This version of the form is not currently in use and is provided for reference only. Download this version of

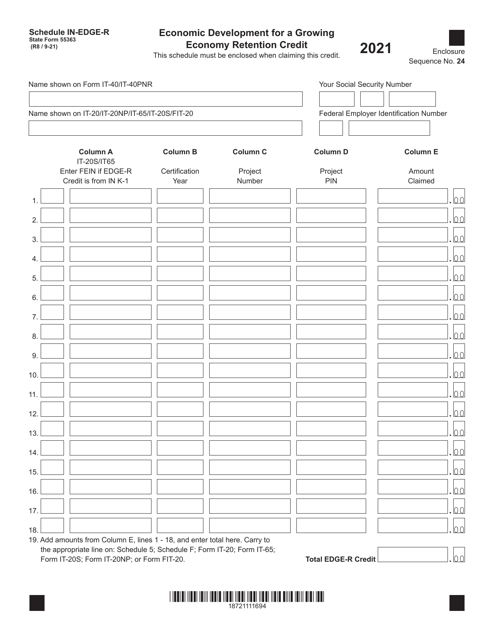

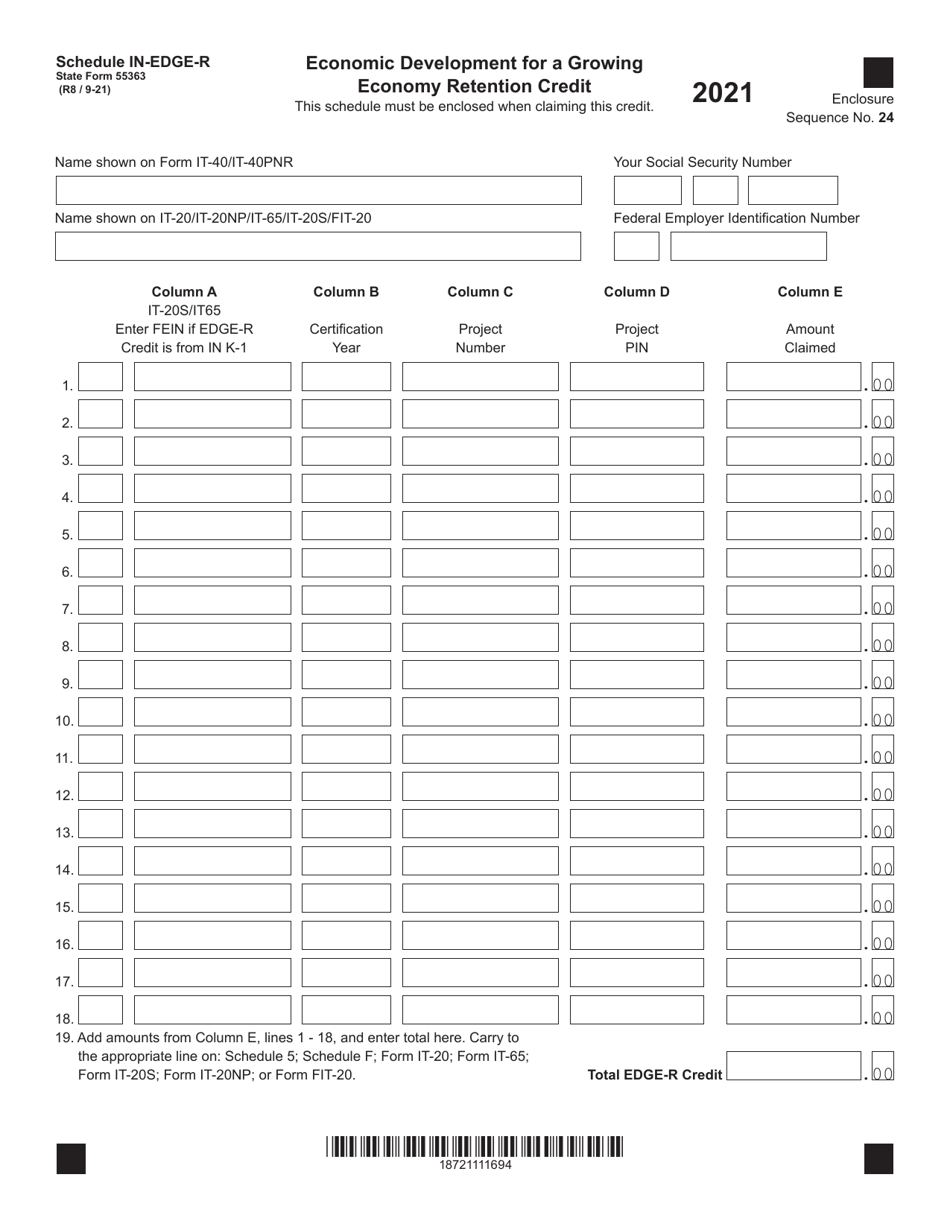

State Form 55363 Schedule IN-EDGE-R

for the current year.

