This version of the form is not currently in use and is provided for reference only. Download this version of

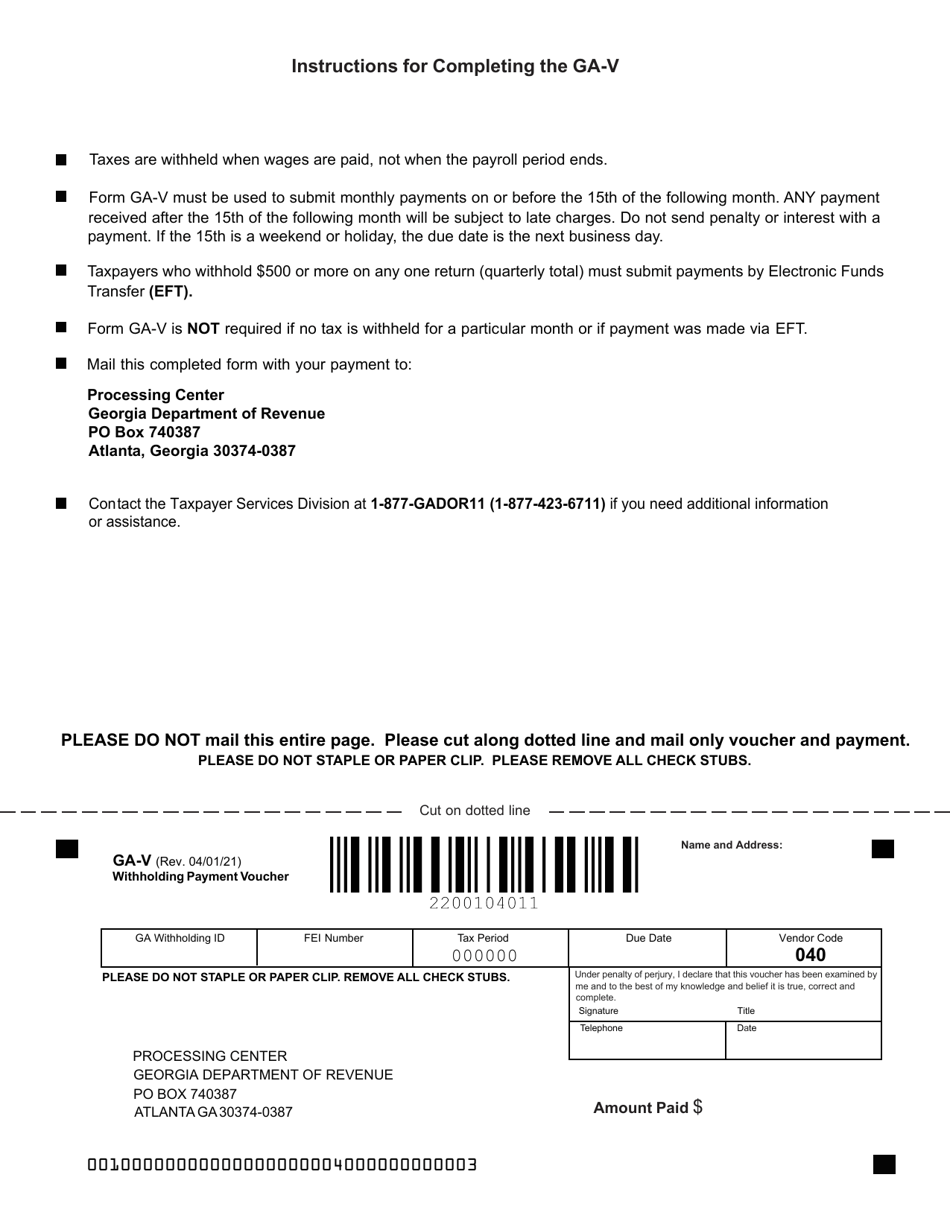

Form GA-V

for the current year.

