This version of the form is not currently in use and is provided for reference only. Download this version of

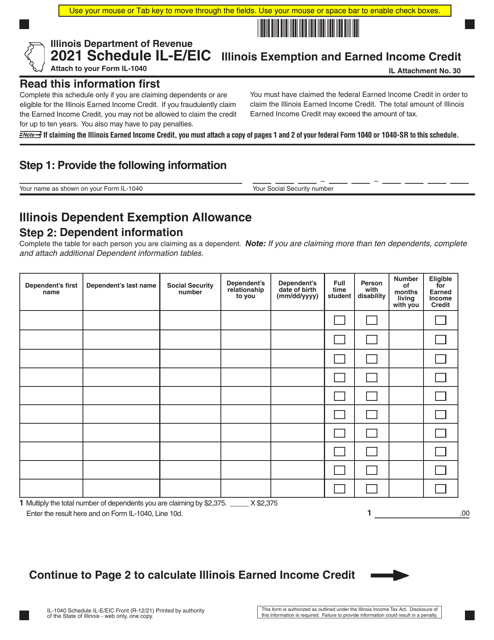

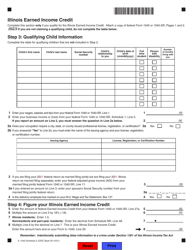

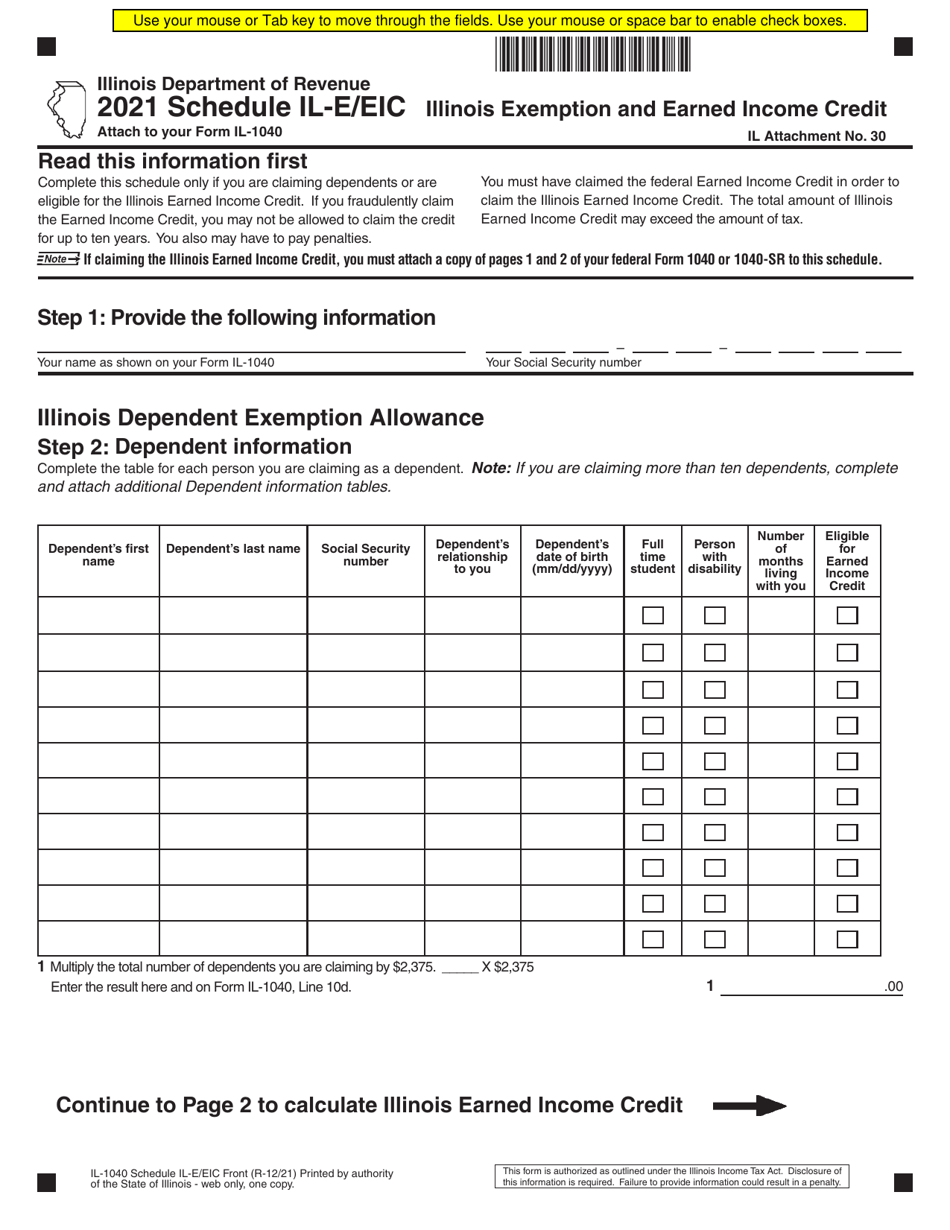

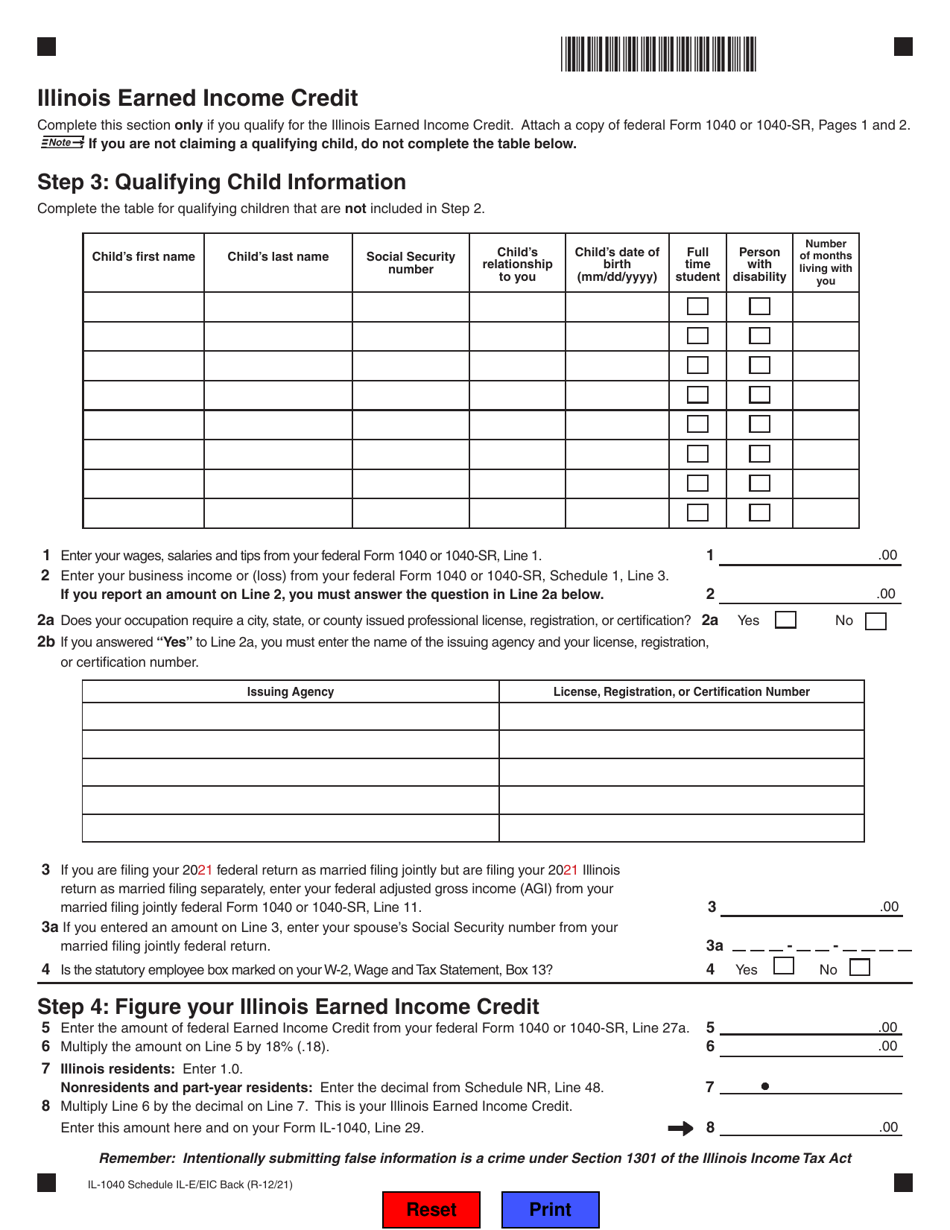

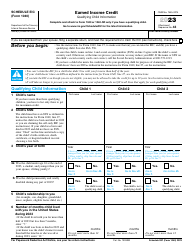

Form IL-1040 Schedule IL-E/EIC

for the current year.

Form IL-1040 Schedule IL-E / EIC Illinois Exemption and Earned Income Credit - Illinois

What Is Form IL-1040 Schedule IL-E/EIC?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois.The document is a supplement to Form IL-1040, Individual Income Tax Return. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-1040 Schedule IL-E/EIC?

A: Form IL-1040 Schedule IL-E/EIC is a tax form used in the state of Illinois to claim the Illinois Exemption and Earned Income Credit.

Q: What is the Illinois Exemption?

A: The Illinois Exemption is a deduction from your taxable income that reduces the amount of tax you owe.

Q: What is the Earned Income Credit?

A: The Earned Income Credit is a tax credit designed to help low-income individuals and families by reducing their tax liability and providing a refund.

Q: Who is eligible for the Illinois Exemption?

A: In general, all residents of Illinois are eligible for the Illinois Exemption.

Q: Who is eligible for the Earned Income Credit?

A: The Earned Income Credit is available to individuals and families with low to moderate income, depending on the specific criteria set by the state of Illinois.

Q: How do I claim the Illinois Exemption and Earned Income Credit?

A: To claim the Illinois Exemption and Earned Income Credit, you must complete Form IL-1040 Schedule IL-E/EIC and include it with your Illinois income tax return (Form IL-1040).

Q: Are there any income limits for the Illinois Exemption and Earned Income Credit?

A: Yes, there are income limits for both the Illinois Exemption and Earned Income Credit. These limits vary depending on your filing status and number of dependents.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1040 Schedule IL-E/EIC by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.