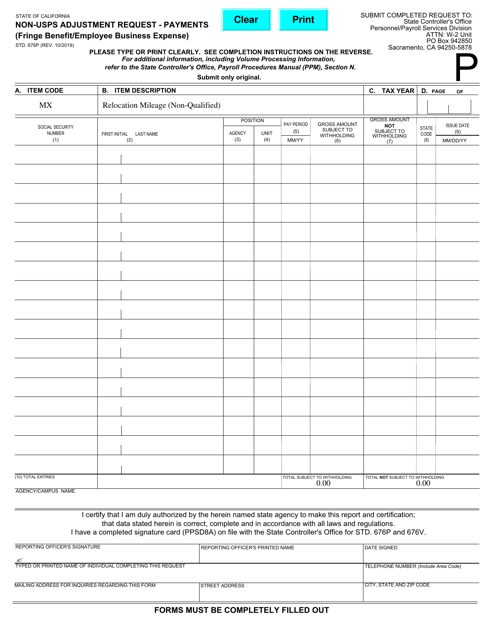

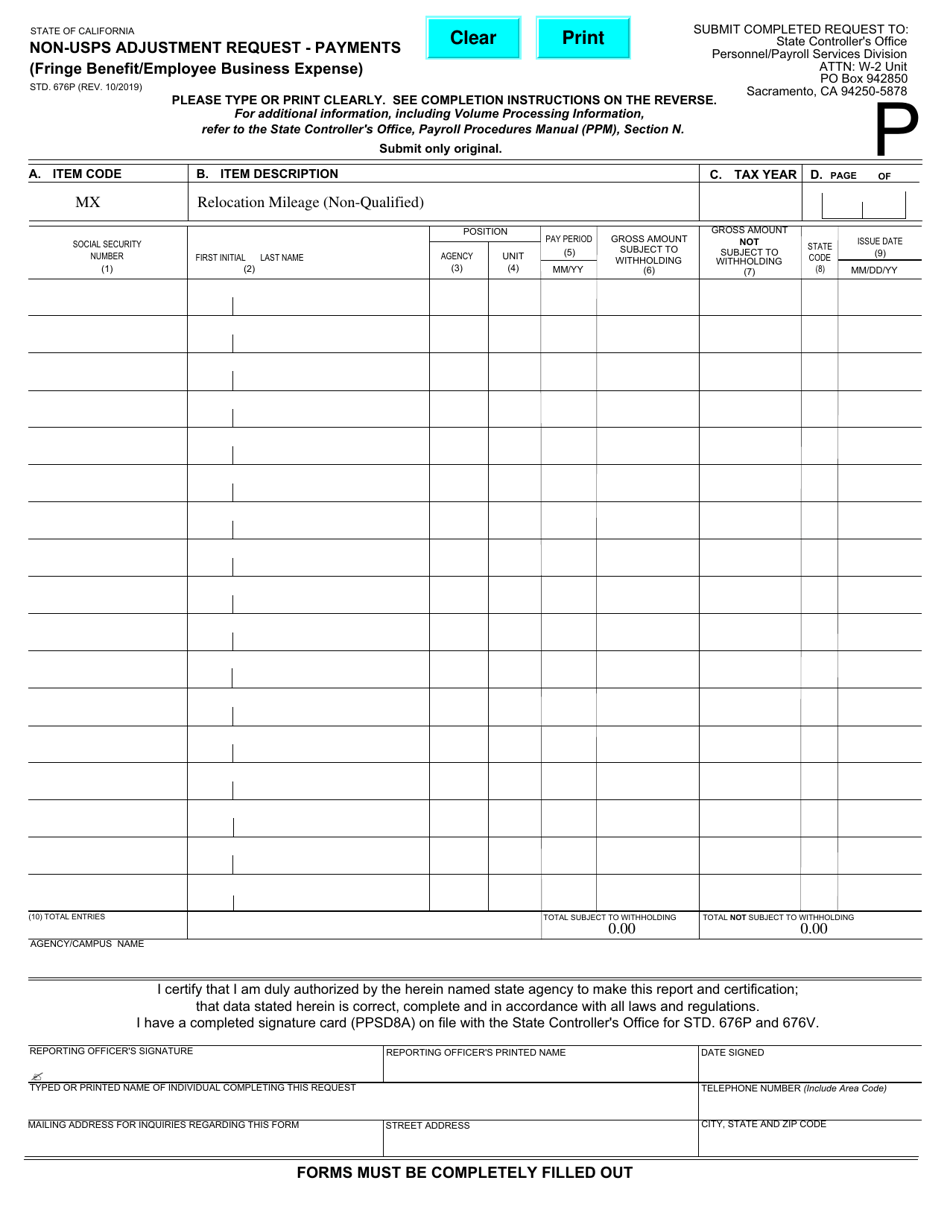

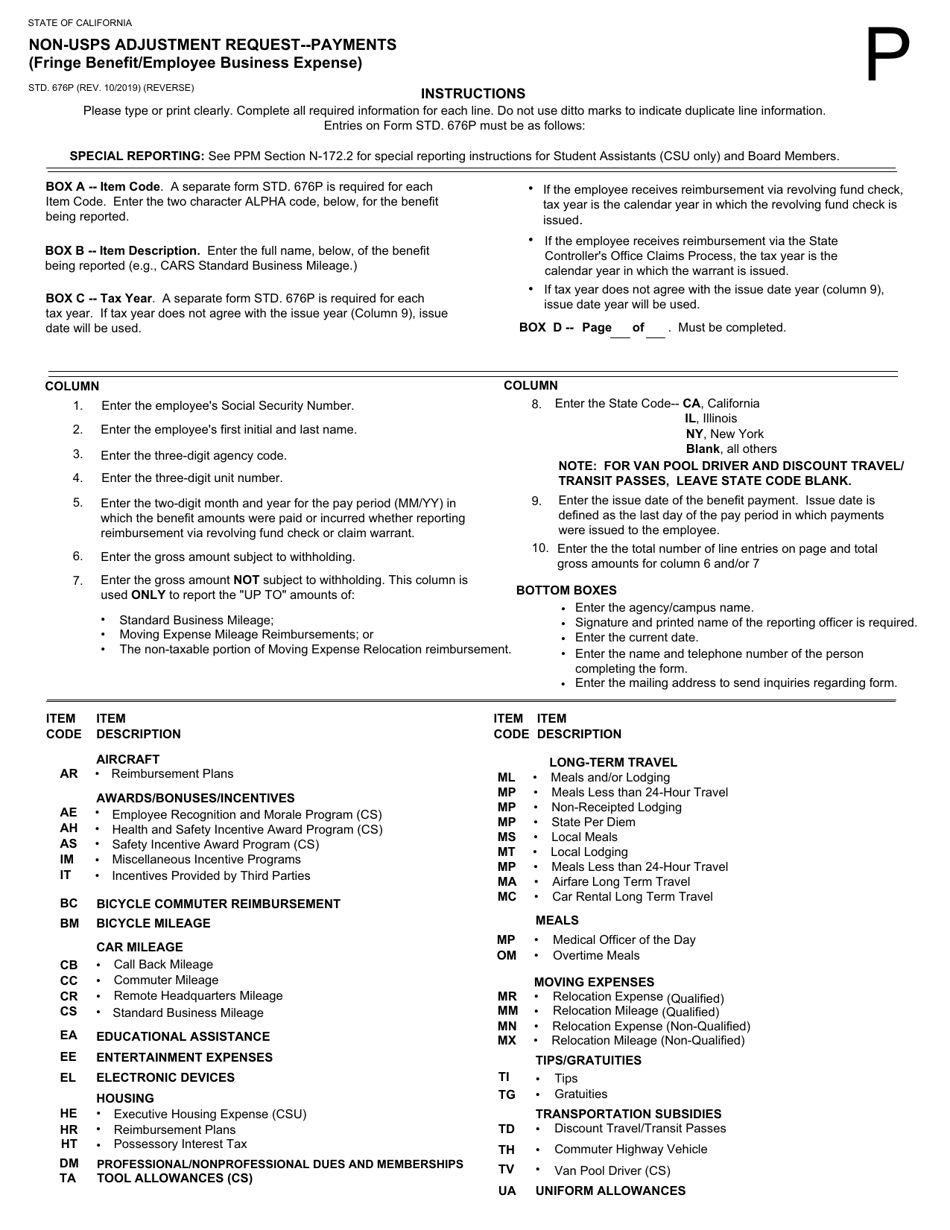

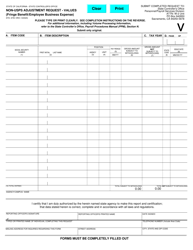

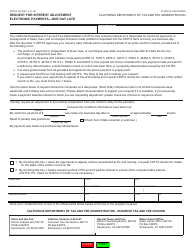

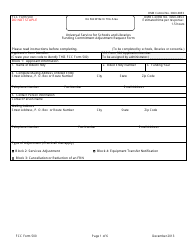

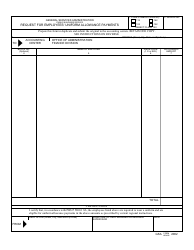

Form STD.676P Non-USPS Adjustment Request - Payments (Fringe Benefit / Employee Business Expense) - California

What Is Form STD.676P?

This is a legal form that was released by the California State Controller’s Office - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form STD.676P?

A: Form STD.676P is a Non-USPS Adjustment Request - Payments form specifically for Fringe Benefit/Employee Business Expense in California.

Q: Who needs to use Form STD.676P?

A: This form is for individuals or businesses in California who need to request adjustments for payments related to fringe benefits or employee business expenses.

Q: What is the purpose of Form STD.676P?

A: The purpose of Form STD.676P is to document and request adjustments for fringe benefit and employee business expense payments in California.

Q: Is Form STD.676P only for USPS employees?

A: No, Form STD.676P is specifically for Non-USPS (Non-United States Postal Service) employees in California.

Q: What types of payments are covered by Form STD.676P?

A: Form STD.676P covers payments related to fringe benefits and employee business expenses in California.

Q: Can I use Form STD.676P for adjustments in other states?

A: No, Form STD.676P is specific to adjustments in California and may not be used for adjustments in other states.

Q: Are there any deadlines for submitting Form STD.676P?

A: For specific deadlines or due dates, you should refer to the instructions provided with the form or contact the California Employment Development Department (EDD).

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the California State Controller’s Office;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form STD.676P by clicking the link below or browse more documents and templates provided by the California State Controller’s Office.