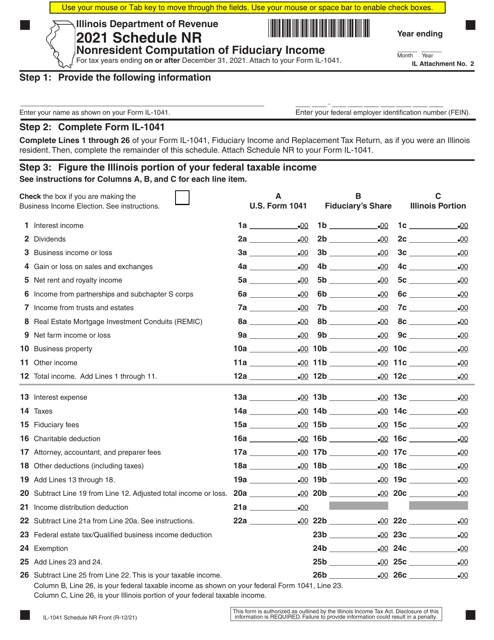

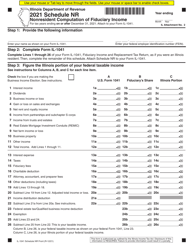

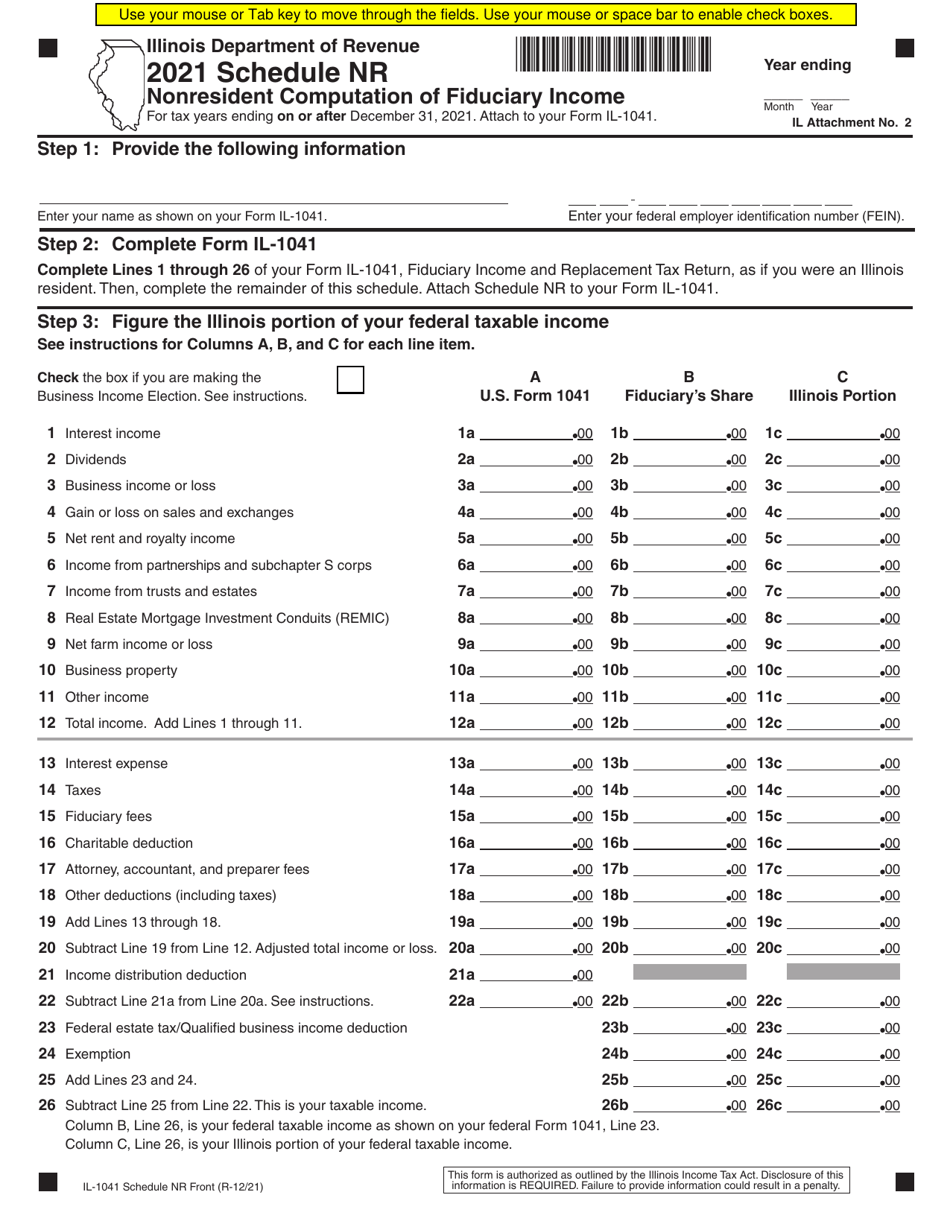

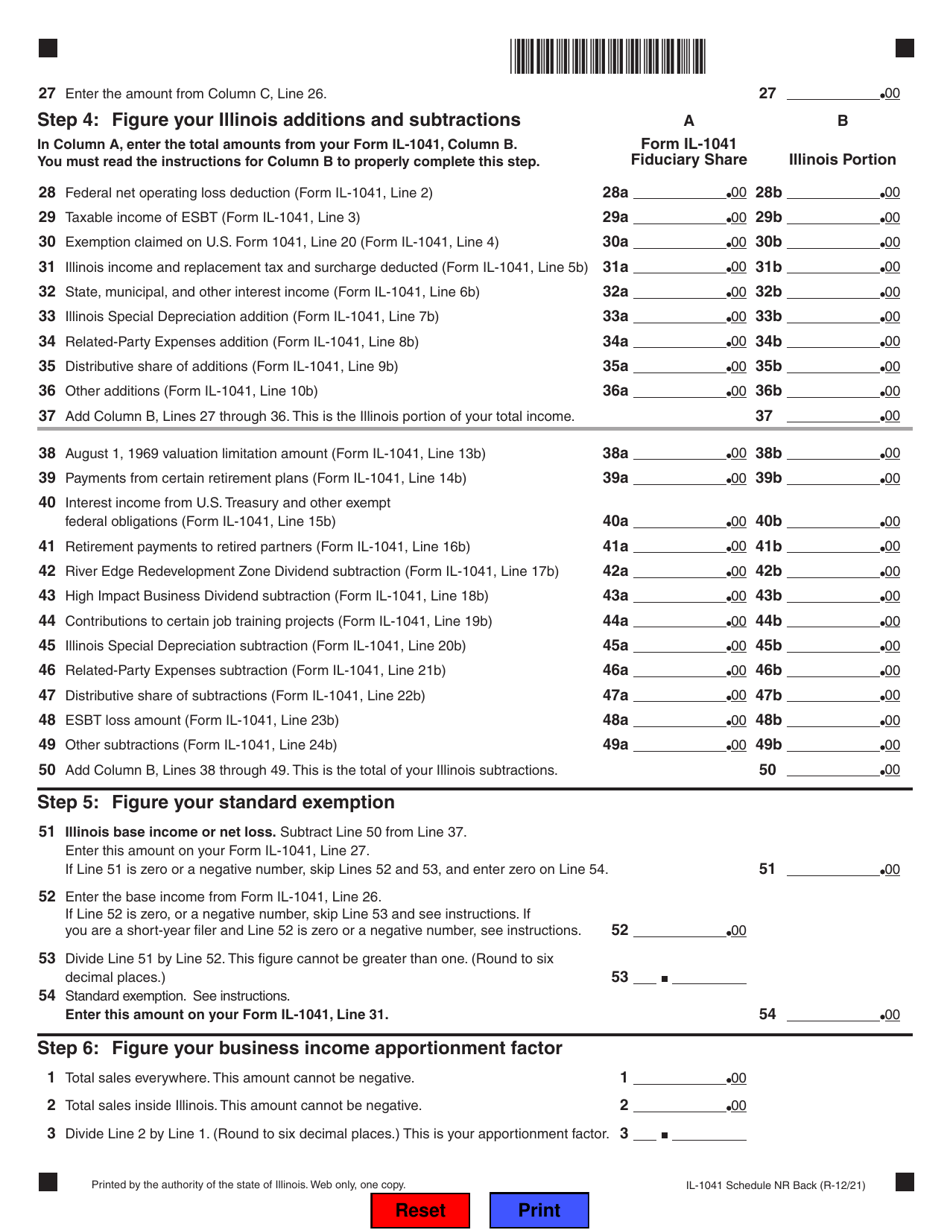

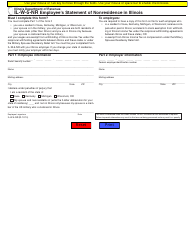

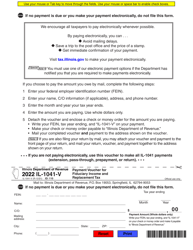

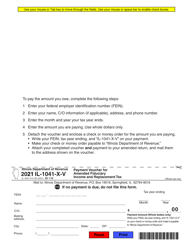

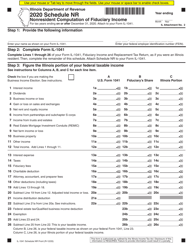

Form IL-1041 Schedule NR Nonresident Computation of Fiduciary Income - Illinois

What Is Form IL-1041 Schedule NR?

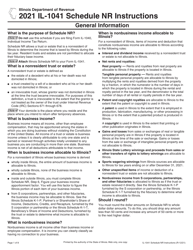

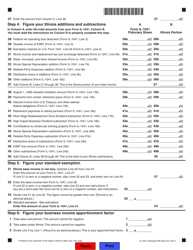

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois.The document is a supplement to Form IL-1041, Fiduciary Income and Replacement Tax Return. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form IL-1041 Schedule NR?

A: Form IL-1041 Schedule NR is a tax form used in Illinois to compute fiduciary income for nonresident filers.

Q: Who needs to file Form IL-1041 Schedule NR?

A: Nonresident individuals who have income from an Illinois trust or estate need to file Form IL-1041 Schedule NR.

Q: What does Form IL-1041 Schedule NR calculate?

A: Form IL-1041 Schedule NR calculates the nonresident portion of fiduciary income for Illinois tax purposes.

Q: When is Form IL-1041 Schedule NR due?

A: Form IL-1041 Schedule NR is due on the same date as the Illinois Form IL-1041, which is the 15th day of the 4th month after the close of the tax year.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1041 Schedule NR by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.