This version of the form is not currently in use and is provided for reference only. Download this version of

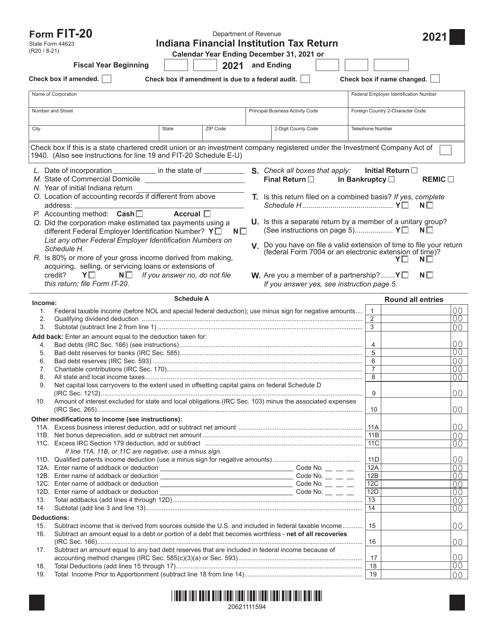

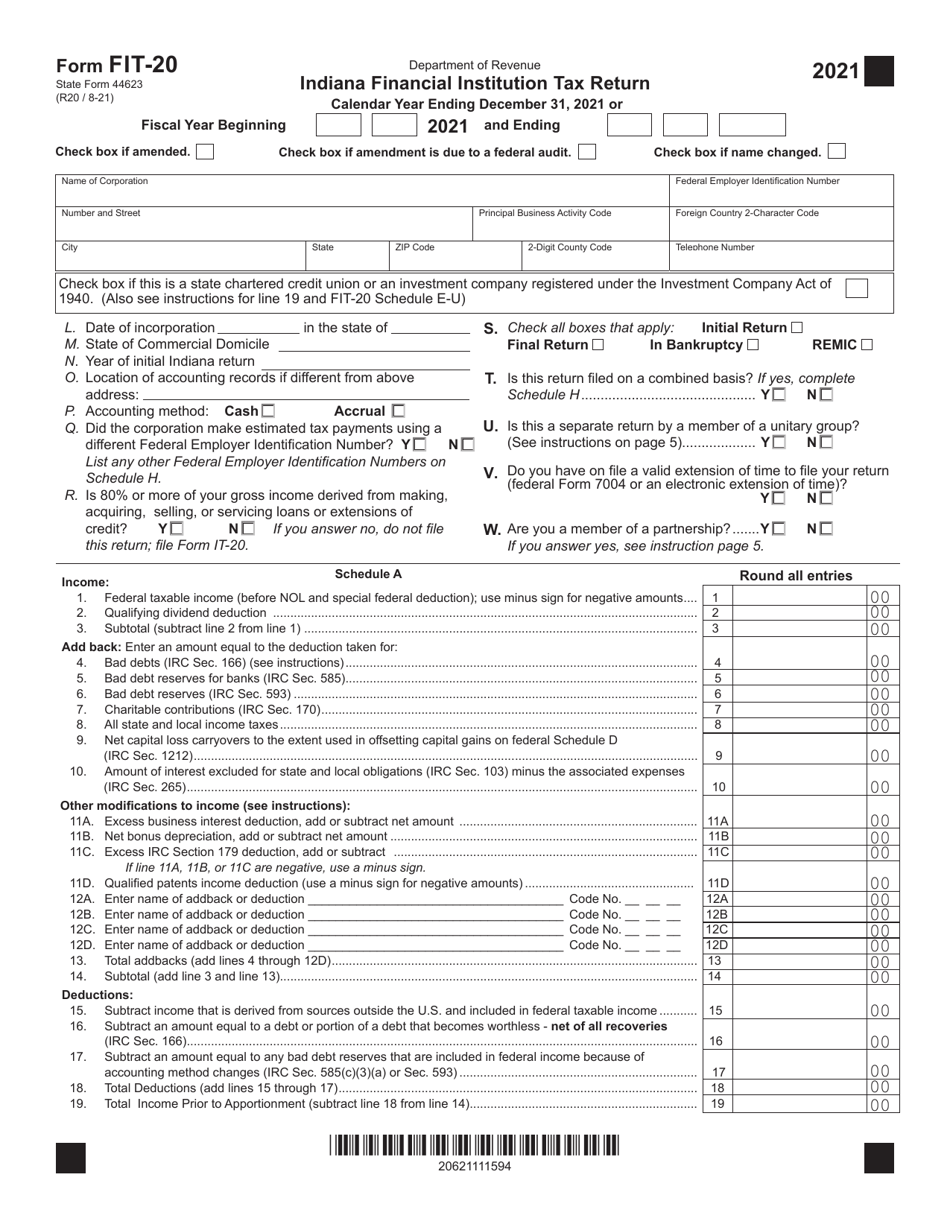

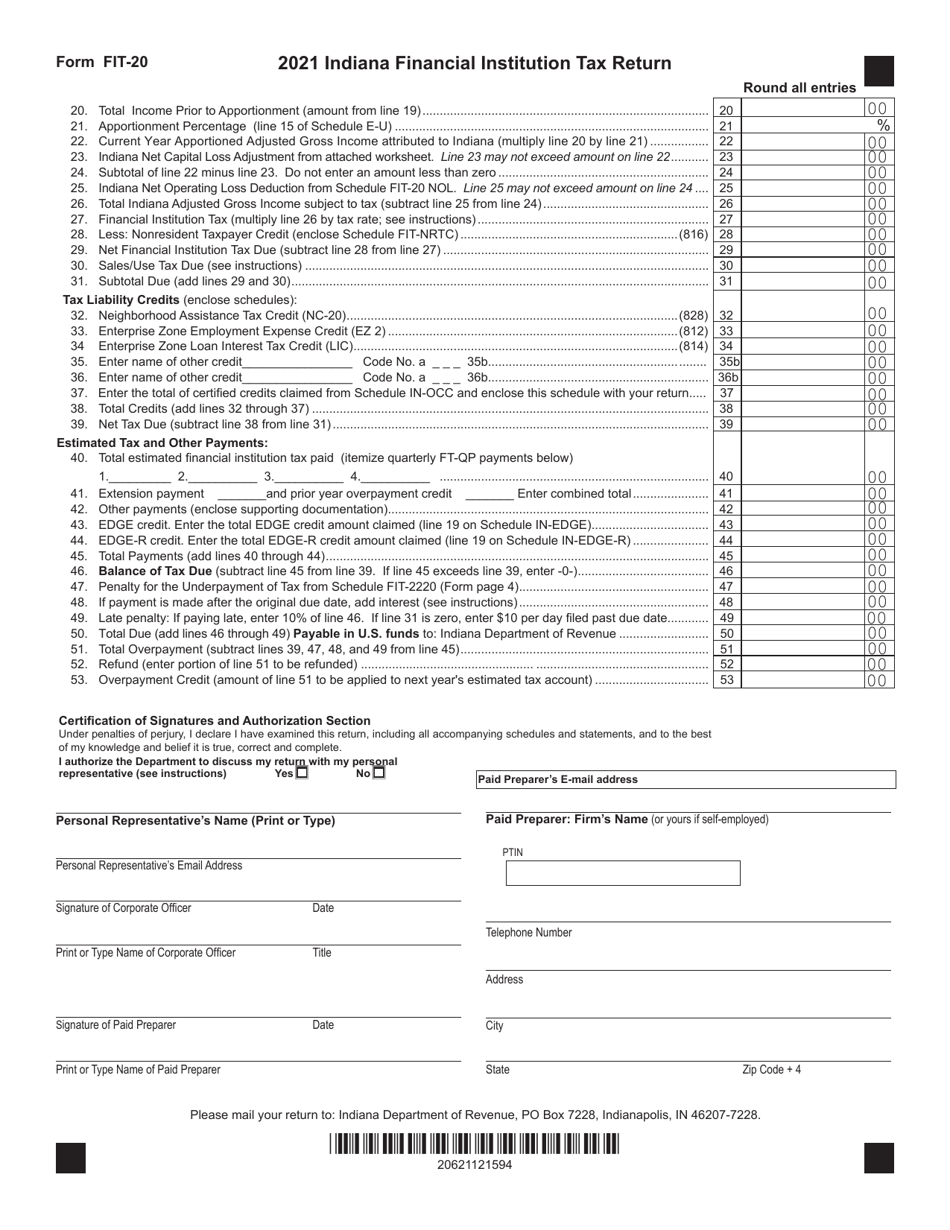

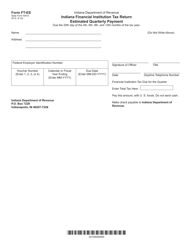

Form FIT-20 (State Form 44623)

for the current year.

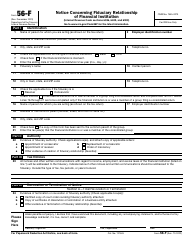

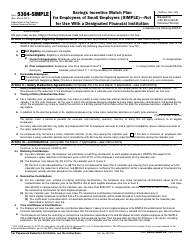

Form FIT-20 (State Form 44623) Indiana Financial Institution Tax Return - Indiana

What Is Form FIT-20 (State Form 44623)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FIT-20?

A: Form FIT-20 is the Indiana Financial Institution Tax Return.

Q: What is the purpose of Form FIT-20?

A: The purpose of Form FIT-20 is to report and pay the financial institution tax owed by Indiana financial institutions.

Q: Who needs to file Form FIT-20?

A: Indiana financial institutions, including banks, credit unions, and trust companies, need to file Form FIT-20.

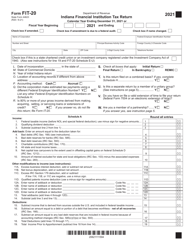

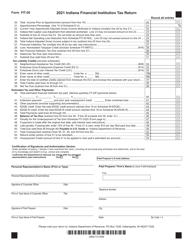

Q: What information is required on Form FIT-20?

A: Form FIT-20 requires information about the financial institution's income, deductions, and tax liability.

Q: When is Form FIT-20 due?

A: Form FIT-20 is due on or before the 15th day of the fourth month following the close of the financial institution's tax year.

Q: Are there any penalties for late filing of Form FIT-20?

A: Yes, late filing of Form FIT-20 may result in penalties and interest charges.

Q: Are there any exemptions or credits available on Form FIT-20?

A: Yes, there are certain exemptions and credits available on Form FIT-20. Consult the instructions accompanying the form for more information.

Q: Who can I contact for more information about Form FIT-20?

A: For more information about Form FIT-20, you can contact the Indiana Department of Revenue or consult the instructions accompanying the form.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FIT-20 (State Form 44623) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.