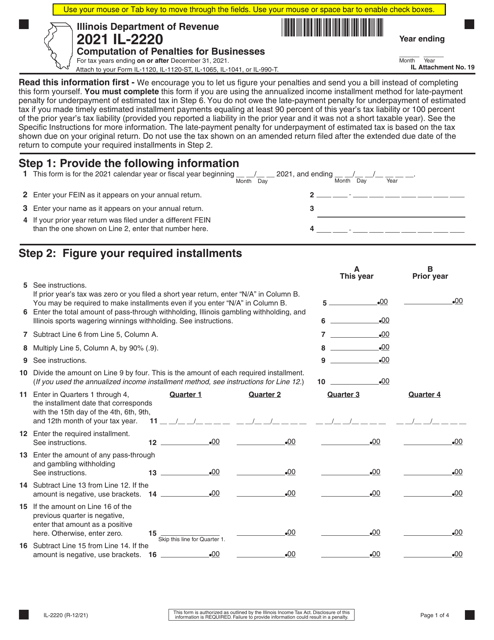

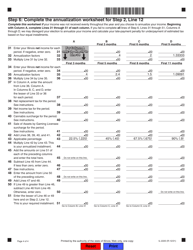

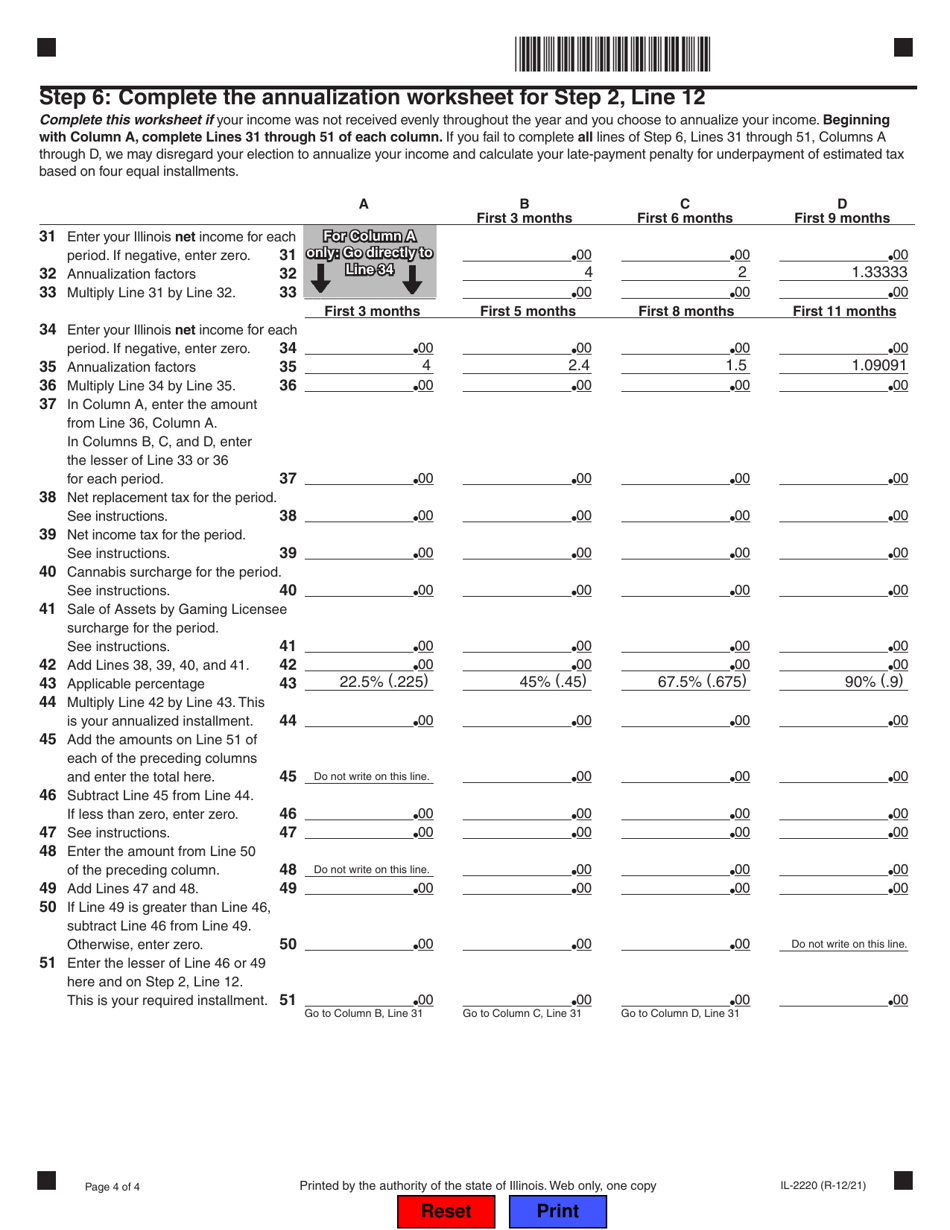

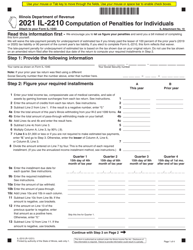

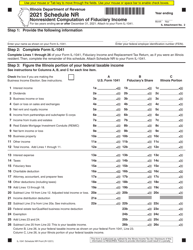

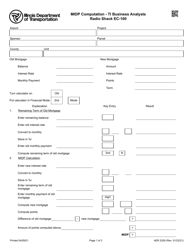

Form IL-2220 Computation of Penalties for Businesses - Illinois

What Is Form IL-2220?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL-2220?

A: Form IL-2220 is a document used in Illinois to compute penalties for businesses.

Q: Who should use Form IL-2220?

A: Businesses operating in Illinois should use Form IL-2220.

