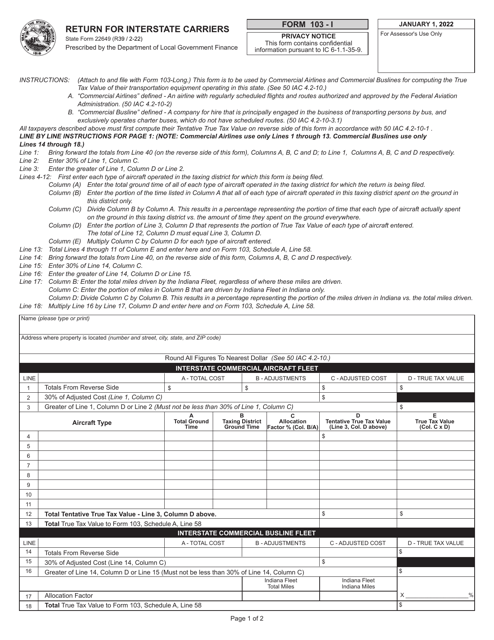

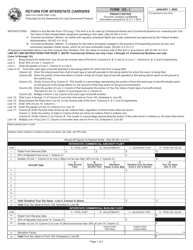

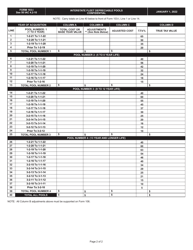

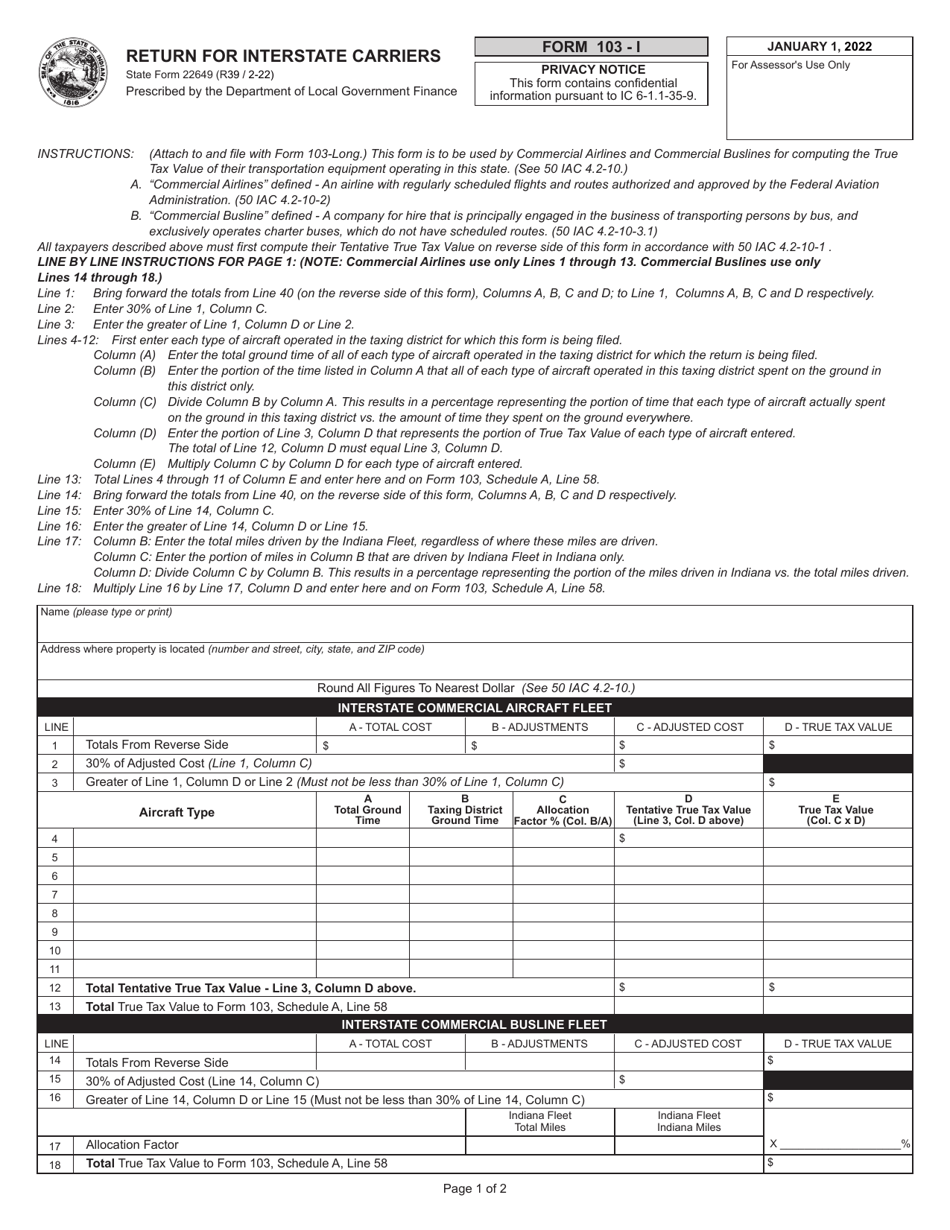

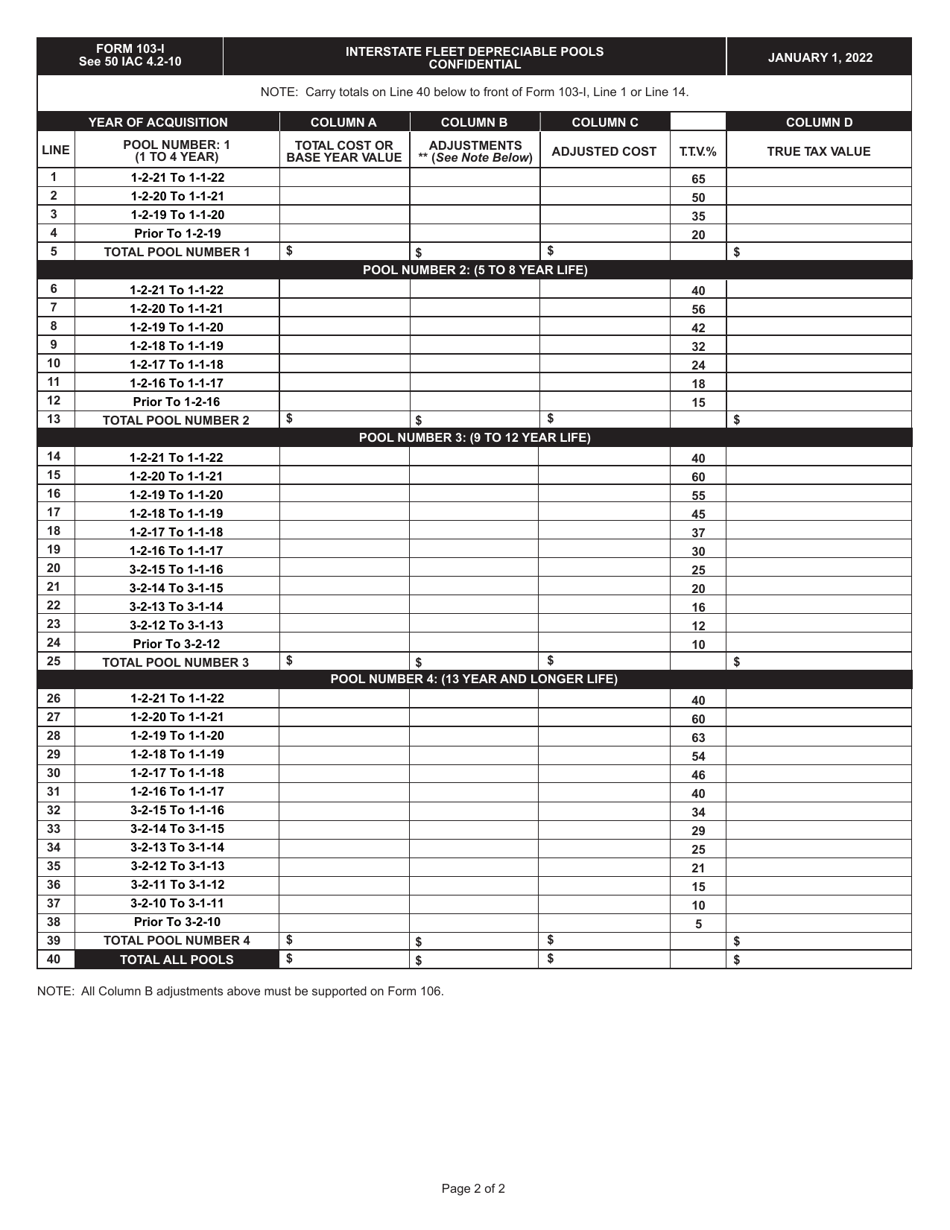

Form 103-I (State Form 22649) Return for Interstate Carriers - Indiana

What Is Form 103-I (State Form 22649)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 103-I?

A: Form 103-I is a return for interstate carriers in Indiana.

Q: Who is required to file Form 103-I?

A: Interstate carriers operating in Indiana are required to file Form 103-I.

Q: What is the purpose of Form 103-I?

A: Form 103-I is used to report and pay taxes on motor carrier operations in Indiana.

Q: When is Form 103-I due?

A: Form 103-I is due on a quarterly basis, with the due dates being the last day of the month following the end of the quarter.

Q: What information do I need to complete Form 103-I?

A: You will need information about your motor carrier operations, including mileage, fuel purchases, and gross revenue.

Q: What taxes are reported on Form 103-I?

A: Form 103-I is used to report and pay the Motor Carrier Fuel Tax and the Gross Revenue Tax.

Q: Are there any penalties for late filing or payment of Form 103-I?

A: Yes, late filing or payment of Form 103-I may result in penalties and interest charges.

Form Details:

- Released on February 1, 2022;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 103-I (State Form 22649) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.