This version of the form is not currently in use and is provided for reference only. Download this version of

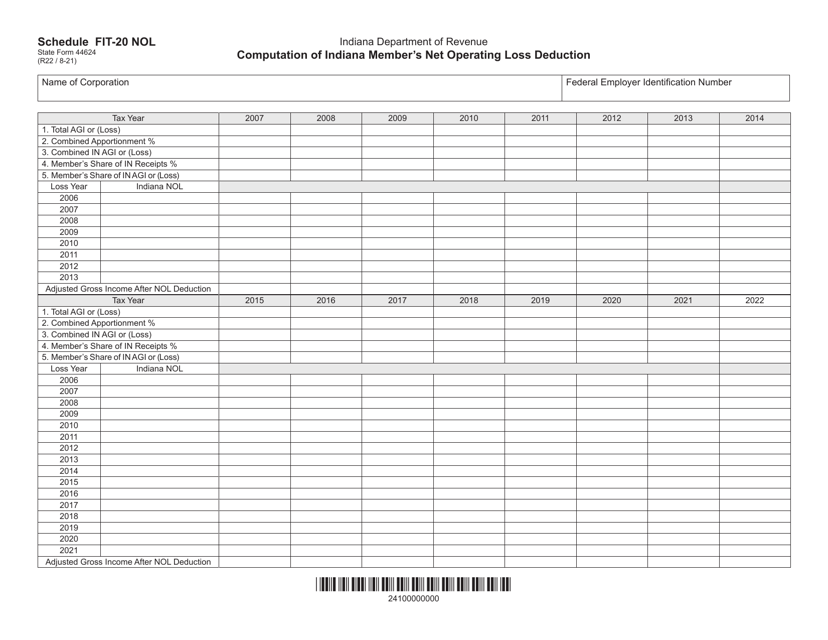

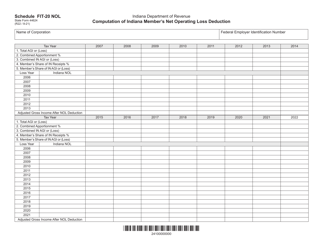

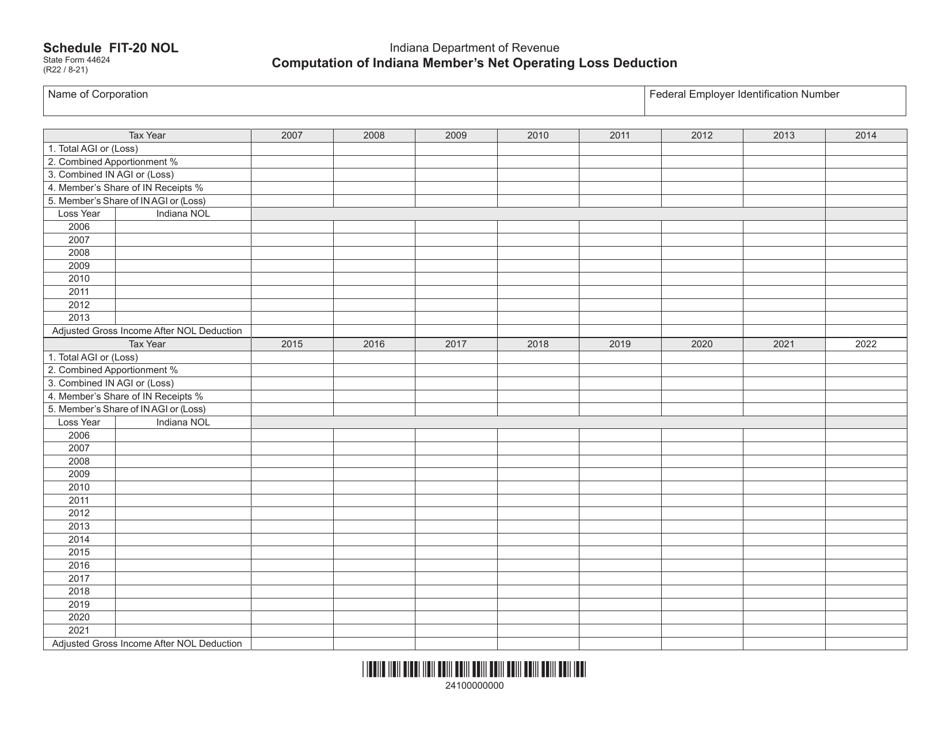

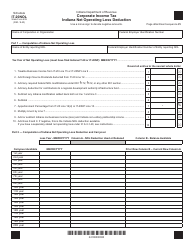

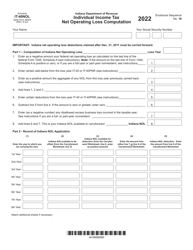

State Form 44624 Schedule FIT-20 NOL

for the current year.

