This version of the form is not currently in use and is provided for reference only. Download this version of

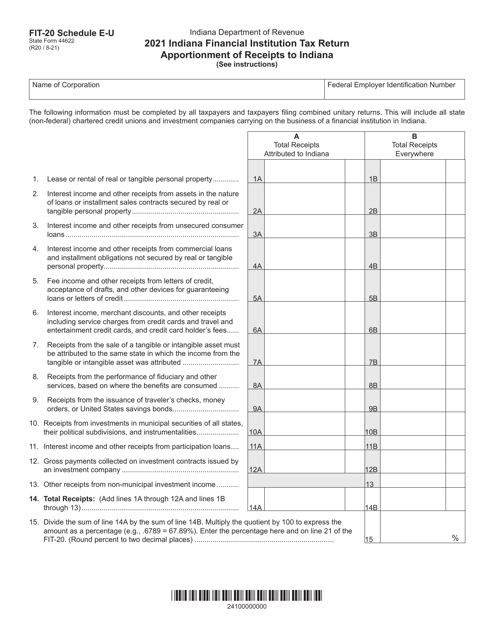

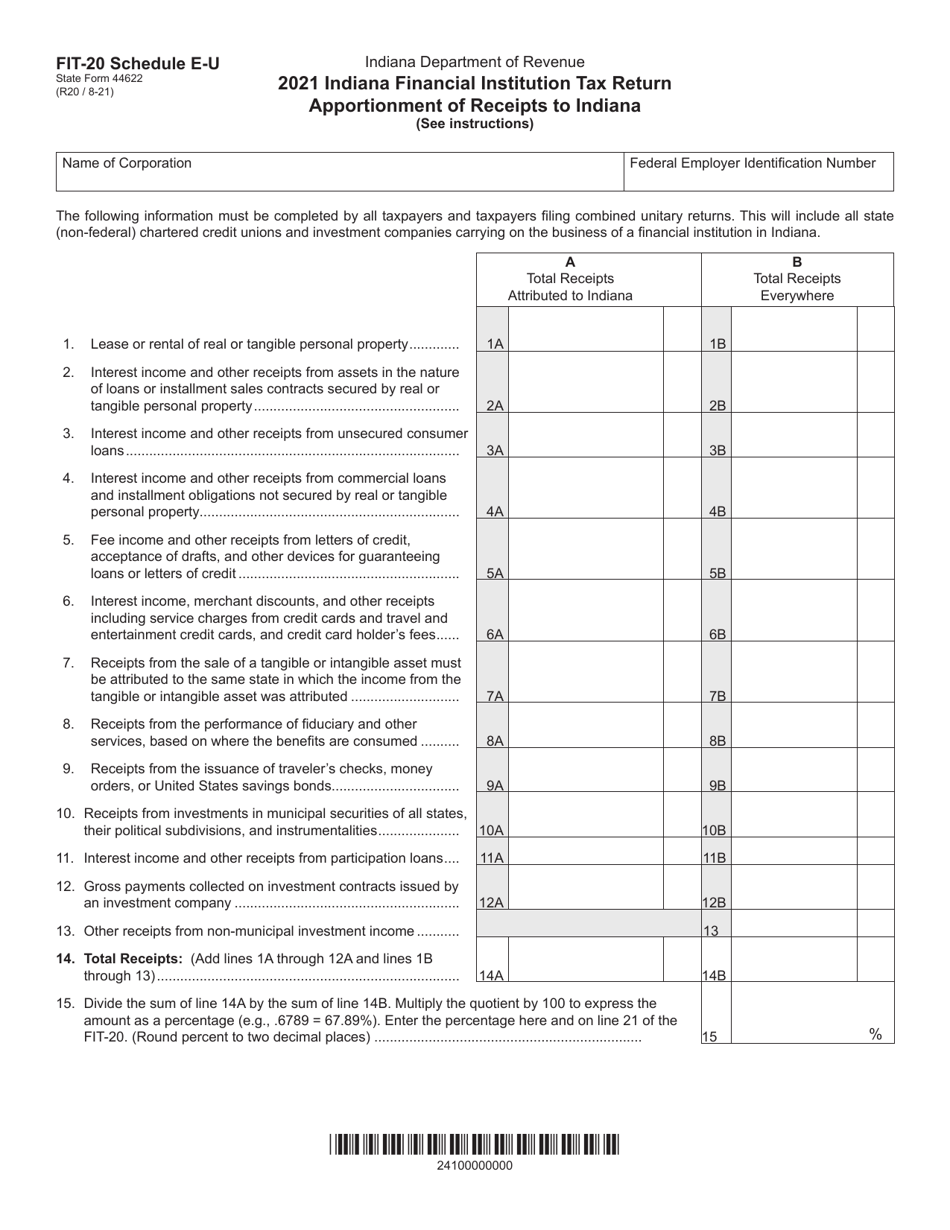

Form FIT-20 (State Form 44622) Schedule E-U

for the current year.

