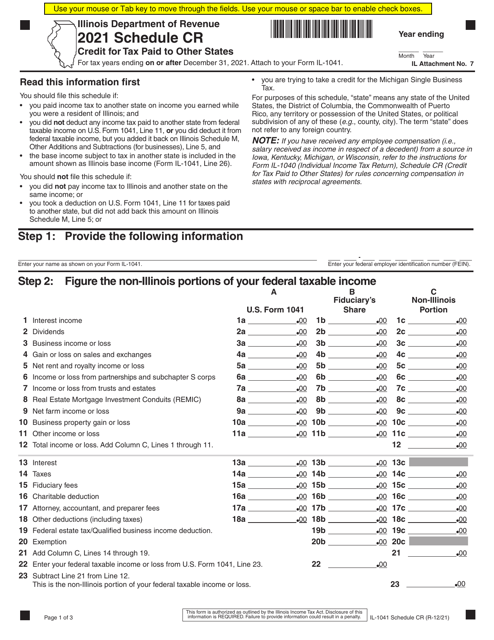

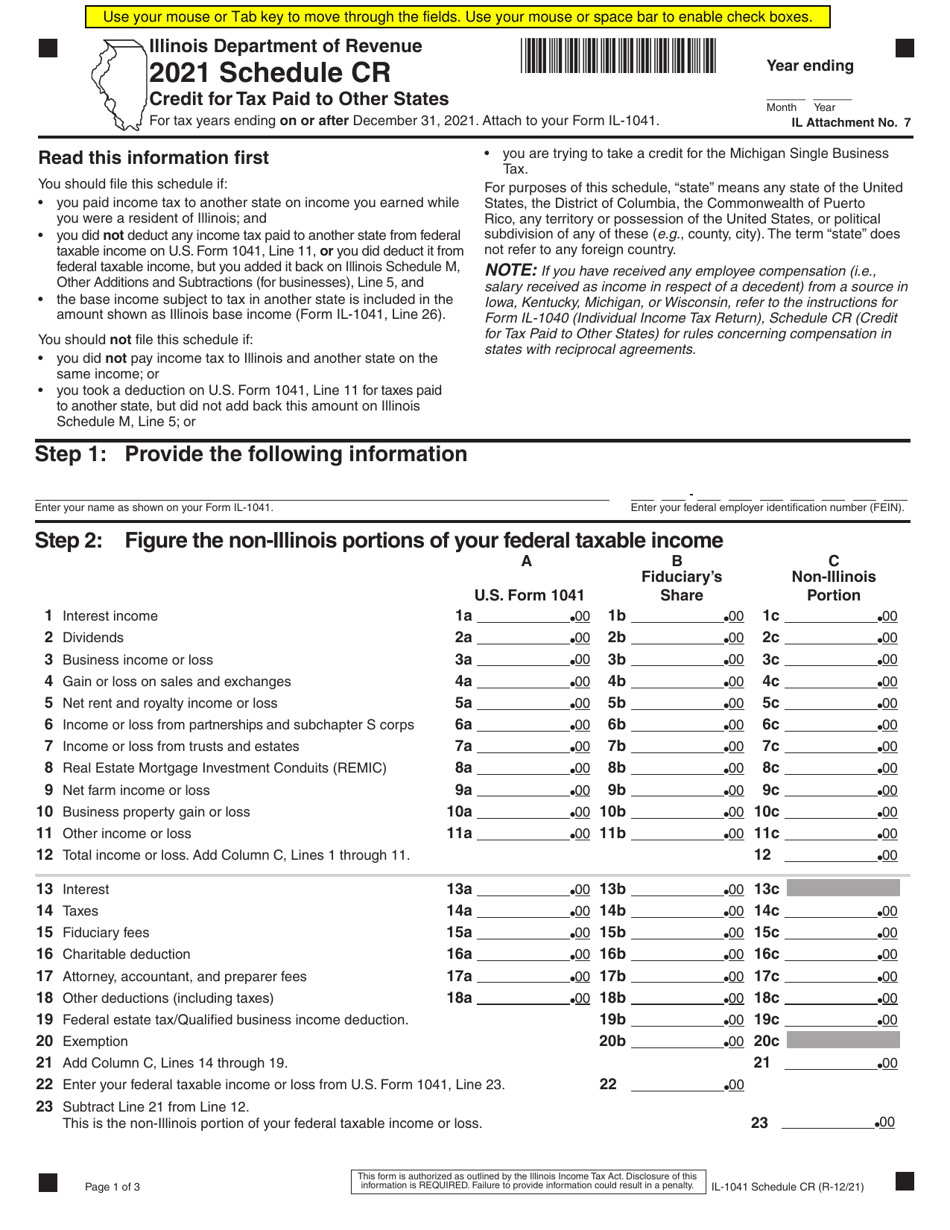

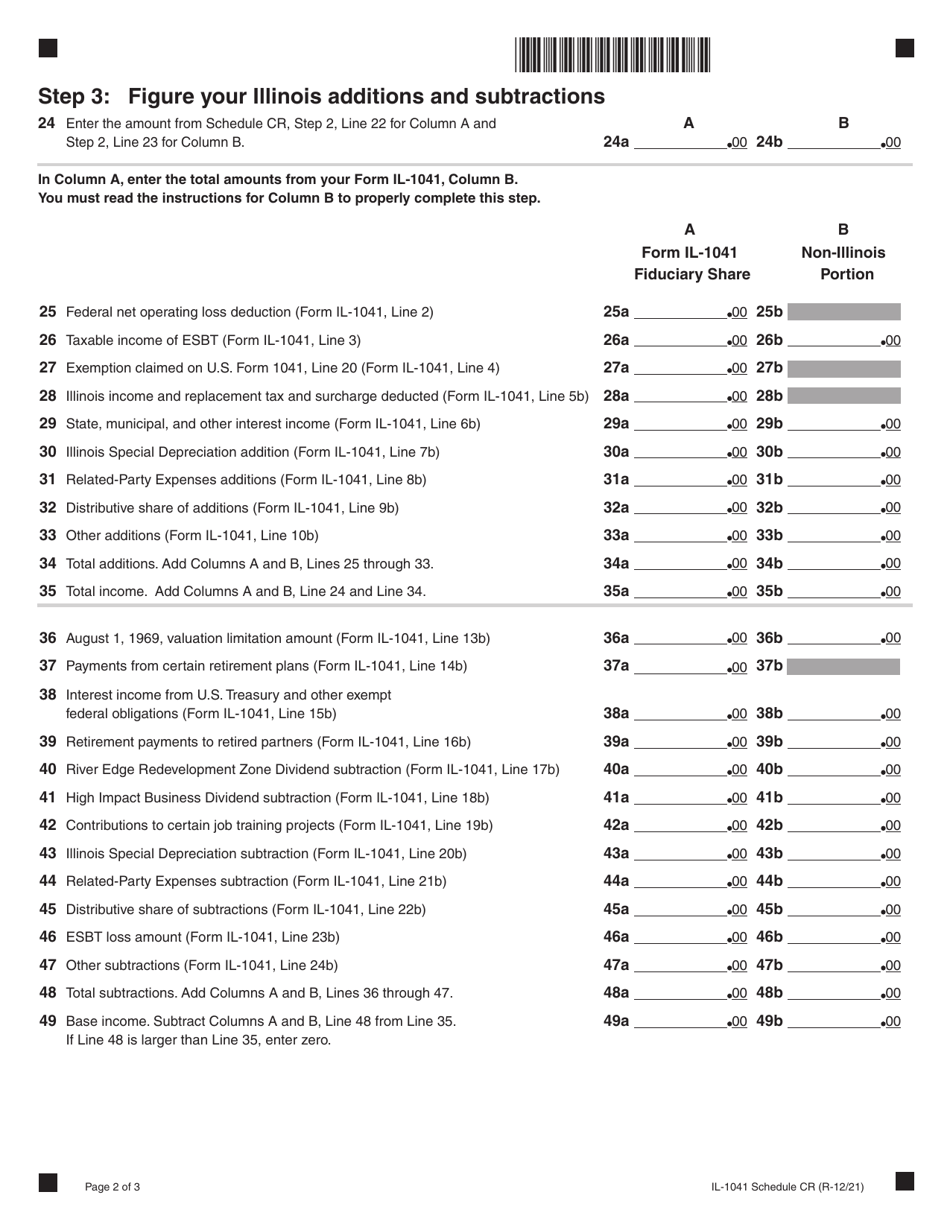

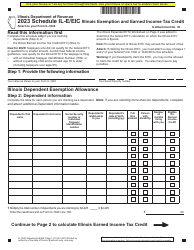

Form IL-1041 Schedule CR Credit for Tax Paid to Other States - Illinois

What Is Form IL-1041 Schedule CR?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois.The document is a supplement to Form IL-1041, Fiduciary Income and Replacement Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL-1041 Schedule CR?

A: Form IL-1041 Schedule CR is a tax form used in Illinois to calculate and claim a credit for taxes paid to other states.

Q: Who needs to file Form IL-1041 Schedule CR?

A: Individuals or businesses who earned income in Illinois and paid taxes to another state may need to file Form IL-1041 Schedule CR.

Q: How do I fill out Form IL-1041 Schedule CR?

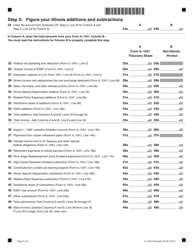

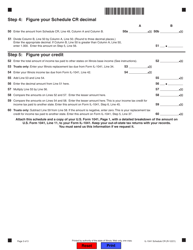

A: You will need to provide information about the income earned in Illinois and the taxes paid to other states. The form provides instructions on how to calculate the credit.

Q: What is the purpose of Form IL-1041 Schedule CR?

A: The purpose of Form IL-1041 Schedule CR is to prevent double taxation by allowing taxpayers to claim a credit for taxes paid to another state.

Q: Is Form IL-1041 Schedule CR only for residents of Illinois?

A: No, Form IL-1041 Schedule CR is not only for residents of Illinois. It can also be filed by non-residents or part-year residents who earned income in Illinois and paid taxes to another state.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1041 Schedule CR by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.