This version of the form is not currently in use and is provided for reference only. Download this version of

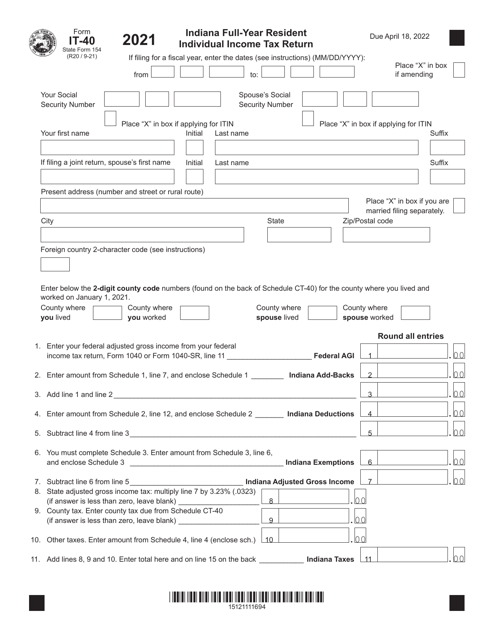

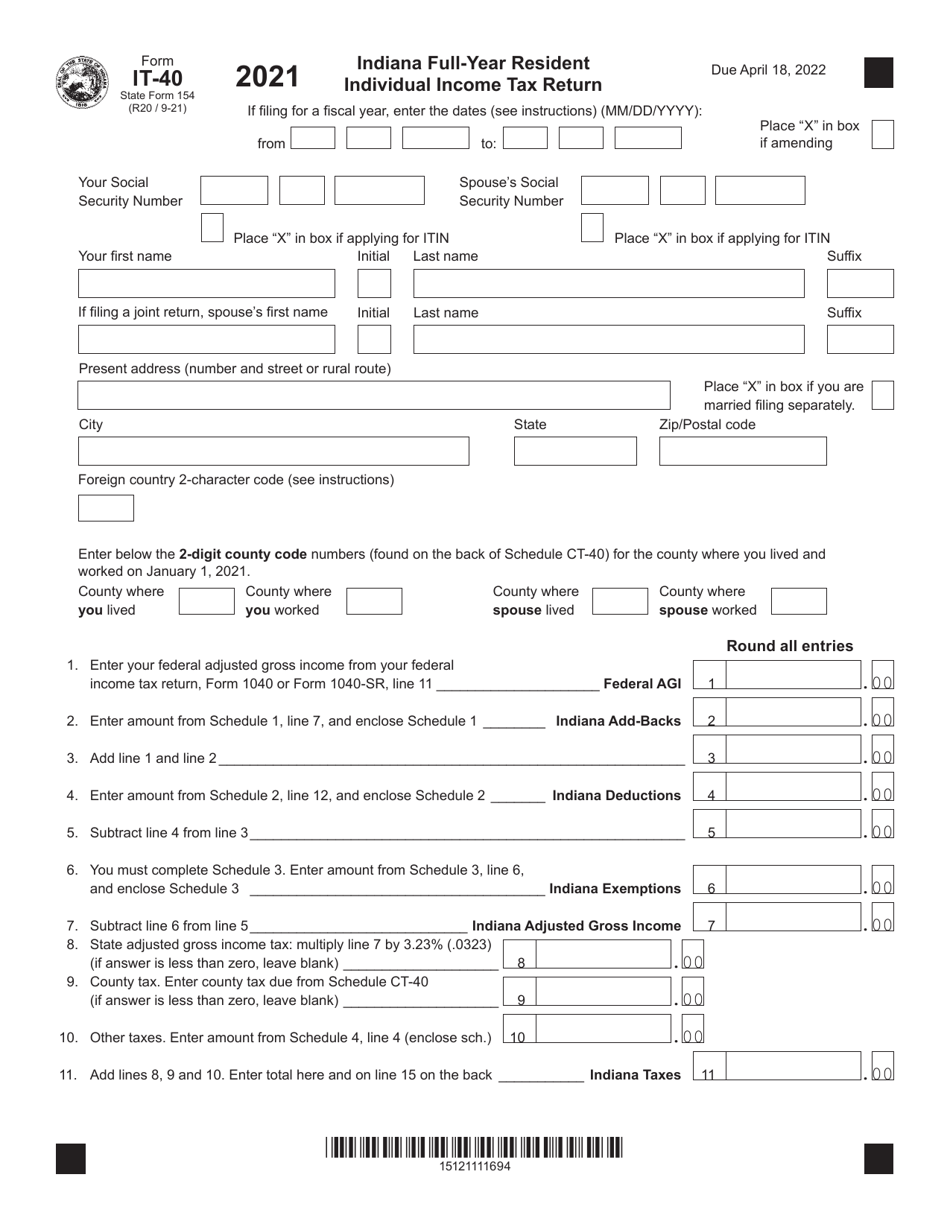

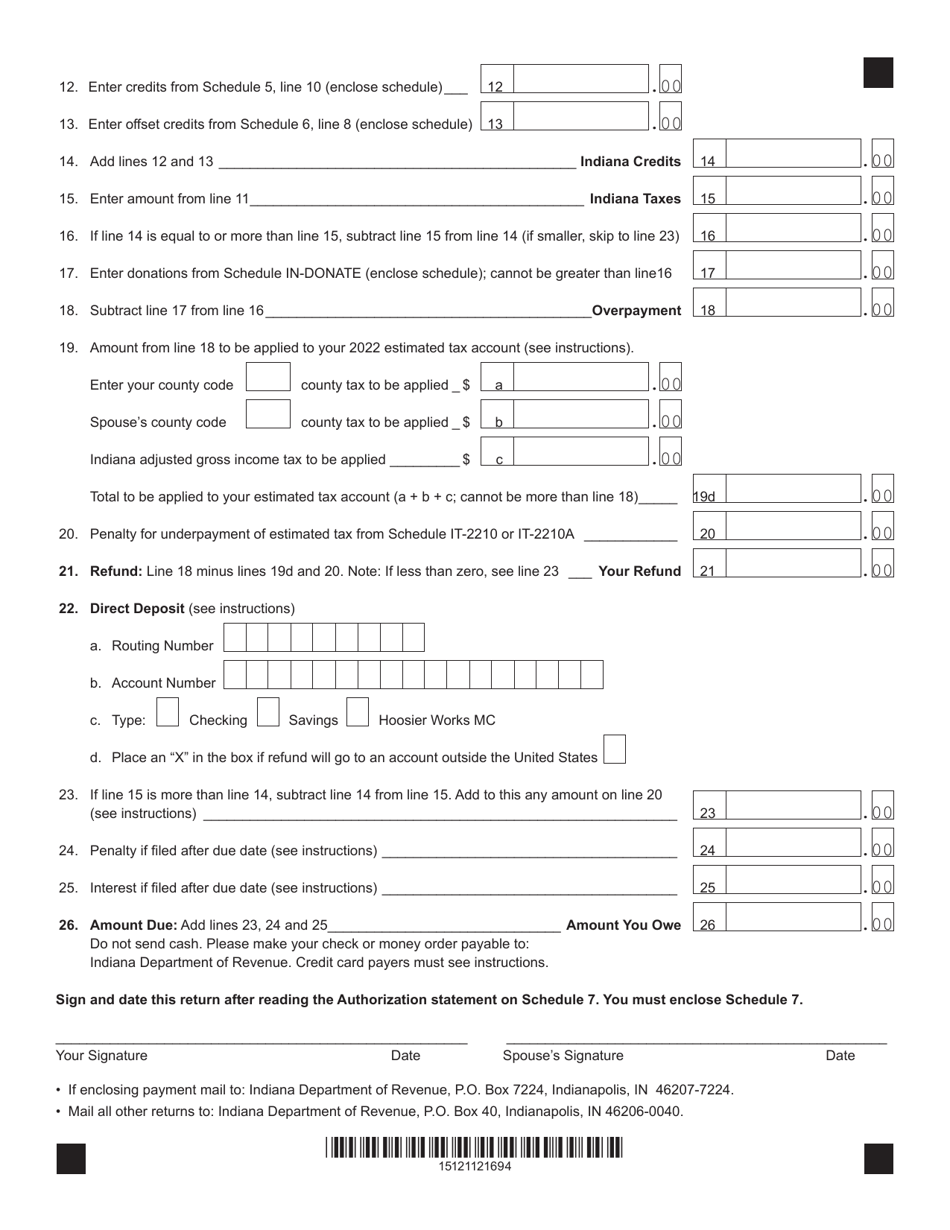

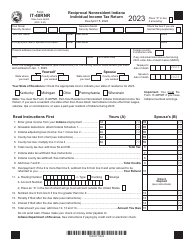

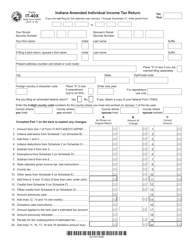

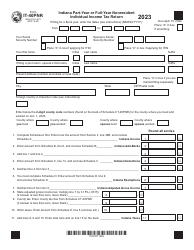

Form IT-40 (State Form 154)

for the current year.

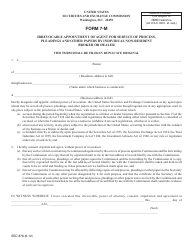

Form IT-40 (State Form 154) Indiana Full-Year Resident Individual Income Tax Return - Indiana

What Is Form IT-40 (State Form 154)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-40?

A: Form IT-40 is the Indiana Full-Year Resident Individual Income Tax Return.

Q: What is the State Form 154?

A: State Form 154 is the specific form number for Form IT-40.

Q: Who needs to file Form IT-40?

A: Indiana full-year residents need to file Form IT-40.

Q: What is the purpose of Form IT-40?

A: Form IT-40 is used to report and pay Indiana state income tax.

Q: Are there any filing requirements for Form IT-40?

A: Yes, you must file Form IT-40 if you had any Indiana income during the tax year.

Q: What are the deadlines for filing Form IT-40?

A: The deadline for filing Form IT-40 is typically April 15th, unless an extension has been granted.

Q: Are there any specific instructions for filling out Form IT-40?

A: Yes, the Indiana Department of Revenue provides detailed instructions for filling out Form IT-40.

Q: Can I e-file Form IT-40?

A: Yes, you can e-file Form IT-40 if you prefer.

Q: What do I do if I need help with Form IT-40?

A: If you need help with Form IT-40, you can contact the Indiana Department of Revenue or consult a tax professional.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40 (State Form 154) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.