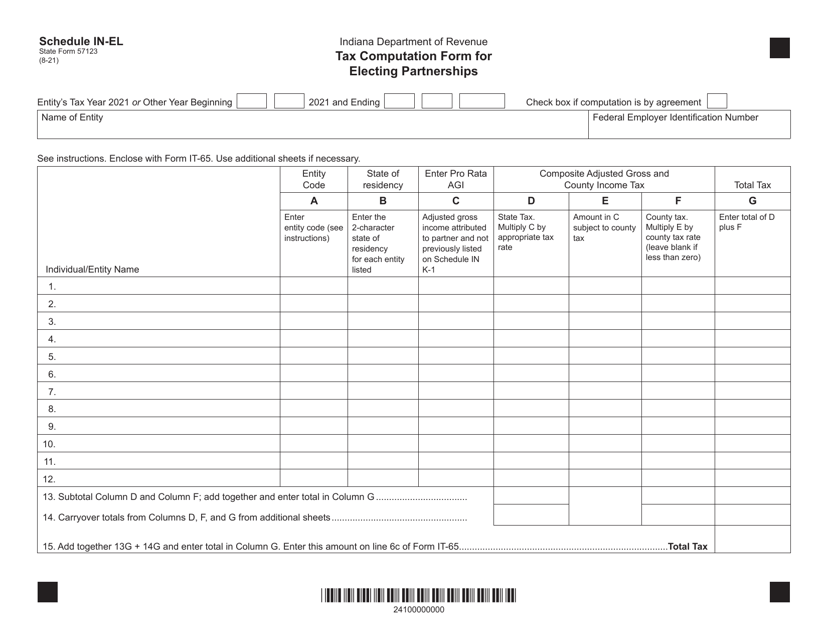

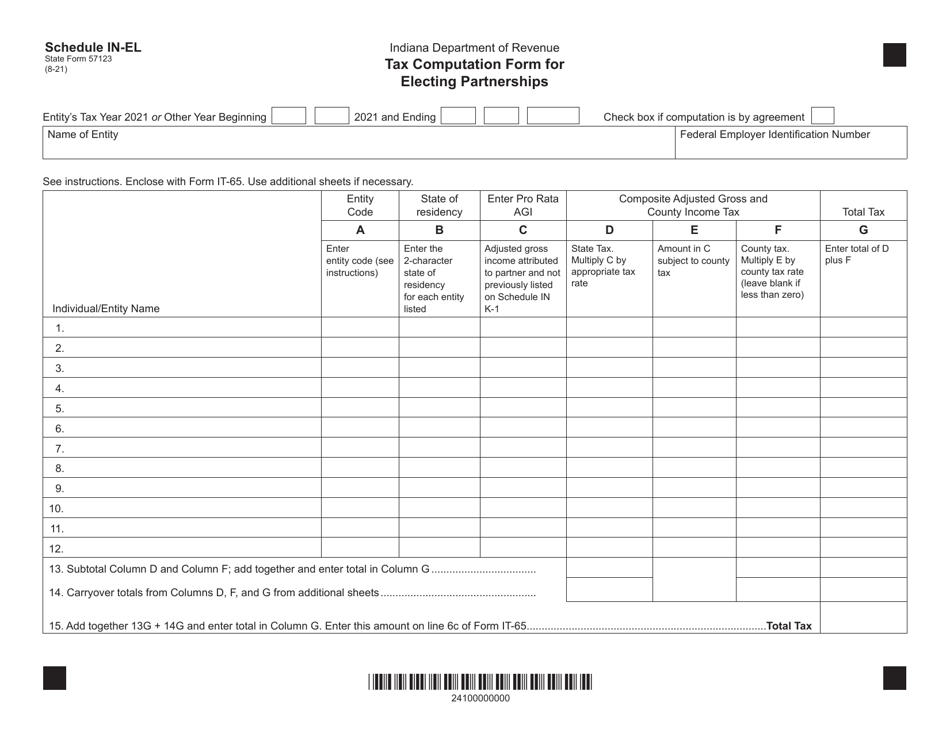

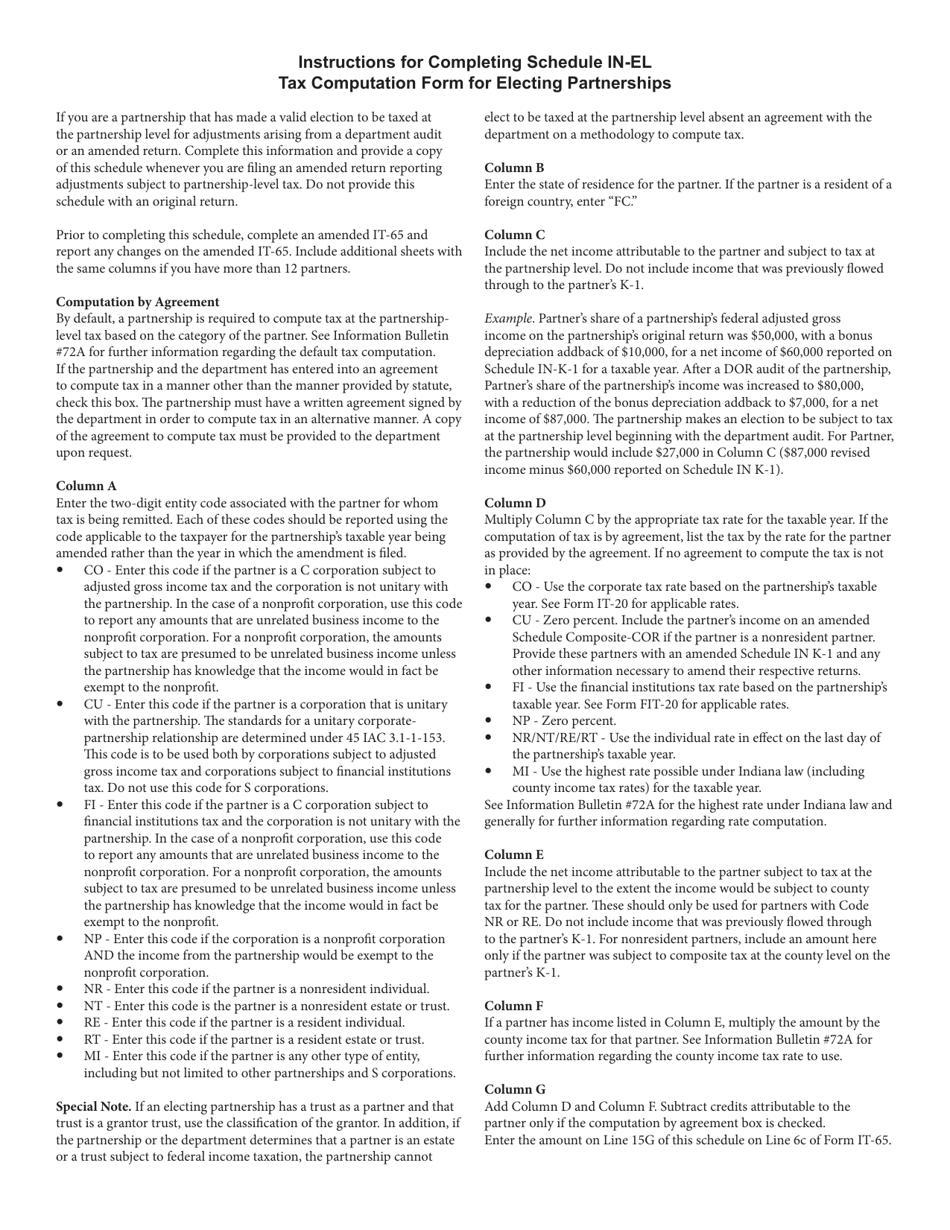

State Form 57123 Schedule IN-EL Tax Computation Form for Electing Partnerships - Indiana

What Is State Form 57123 Schedule IN-EL?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 57123 Schedule IN-EL?

A: Form 57123 Schedule IN-EL is a tax computation form for electing partnerships in Indiana.

Q: Who should use Form 57123 Schedule IN-EL?

A: Form 57123 Schedule IN-EL should be used by electing partnerships in Indiana.

Q: What is the purpose of Form 57123 Schedule IN-EL?

A: The purpose of Form 57123 Schedule IN-EL is to calculate the tax liability for electing partnerships in Indiana.

Q: Do I need to file Form 57123 Schedule IN-EL?

A: If you are an electing partnership in Indiana, you are required to file Form 57123 Schedule IN-EL along with your annual tax return.

Q: What information is required on Form 57123 Schedule IN-EL?

A: Form 57123 Schedule IN-EL requires information about the electing partnership's income, deductions, and tax credits in order to determine the tax liability.

Q: When is Form 57123 Schedule IN-EL due?

A: Form 57123 Schedule IN-EL is due on the same date as the electing partnership's annual tax return, usually April 15th.

Q: What happens if I don't file Form 57123 Schedule IN-EL?

A: Failing to file Form 57123 Schedule IN-EL may result in penalties and interest being assessed on any tax owed by the electing partnership.

Q: Can I amend Form 57123 Schedule IN-EL?

A: Yes, you can amend Form 57123 Schedule IN-EL if you need to correct any errors or update information previously reported.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 57123 Schedule IN-EL by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.