This version of the form is not currently in use and is provided for reference only. Download this version of

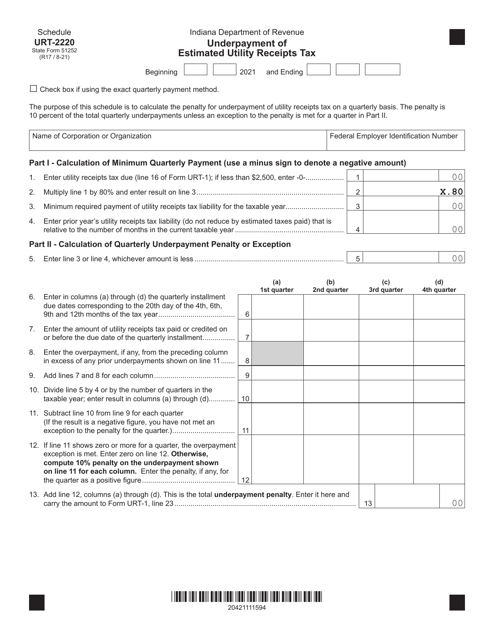

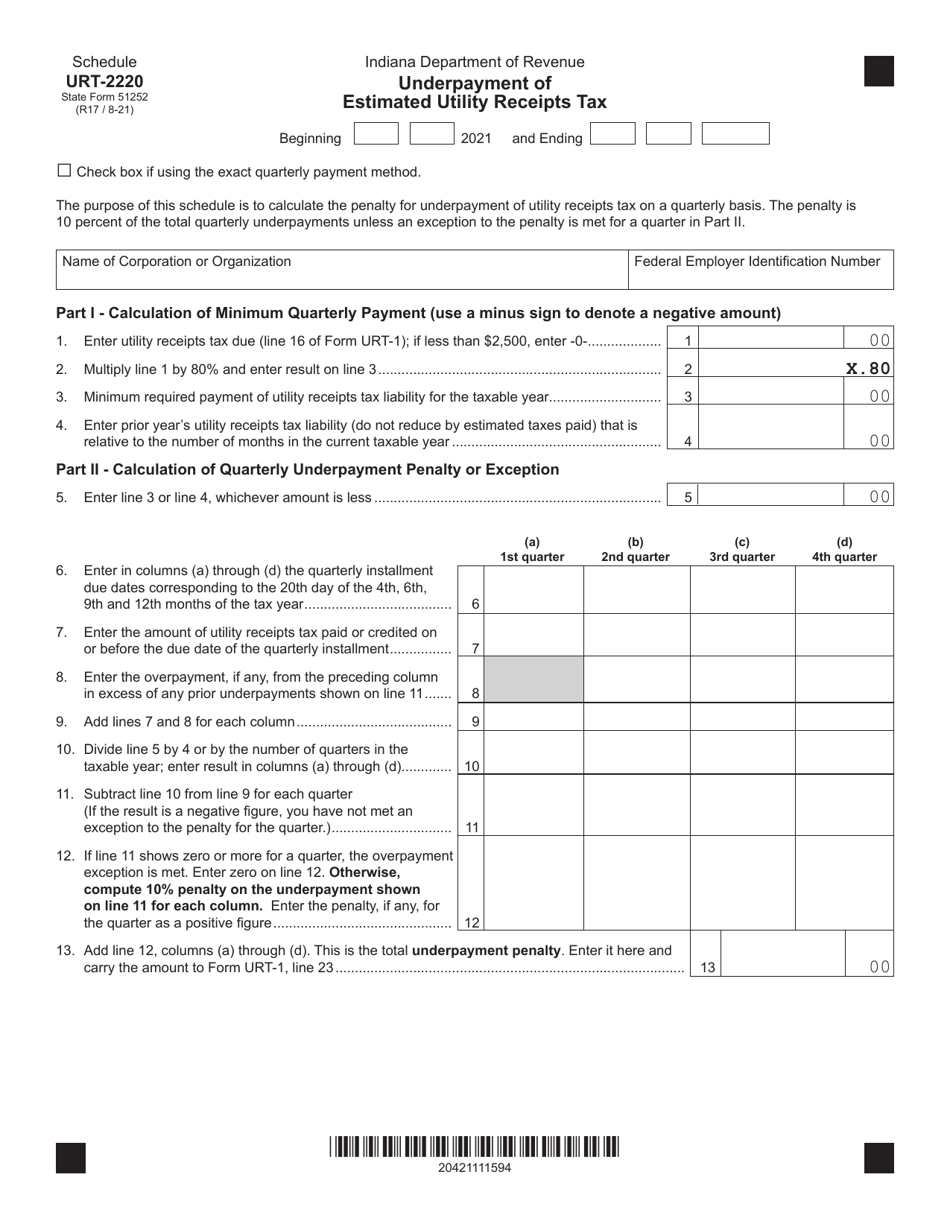

State Form 51252 Schedule URT-2220

for the current year.

State Form 51252 Schedule URT-2220 Underpayment of Estimated Utility Receipts Tax - Indiana

What Is State Form 51252 Schedule URT-2220?

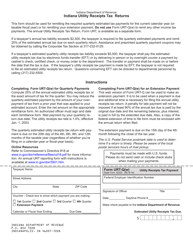

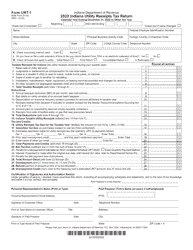

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 51252 Schedule URT-2220?

A: Form 51252 Schedule URT-2220 is a tax form used in Indiana.

Q: What is the purpose of Form 51252 Schedule URT-2220?

A: The purpose of Form 51252 Schedule URT-2220 is to report underpayment of estimated utility receipts tax in Indiana.

Q: Who needs to file Form 51252 Schedule URT-2220?

A: Anyone who has underpaid their estimated utility receipts tax in Indiana needs to file Form 51252 Schedule URT-2220.

Q: When is Form 51252 Schedule URT-2220 due?

A: Form 51252 Schedule URT-2220 is due on or before the original due date of the tax return for the tax year.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 51252 Schedule URT-2220 by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.