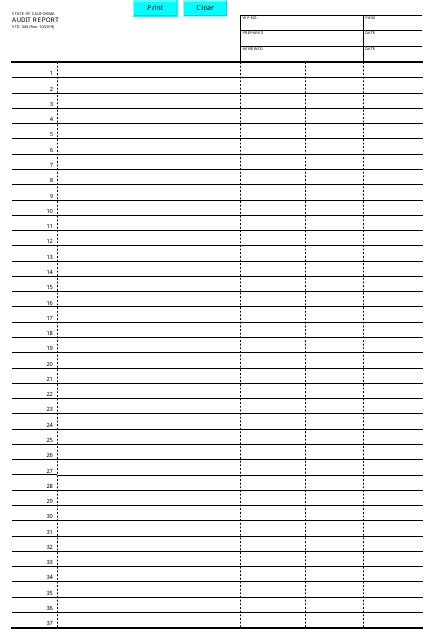

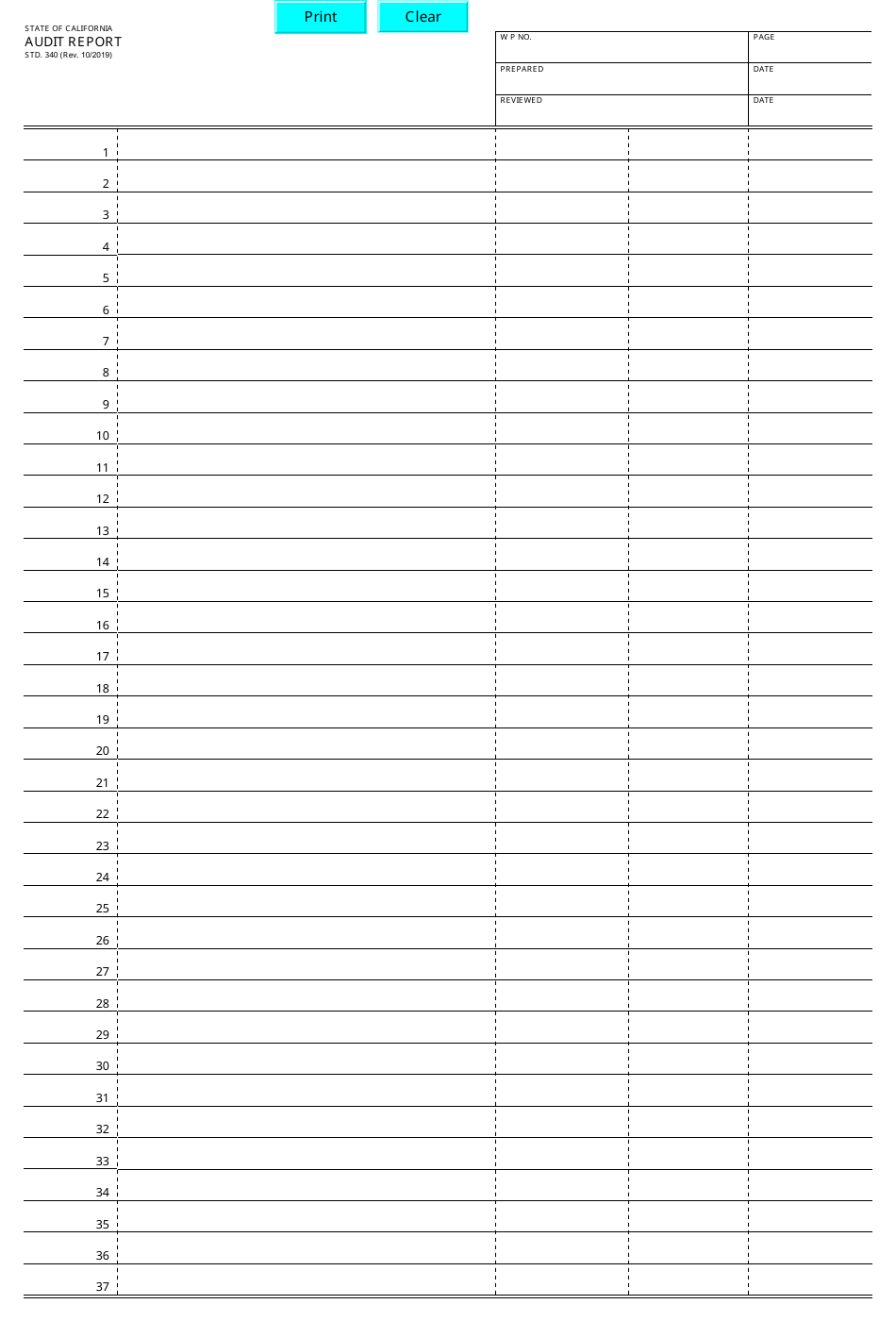

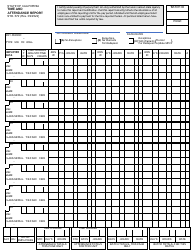

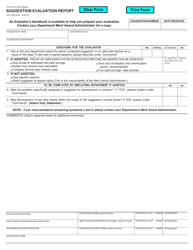

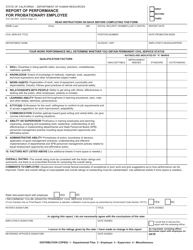

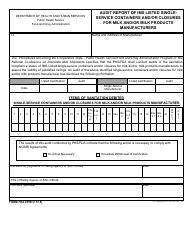

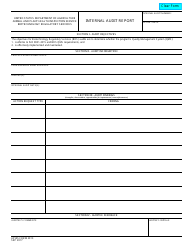

Form STD.340 Audit Report - California

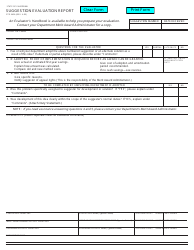

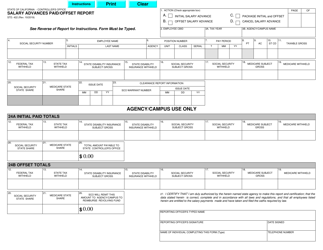

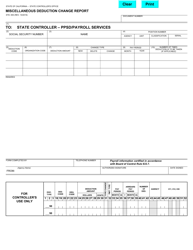

Form STD.340, also known as the Audit Report Form, is a document used in the state of California by auditors to record and present the findings of an audit. This could be any kind of audit, including financial audits, compliance audits, or operational audits within a government department or agency. The form provides a structured format for detailing the objectives of the audit, the scope of the audit, the methodology used, the findings, and any recommendations. It allows for clear communication between auditors and the audited party, and makes it easier to follow up on any identified issues.

The Form STD.340 Audit Report in California is typically filed by state agencies, departments, or institutions that are conducting an internal audit of their operations, finances, and compliance with regulations. The internal auditors within these organizations or independent auditors contracted by the said organizations are the ones who compile and officially file this report. This is a state-level document and is not used at the federal level or in other states. It's used to maintain transparency, accountability, and financial integrity within public organizations.

FAQ

Q: What is Form STD.340?

A: Form STD.340 is a standard audit report form used by the State of California. It is used by auditors to record and present their findings after an audit of a California state agency or department.

Q: Who uses Form STD.340?

A: Form STD.340 is used by auditors who are conducting an audit of a California state agency or department.

Q: What types of information are included in Form STD.340?

A: Form STD.340 includes detailed information about the audit, including the purpose of the audit, the scope of the audit, findings and recommendations, the responses of the audited entity, and the auditors' conclusions.

Q: Is Form STD.340 used only in California?

A: Yes, Form STD.340 is a California state document used specifically for audit reports of California state agencies and departments.

Q: What is the purpose of conducting an audit in California?

A: An audit in California is conducted to ensure that state agencies and departments are operating efficiently, effectively, and in compliance with all applicable laws and regulations.

Q: How often are audits conducted in California?

A: The frequency of audits in California varies depending on the agency, risk assessments, and other factors. Some agencies may be audited annually, while others may be audited less frequently.