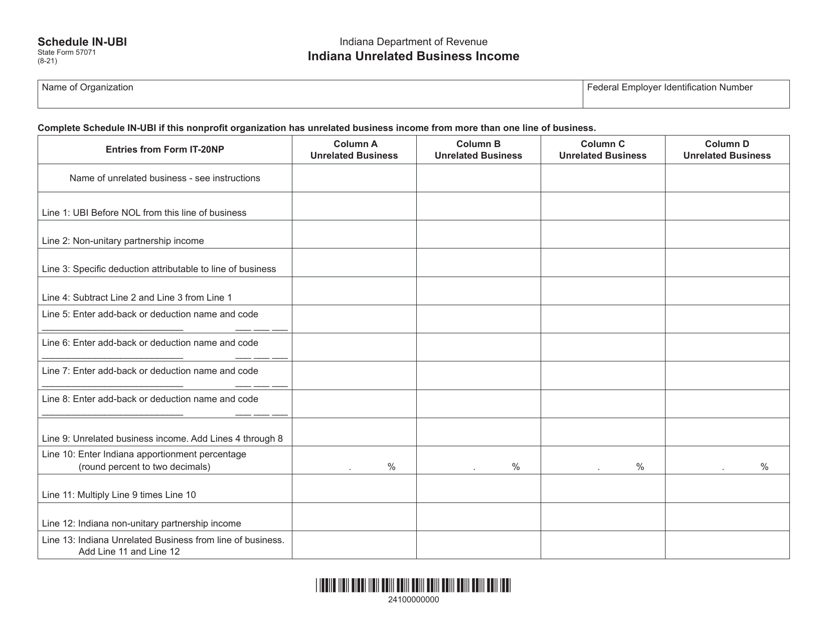

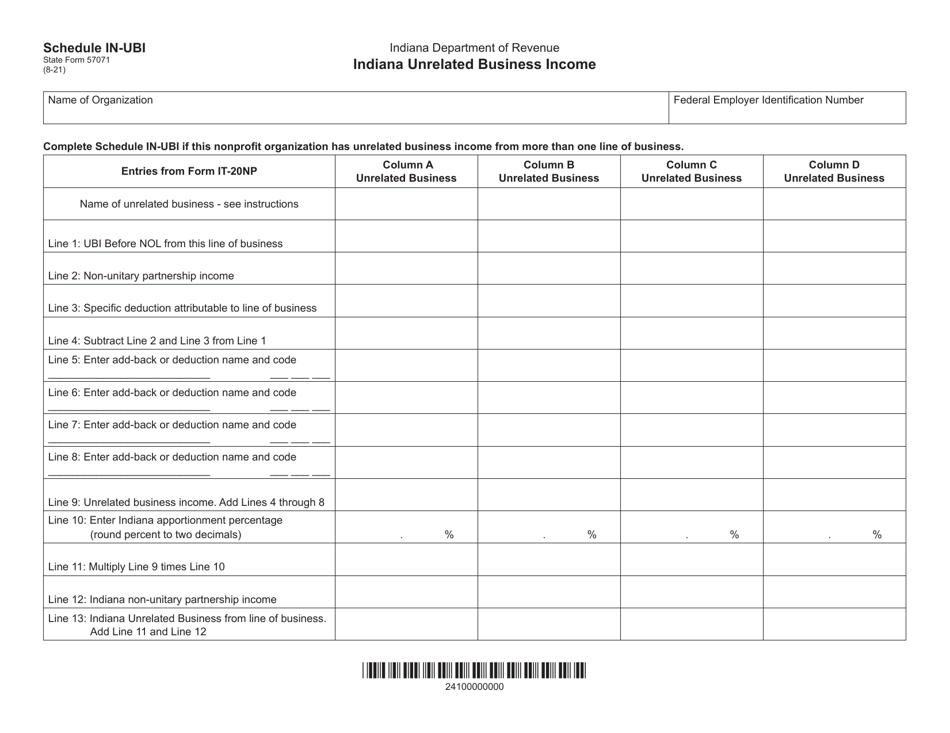

State Form 57071 Schedule IN-UBI Indiana Unrelated Business Income - Indiana

What Is State Form 57071 Schedule IN-UBI?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 57071 Schedule IN-UBI?

A: State Form 57071 Schedule IN-UBI is a form used in Indiana to report unrelated business income.

Q: What is unrelated business income?

A: Unrelated business income refers to income generated by a tax-exempt organization through activities not related to its tax-exempt purpose.

Q: Why do organizations need to report unrelated business income?

A: Organizations need to report unrelated business income to ensure compliance with tax laws and regulations.

Q: Who needs to file State Form 57071 Schedule IN-UBI?

A: Tax-exempt organizations in Indiana that have generated unrelated business income need to file State Form 57071 Schedule IN-UBI.

Q: When is the deadline to file State Form 57071 Schedule IN-UBI?

A: The deadline to file State Form 57071 Schedule IN-UBI is typically the same as the deadline for filing the organization's annual tax return.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 57071 Schedule IN-UBI by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.