This version of the form is not currently in use and is provided for reference only. Download this version of

Form 83 (EFO00011)

for the current year.

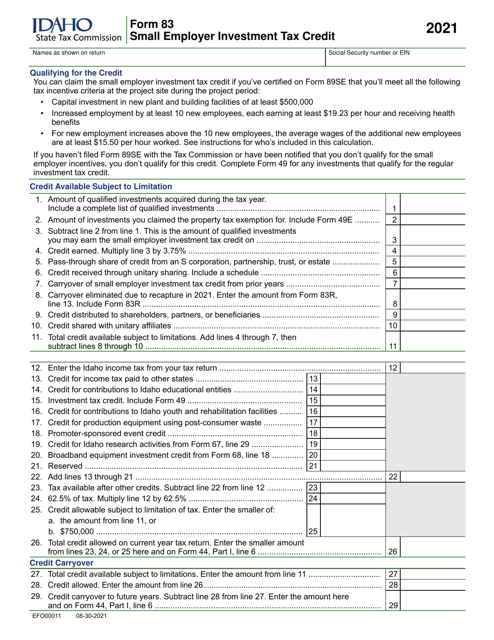

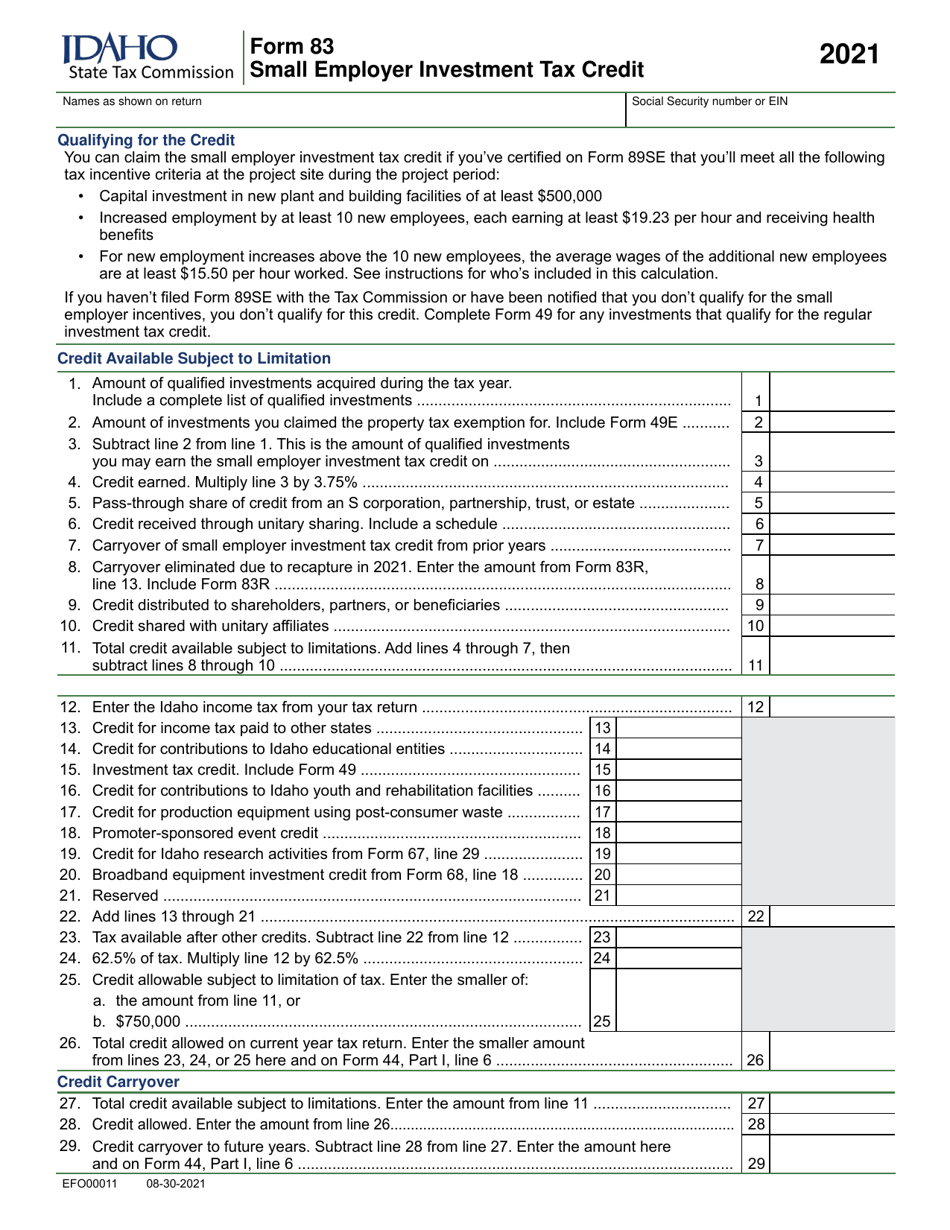

Form 83 (EFO00011) Small Employer Investment Tax Credit - Idaho

What Is Form 83 (EFO00011)?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 83 (EFO00011)?

