This version of the form is not currently in use and is provided for reference only. Download this version of

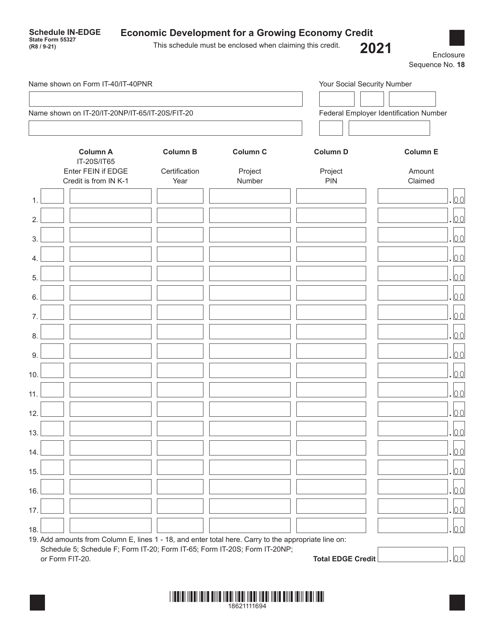

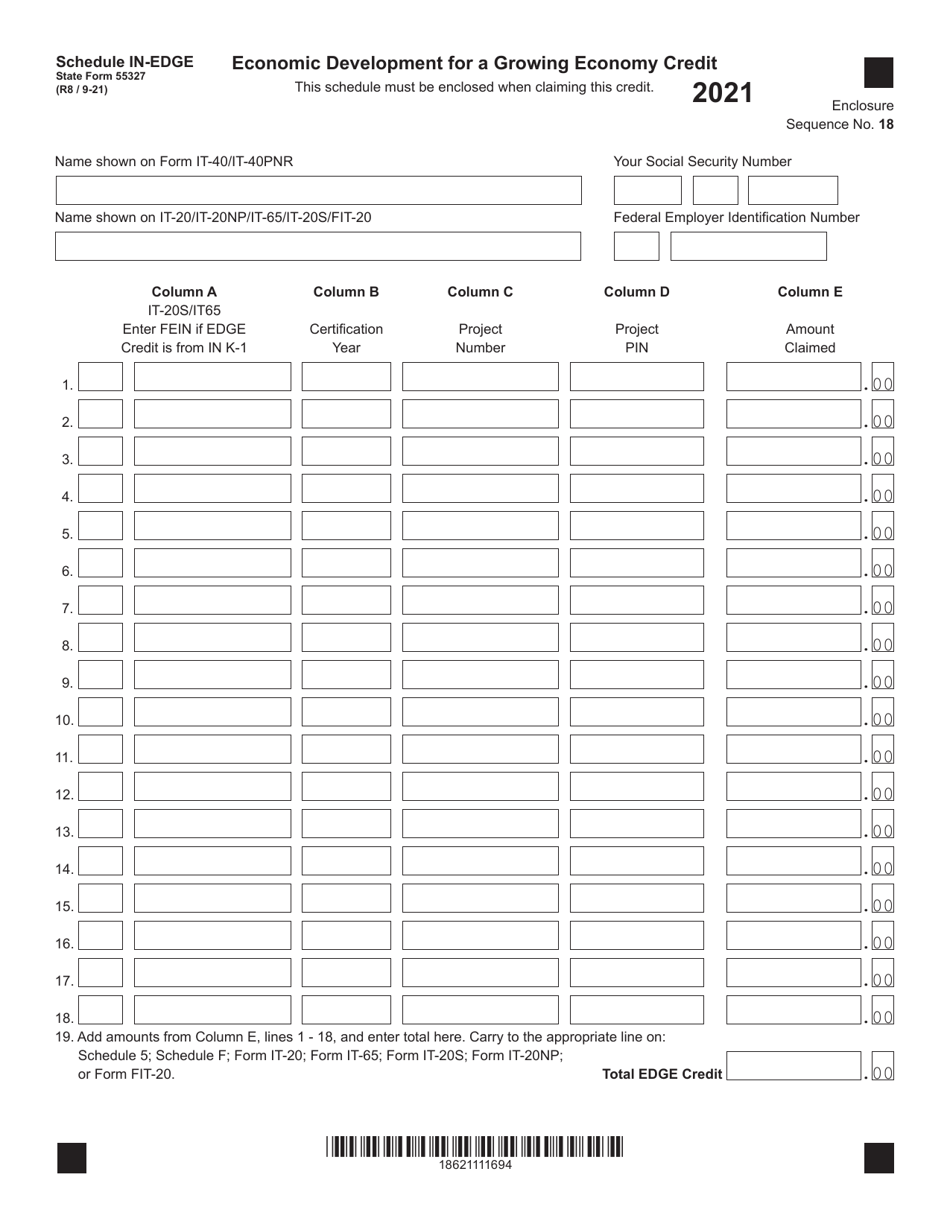

State Form 55327 Schedule IN-EDGE

for the current year.

State Form 55327 Schedule IN-EDGE Economic Development for a Growing Economy Credit - Indiana

What Is State Form 55327 Schedule IN-EDGE?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 55327?

A: State Form 55327 is a form used for Schedule IN-EDGE Economic Development for a Growing Economy Credit in Indiana.

Q: What is the purpose of Schedule IN-EDGE Economic Development for a Growing Economy Credit?

A: The purpose of this credit is to promote economic growth and development in Indiana.

Q: Who is eligible for the IN-EDGE Economic Development for a Growing Economy Credit?

A: Eligible taxpayers include corporations and individuals engaged in qualified activities in Indiana.

Q: What are qualified activities for this credit?

A: Qualified activities include manufacturing, logistics, warehousing, information technology, research and development, and other specified industries.

Q: How is the credit calculated?

A: The credit is based on a percentage of the taxpayer's qualified investment and job creation.

Q: Are there any limitations on the credit?

A: Yes, there are limitations, including an annual cap on the total amount of credits that will be awarded.

Q: How do I apply for the IN-EDGE Economic Development for a Growing Economy Credit?

A: To apply for this credit, you must complete and file State Form 55327 Schedule IN-EDGE with your tax return.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 55327 Schedule IN-EDGE by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.