This version of the form is not currently in use and is provided for reference only. Download this version of

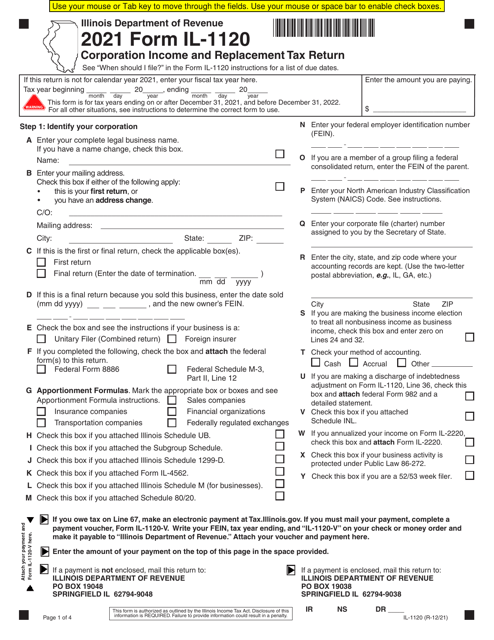

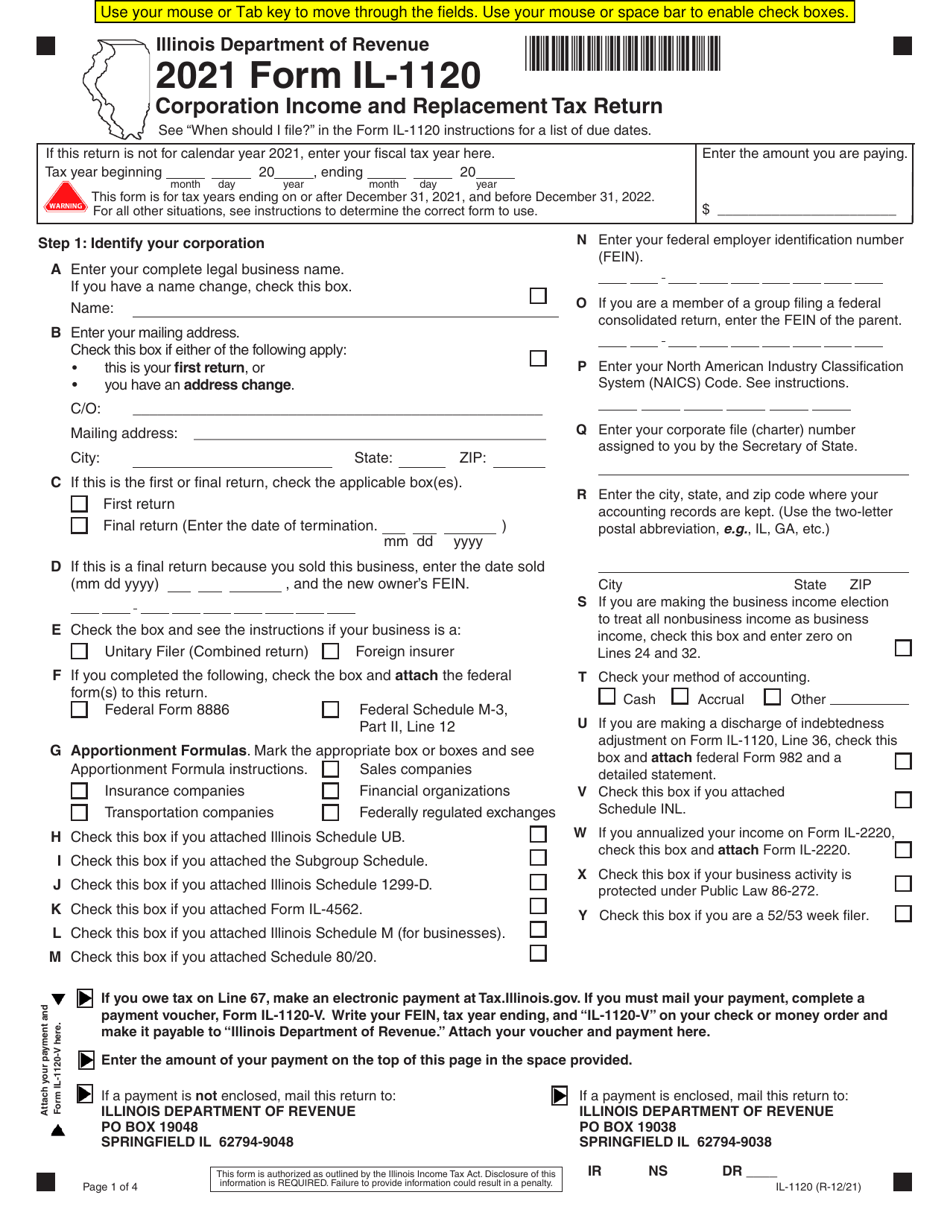

Form IL-1120

for the current year.