A: Form 83 (EFO00011) is a tax form used to claim the Small Employer Investment Tax Credit in Idaho.

Q: What is the Small Employer Investment Tax Credit?

A: The Small Employer Investment Tax Credit is a tax credit available to small employers in Idaho who invest in qualified property.

Q: Who is eligible for the Small Employer Investment Tax Credit?

A: Small employers in Idaho who invest in qualified property are eligible for the tax credit.

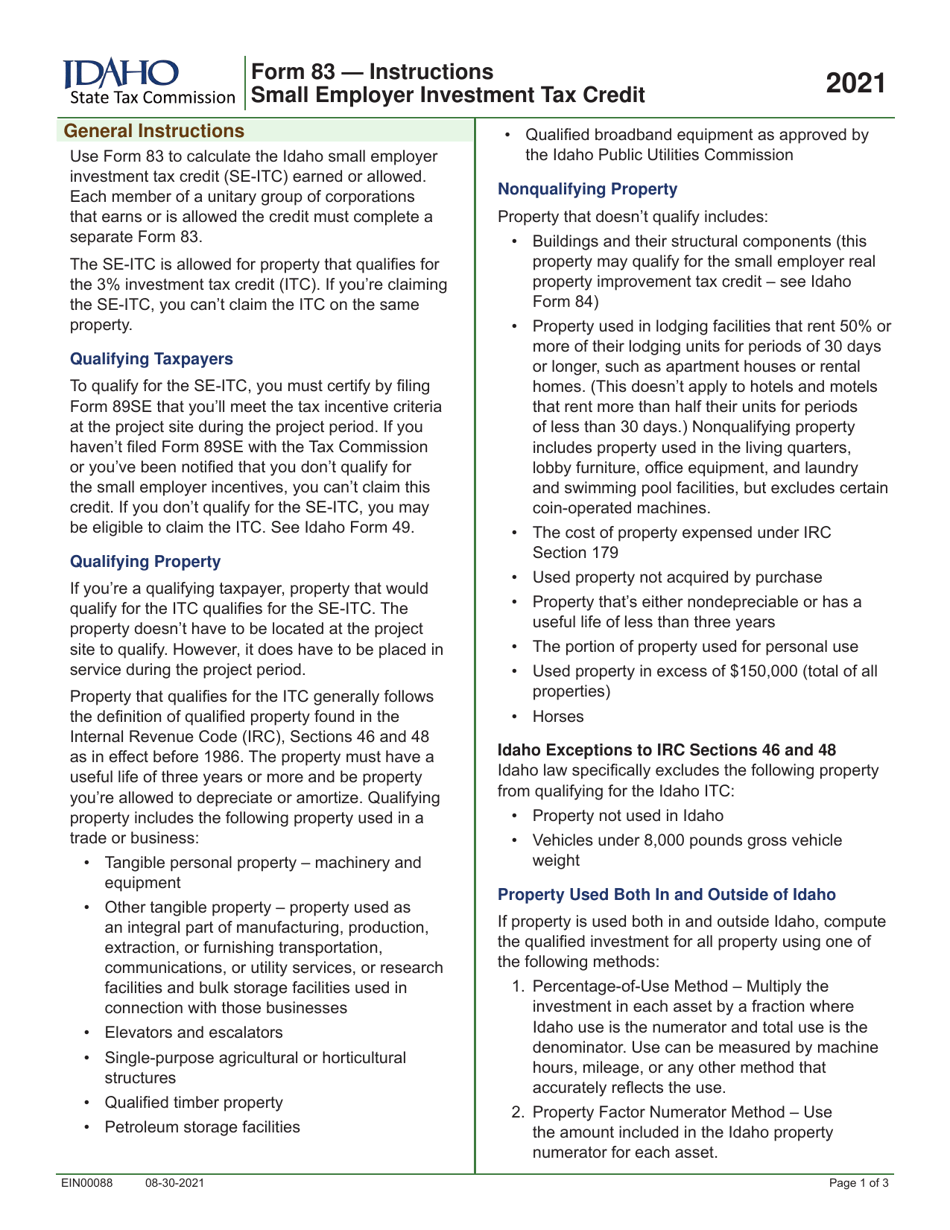

Q: What is qualified property?

A: Qualified property includes depreciable property that is used in a trade or business in Idaho.

Q: How much is the Small Employer Investment Tax Credit?

A: The tax credit is equal to 3% of the cost of qualified property, up to a maximum of $10,000 per year.

Q: How do I claim the Small Employer Investment Tax Credit?

A: You can claim the tax credit by filling out Form 83 (EFO00011) and attaching it to your Idaho tax return.

Form Details:

- Released on August 30, 2021;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 83 (EFO00011) by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.