This version of the form is not currently in use and is provided for reference only. Download this version of

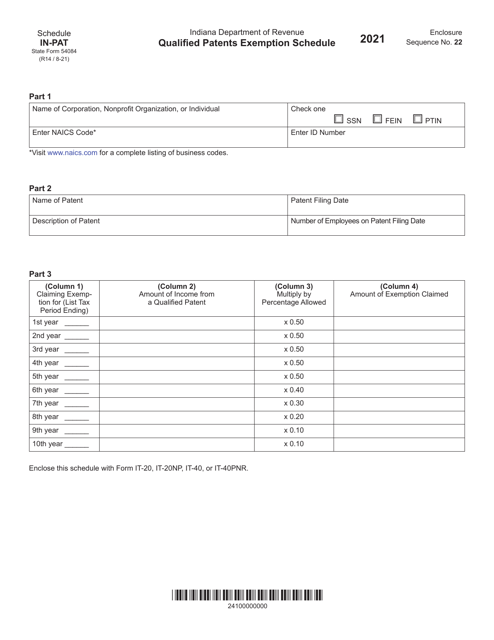

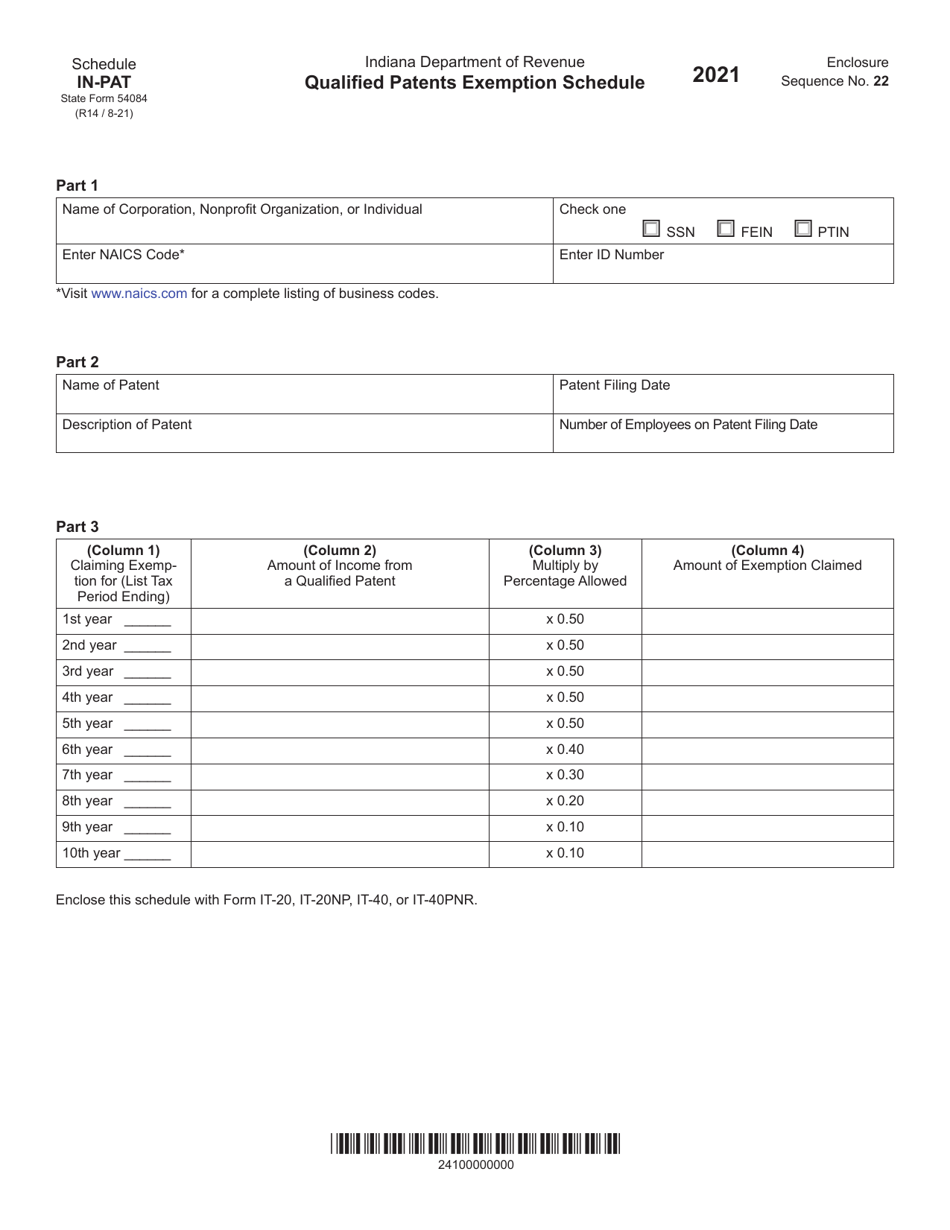

State Form 54084 Schedule IN-PAT

for the current year.

State Form 54084 Schedule IN-PAT Qualified Patents Exemption Schedule - Indiana

What Is State Form 54084 Schedule IN-PAT?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the State Form 54084 Schedule IN-PAT?

A: State Form 54084 Schedule IN-PAT is a tax exemption schedule for qualified patents in Indiana.

Q: What is the purpose of Schedule IN-PAT?

A: The purpose of Schedule IN-PAT is to provide a tax exemption for qualified patents in Indiana.

Q: Who is eligible for the Qualified Patents Exemption?

A: Individuals or businesses who hold qualified patents in Indiana may be eligible for the exemption.

Q: What are qualified patents?

A: Qualified patents refer to patents that have been issued by the United States Patent and Trademark Office.

Q: What taxes are exempted by Schedule IN-PAT?

A: Schedule IN-PAT provides exemption from the state and county option income taxes for qualified patents.

Q: How do I claim the Qualified Patents Exemption?

A: To claim the exemption, you must complete and file State Form 54084 Schedule IN-PAT with your Indiana income tax return.

Q: Are there any limitations to the exemption?

A: Yes, there are limitations to the exemption, such as a maximum exemption amount and an expiration date for the patent.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 54084 Schedule IN-PAT by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.