This version of the form is not currently in use and is provided for reference only. Download this version of

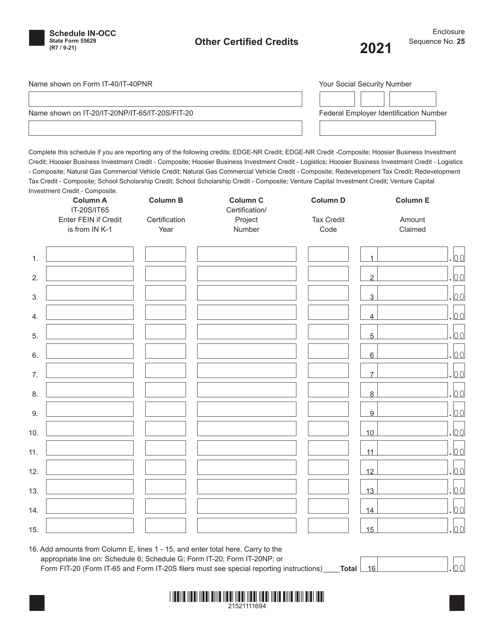

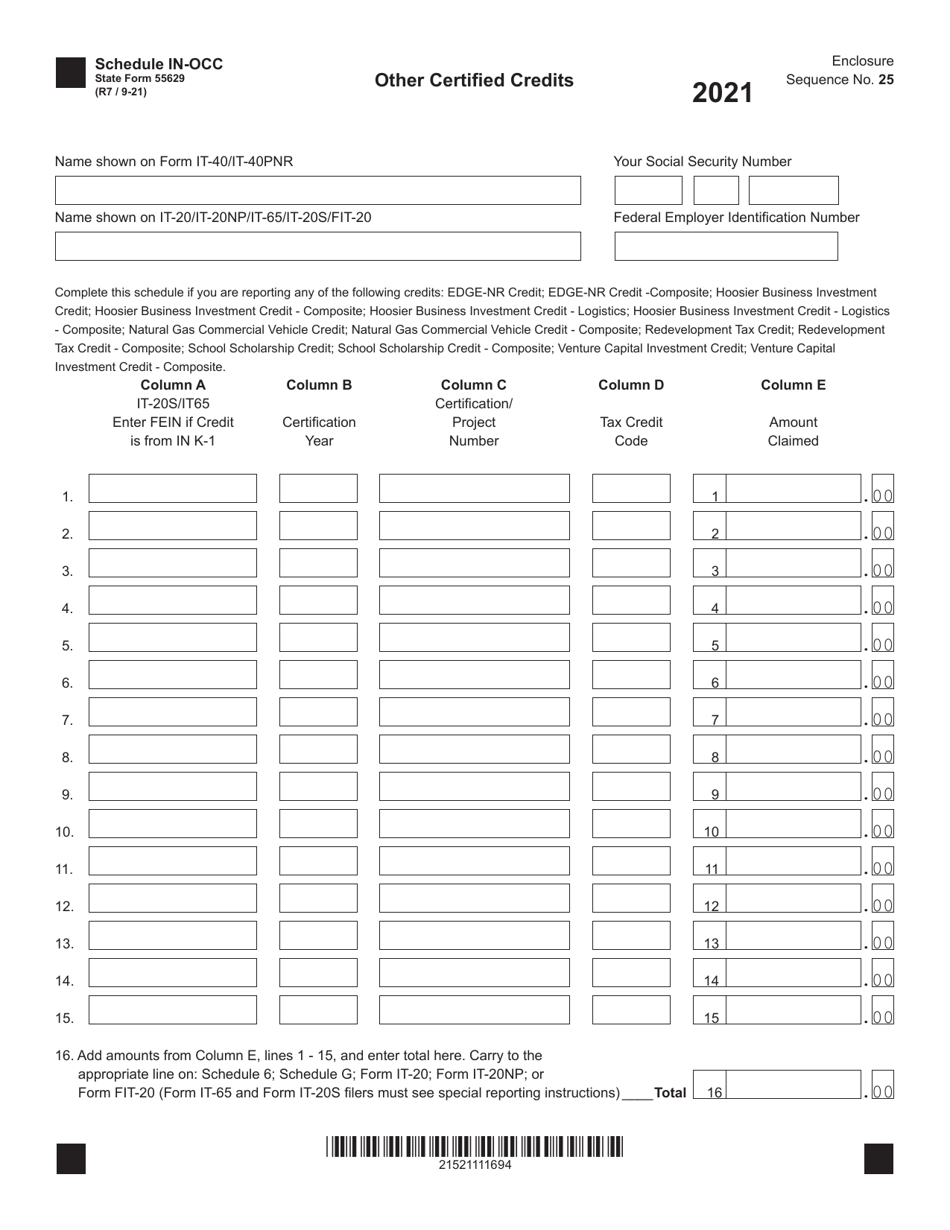

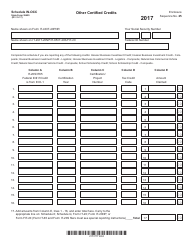

State Form 55629 Schedule IN-OCC

for the current year.

