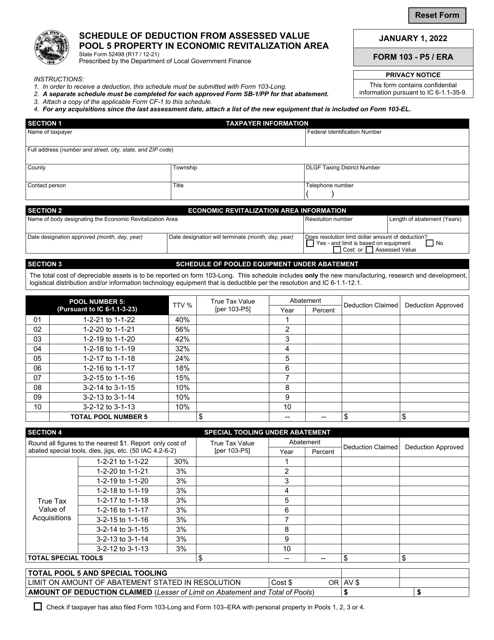

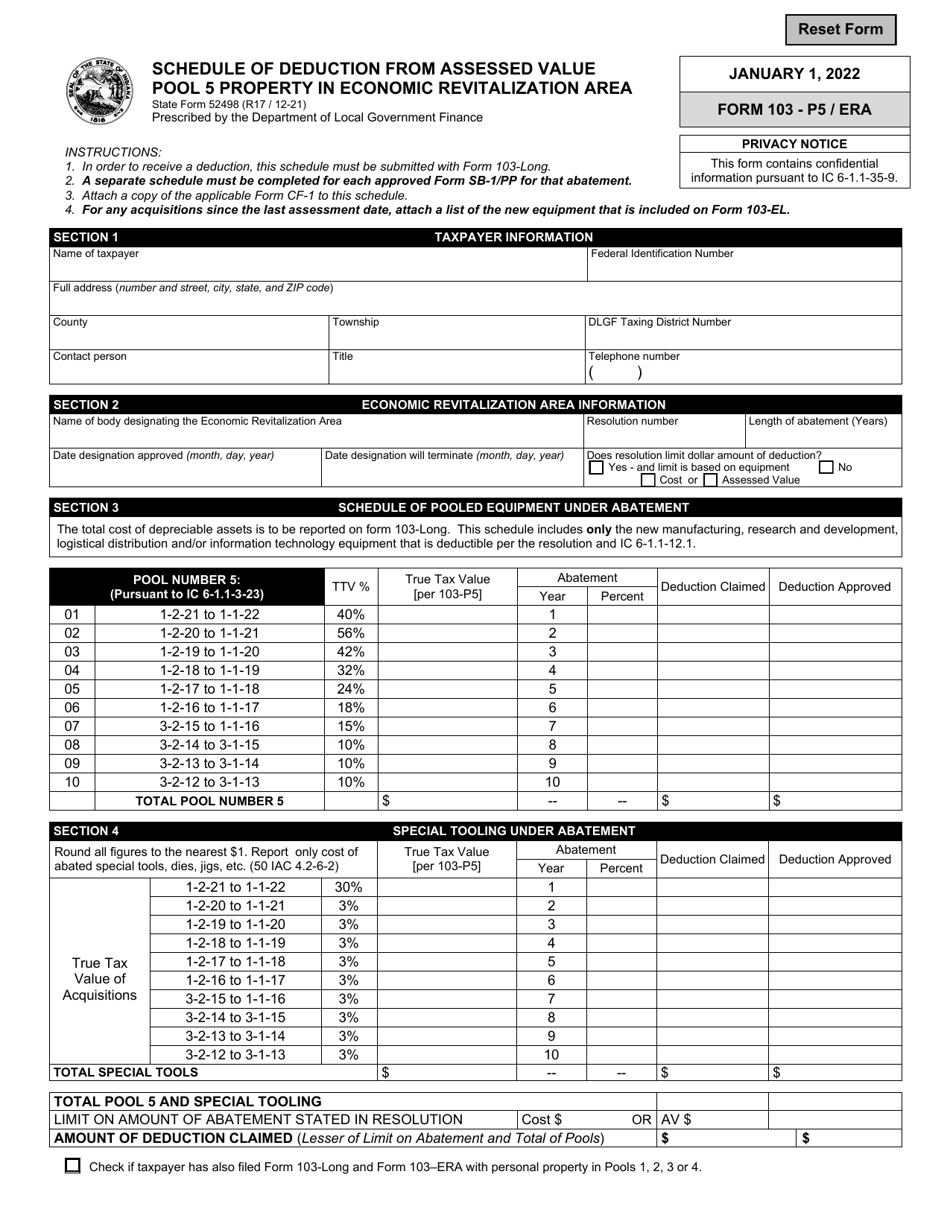

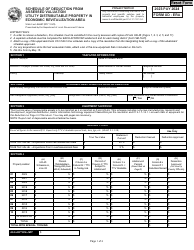

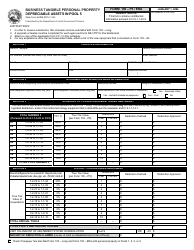

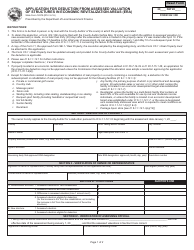

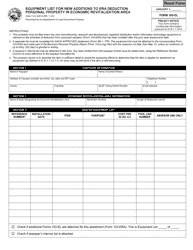

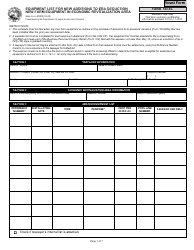

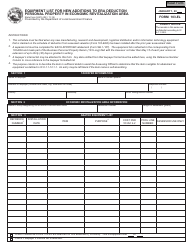

Form 103-P5 / ERA (State Form 52498) Schedule of Deduction From Assessed Value Pool 5 Property in Economic Revitalization Area - Indiana

What Is Form 103-P5/ERA (State Form 52498)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 103-P5/ERA?

A: Form 103-P5/ERA is a schedule of deduction from assessed value for property located in an Economic Revitalization Area (ERA) in Indiana.

Q: What is the purpose of Form 103-P5/ERA?

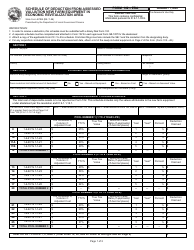

A: The purpose of Form 103-P5/ERA is to calculate and report the requested deduction from the assessed value of property in an Economic Revitalization Area.

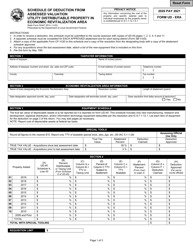

Q: Who needs to file Form 103-P5/ERA?

A: Property owners in an Economic Revitalization Area in Indiana are required to file Form 103-P5/ERA if they want to claim a deduction from the assessed value of their property.

Q: When should Form 103-P5/ERA be filed?

A: Form 103-P5/ERA should be filed annually before the Form 103 is filed with the county auditor.

Q: Are there any fees associated with filing Form 103-P5/ERA?

A: No, there are no fees associated with filing Form 103-P5/ERA.

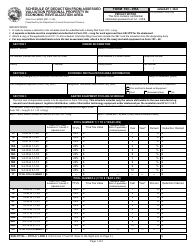

Q: What information is needed to complete Form 103-P5/ERA?

A: To complete Form 103-P5/ERA, you will need property information, such as the property address, parcel number, and the date the property was first acquired.

Q: What are the deductions that can be claimed on Form 103-P5/ERA?

A: The deductions that can be claimed on Form 103-P5/ERA include deductions for economic revitalization, abatement applicability, demolition or removal of buildings, and any other applicable deductions specified by the county.

Q: Can Form 103-P5/ERA be filed electronically?

A: Yes, Form 103-P5/ERA can be filed electronically if the county auditor's office accepts electronic filing.

Q: What happens after Form 103-P5/ERA is filed?

A: After Form 103-P5/ERA is filed, the county auditor will review the form and determine if the requested deductions are valid.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 103-P5/ERA (State Form 52498) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.