This version of the form is not currently in use and is provided for reference only. Download this version of

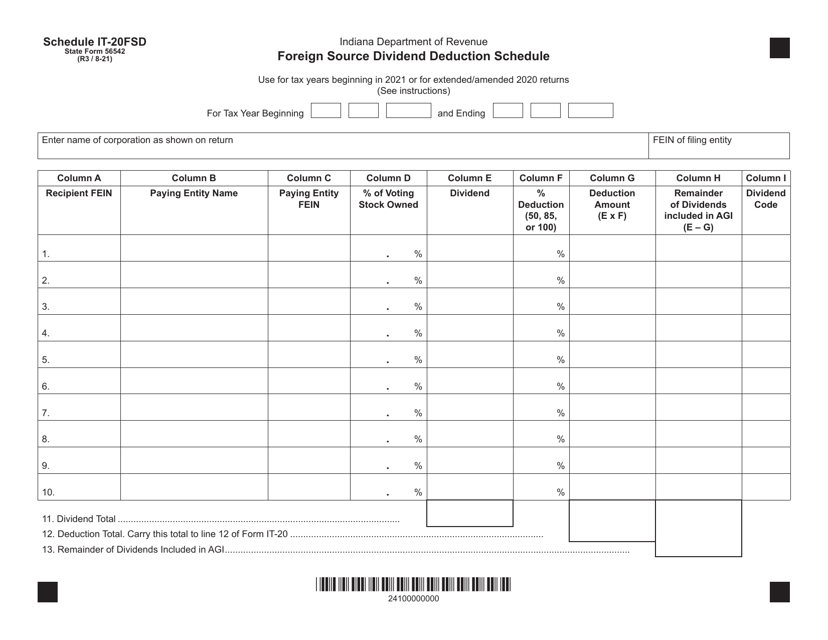

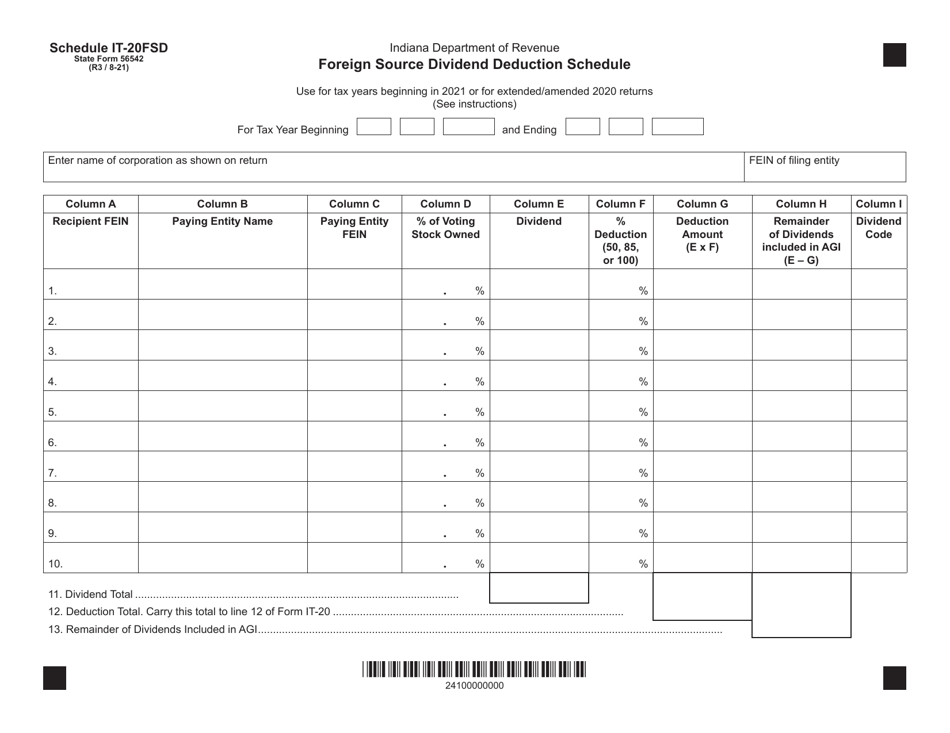

State Form 56542 Schedule IT-20FSD

for the current year.

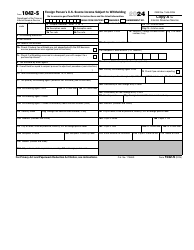

State Form 56542 Schedule IT-20FSD Foreign Source Dividend Deduction Schedule - Indiana

What Is State Form 56542 Schedule IT-20FSD?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 56542 Schedule IT-20FSD?

A: Form 56542 Schedule IT-20FSD is the Foreign Source Dividend Deduction Schedule used in Indiana.

Q: What is the purpose of Schedule IT-20FSD?

A: Schedule IT-20FSD is used to calculate and claim deductions for foreign source dividends in Indiana.