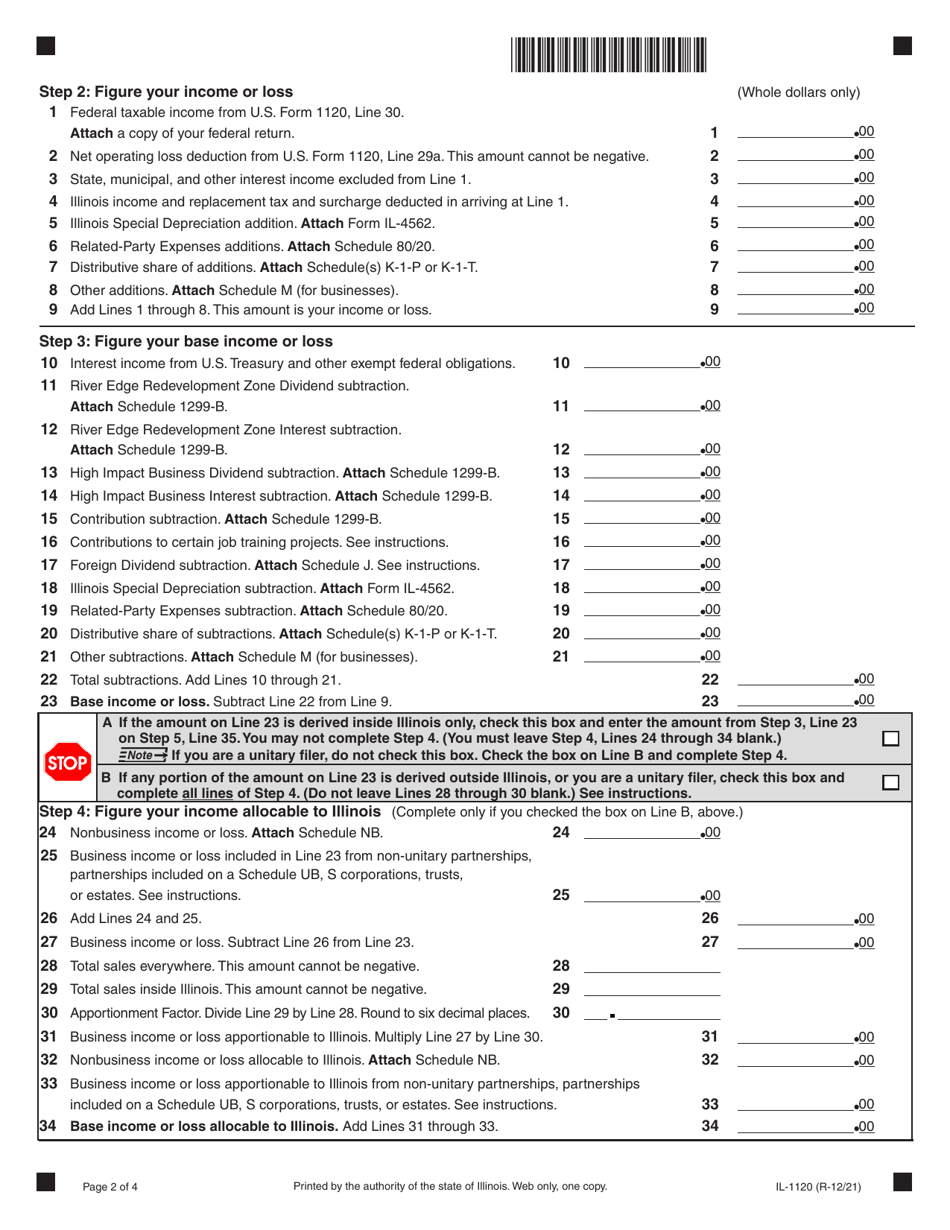

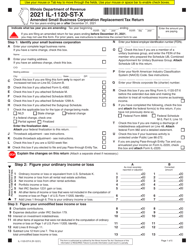

Form IL-1120 Corporation Income and Replacement Tax Return - Illinois

What Is Form IL-1120?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form IL-1120?