State Form 44624 Schedule FIT-20 NOL Computation of Indiana Member's Net Operating Loss Deduction - Indiana

What Is State Form 44624 Schedule FIT-20 NOL?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 44624?

A: State Form 44624 is the form used in Indiana to compute the net operating loss deduction for Indiana members.

Q: What is Schedule FIT-20?

A: Schedule FIT-20 is a schedule on State Form 44624 used to compute the net operating loss deduction.

Q: What does NOL stand for?

A: NOL stands for Net Operating Loss.

Q: What is the purpose of the Indiana Member's Net Operating Loss Deduction?

A: The Indiana Member's Net Operating Loss Deduction is used to calculate the deduction that a member of an Indiana business can take for their share of the net operating loss.

Q: Who needs to file State Form 44624?

A: Indiana members of businesses with a net operating loss need to file State Form 44624.

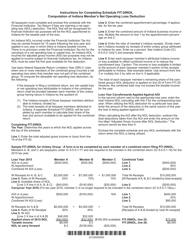

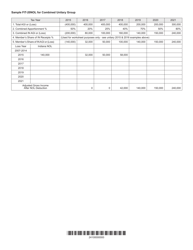

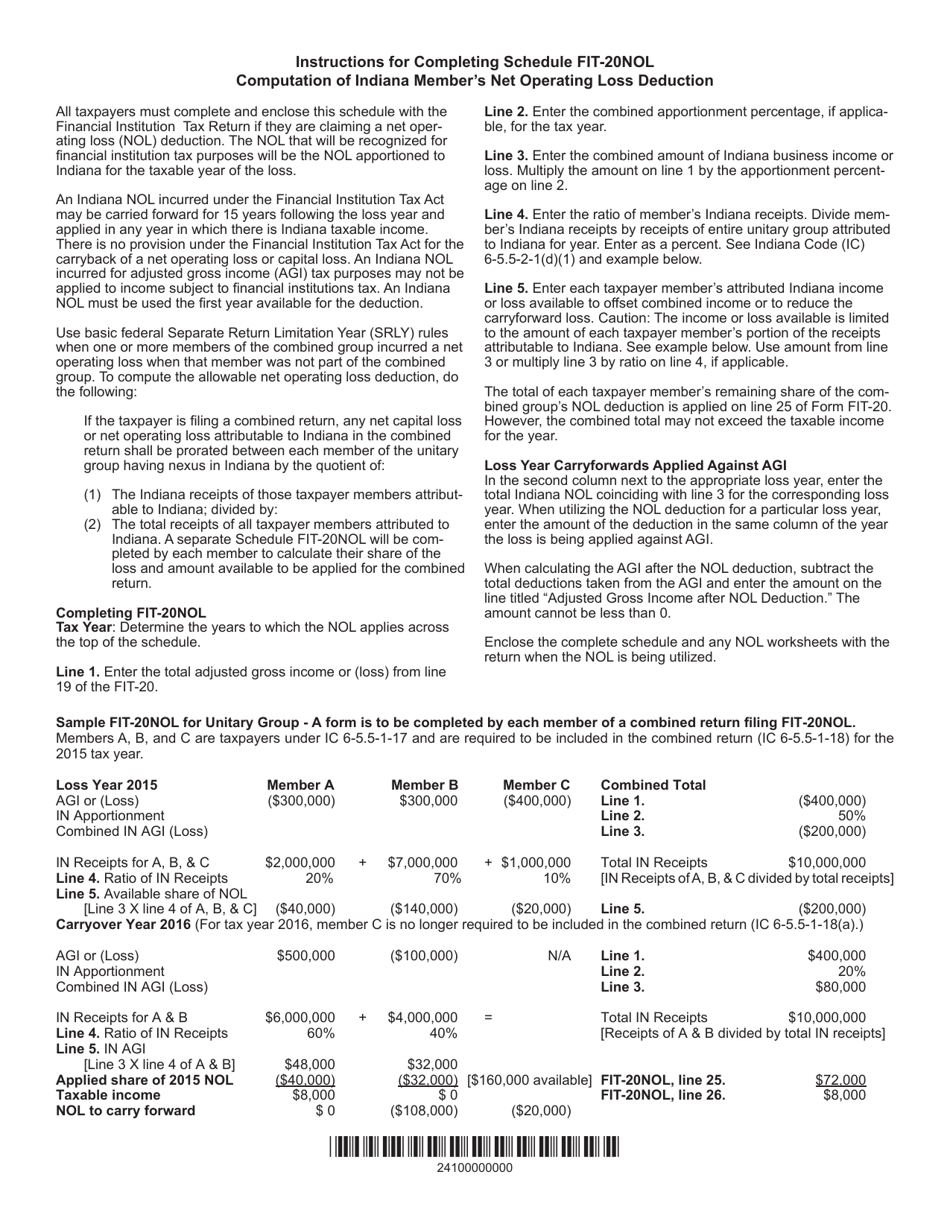