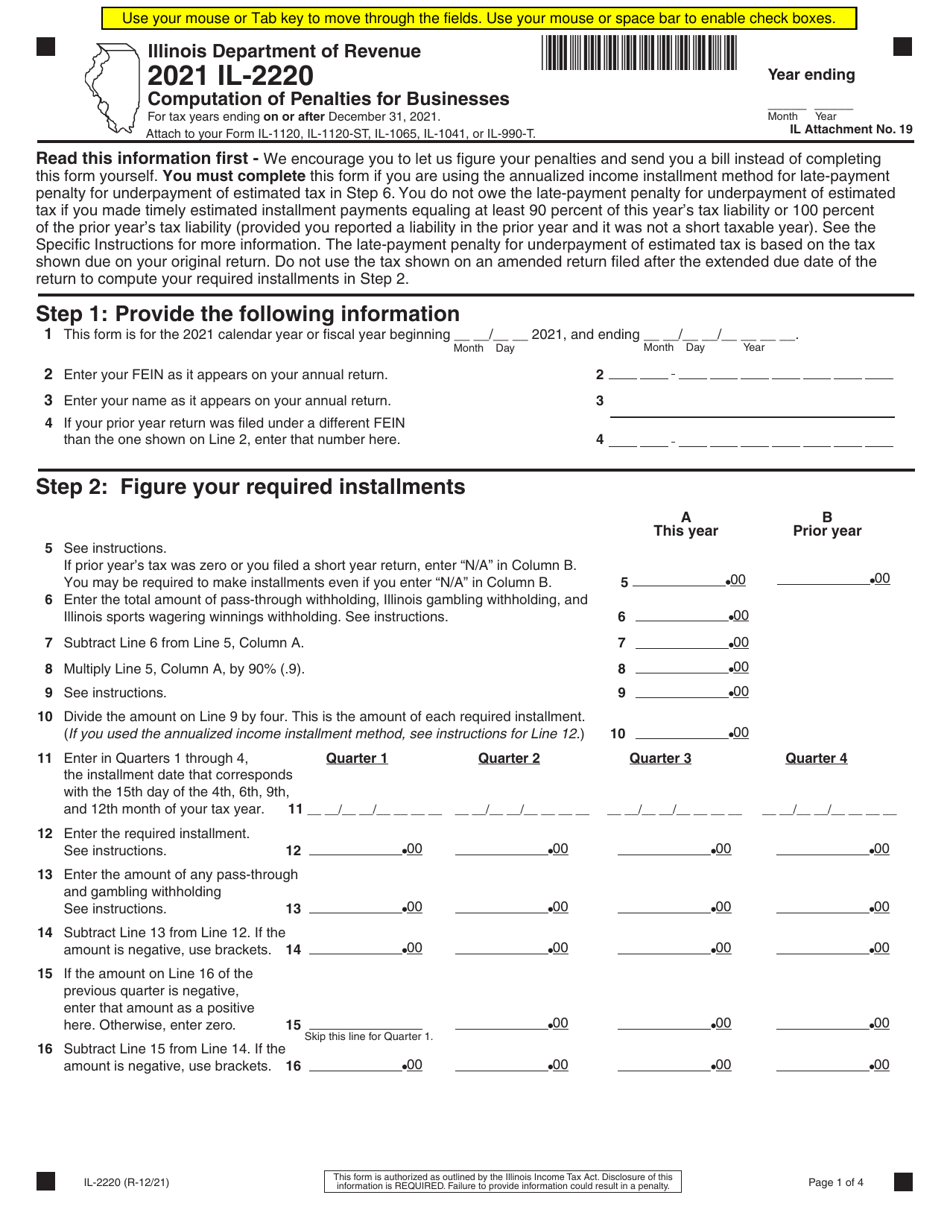

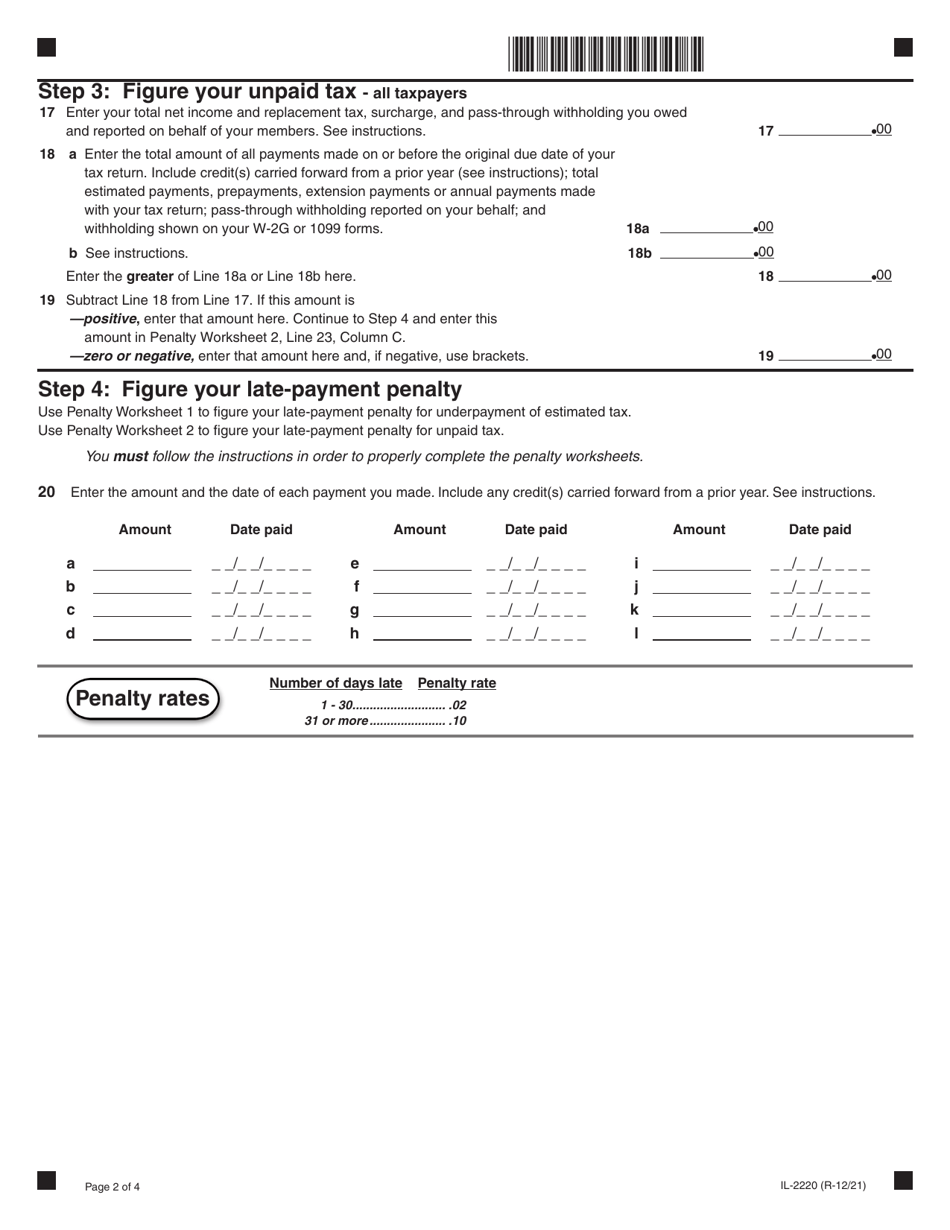

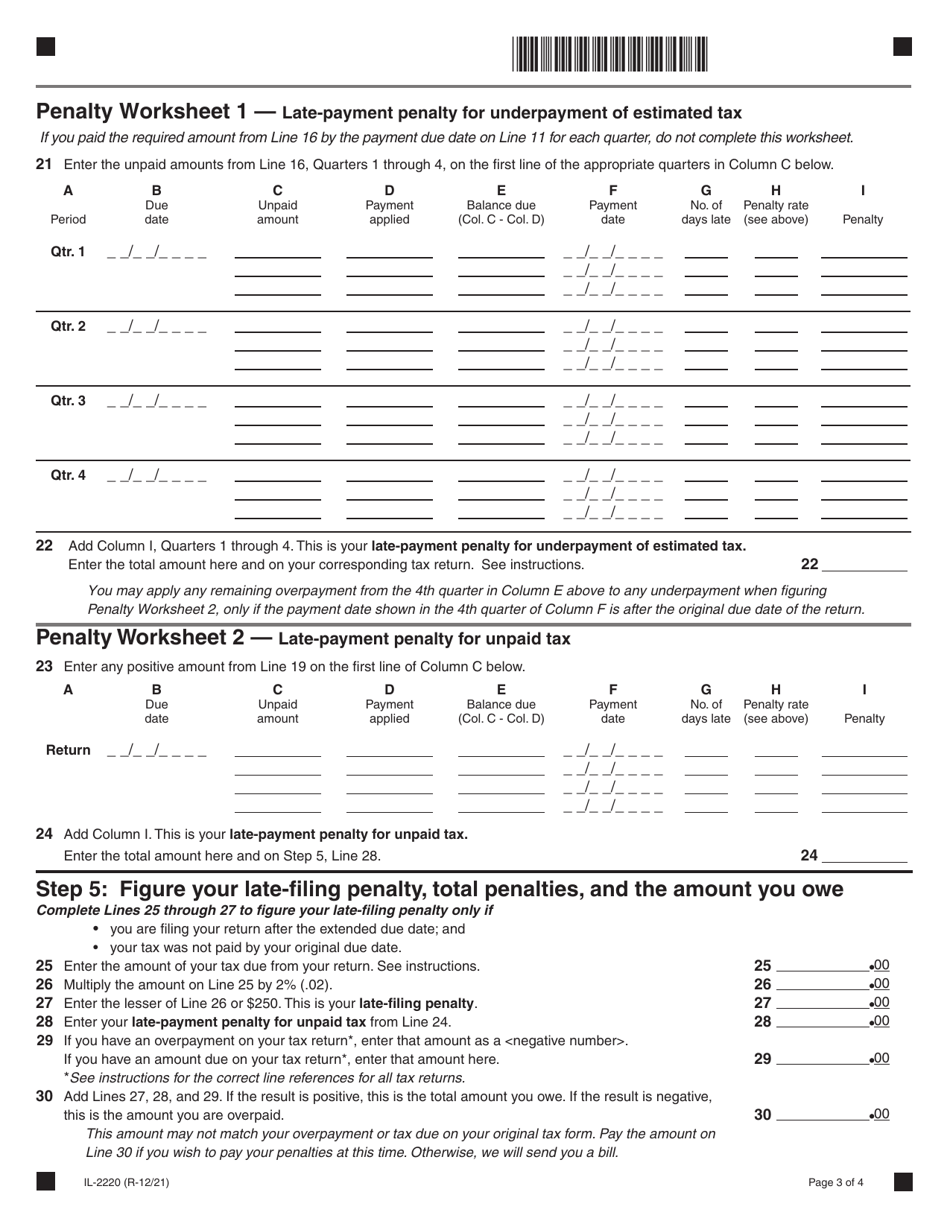

Q: What does Form IL-2220 compute?

A: Form IL-2220 computes penalties for businesses.

Q: When is Form IL-2220 due?

A: The due date for Form IL-2220 varies depending on the tax year, so it is important to check the instructions provided with the form.

Q: What happens if I don't file Form IL-2220?

A: If you don't file Form IL-2220 when required, you may be subject to penalties.

