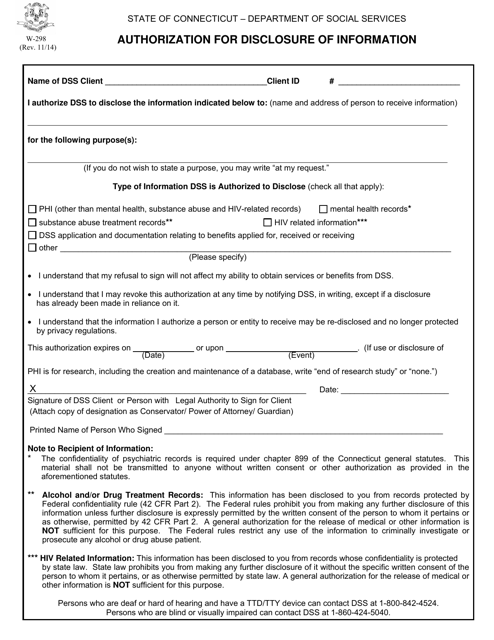

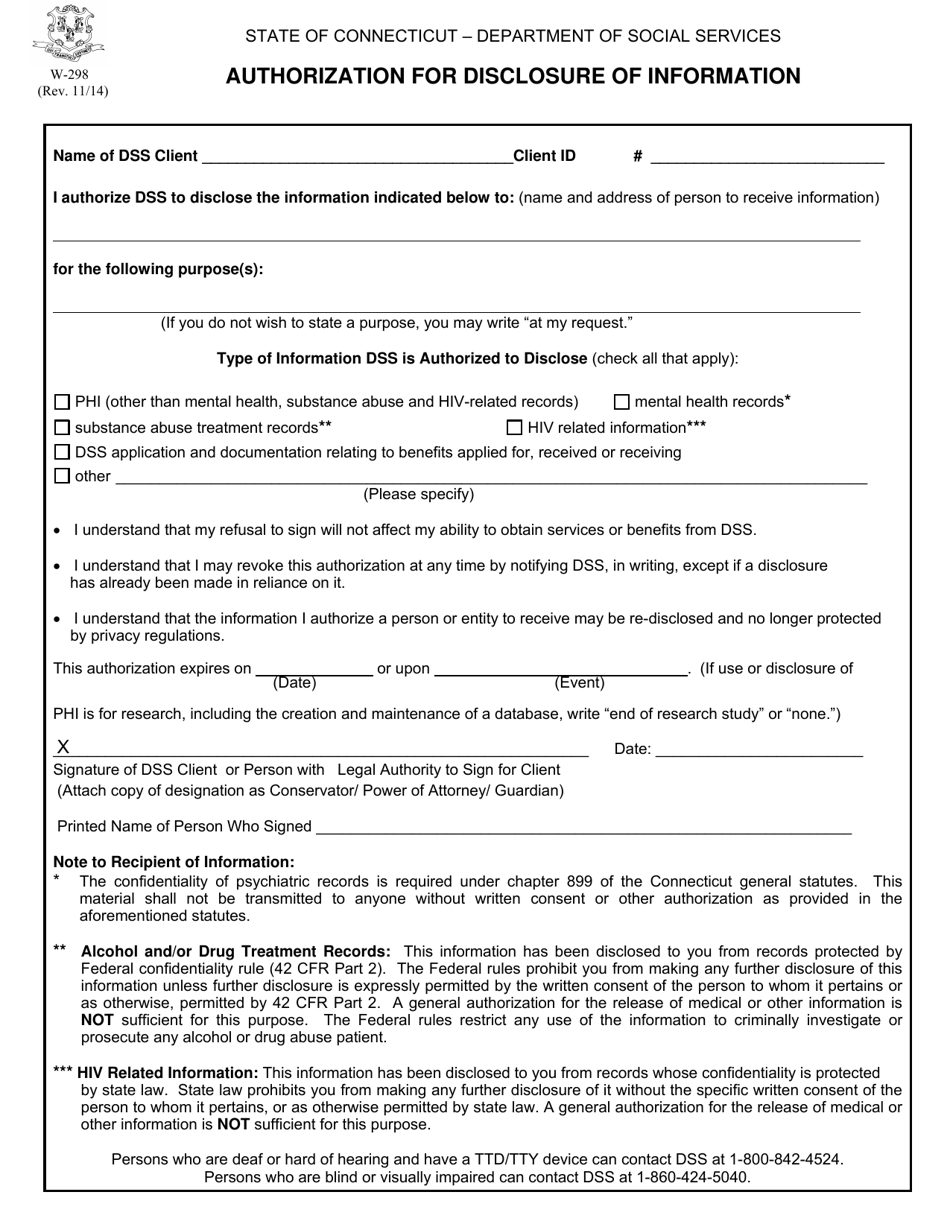

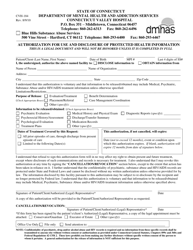

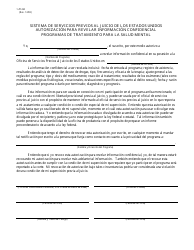

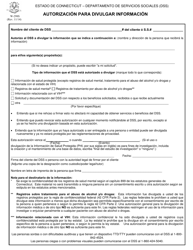

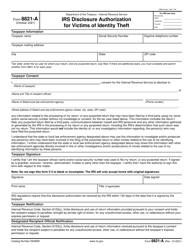

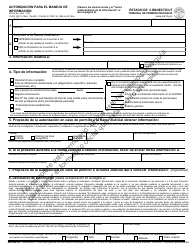

Form W-298 Authorization for Disclosure of Information - Connecticut

What Is Form W-298?

This is a legal form that was released by the Connecticut State Department of Social Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W-298?

A: Form W-298, Authorization for Disclosure of Information, is a form used in Connecticut to authorize the disclosure of taxpayer information to a designated third party.

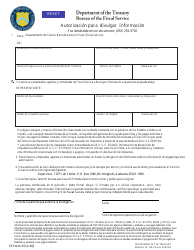

Q: When is Form W-298 used?

A: Form W-298 is used when a taxpayer in Connecticut wants to grant permission to a specific individual or organization to access and receive their confidential tax information.

Q: Who can use Form W-298?

A: Form W-298 can be used by individual taxpayers as well as businesses in Connecticut who want to authorize the disclosure of their tax information to a designated third party.

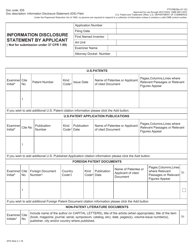

Q: What information is disclosed through Form W-298?

A: Form W-298 allows the disclosure of various types of taxpayer information, including but not limited to, tax returns, financial statements, and other related records.

Q: Is there a fee to file Form W-298?

A: No, there is no fee to file Form W-298 in Connecticut.

Q: How do I fill out Form W-298?

A: Form W-298 requires the taxpayer to provide their name, address, and taxpayer identification number, as well as the name and contact information of the designated third party.

Q: What happens after I submit Form W-298?

A: After submitting Form W-298, the designated third party will be authorized to access and receive the taxpayer's confidential information as specified on the form.

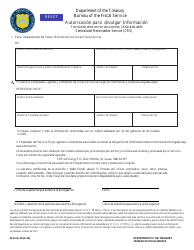

Form Details:

- Released on November 1, 2014;

- The latest edition provided by the Connecticut State Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W-298 by clicking the link below or browse more documents and templates provided by the Connecticut State Department of Social Services.