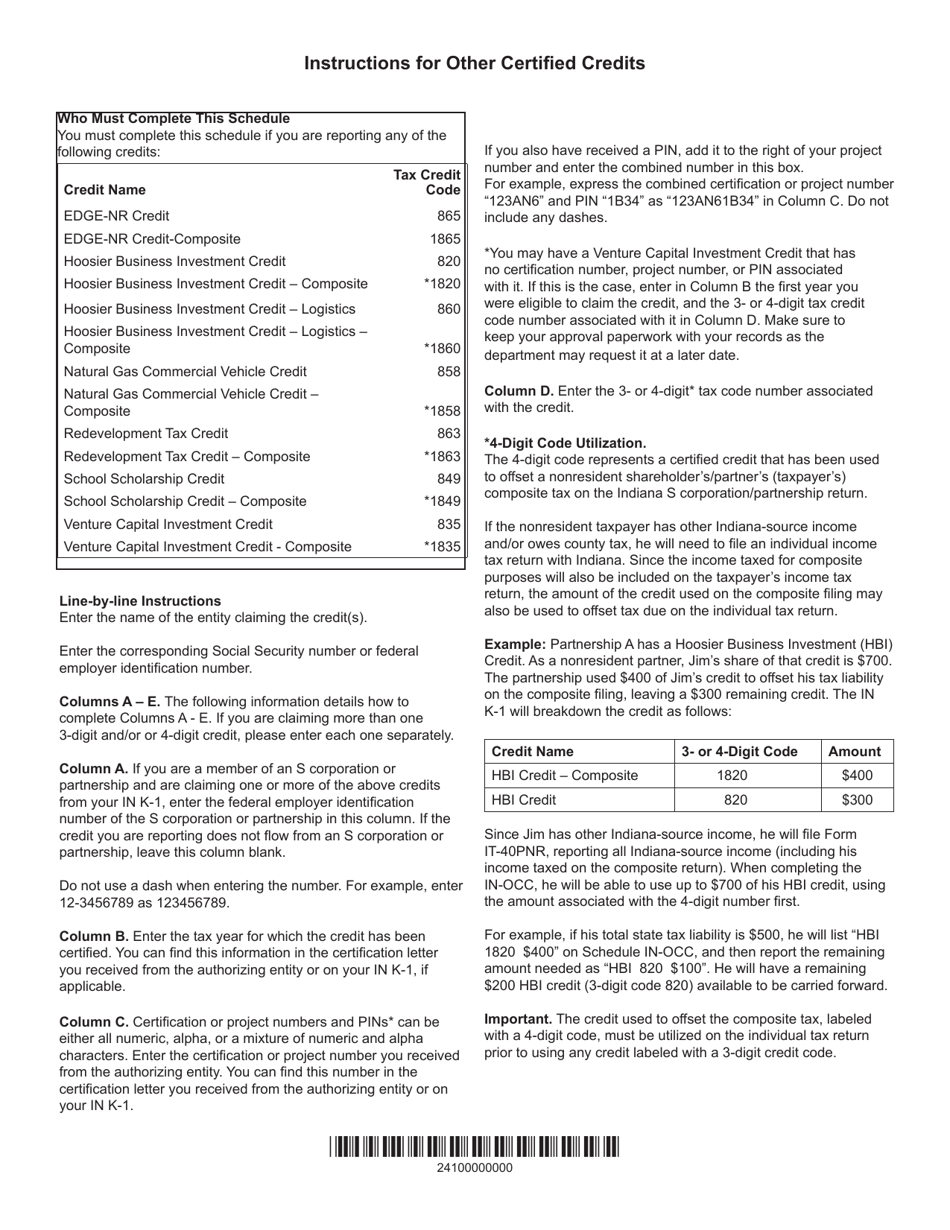

State Form 55629 Schedule IN-OCC Other Certified Credits - Indiana

What Is State Form 55629 Schedule IN-OCC?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 55629?

A: State Form 55629 is a document used in Indiana for reporting and claiming other certified credits.

Q: What is Schedule IN-OCC?