Q: Are there any exceptions to filing Form IL-2220?

A: There may be exceptions to filing Form IL-2220, so it's important to review the instructions or consult with a tax professional.

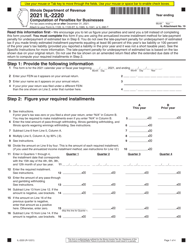

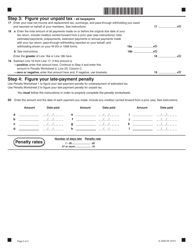

Q: How do I calculate the penalties using Form IL-2220?

A: The instructions on Form IL-2220 will guide you on how to calculate the penalties.

Q: Can penalties be waived?

A: Penalties may be waived under certain circumstances, such as reasonable cause. Consult the instructions or contact the Illinois Department of Revenue for more information.

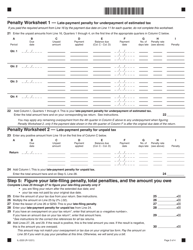

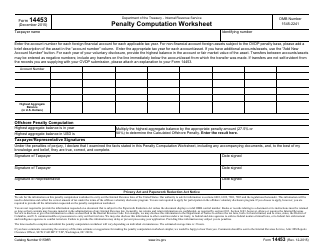

Q: What other forms do I need to submit along with Form IL-2220?

A: The specific requirements for filing Form IL-2220 may vary, so it's important to review the instructions or consult with a tax professional.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-2220 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.