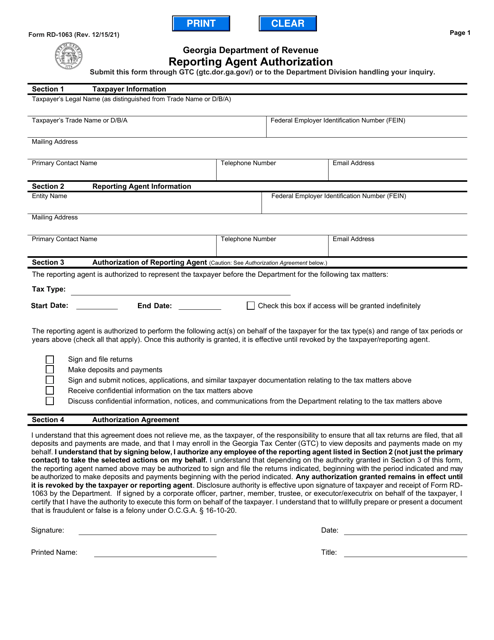

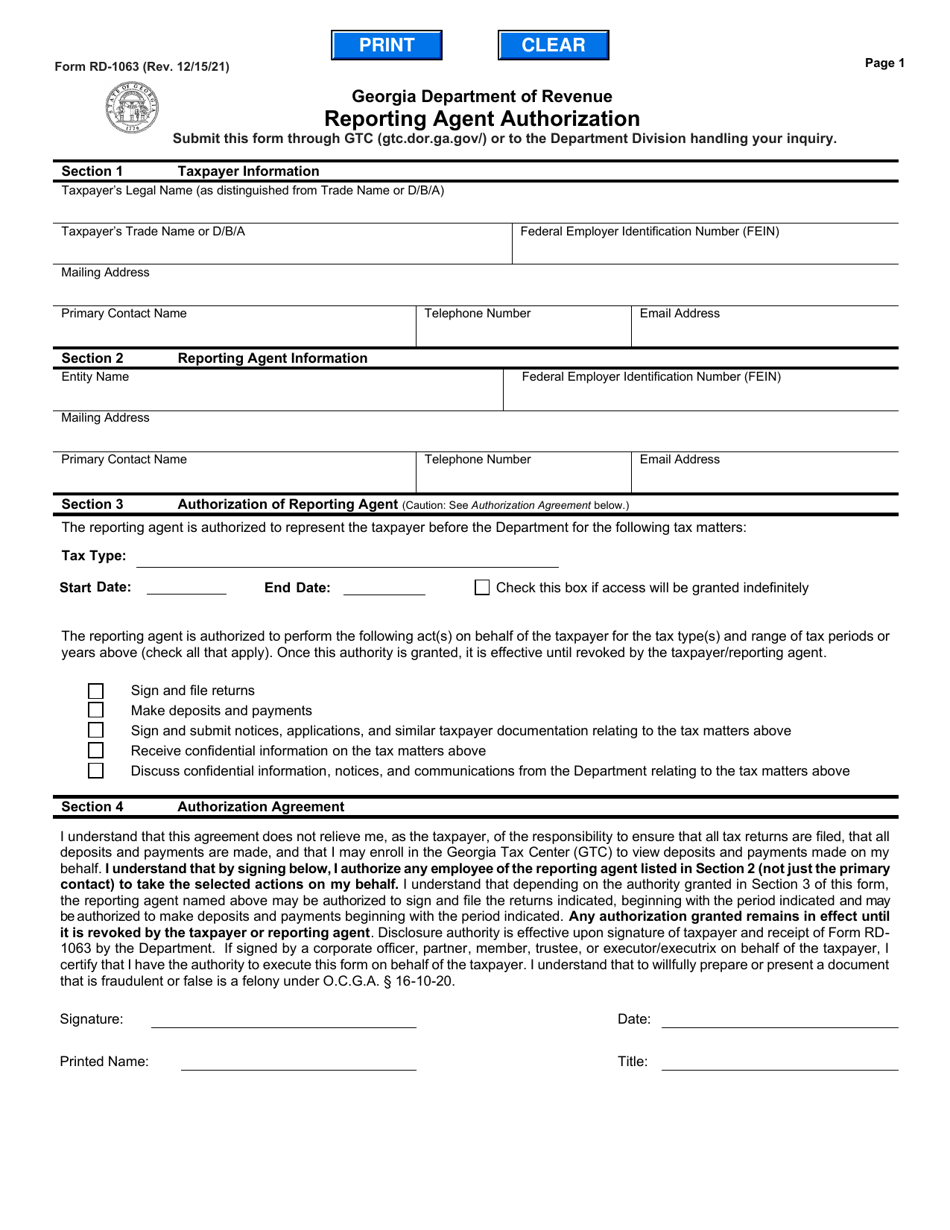

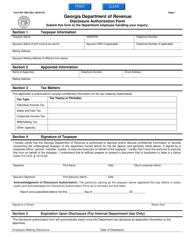

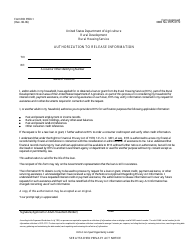

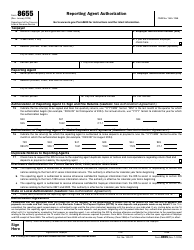

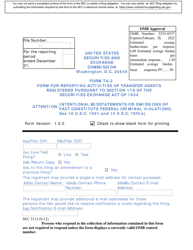

Form RD-1063 Reporting Agent Authorization - Georgia (United States)

What Is Form RD-1063?

