This version of the form is not currently in use and is provided for reference only. Download this version of

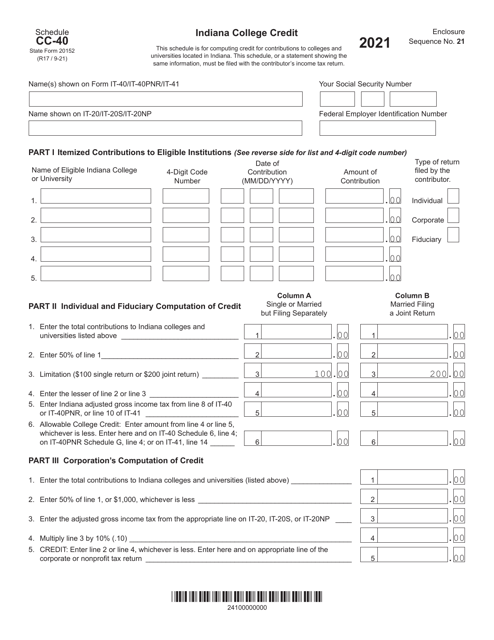

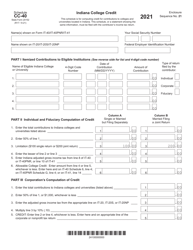

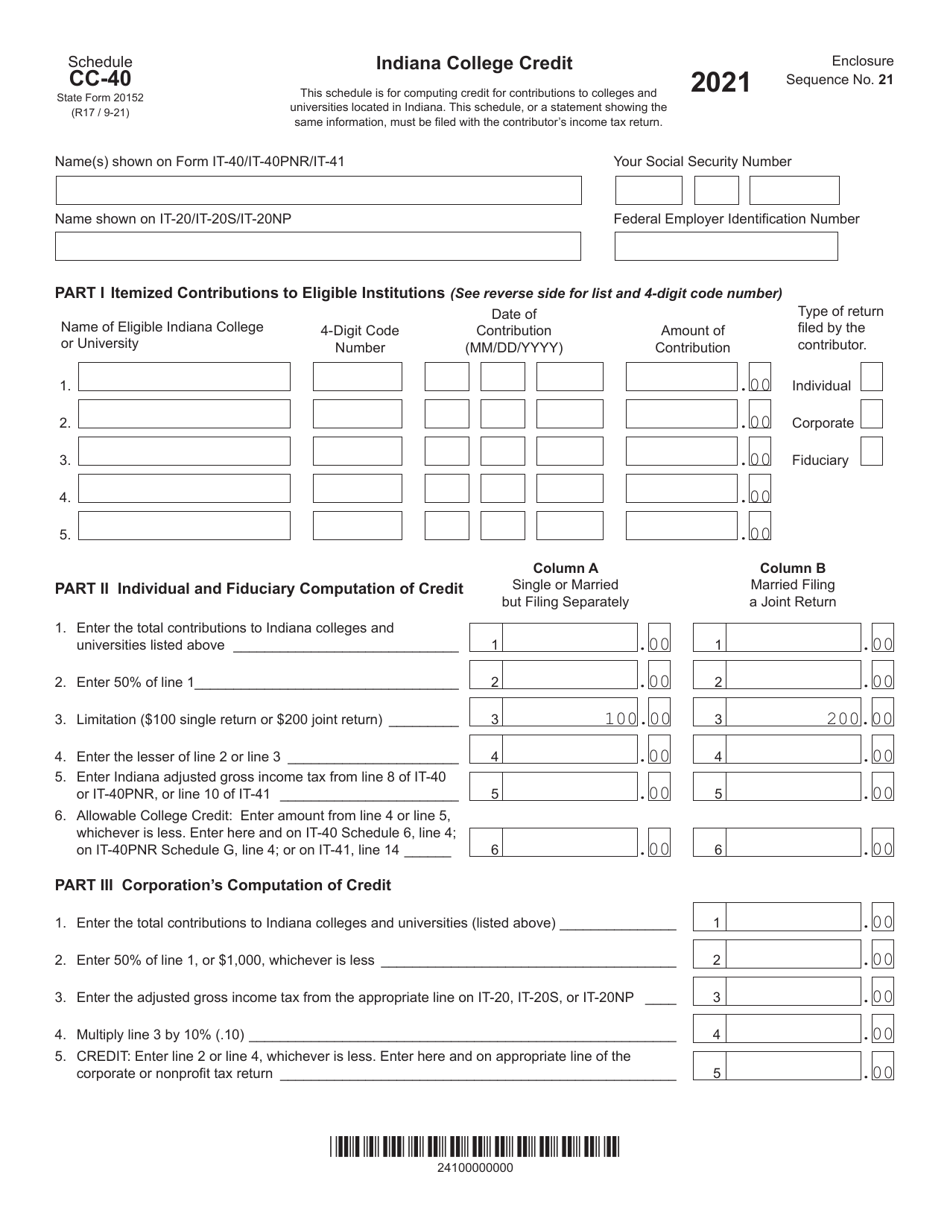

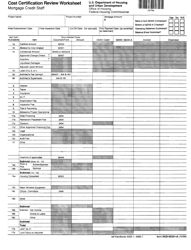

State Form 20152 Schedule CC-40

for the current year.

