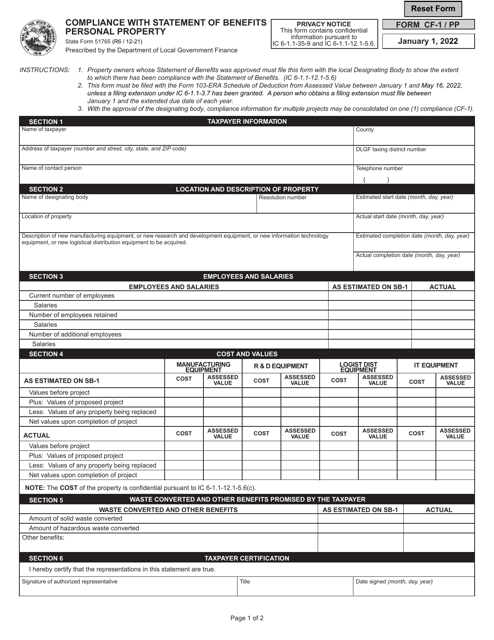

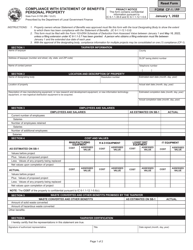

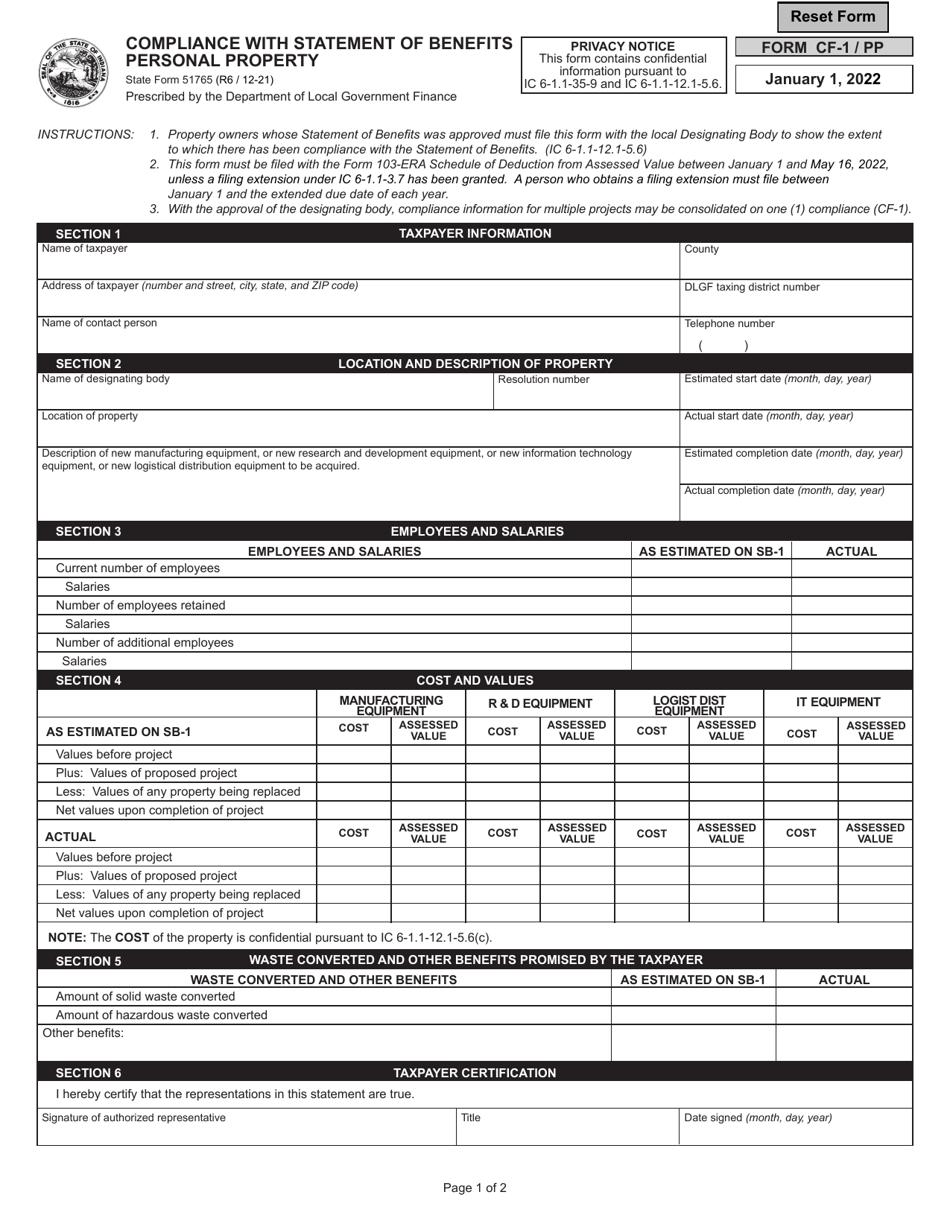

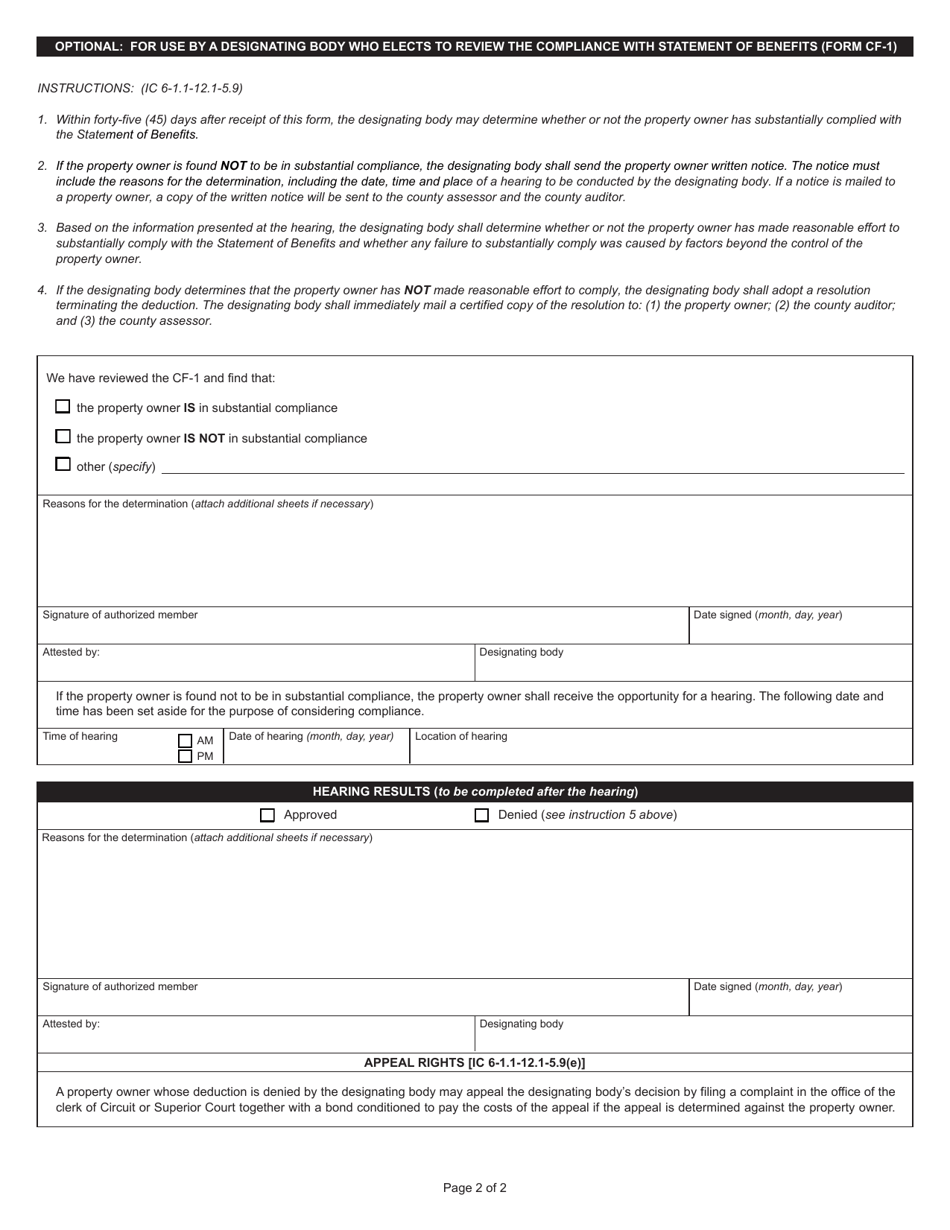

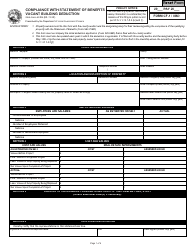

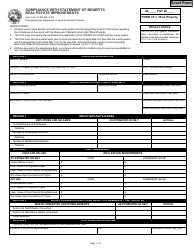

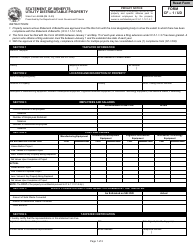

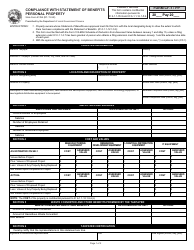

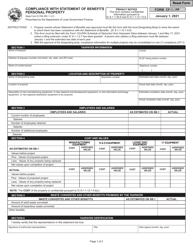

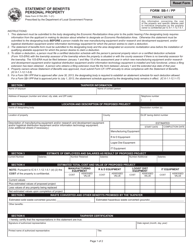

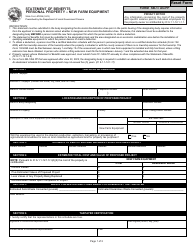

Form CF-1 / PP (State Form 51765) Compliance With Statement of Benefits Personal Property - Indiana

What Is Form CF-1/PP (State Form 51765)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CF-1/PP?

A: Form CF-1/PP is a compliance form used for reporting personal property in Indiana.

Q: What is the purpose of Form CF-1/PP?

A: The purpose of Form CF-1/PP is to ensure compliance with the Statement of Benefits Personal Property requirement in Indiana.

Q: Who needs to fill out Form CF-1/PP?

A: Anyone who owns personal property in Indiana and meets the filing requirements must fill out Form CF-1/PP.

Q: When is Form CF-1/PP due?

A: Form CF-1/PP is due by May 15th each year.

Q: What information is required on Form CF-1/PP?

A: Form CF-1/PP requires information such as the description and value of the personal property owned.

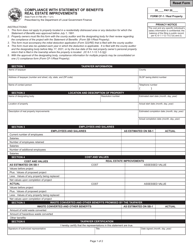

Q: Are there any penalties for not filing Form CF-1/PP?

A: Yes, there are penalties for not filing Form CF-1/PP, including potential fines and interest charges.

Q: Do I need to file Form CF-1/PP if I don't own any personal property?

A: If you don't own any personal property in Indiana, you do not need to file Form CF-1/PP.

Q: What other forms may be required in addition to Form CF-1/PP?

A: Depending on your circumstances, you may also need to file other forms such as Form CF-2/PP or Form CF-3/PP.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CF-1/PP (State Form 51765) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.