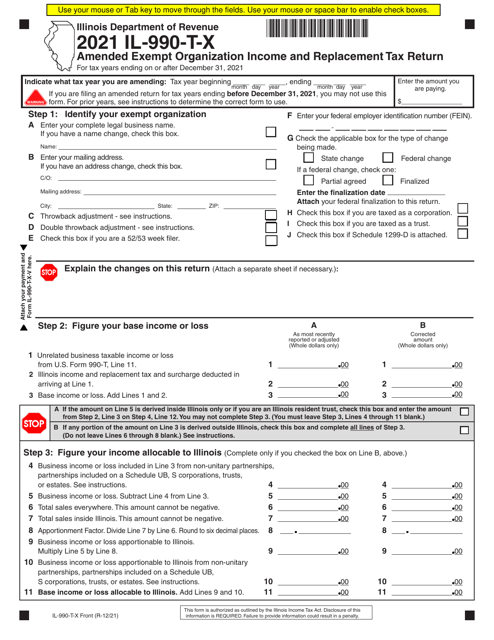

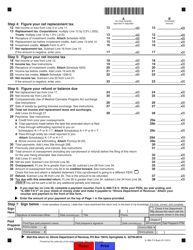

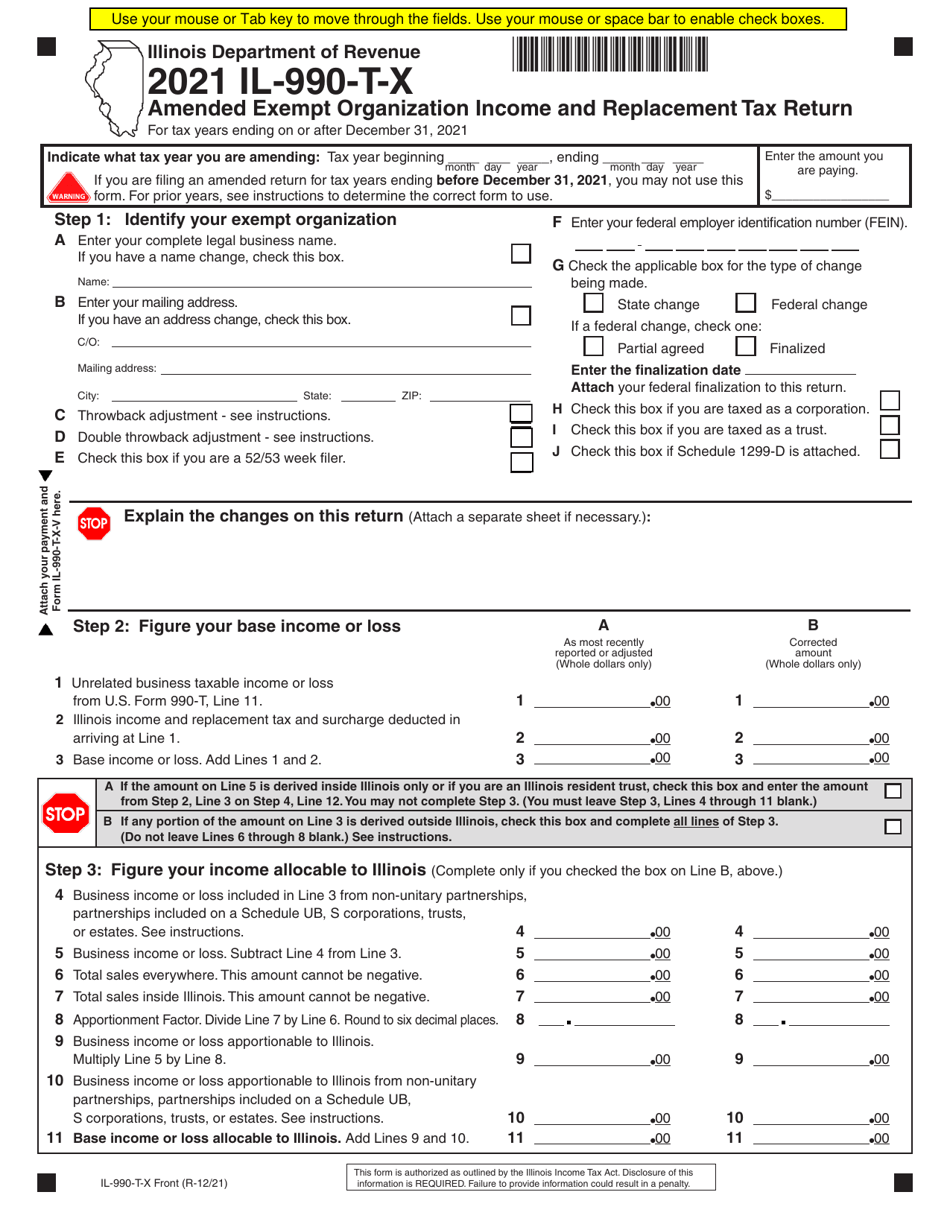

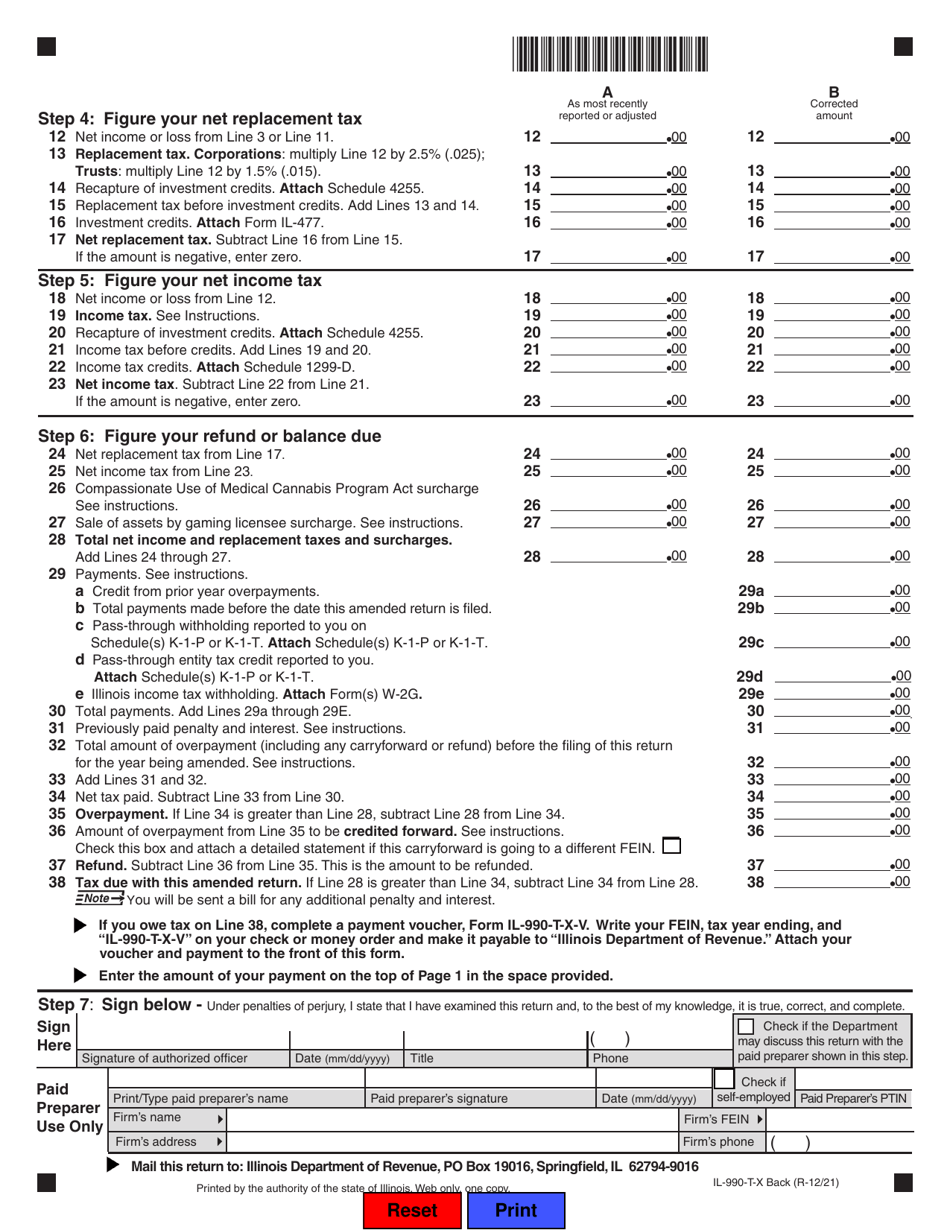

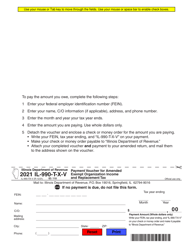

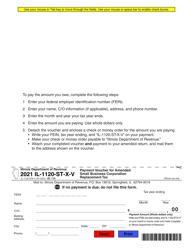

Form IL-990-T-X Amended Exempt Organization Income and Replacement Tax Return - Illinois

What Is Form IL-990-T-X?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-990-T-X?

A: Form IL-990-T-X is the Amended Exempt Organization Income and Replacement Tax Return for Illinois.

Q: Who needs to file Form IL-990-T-X?

A: Exempt organizations in Illinois who need to amend their previous income and replacement tax return.

Q: What is the purpose of Form IL-990-T-X?

A: Form IL-990-T-X is used to correct any errors or changes on the original Illinois exempt organization income and replacement tax return.

Q: When is the deadline to file Form IL-990-T-X?

A: The deadline to file Form IL-990-T-X is the same as the original due date for the exempt organization income and replacement tax return.

Q: Are there any penalties for late filing of Form IL-990-T-X?

A: Yes, there may be penalties for late filing of Form IL-990-T-X. It is important to file the amended return as soon as possible to avoid penalties.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-990-T-X by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.