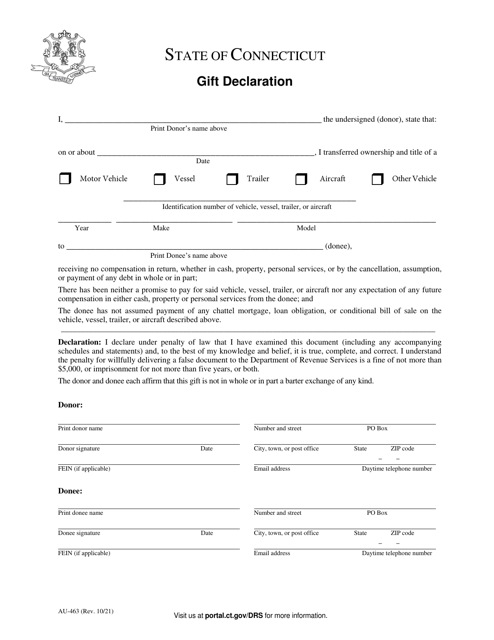

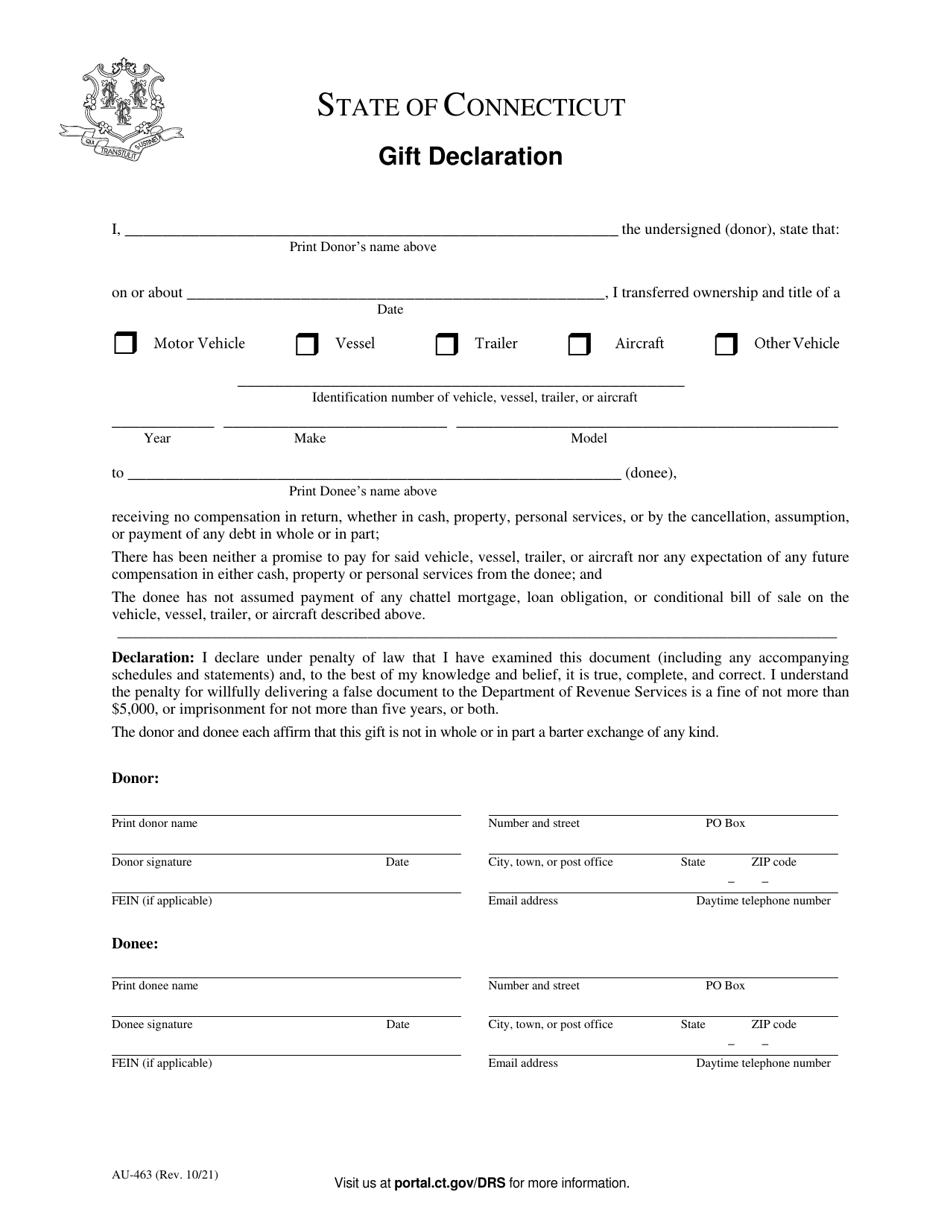

Form AU-463 Gift Declaration - Connecticut

What Is Form AU-463?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AU-463 Gift Declaration?

A: Form AU-463 Gift Declaration is a document used in the state of Connecticut to declare gifts received by an individual.

Q: Who needs to file Form AU-463 Gift Declaration?

A: Any individual who receives a gift worth $10,000 or more in a calendar year from a non-relative in Connecticut needs to file Form AU-463 Gift Declaration.

Q: What information is required on Form AU-463 Gift Declaration?

A: Form AU-463 Gift Declaration requires information such as the donor's name, address, and relationship to the recipient, as well as details about the gift, including its value and date of receipt.

Q: Is there a deadline for filing Form AU-463 Gift Declaration?

A: Yes, Form AU-463 Gift Declaration must be filed within 30 days of receiving the gift.

Q: Are there any penalties for not filing Form AU-463 Gift Declaration?

A: Yes, failure to file Form AU-463 Gift Declaration or providing false information can result in penalties, including fines and interest charges.

Q: What happens after I file Form AU-463 Gift Declaration?

A: Once you file Form AU-463 Gift Declaration, the Connecticut Department of Revenue Services will review the information provided and may follow up for further documentation or clarification, if needed.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AU-463 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.