This version of the form is not currently in use and is provided for reference only. Download this version of

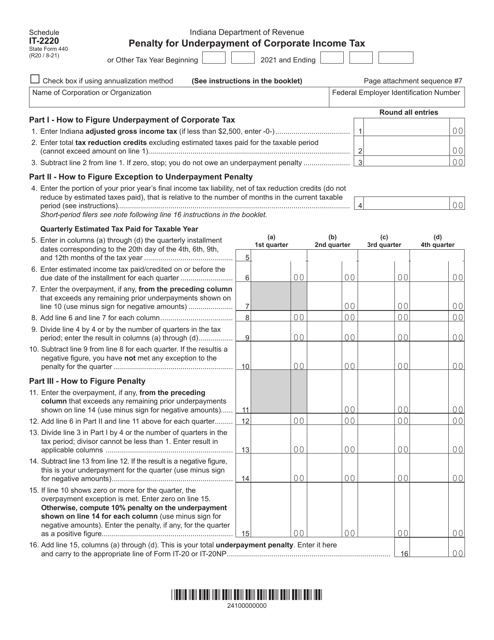

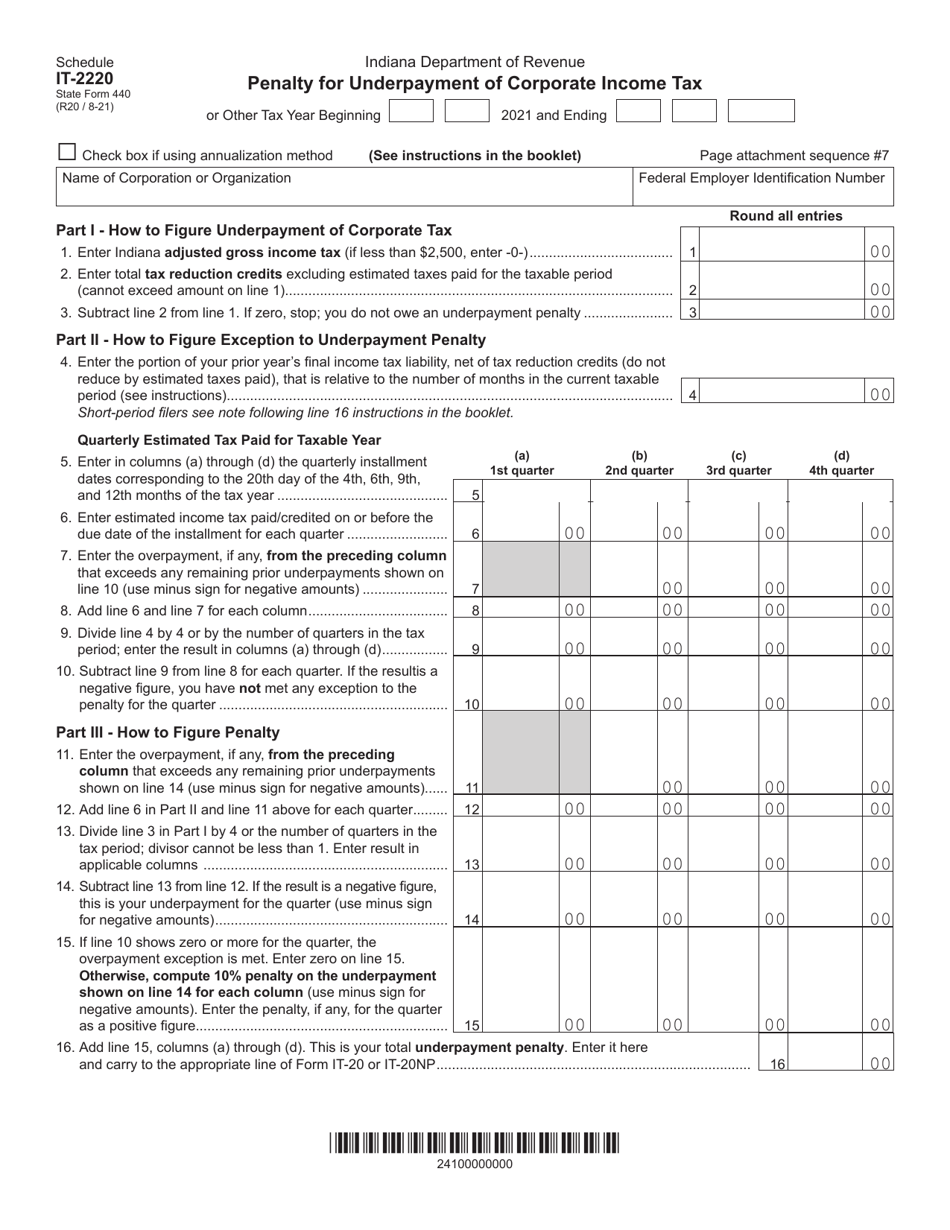

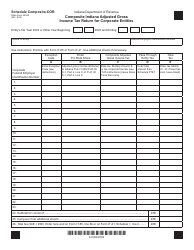

State Form 440 Schedule IT-2220

for the current year.

State Form 440 Schedule IT-2220 Penalty for Underpayment of Corporate Income Tax - Indiana

What Is State Form 440 Schedule IT-2220?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 440 Schedule IT-2220?

A: Form 440 Schedule IT-2220 is a form used in Indiana to calculate penalties for underpayment of corporate income tax.

Q: What is the penalty for underpayment of corporate income tax in Indiana?

A: The penalty for underpayment of corporate income tax in Indiana is calculated using Form 440 Schedule IT-2220.

Q: How do I calculate the penalty for underpayment of corporate income tax in Indiana?

A: You can calculate the penalty for underpayment of corporate income tax in Indiana by completing Form 440 Schedule IT-2220.

Q: Do I need to file Form 440 Schedule IT-2220?

A: You only need to file Form 440 Schedule IT-2220 if you have underpaid your corporate income tax in Indiana.

Q: Is there a deadline for filing Form 440 Schedule IT-2220?

A: Yes, there is a deadline for filing Form 440 Schedule IT-2220. The deadline is usually the same as the deadline for filing your corporate income tax return in Indiana.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 440 Schedule IT-2220 by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.