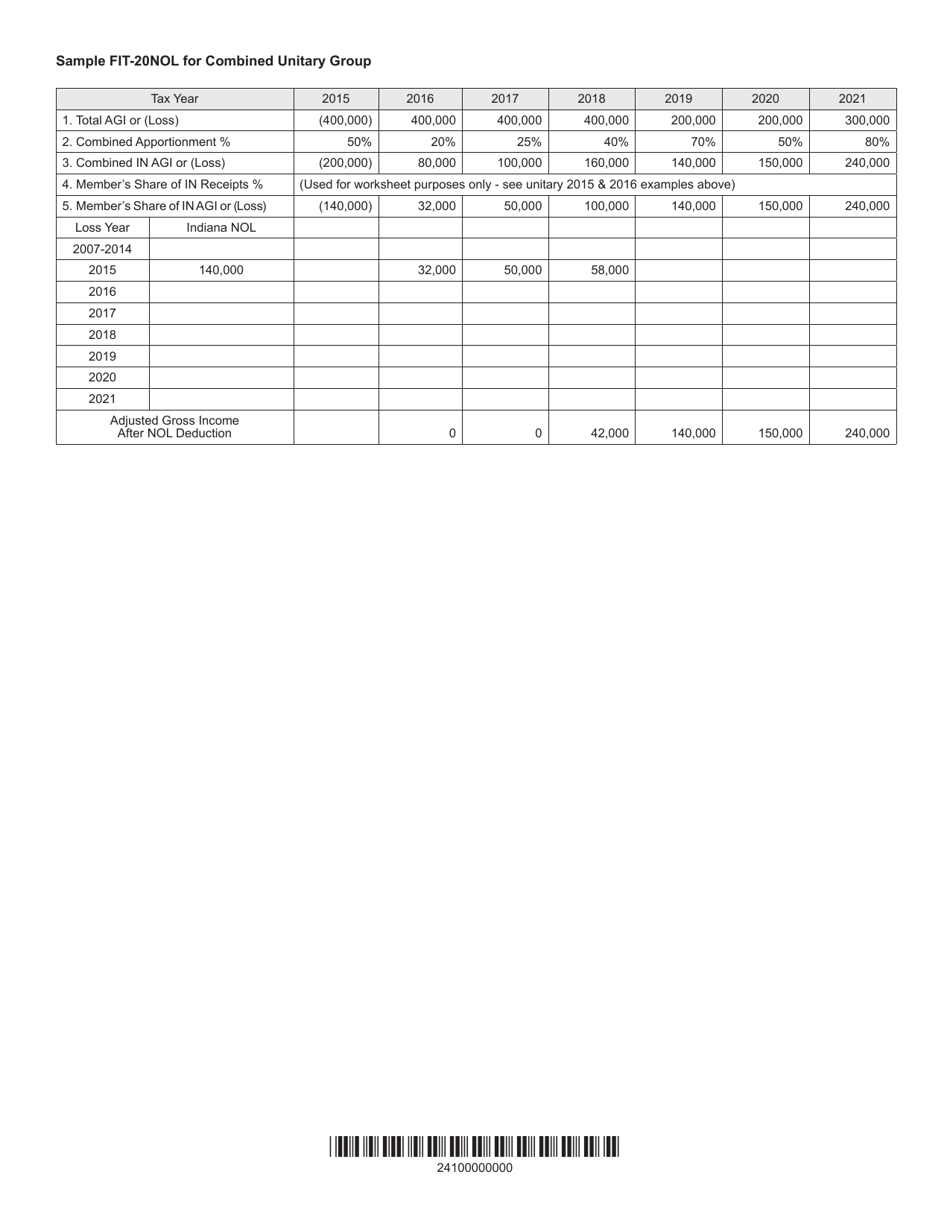

Q: Are there any specific requirements for filling out State Form 44624?

A: Yes, there are specific requirements for filling out State Form 44624. It is important to carefully read the instructions provided with the form to ensure accurate completion.

Q: What is the deadline for filing State Form 44624?

A: The deadline for filing State Form 44624 is usually the same as the deadline for filing the income tax return.

Q: Is the Net Operating Loss Deduction the same for all Indiana members?

A: No, the Net Operating Loss Deduction can vary for each Indiana member based on their share of the net operating loss.

Q: Can I claim the Net Operating Loss Deduction on my federal tax return as well?

A: Yes, you can claim the Net Operating Loss Deduction on your federal tax return, but you will need to use the appropriate federal form.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 44624 Schedule FIT-20 NOL by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.