A: The Form IL-1120 is the Corporation Income and Replacement Tax Return for the state of Illinois.

Q: Who needs to file the Form IL-1120?

A: Corporations that are doing business in Illinois or have income derived from Illinois sources need to file the Form IL-1120.

Q: What taxes are covered by the Form IL-1120?

A: The Form IL-1120 covers the corporation income tax and replacement tax in the state of Illinois.

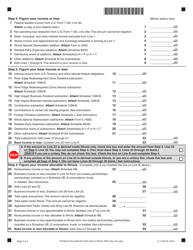

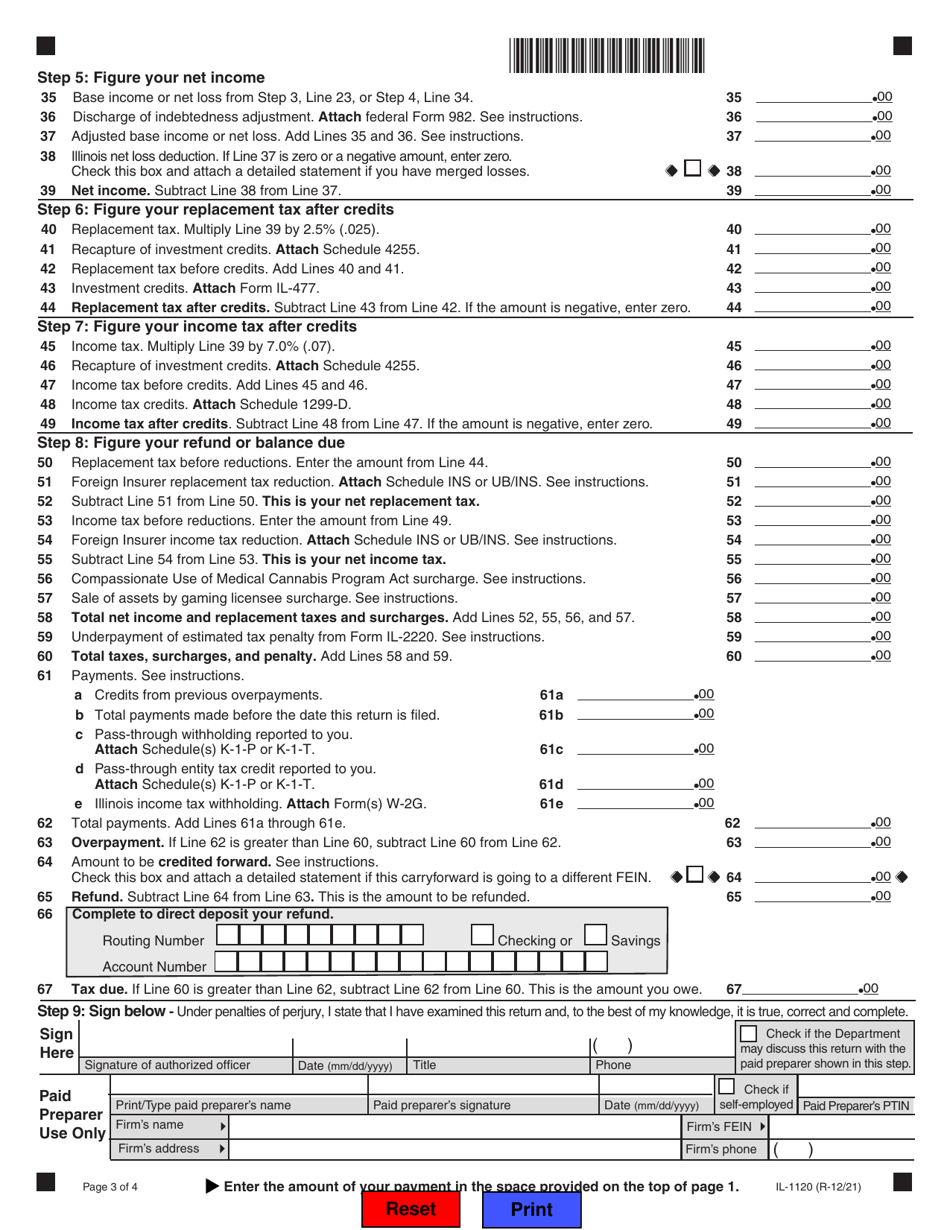

Q: What information do I need to complete the Form IL-1120?

