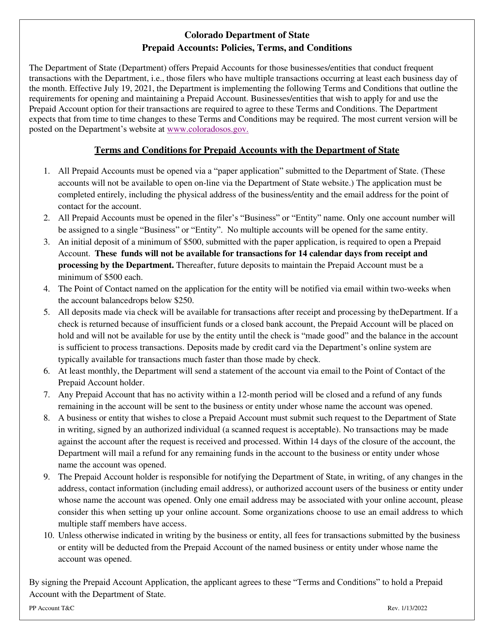

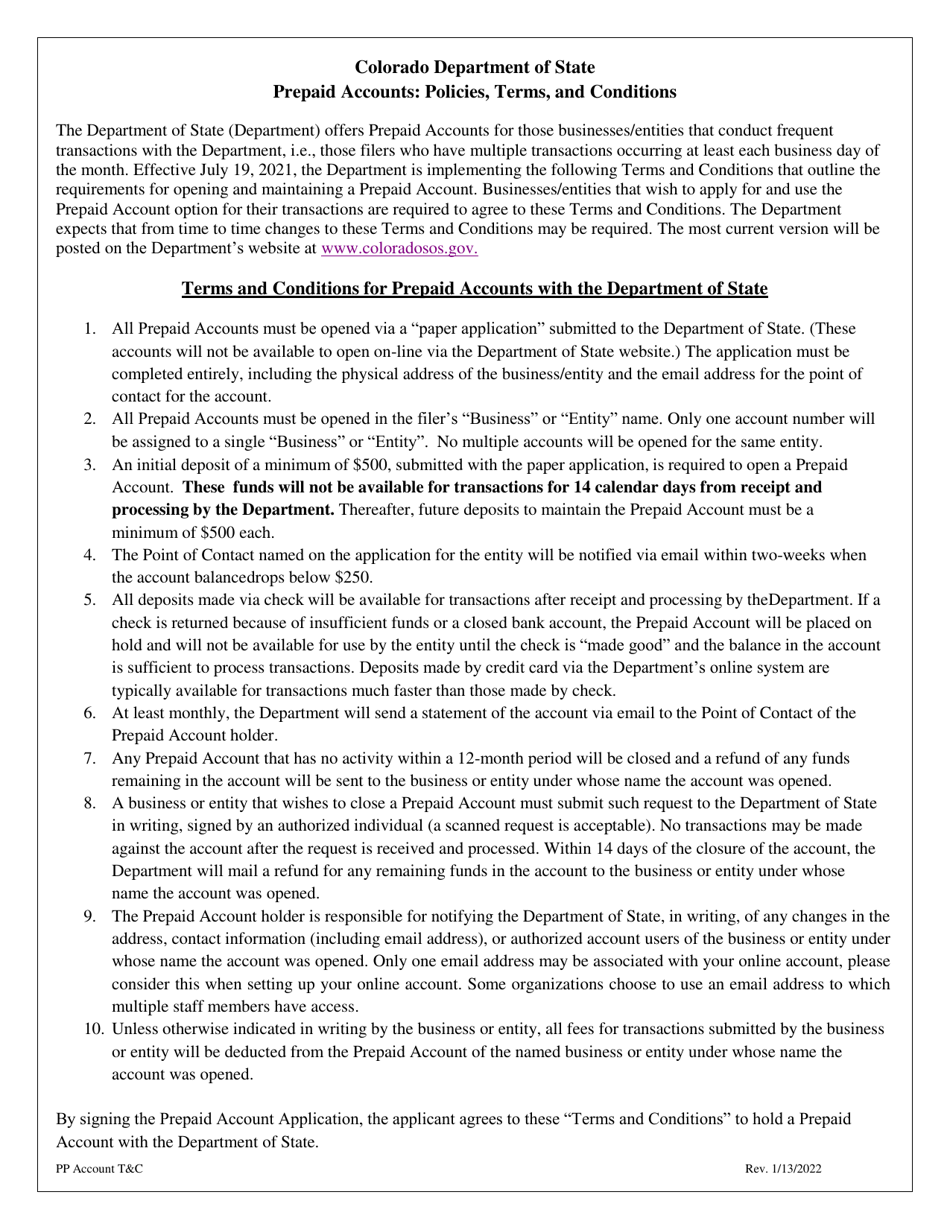

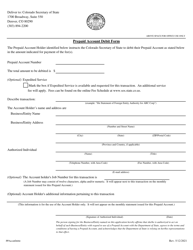

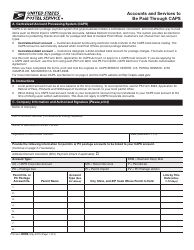

Prepaid Account Application - Colorado

Prepaid Account Application is a legal document that was released by the Colorado Secretary of State - a government authority operating within Colorado.

