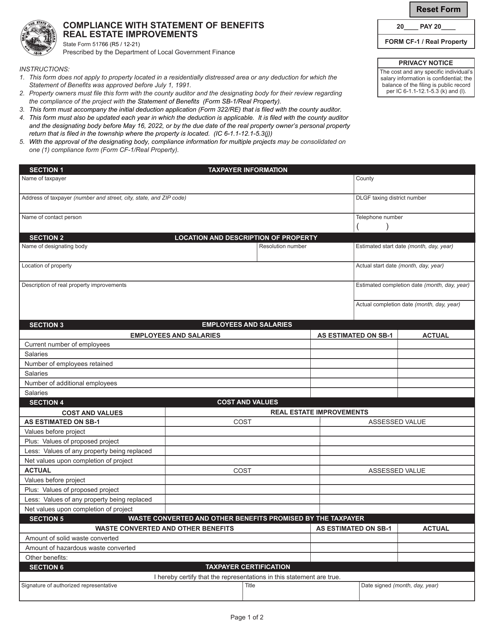

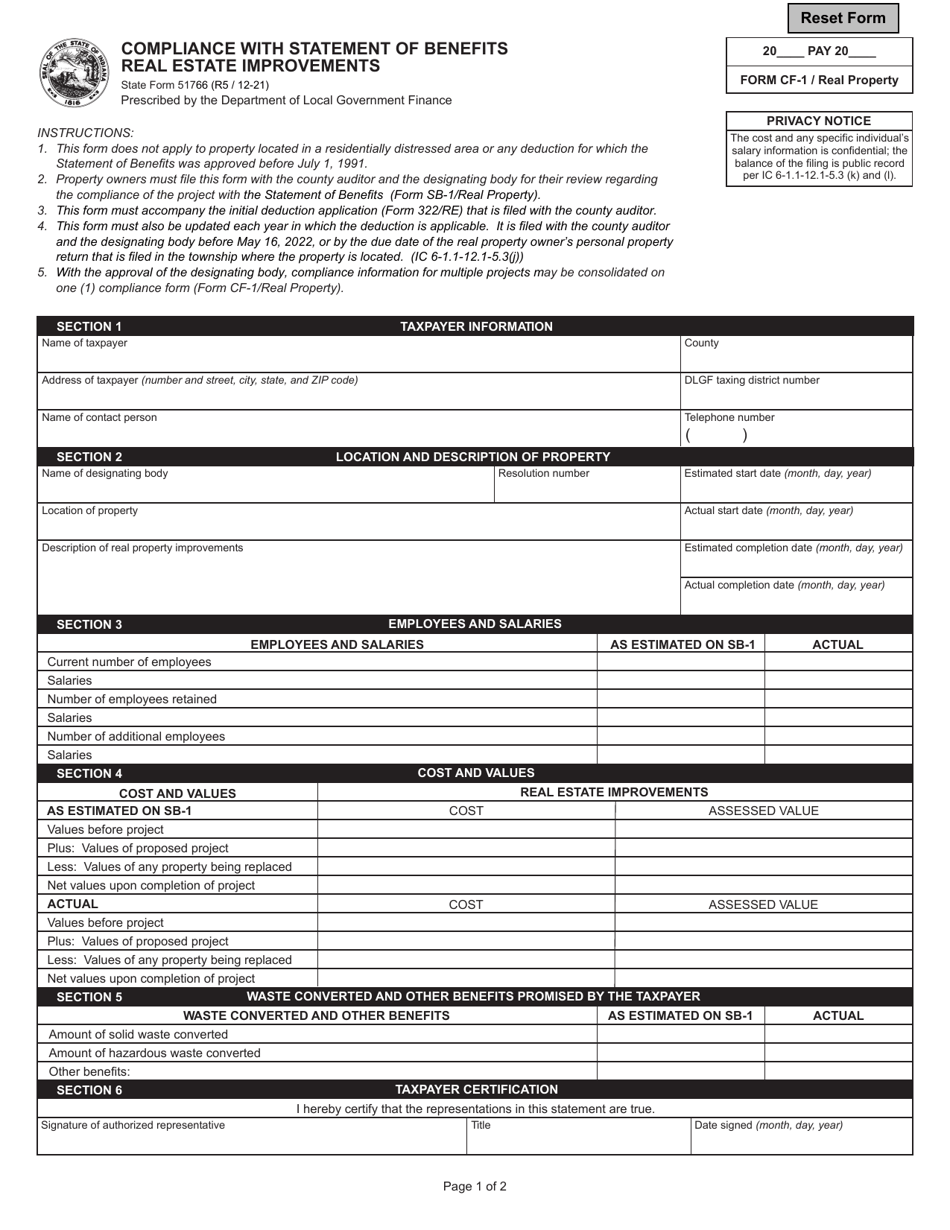

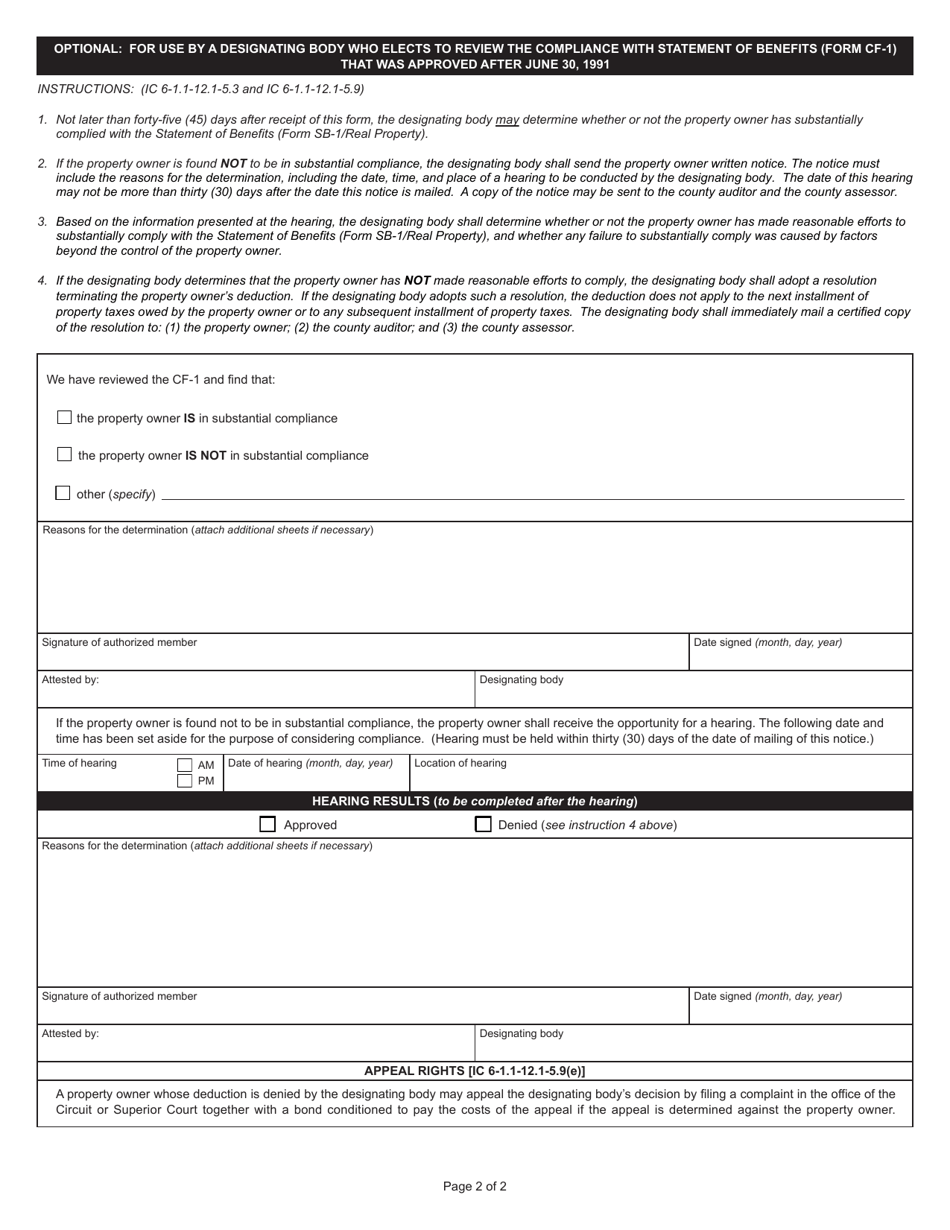

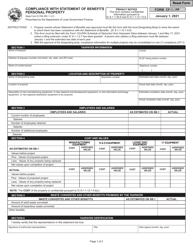

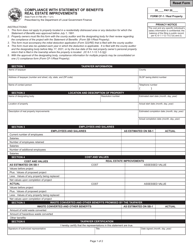

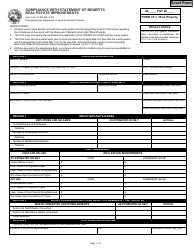

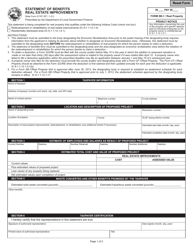

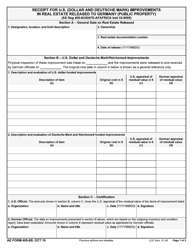

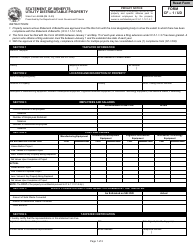

Form CF-1 / REAL PROPERTY (State Form 51766) Compliance With Statement of Benefits Real Estate Improvements - Indiana

What Is Form CF-1/REAL PROPERTY (State Form 51766)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CF-1?

A: Form CF-1 is a document used in Indiana to comply with the Statement of Benefits for Real Estate Improvements.

Q: What is State Form 51766?

A: State Form 51766 is the official form number for Form CF-1 in Indiana.

Q: What is the purpose of Form CF-1?

A: The purpose of Form CF-1 is to demonstrate compliance with the Statement of Benefits for Real Estate Improvements in Indiana.

Q: What does Form CF-1 assess?

A: Form CF-1 assesses the benefits provided by real estate improvements in Indiana.

Q: Who needs to use Form CF-1?

A: Anyone who has made real estate improvements in Indiana and wants to demonstrate compliance with the Statement of Benefits needs to use Form CF-1.

Q: Are there any fees associated with Form CF-1?

A: It is best to check with the relevant authorities or consult the instructions accompanying Form CF-1 to determine if there are any associated fees.

Q: What is the deadline to submit Form CF-1?

A: The deadline to submit Form CF-1 may vary, so it is important to check with the appropriate authorities or consult the instructions accompanying the form.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CF-1/REAL PROPERTY (State Form 51766) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.