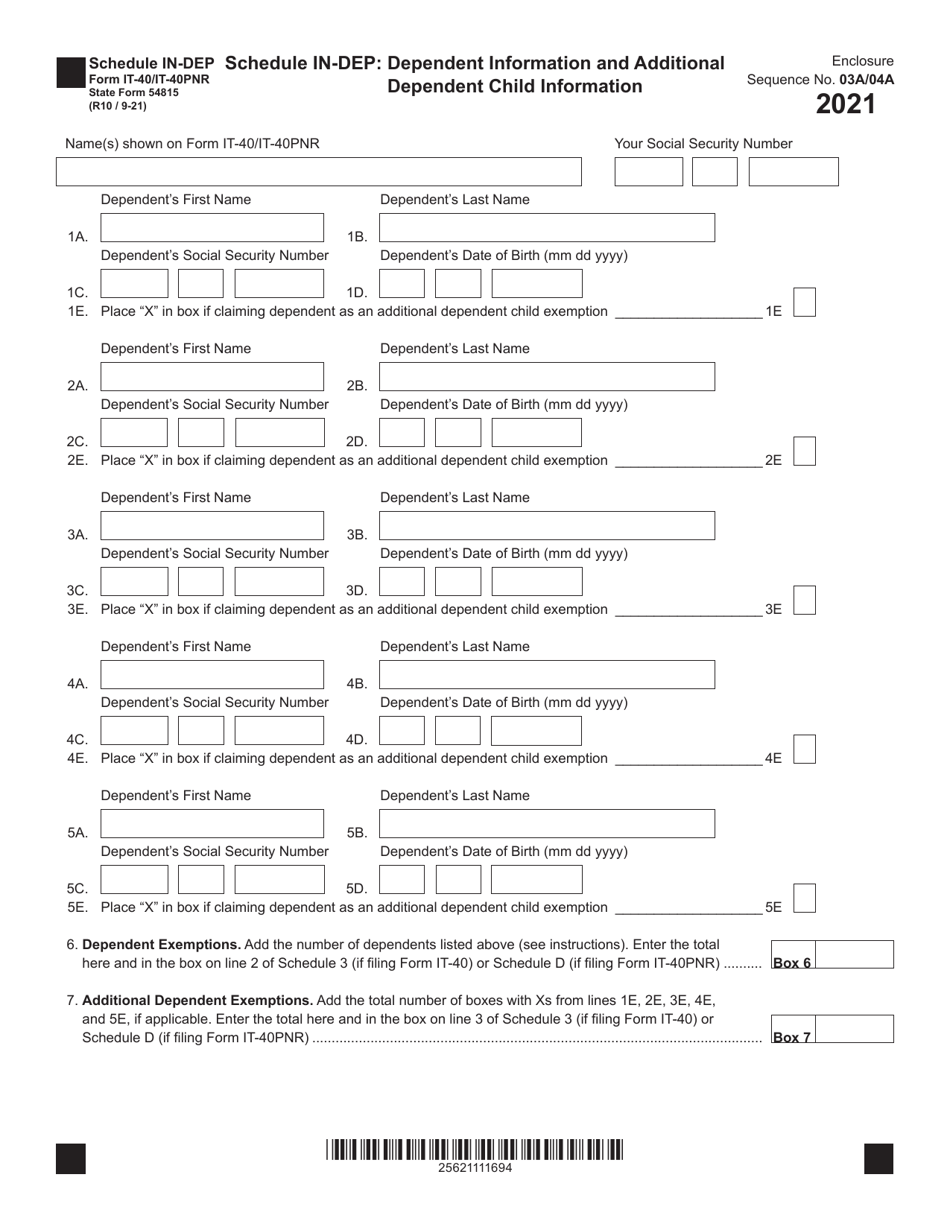

Form IT-40 (IT-40PNR; State Form 54815) Addendum IN-DEP Dependent Information and Additional Dependent Child Information - Indiana

What Is Form IT-40 (IT-40PNR; State Form 54815) Addendum IN-DEP?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana.The document is a supplement to Form IT-40, and Form IT-40PNR. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-40?

A: Form IT-40 is a tax form used in Indiana to file state income tax.

Q: What is Form IT-40PNR?

A: Form IT-40PNR is a tax form used in Indiana to file state income tax if you're a part-year resident.

Q: What is an Addendum IN-DEP?

A: Addendum IN-DEP is a supplemental form used to provide information about dependents on your tax return.

Q: What information is required on the Addendum IN-DEP?

A: The Addendum IN-DEP requires details about dependents, including their names, Social Security numbers, and relationship to the filer.

Q: What is Additional Dependent Child Information?

A: Additional Dependent Child Information is an optional section on the Addendum IN-DEP where you can provide more details about dependent children.

Q: Why is the Addendum IN-DEP necessary?

A: The Addendum IN-DEP is necessary to accurately report dependents and claim any applicable tax credits or deductions related to dependents.

Q: Do I need to file the Addendum IN-DEP if I don't have any dependents?

A: If you don't have any dependents, you don't need to file the Addendum IN-DEP. However, you may still need to complete other sections of Form IT-40.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40 (IT-40PNR; State Form 54815) Addendum IN-DEP by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.