FAQ

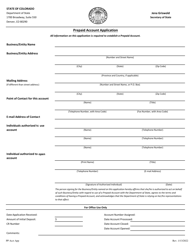

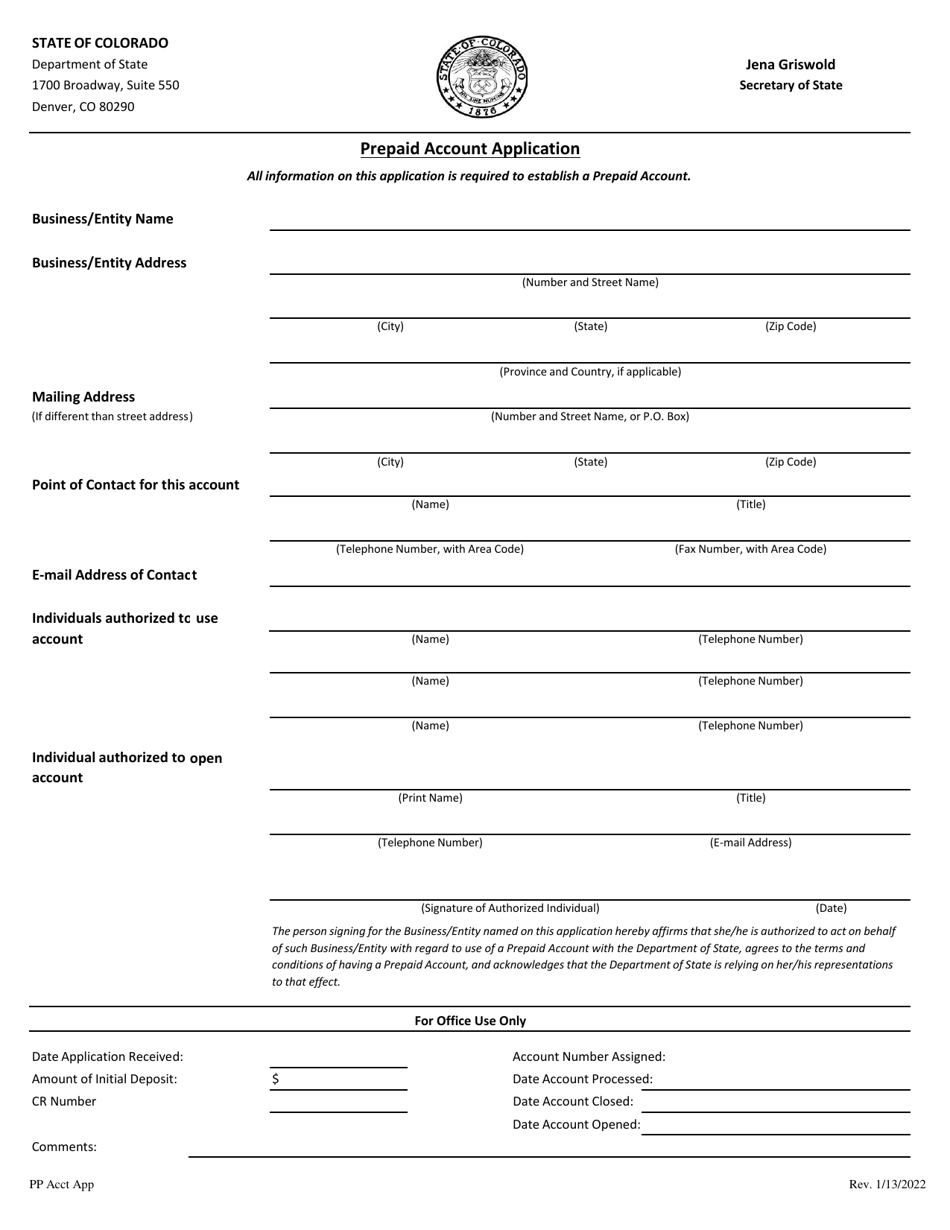

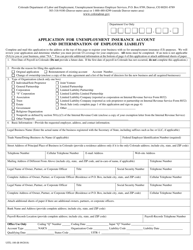

Q: What information do I need to provide when applying for a prepaid account in Colorado?

A: When applying for a prepaid account in Colorado, you will generally need to provide personal information such as your name, date of birth, social security number, contact information, and sometimes proof of address or identification.

Q: Are there any fees associated with prepaid accounts in Colorado?

A: Yes, prepaid accounts in Colorado may come with various fees, such as monthly maintenance fees, transaction fees, ATM withdrawal fees, and others. It is important to review the fee schedule provided by the prepaid account provider before opening an account.

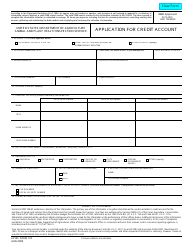

Q: What are the benefits of having a prepaid account in Colorado?

A: Having a prepaid account in Colorado can offer convenient access to funds, the ability to make purchases and payments, and financial management tools. It can be a suitable option for those who do not have or do not wish to have a traditional bank account.

Q: Can I use a prepaid account in Colorado for direct deposit?

A: Yes, many prepaid accounts in Colorado allow direct deposit, enabling you to have your paychecks, government benefits, or other recurring income directly deposited into your account.

Q: Is my money safe in a prepaid account in Colorado?

A: Prepaid accounts in Colorado are generally covered by federal consumer protection regulations, such as the Electronic Fund Transfer Act (EFTA) and the Consumer Financial Protection Bureau (CFPB). However, it is important to choose a reputable prepaid account provider and review their terms and conditions.

Form Details:

- Released on January 13, 2022;

- The latest edition currently provided by the Colorado Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Colorado Secretary of State.