This version of the form is not currently in use and is provided for reference only. Download this version of

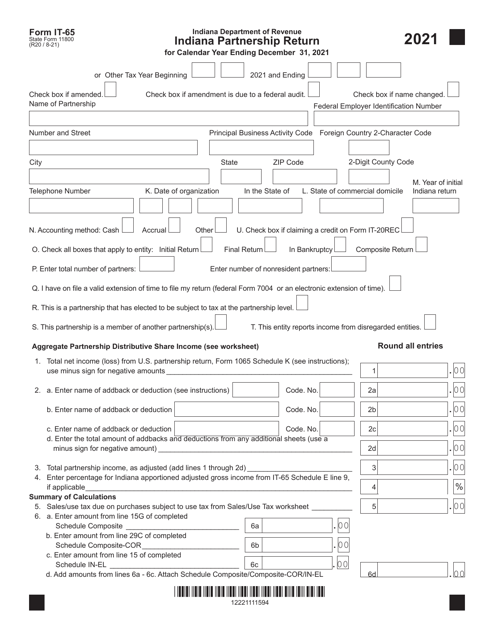

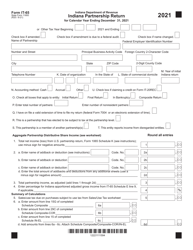

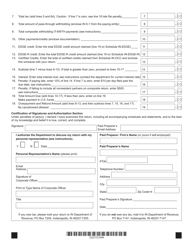

Form IT-65 (State Form 11800)

for the current year.

Form IT-65 (State Form 11800) Indiana Partnership Return - Indiana

What Is Form IT-65 (State Form 11800)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-65?

A: Form IT-65 is the Indiana Partnership Return.

Q: Who needs to file Form IT-65?

A: Partnerships doing business in Indiana need to file Form IT-65.

Q: What is the purpose of Form IT-65?

A: Form IT-65 is used to report partnership income, deductions, credits, and other tax information to the state of Indiana.

Q: When is Form IT-65 due?

A: Form IT-65 is generally due on the 15th day of the 4th month following the end of the partnership's tax year.

Q: Are there any filing fees for Form IT-65?

A: No, there are no filing fees for Form IT-65.

Q: What should I do if I need more time to file Form IT-65?

A: You can request an extension to file Form IT-65 by filing Form IT-9.

Q: Are there any penalties for late filing of Form IT-65?

A: Yes, there may be penalties for late filing of Form IT-65. It is important to file the form on time to avoid penalties.

Q: Is Form IT-65 only for partnerships with income in Indiana?

A: Yes, Form IT-65 is specifically for partnerships that have income or conduct business in Indiana.

Q: Are there any additional forms or schedules that need to be filed with Form IT-65?

A: Yes, depending on the partnership's activities, additional forms or schedules may need to be filed along with Form IT-65.

Q: Can I amend a previously filed Form IT-65?

A: Yes, you can amend a previously filed Form IT-65 by filing Form IT-65-V.

Q: What should I do if I have questions about filing Form IT-65?

A: If you have questions about filing Form IT-65, you can contact the Indiana Department of Revenue for assistance.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-65 (State Form 11800) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.