A: You will need various financial and tax-related information such as business income, deductions, credits, and tax payments to complete the Form IL-1120.

Q: When is the due date for filing the Form IL-1120?

A: The due date for filing the Form IL-1120 is generally the 15th day of the 3rd month following the end of the corporation's tax year.

Q: Are there any penalties for late filing of the Form IL-1120?

A: Yes, there are penalties for late filing of the Form IL-1120. It is important to file the return on time to avoid these penalties.

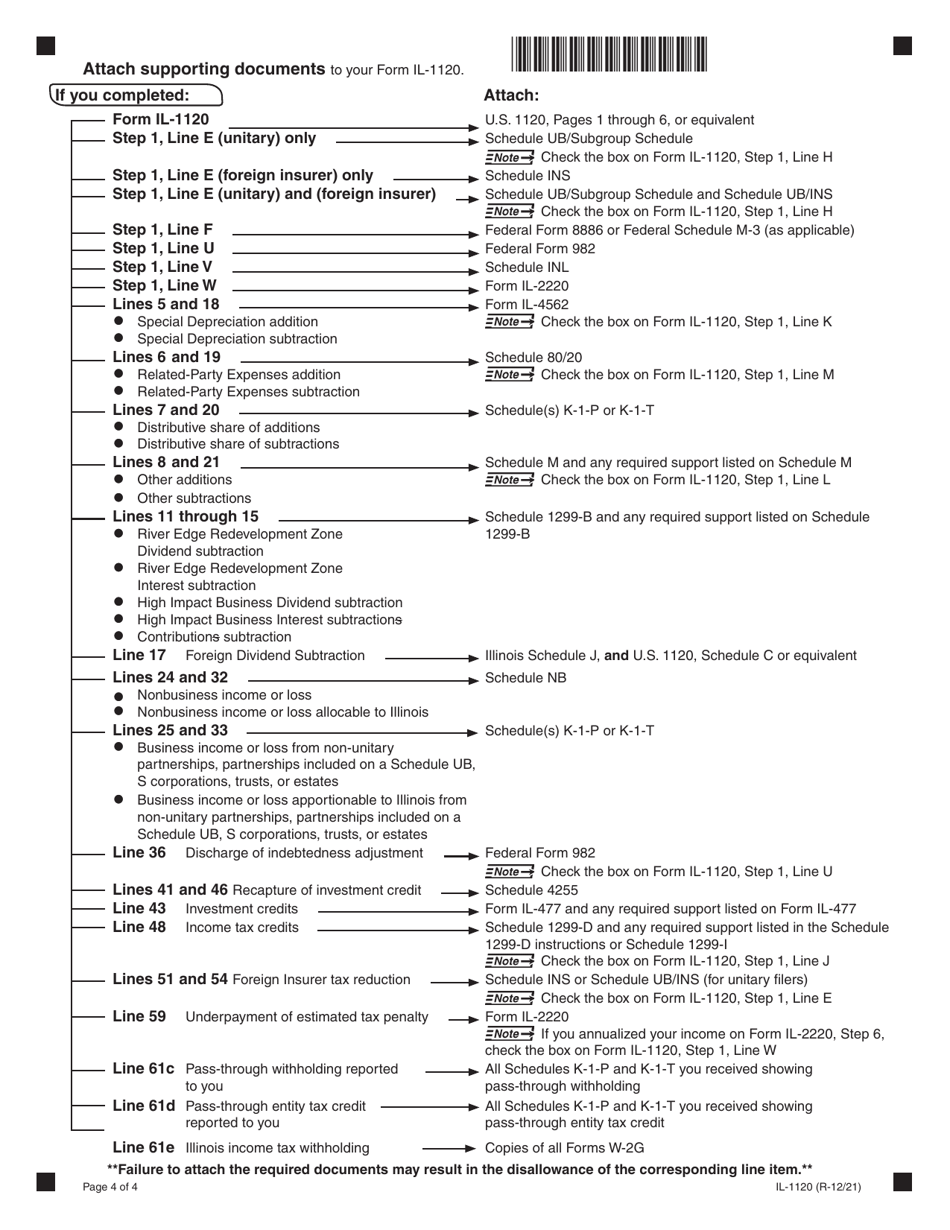

Q: Do I need to include any supporting documents with the Form IL-1120?

A: Yes, you may need to include supporting documents such as schedules, statements, or other attachments depending on your specific tax situation.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1120 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.