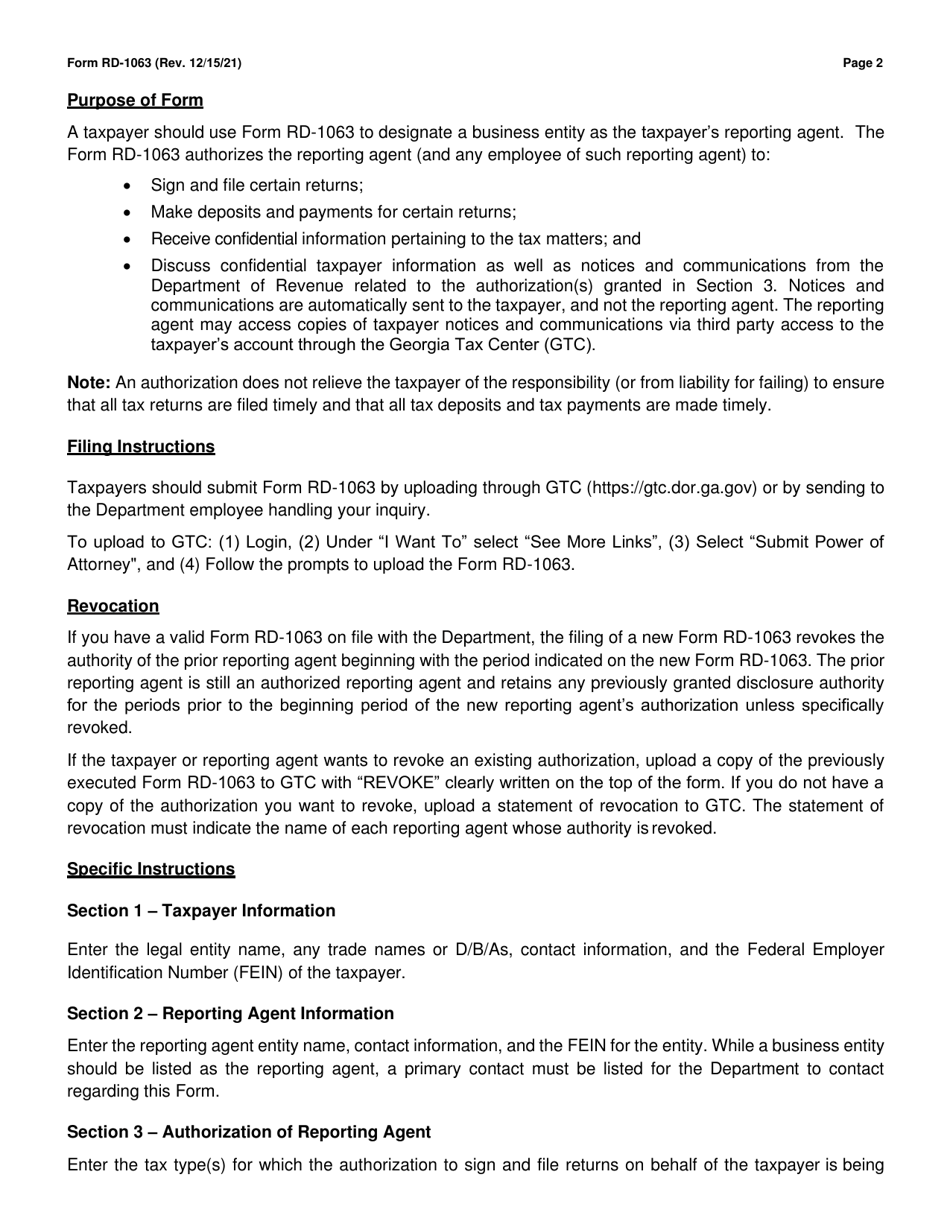

This is a legal form that was released by the Georgia Department of Revenue - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RD-1063?

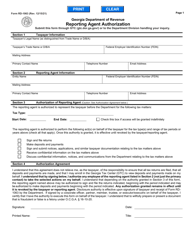

A: Form RD-1063 is a Reporting Agent Authorization form.

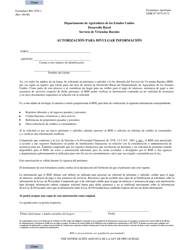

Q: Who uses Form RD-1063?

A: Form RD-1063 is used by individuals or entities in Georgia (United States) who want to appoint a reporting agent to represent them before the IRS.

Q: What is the purpose of Form RD-1063?

A: The purpose of Form RD-1063 is to authorize a reporting agent to act on behalf of the taxpayer when dealing with the IRS.

Q: Are there any fees associated with Form RD-1063?

A: There are no fees associated with filing Form RD-1063.

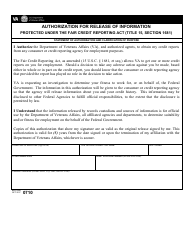

Q: Can I revoke the authorization granted on Form RD-1063?

A: Yes, you can revoke the authorization granted on Form RD-1063 at any time by submitting a written request to the IRS.

Q: Is Form RD-1063 specific to Georgia?

A: Yes, Form RD-1063 is specific to Georgia and is used by taxpayers in Georgia (United States) to authorize a reporting agent.

