This version of the form is not currently in use and is provided for reference only. Download this version of

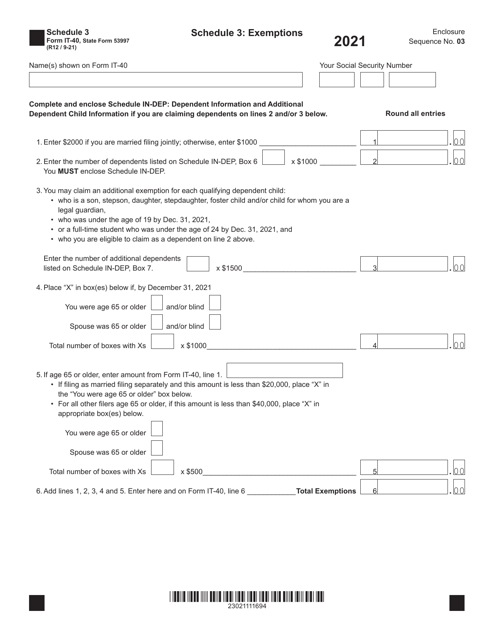

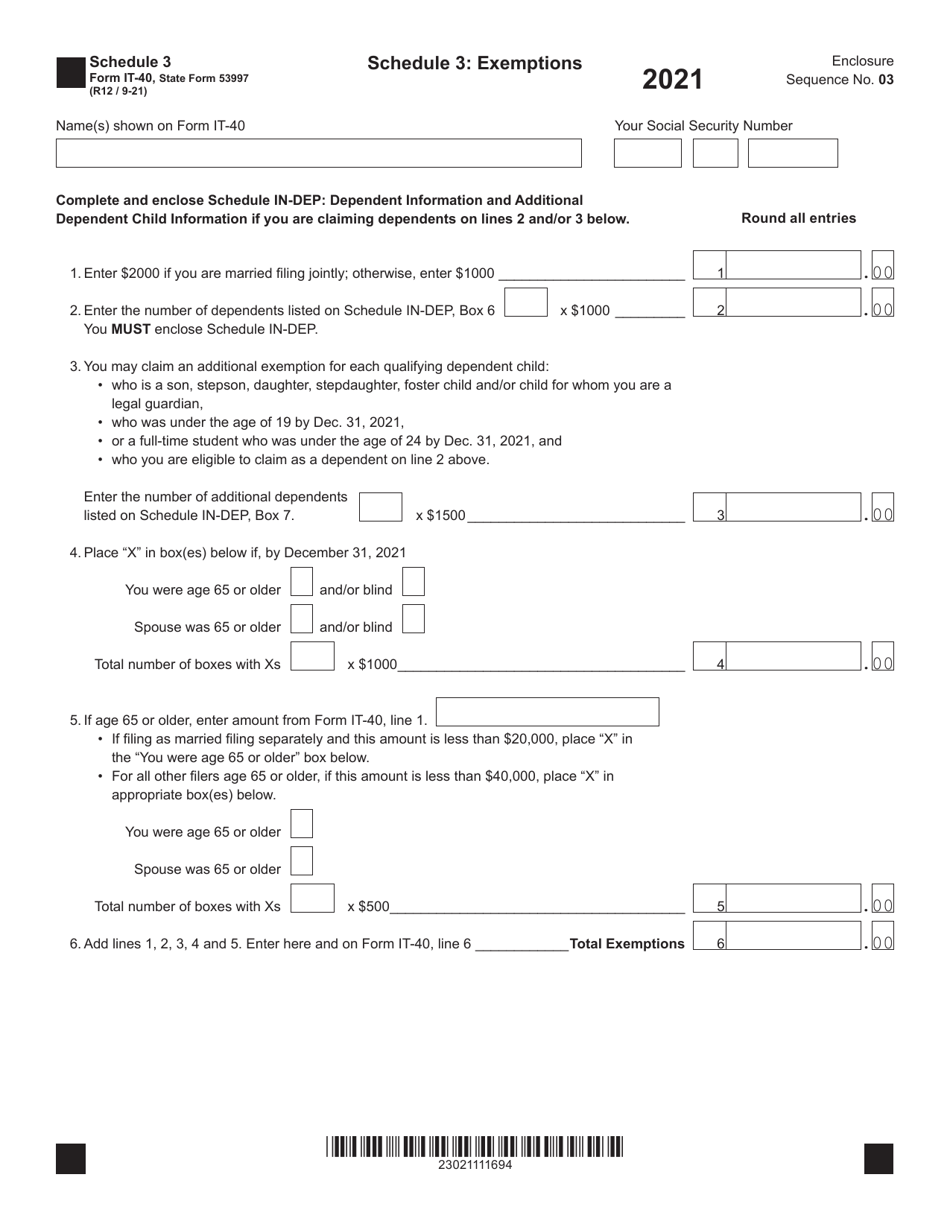

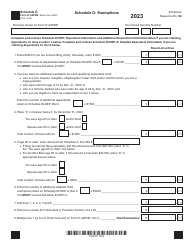

Form IT-40 (State Form 53997) Schedule 3

for the current year.

Form IT-40 (State Form 53997) Schedule 3 Exemptions - Indiana

What Is Form IT-40 (State Form 53997) Schedule 3?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana.The document is a supplement to Form IT-40, Indiana Full-Year Resident Individual Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-40?

A: Form IT-40 is a state tax form used in Indiana to file individual income tax returns.

Q: What is Schedule 3 Exemptions?

A: Schedule 3 Exemptions is a section of Form IT-40 where you report any exemptions you are eligible for.

Q: What are exemptions?

A: Exemptions are deductions that reduce your taxable income.

Q: What should I report on Schedule 3 Exemptions?

A: You should report any exemptions you are eligible for, such as personal exemptions or dependents.

Q: Do I need to file Schedule 3 Exemptions?

A: You only need to file Schedule 3 Exemptions if you have eligible exemptions to report.

Q: Are there any specific eligibility requirements for exemptions?

A: Yes, there are specific eligibility requirements for exemptions. It is best to consult the instructions on the form or seek professional tax advice.

Q: When is the deadline to file Form IT-40?

A: The deadline to file Form IT-40 is usually April 15th, but it may vary depending on any extensions or special circumstances.

Q: What if I need help with filling out Form IT-40?

A: If you need help with filling out Form IT-40, you can consult the instructions on the form, contact the Indiana Department of Revenue, or seek assistance from a tax professional.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40 (State Form 53997) Schedule 3 by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.