State Form 20152 Schedule CC-40 Indiana College Credit - Indiana

What Is State Form 20152 Schedule CC-40?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

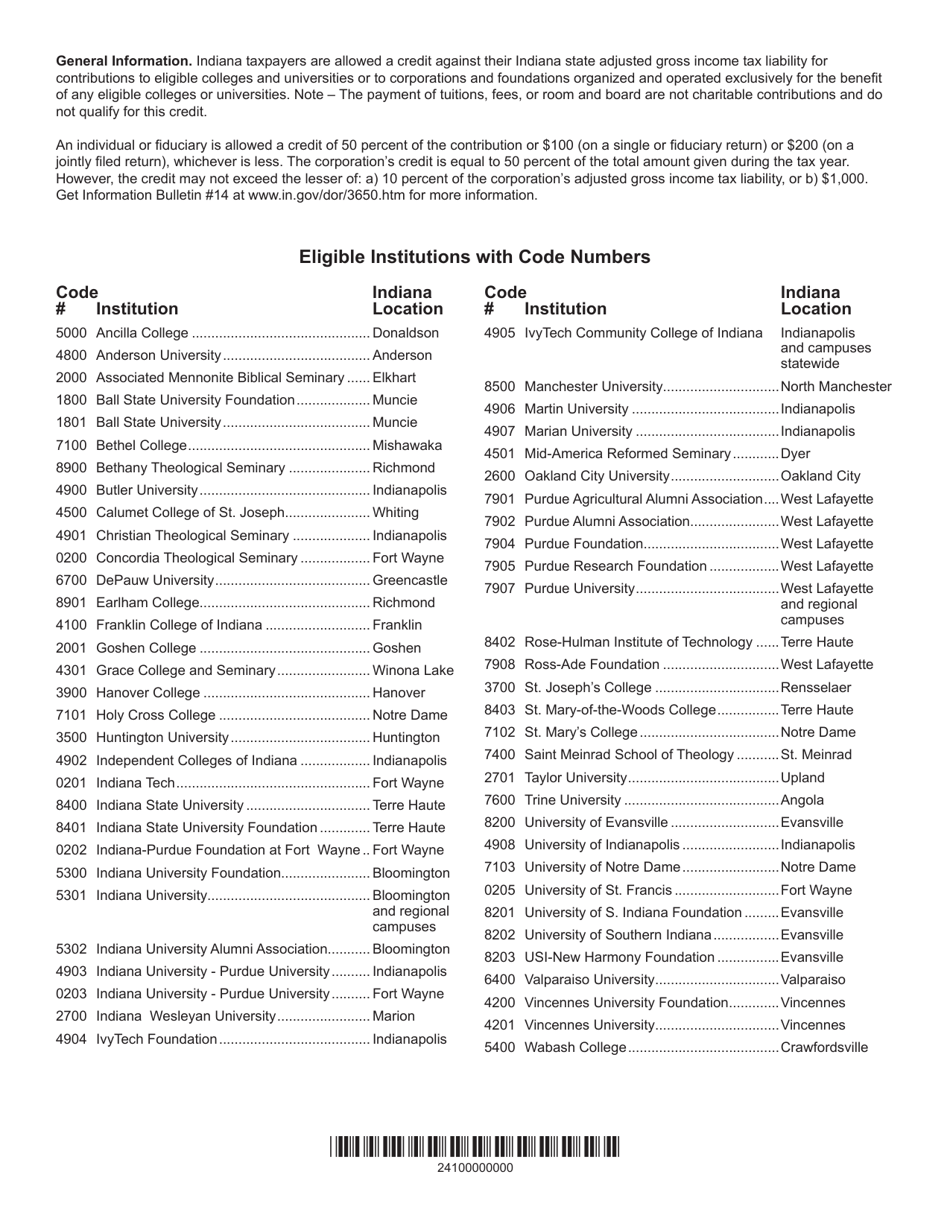

Q: What is Schedule CC-40?

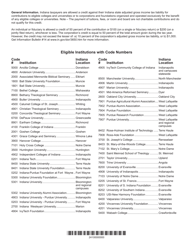

A: Schedule CC-40 is a form used in the state of Indiana to claim the Indiana College Credit.

Q: What is the Indiana College Credit?

A: The Indiana College Credit is a tax credit available to residents of Indiana who have incurred qualified higher education expenses.

Q: Who can claim the Indiana College Credit?

A: Residents of Indiana who have incurred qualified higher education expenses can claim the Indiana College Credit.

Q: What are qualified higher education expenses?

A: Qualified higher education expenses include tuition, books, and fees paid to an eligible educational institution.

Q: How much is the Indiana College Credit?

A: The Indiana College Credit is equal to 50% of the qualified higher education expenses, up to a maximum credit of $2,500 per year.

Q: How do I claim the Indiana College Credit?

A: To claim the Indiana College Credit, you must complete Schedule CC-40 and include it with your Indiana state income tax return.

Q: Is the Indiana College Credit refundable?

A: No, the Indiana College Credit is non-refundable. It can only be used to offset your state income tax liability.

Q: Are there any income limits to claim the Indiana College Credit?

A: Yes, there are income limits to claim the Indiana College Credit. The credit is gradually phased out for higher income individuals.

Q: When is the deadline to file Schedule CC-40?

A: Schedule CC-40 must be filed with your Indiana state income tax return by the due date, which is typically April 15th.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 20152 Schedule CC-40 by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.