State Form 55363 Schedule IN-EDGE-R Economic Development for a Growing Economy Retention Credit - Indiana

What Is State Form 55363 Schedule IN-EDGE-R?

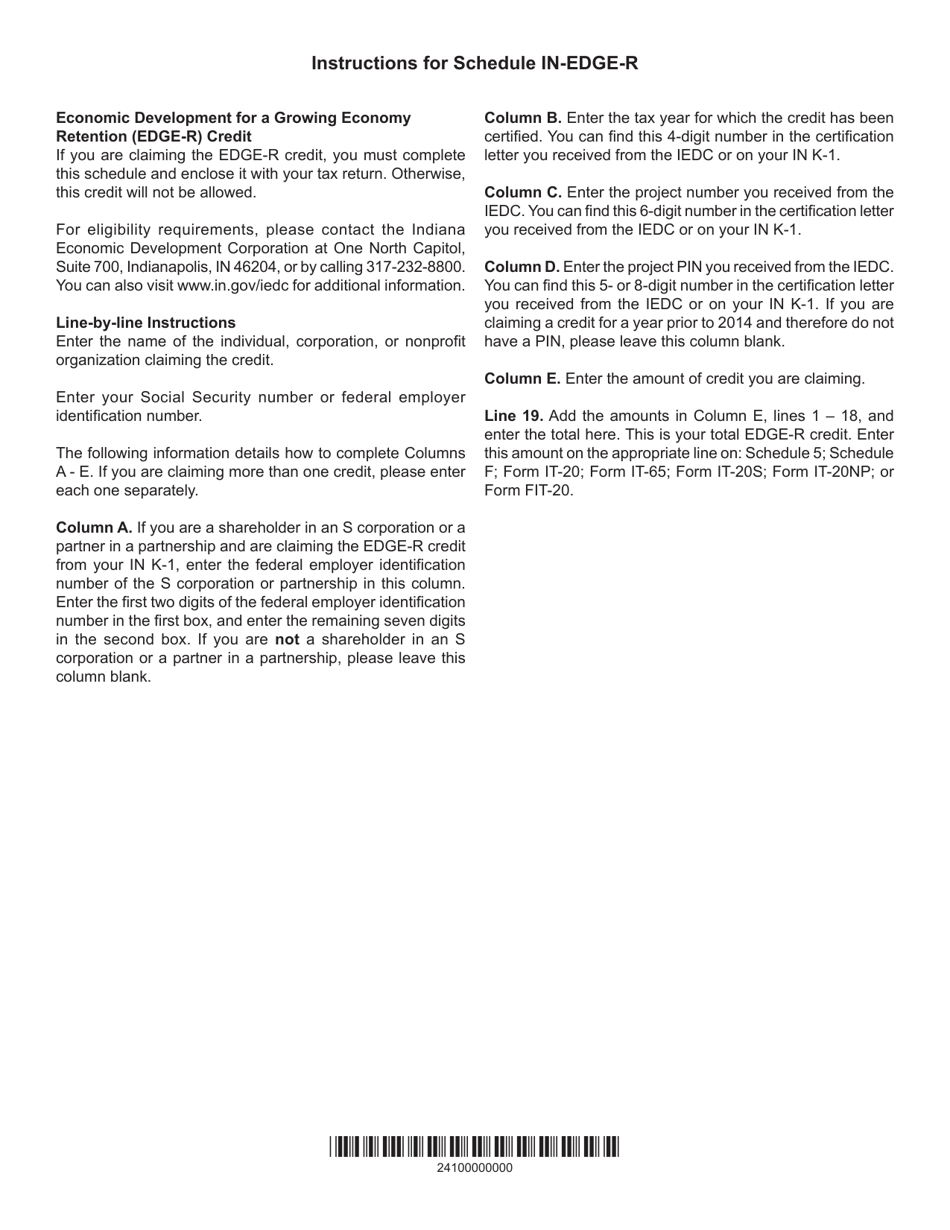

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 55363?

A: State Form 55363 is a form used for Schedule IN-EDGE-R Economic Development for a Growing Economy Retention Credit in Indiana.

Q: What is the purpose of Schedule IN-EDGE-R?

A: The purpose of Schedule IN-EDGE-R is to claim the Economic Development for a Growing Economy Retention Credit in Indiana.

Q: What is the Economic Development for a Growing Economy Retention Credit?

A: The Economic Development for a Growing Economy Retention Credit is a tax credit provided to businesses in Indiana that meet certain criteria.

Q: Who is eligible for the Economic Development for a Growing Economy Retention Credit?

A: Businesses that meet the criteria set by the state of Indiana are eligible for the Economic Development for a Growing Economy Retention Credit.

Q: How can I claim the Economic Development for a Growing Economy Retention Credit?

A: You can claim the Economic Development for a Growing Economy Retention Credit by filling out Schedule IN-EDGE-R on State Form 55363 and submitting it to the appropriate authority in Indiana.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 55363 Schedule IN-EDGE-R by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.