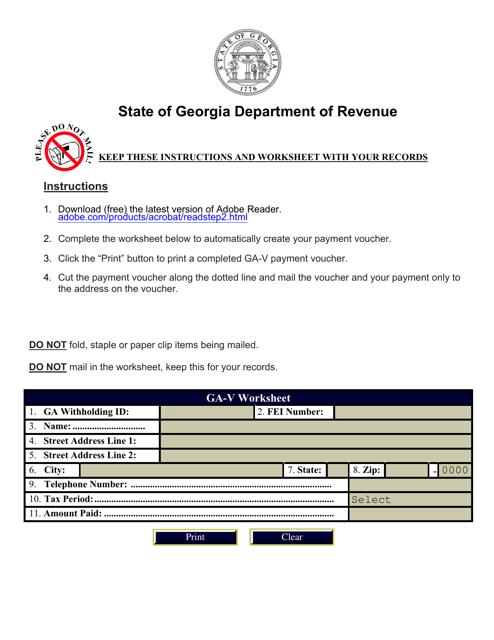

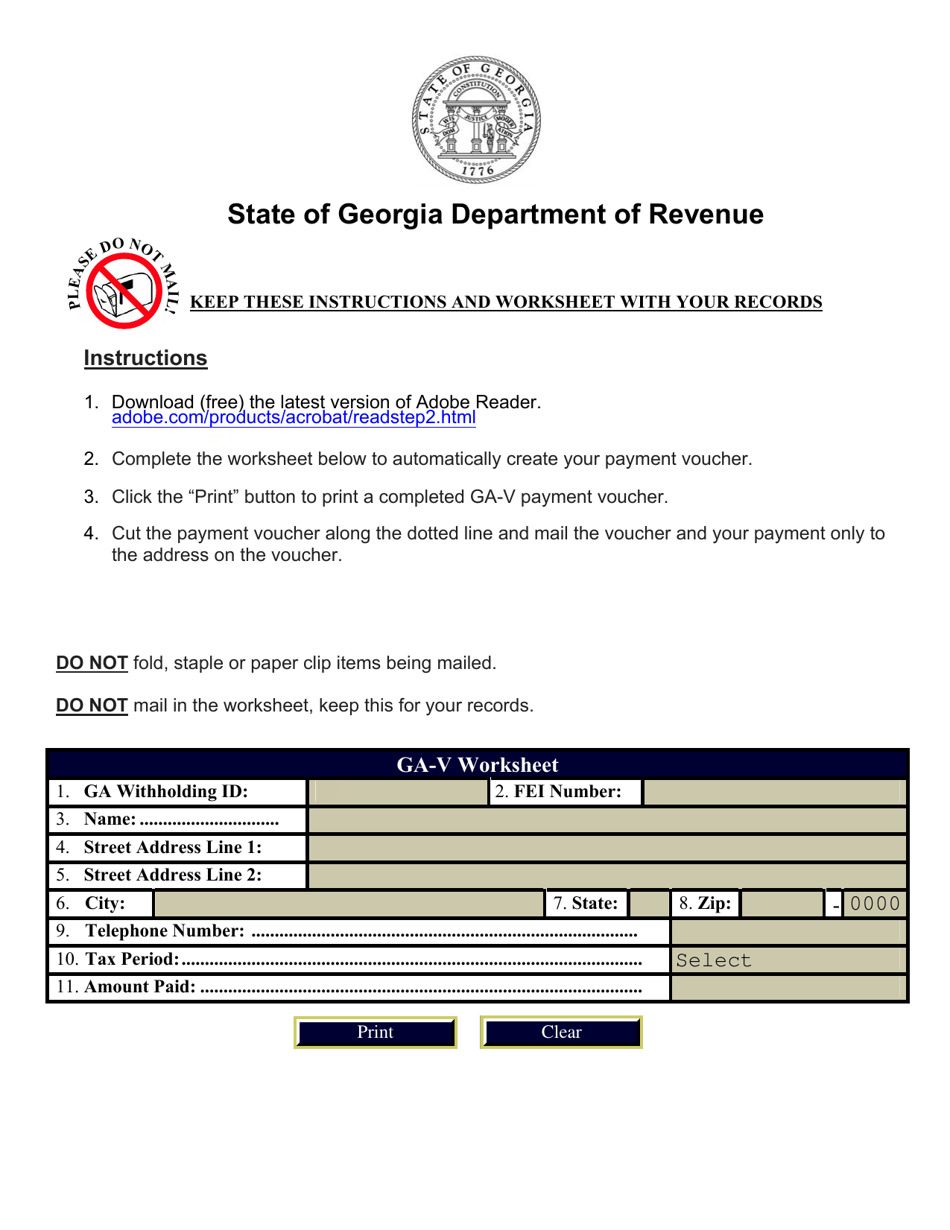

Form GA-V Withholding Monthly Payment Voucher - Georgia (United States)

What Is Form GA-V?

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GA-V?

A: Form GA-V is the Withholding Monthly Payment Voucher used in Georgia.

Q: What is the purpose of Form GA-V?

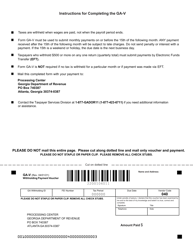

A: Form GA-V is used to report and pay withholding taxes to the state of Georgia on a monthly basis.

Q: Who needs to file Form GA-V?

A: Employers in Georgia who withhold state income taxes from their employees' wages need to file Form GA-V.

Q: When is Form GA-V due?

A: Form GA-V is due on a monthly basis and must be filed by the 15th day of the following month.

Q: What information is required on Form GA-V?

A: Form GA-V requires the employer's name, address, federal employer identification number (FEIN), total amount of state income tax withheld, and the payment amount.

Q: Are there any penalties for not filing Form GA-V?

A: Yes, failure to file Form GA-V or late payment of the withholding taxes can result in penalties and interest.

Q: Can Form GA-V be filed electronically?

A: Yes, employers can choose to file Form GA-V electronically using the Georgia Tax Center.

Q: Can Form GA-V be mailed to the Georgia Department of Revenue?

A: Yes, if you prefer to file a paper copy of Form GA-V, you can mail it to the Georgia Department of Revenue.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GA-V by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.