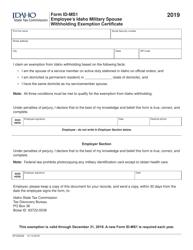

This version of the form is not currently in use and is provided for reference only. Download this version of

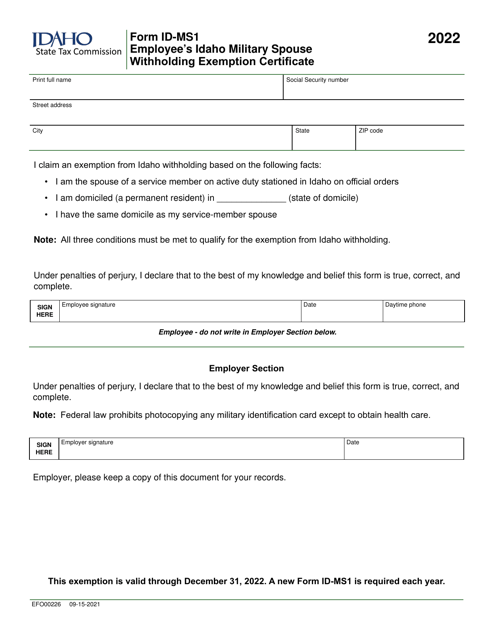

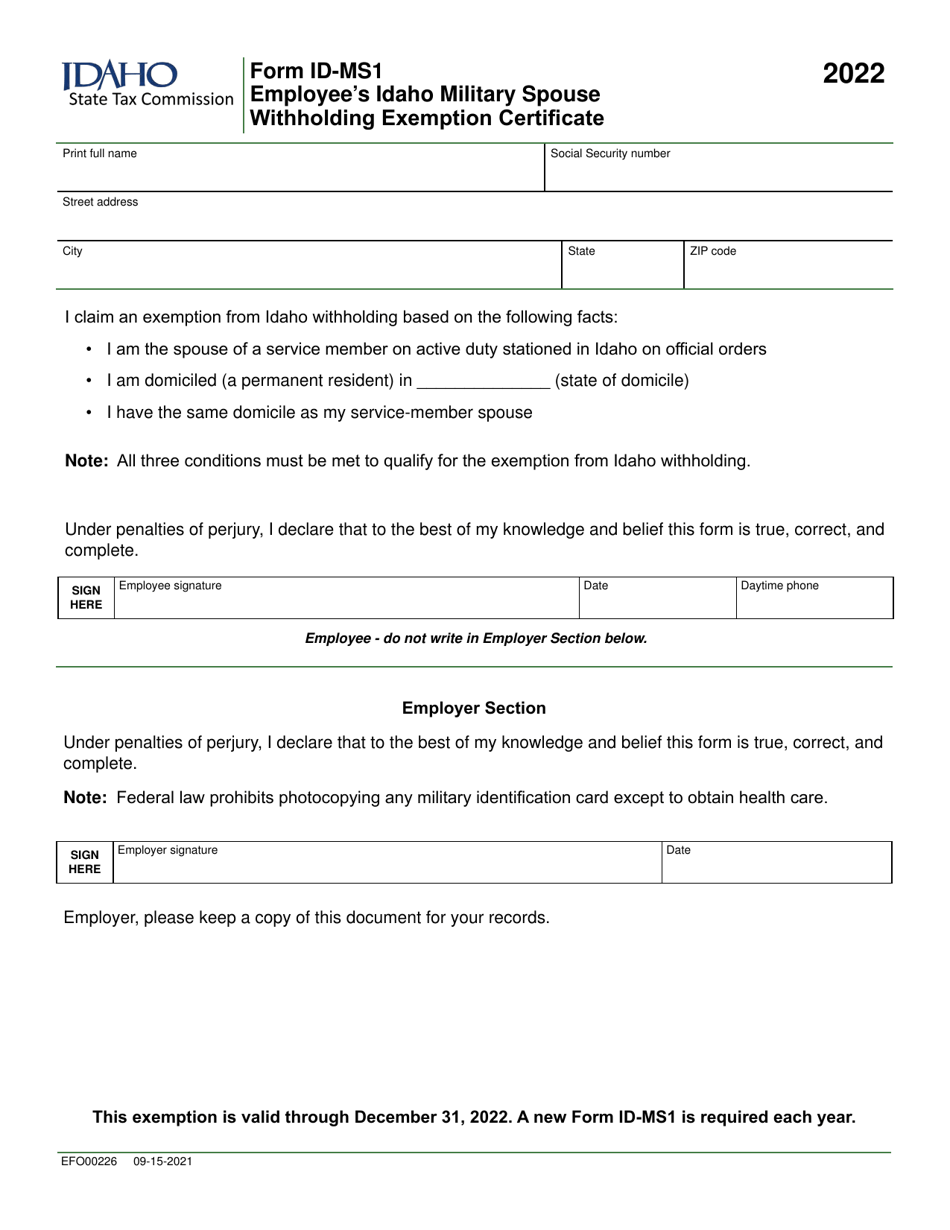

Form ID-MS1 (EFO00226)

for the current year.

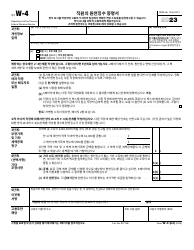

Form ID-MS1 (EFO00226) Employee's Idaho Military Spouse Withholding Exemption Certificate - Idaho

What Is Form ID-MS1 (EFO00226)?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ID-MS1?

A: Form ID-MS1 is the Employee's Idaho Military Spouse Withholding Exemption Certificate for Idaho.

Q: What is the purpose of Form ID-MS1?

A: The purpose of Form ID-MS1 is to declare your exemption from Idaho withholding tax as a military spouse.

Q: Who needs to fill out Form ID-MS1?

A: Military spouses who are exempt from Idaho withholding tax need to fill out Form ID-MS1.

Q: Do I need to submit Form ID-MS1 every year?

A: No, you only need to submit Form ID-MS1 once unless your circumstances change.

Q: Is there a deadline for submitting Form ID-MS1?

A: There is no specific deadline for submitting Form ID-MS1, but it is recommended to submit it as soon as possible.

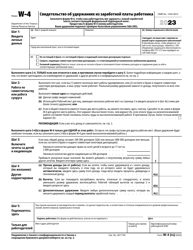

Q: Can I claim exemption from both federal and Idaho withholding tax?

A: Yes, you can claim exemption from both federal and Idaho withholding tax if you meet the eligibility criteria.

Q: What should I do if my exemption status changes?

A: If your exemption status changes, you must submit a new Form ID-MS1 to your employer.

Q: Can I use Form ID-MS1 for other states?

A: No, Form ID-MS1 is specific to Idaho. If you are a military spouse in another state, you will need to check that state's requirements.

Q: What if I have more questions about Form ID-MS1?

A: If you have more questions about Form ID-MS1, you can contact the Idaho State Tax Commission or consult a tax professional.

Form Details:

- Released on September 15, 2021;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ID-MS1 (EFO00226) by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.