A: Schedule IN-OCC is a specific section of State Form 55629 where you can report and claim other certified credits in Indiana.

Q: What are other certified credits?

A: Other certified credits are a type of tax credit that can be claimed by taxpayers in Indiana for certain qualifying expenses or activities.

Q: Who can use State Form 55629 Schedule IN-OCC?

A: Individuals or businesses in Indiana who have eligible expenses or activities for other certified credits can use State Form 55629 Schedule IN-OCC.

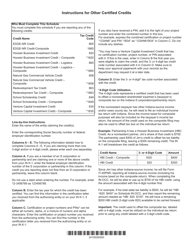

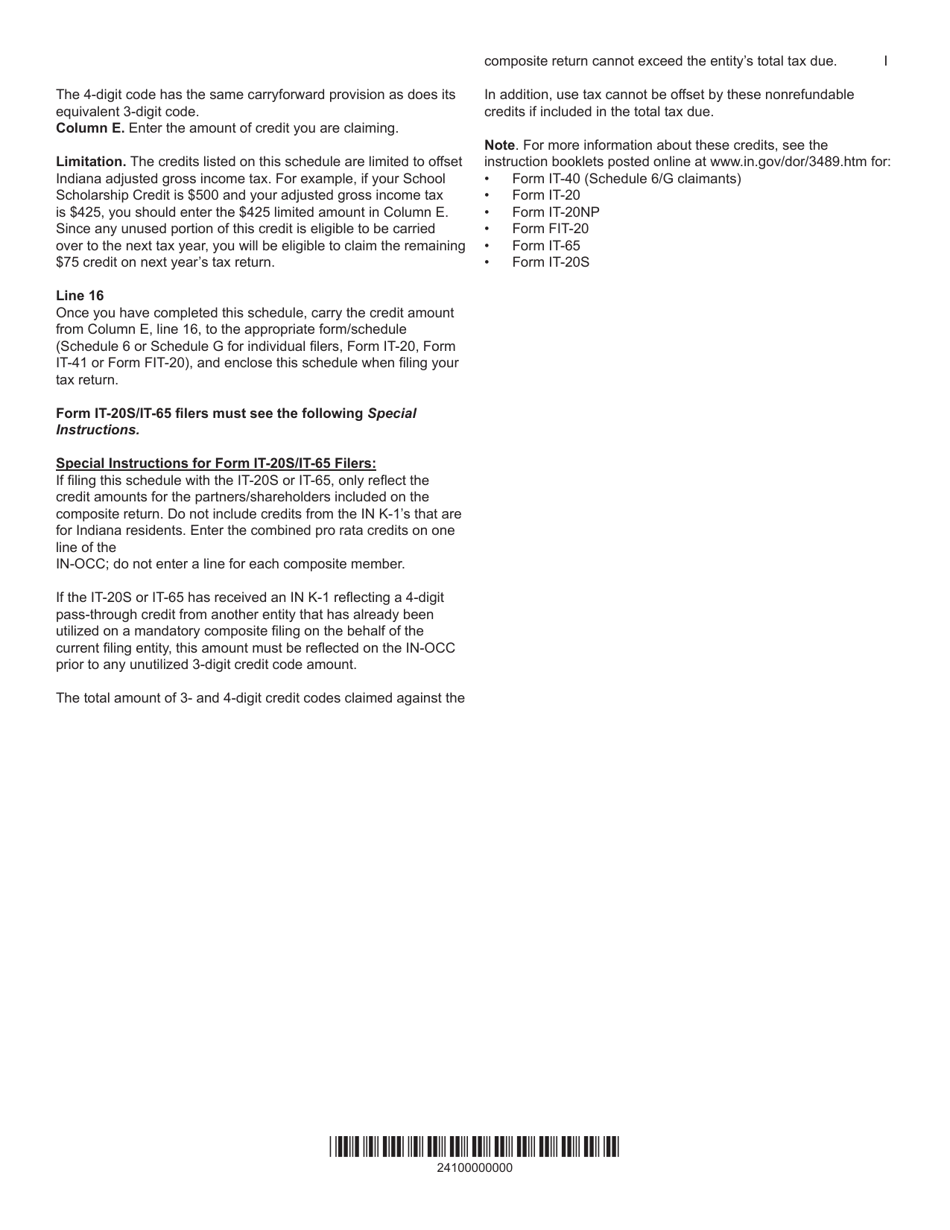

Q: What types of credits can be claimed on Schedule IN-OCC?

A: Schedule IN-OCC allows you to claim a variety of other certified credits, such as the Research Expense Credit or the Venture CapitalInvestment Tax Credit.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 55629 Schedule IN-OCC by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.