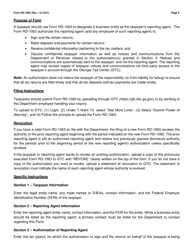

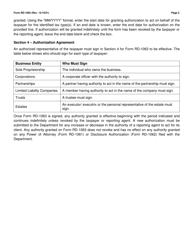

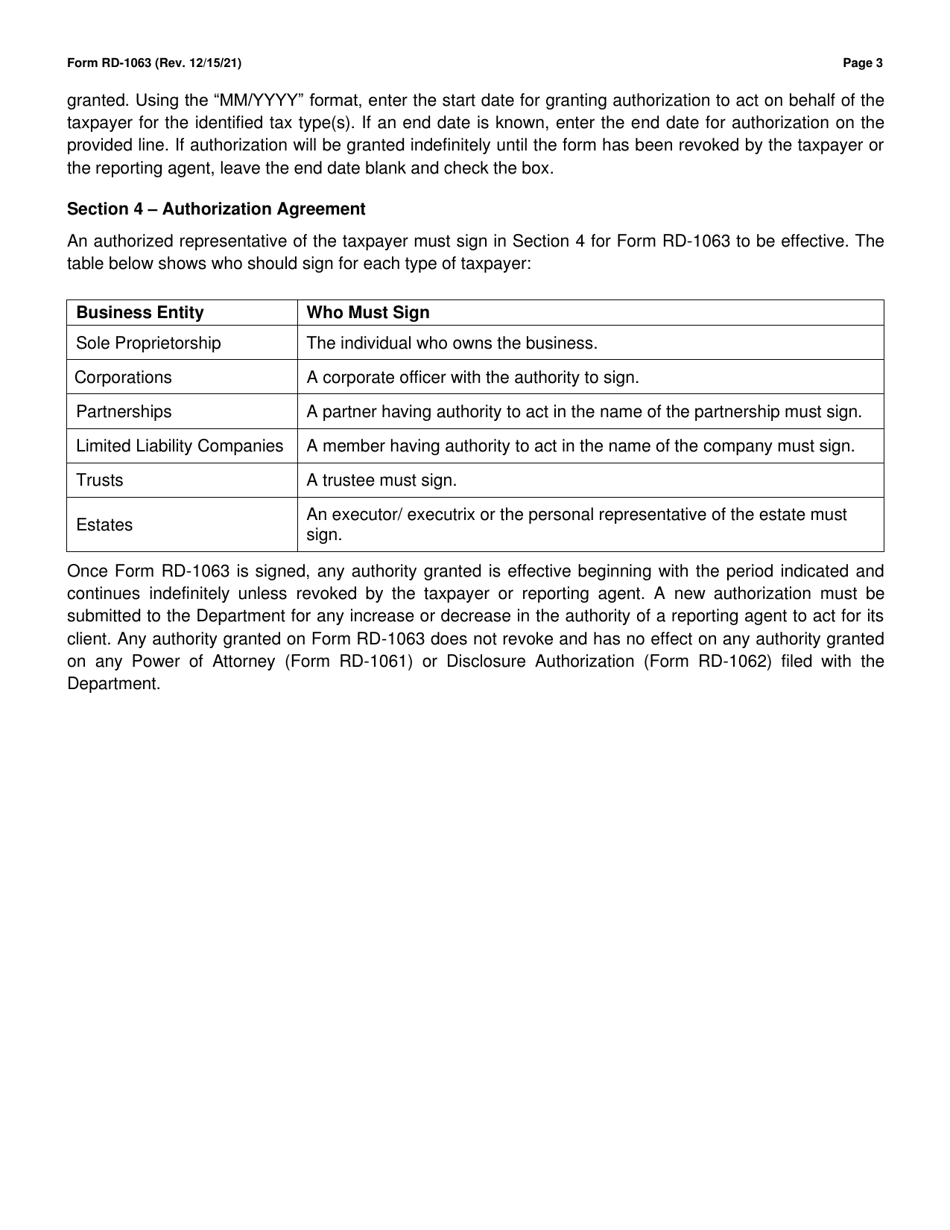

Q: Is Form RD-1063 used for both individual and business taxpayers?

A: Yes, Form RD-1063 can be used by both individual and business taxpayers in Georgia (United States).

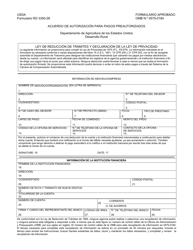

Q: What information is required on Form RD-1063?

A: Form RD-1063 requires information such as the taxpayer's name, address, taxpayer identification number, and the name and address of the reporting agent being authorized.

Form Details:

- Released on December 15, 2021;

- The latest edition provided by the Georgia Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RD-1063 by clicking the link below or browse more documents and templates provided by the Georgia Department of Revenue.