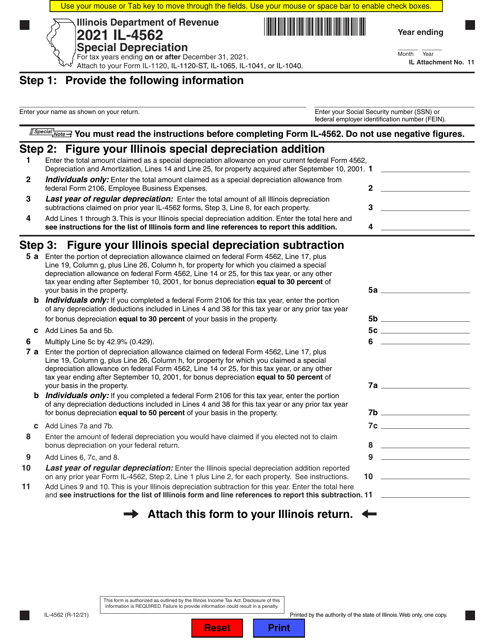

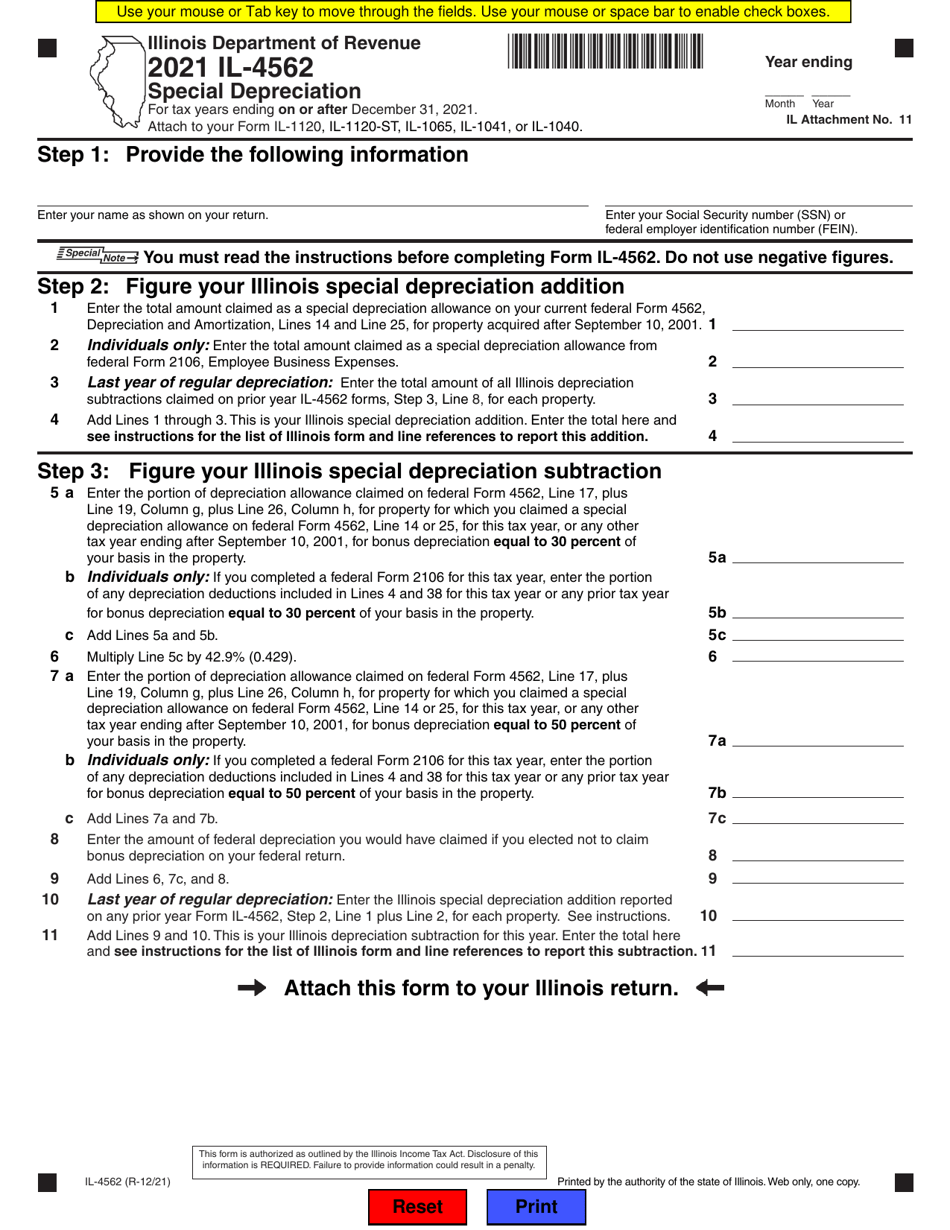

Form IL-4562 Special Depreciation - Illinois

What Is Form IL-4562?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-4562?

A: Form IL-4562 is a tax form used in Illinois to claim special depreciation deductions.

Q: What is special depreciation?

A: Special depreciation allows businesses to take an additional deduction for certain types of property.

Q: Who needs to file Form IL-4562?

A: Any taxpayer in Illinois who wants to claim special depreciation deductions on their tax return needs to file Form IL-4562.

Q: What information is required on Form IL-4562?

A: Form IL-4562 requires taxpayers to provide information on the property for which they are claiming special depreciation, including the date placed in service, the cost or other basis, and the method and recovery period used for depreciation.

Q: When is Form IL-4562 due?

A: Form IL-4562 is due on the same date as the taxpayer's income tax return, which is typically April 15th of the following year.

Q: Are there any additional requirements or qualifications for claiming special depreciation in Illinois?

A: Yes, there may be additional requirements or qualifications for claiming special depreciation in Illinois. Taxpayers should consult the instructions for Form IL-4562 or seek professional tax advice for more specific information.

Q: Is Form IL-4562 applicable in both Illinois and Canada?

A: No, Form IL-4562 is specific to Illinois and is not applicable in Canada. Canadian taxpayers should consult the Canada Revenue Agency for information on claiming special depreciation deductions.

Q: Can I e-file Form IL-4562?

A: Yes, Form IL-4562 can be e-filed along with the taxpayer's income tax return. However, some taxpayers may be required to file a paper copy of the form depending on their specific circumstances.

Q: What should I do if I made a mistake on Form IL-4562?

A: If you made a mistake on Form IL-4562, you should file an amended return using Form IL-4562-X to correct the error. It is important to correct any errors as soon as possible to avoid penalties or additional interest charges.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-4562 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.