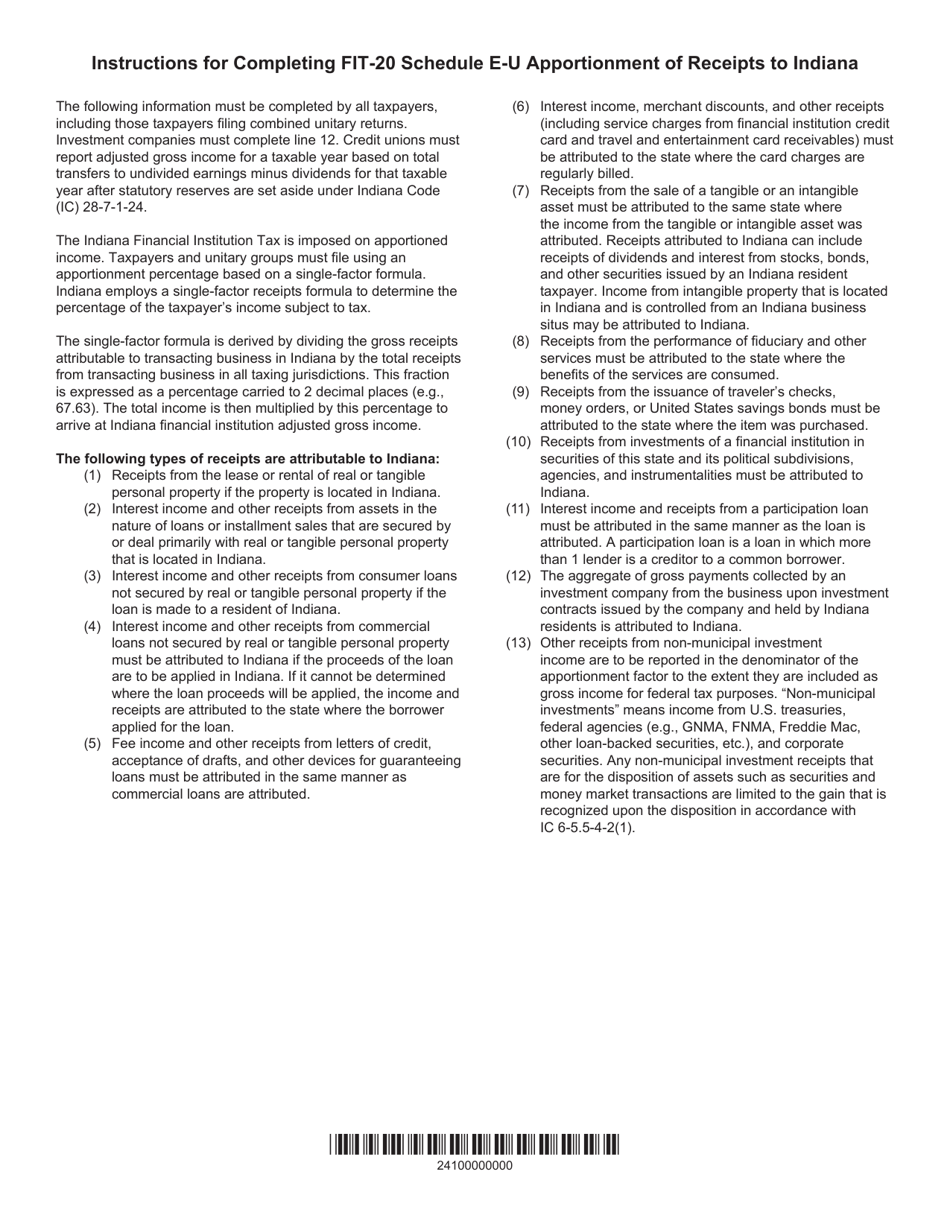

Form FIT-20 (State Form 44622) Schedule E-U Indiana Financial Institution Tax Return Apportionment of Receipts to Indiana - Indiana

What Is Form FIT-20 (State Form 44622) Schedule E-U?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana.The document is a supplement to Form FIT-20, Indiana Financial Institution Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

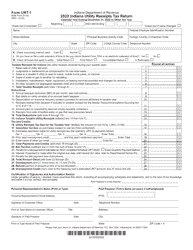

Q: What is Form FIT-20?

A: Form FIT-20 is the Indiana Financial Institution Tax Return.

Q: What is Schedule E-U?

A: Schedule E-U is used to calculate the apportionment of receipts to Indiana for the financial institution tax return.

Q: What is the purpose of Schedule E-U?

A: The purpose of Schedule E-U is to determine the portion of a financial institution's receipts that are subject to taxation in Indiana.

Q: Who should file Form FIT-20 and Schedule E-U?

A: Financial institutions that are liable for the Indiana Financial Institution Tax should file Form FIT-20 and Schedule E-U.

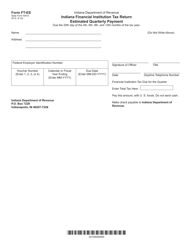

Q: What is the due date for filing Form FIT-20 and Schedule E-U?

A: The due date for filing Form FIT-20 and Schedule E-U is on or before the 15th day of the fourth month following the close of the financial institution's taxable year.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FIT-20 (State Form 44622) Schedule E-U by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.