Q: Who needs to file Schedule IT-20FSD?

A: Individuals or businesses that have received foreign source dividends and want to claim a deduction in Indiana need to file Schedule IT-20FSD.

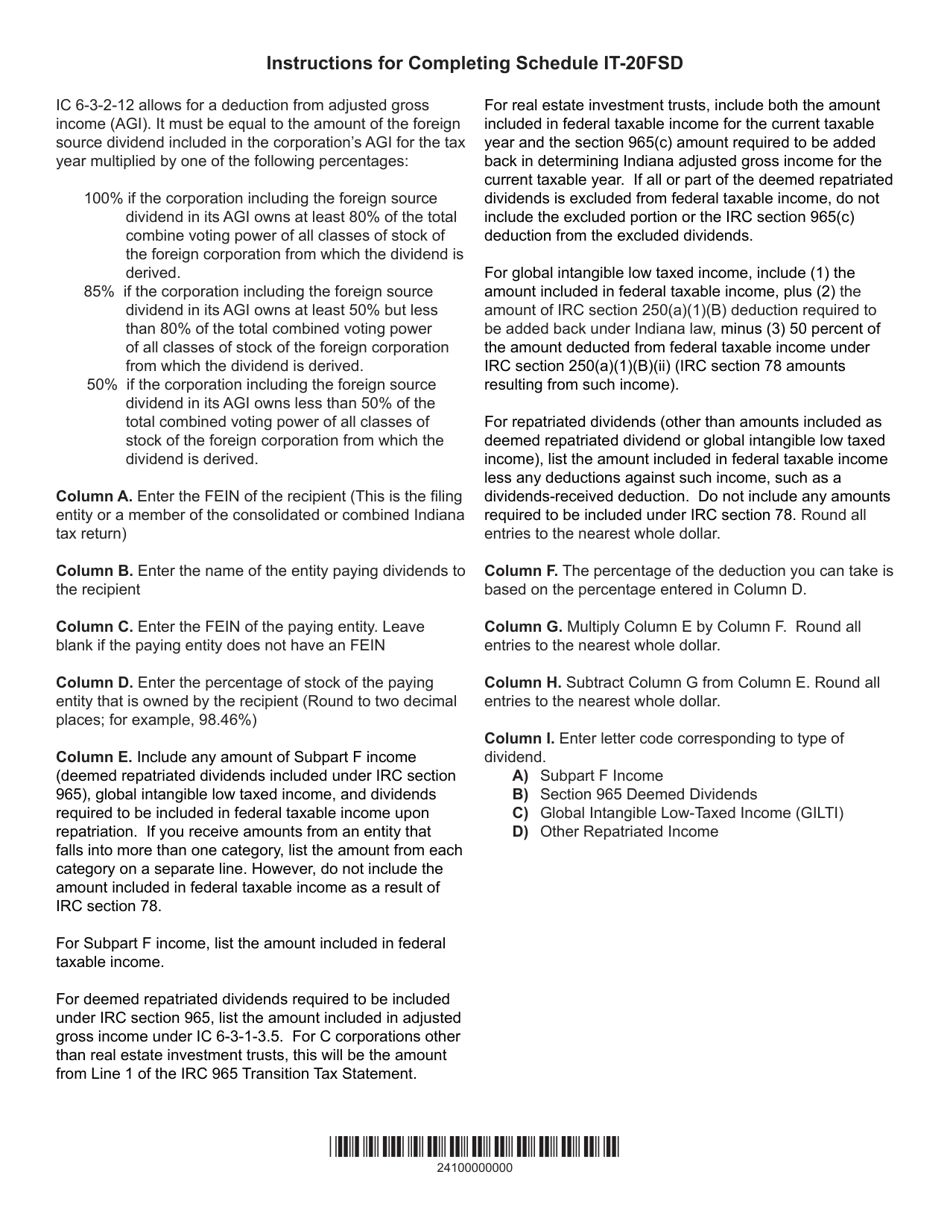

Q: What information do I need to complete Schedule IT-20FSD?

A: You will need information about your foreign source dividends, including the amount received and any applicable taxes paid.

Q: When is the deadline to file Schedule IT-20FSD?

A: The deadline to file Schedule IT-20FSD in Indiana is the same as the deadline for filing your state tax return, which is generally April 15th.

Q: Is there a fee to file Schedule IT-20FSD?

A: No, there is no fee to file Schedule IT-20FSD in Indiana.

Q: Can I e-file Schedule IT-20FSD?

A: Yes, you can e-file Schedule IT-20FSD in Indiana.

Q: What if I make an error on Schedule IT-20FSD?

A: If you make an error on Schedule IT-20FSD, you may need to file an amended return to correct the mistake.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 56542 Schedule IT-20FSD by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.