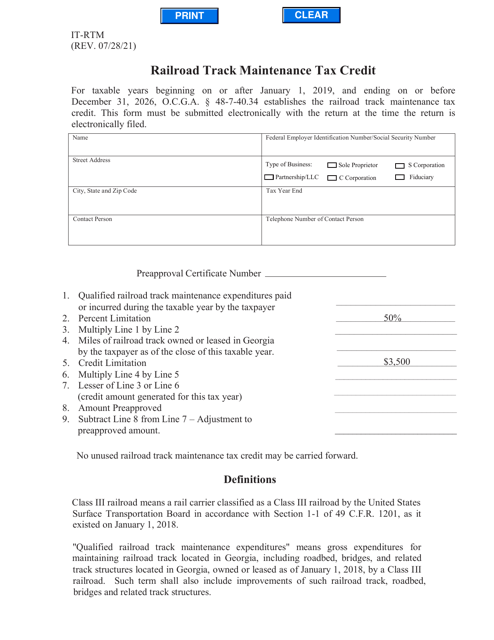

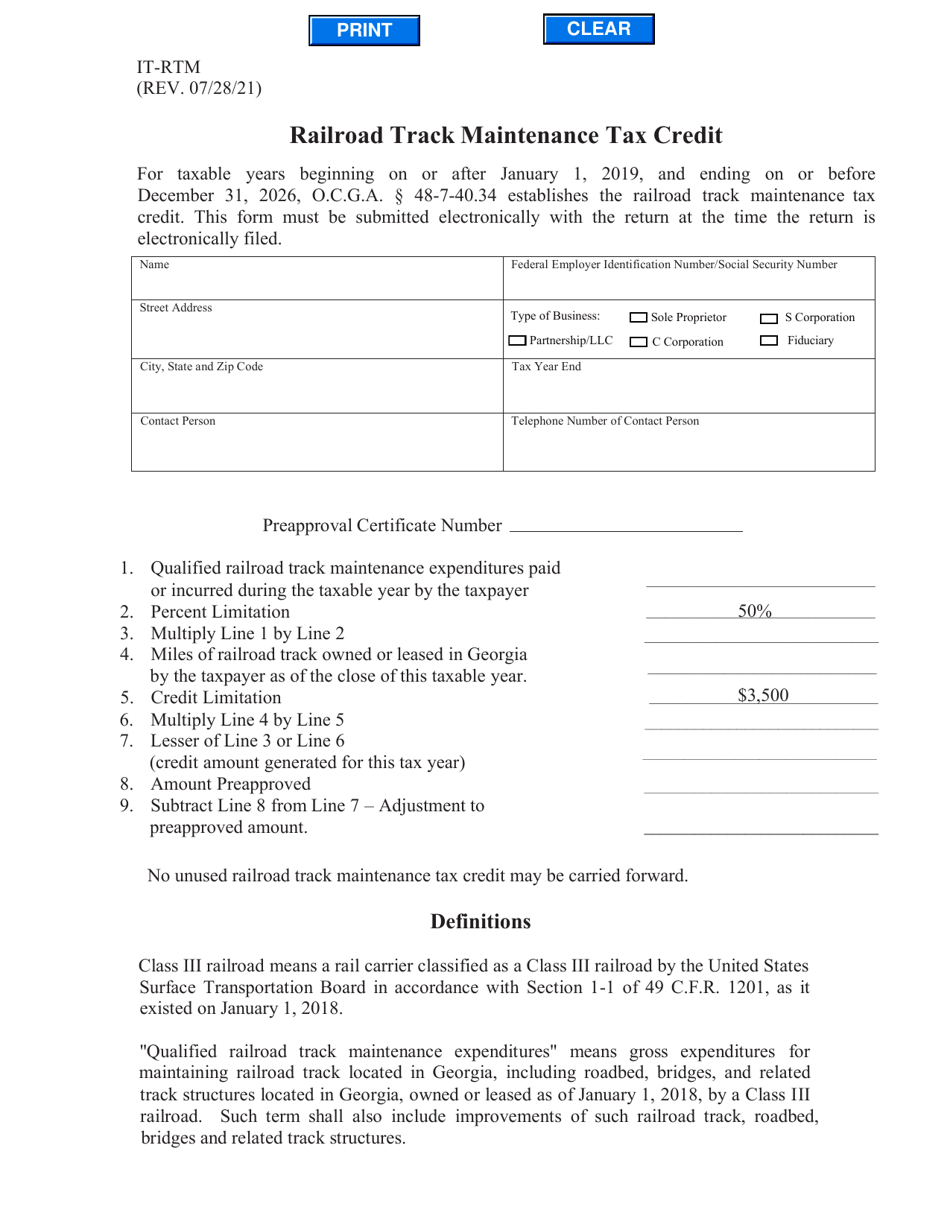

Form IT-RTM Railroad Track Maintenance Tax Credit - Georgia (United States)

What Is Form IT-RTM?

This is a legal form that was released by the Georgia Department of Education - a government authority operating within Georgia (United States). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-RTM?

A: Form IT-RTM is a tax form used in Georgia (United States) to claim the Railroad Track Maintenance Tax Credit.

Q: Who can use Form IT-RTM?

A: Form IT-RTM can be used by individuals or businesses that own or lease railroad tracks in Georgia and have incurred qualified track maintenance expenses.

Q: What is the purpose of the Railroad Track Maintenance Tax Credit?

A: The purpose of the Railroad Track Maintenance Tax Credit is to incentivize the maintenance and improvement of railroad tracks in Georgia.

Q: What expenses qualify for the tax credit?

A: Qualified track maintenance expenses include expenses related to construction, repair, and maintenance of railroad tracks in Georgia.

Q: How do I claim the tax credit using Form IT-RTM?

A: To claim the tax credit, you need to complete and attach Form IT-RTM to your Georgia tax return and provide the necessary documentation supporting your qualified track maintenance expenses.

Form Details:

- Released on July 28, 2021;

- The latest edition provided by the Georgia Department of Education;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-RTM by clicking the link below or browse more documents and templates provided by the Georgia Department of Education.