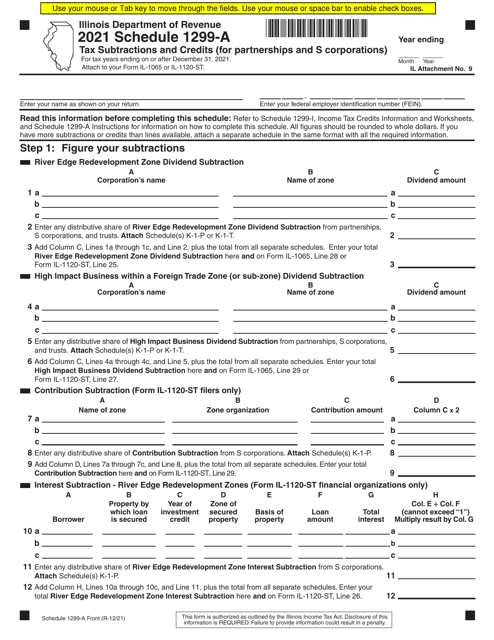

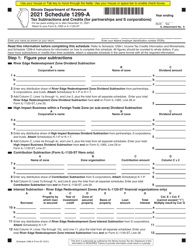

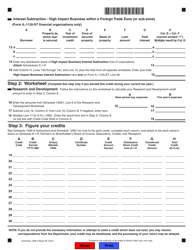

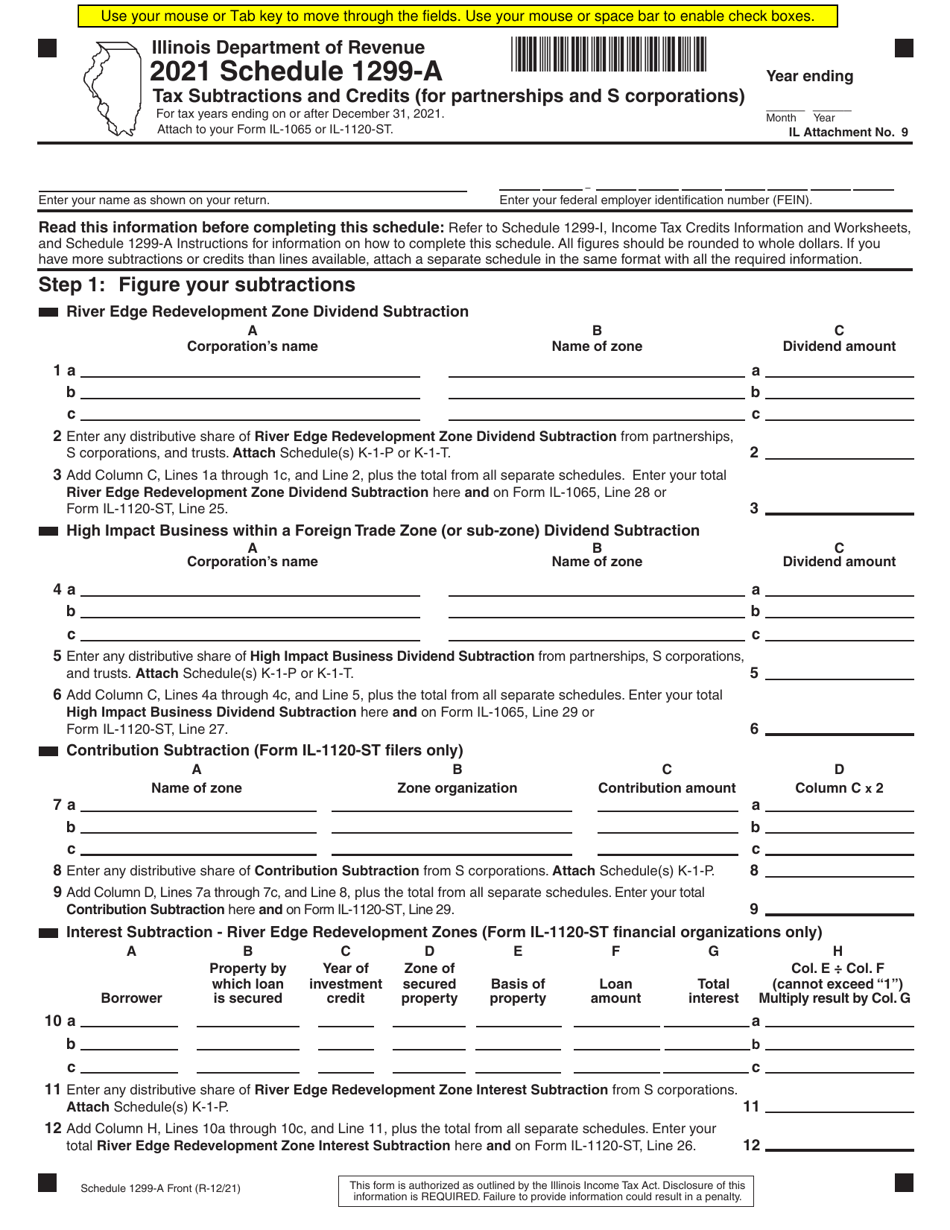

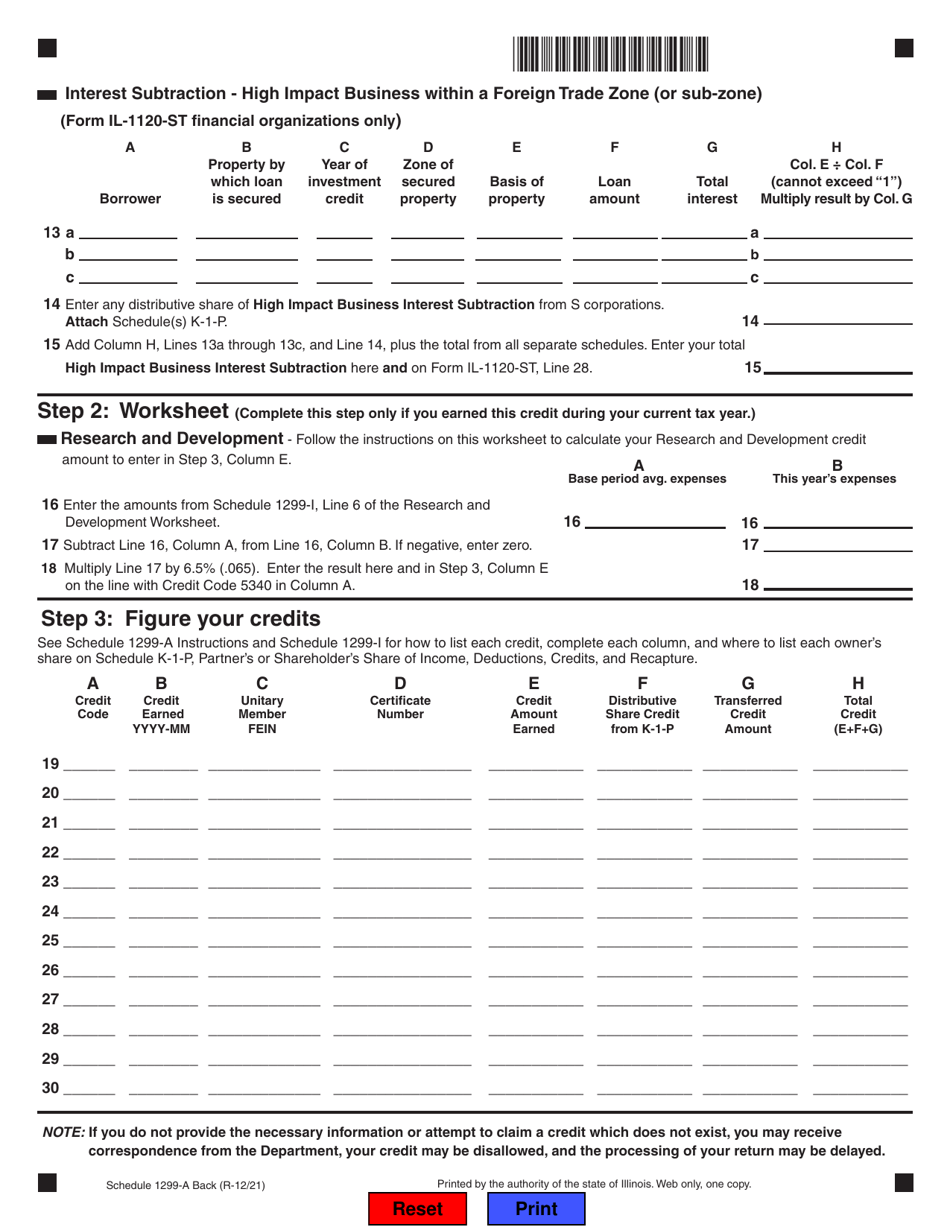

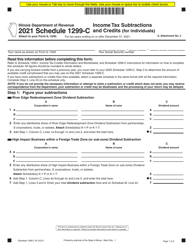

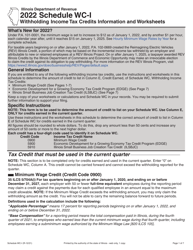

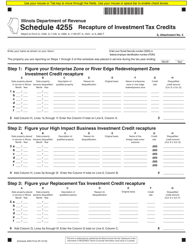

Schedule 1299-A Tax Subtractions and Credits (For Partnerships and S Corporations) - Illinois

What Is Schedule 1299-A?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule 1299-A?

A: Schedule 1299-A is a tax form used by partnerships and S corporations in Illinois to calculate tax subtractions and credits.

Q: Who needs to file Schedule 1299-A?

A: Partnerships and S corporations in Illinois need to file Schedule 1299-A.

Q: What information is required for Schedule 1299-A?

A: You will need to provide information on the various tax subtractions and credits that your partnership or S corporation is eligible for.

Q: What are tax subtractions?

A: Tax subtractions are deductions that reduce the amount of income subject to tax.

Q: What are tax credits?

A: Tax credits are direct reductions of the tax liability.

Q: Why are tax subtractions and credits important?

A: Tax subtractions and credits can help reduce your overall tax liability, potentially resulting in a lower tax bill.

Q: When is the deadline to file Schedule 1299-A?

A: The deadline to file Schedule 1299-A in Illinois is the same as the deadline for your partnership or S corporation's tax return, typically April 15th.

Q: Can I file Schedule 1299-A electronically?

A: Yes, you can file Schedule 1299-A electronically if you are e-filing your partnership or S corporation tax return.

Q: Do I need to file Schedule 1299-A if I don't have any tax subtractions or credits?

A: If you don't have any tax subtractions or credits, you may not need to file Schedule 1299-A. However, it's always best to consult with a tax professional or refer to the instructions provided with the form.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule 1299-A by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.