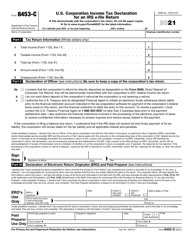

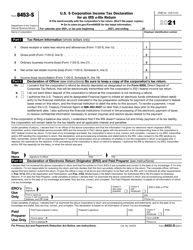

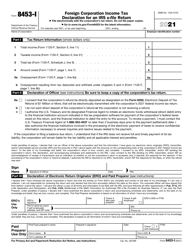

This version of the form is not currently in use and is provided for reference only. Download this version of

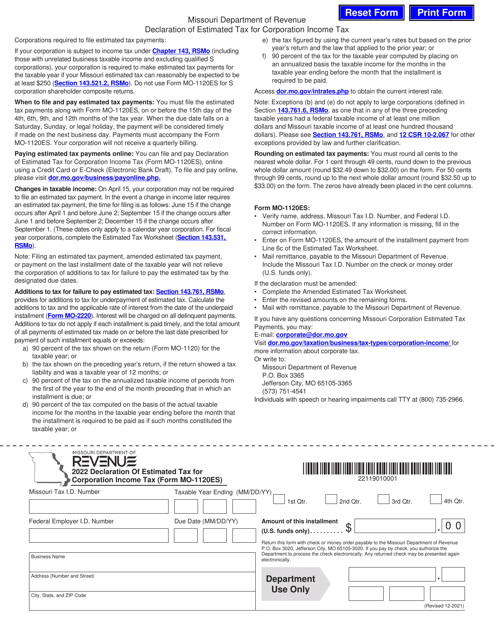

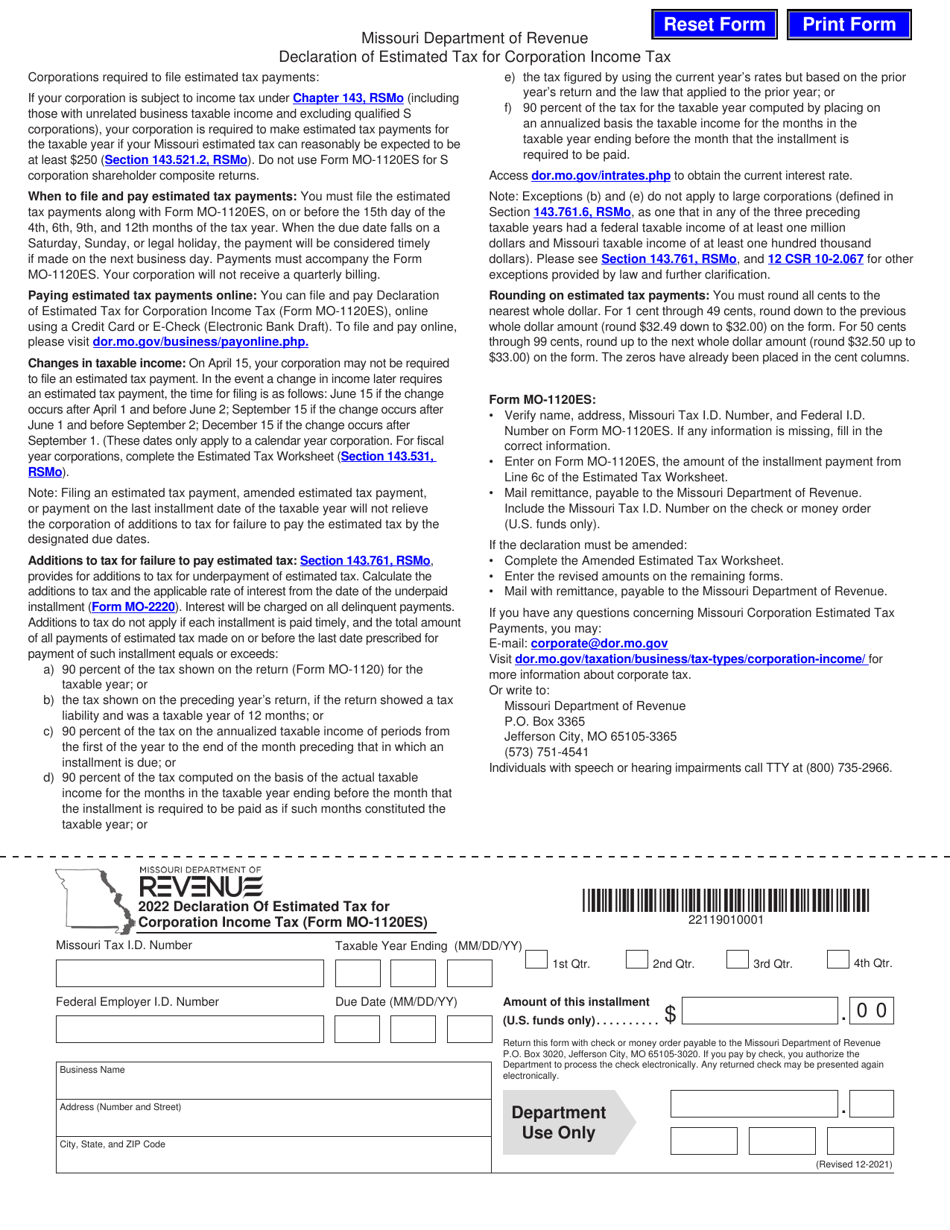

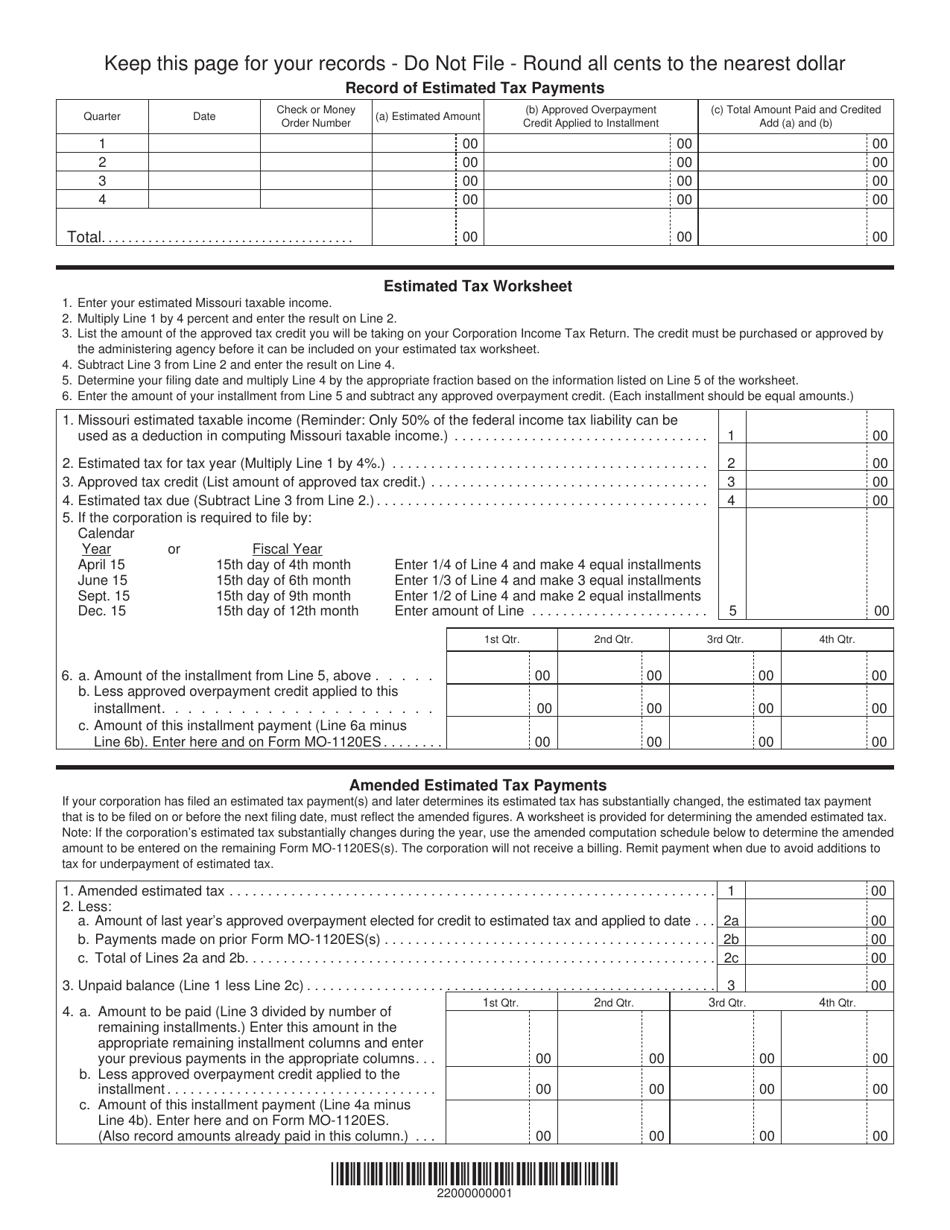

Form MO-1120ES

for the current year.

Form MO-1120ES Declaration of Estimated Tax for Corporation Income Tax - Missouri

What Is Form MO-1120ES?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-1120ES?

A: Form MO-1120ES is the declaration of estimated tax for corporation income tax in Missouri.

Q: Who needs to file Form MO-1120ES?

A: Corporations that expect to owe more than $200 in Missouri income tax for the tax year must file Form MO-1120ES.

Q: What is the purpose of Form MO-1120ES?

A: The purpose of Form MO-1120ES is to report and pay estimated income tax for corporations in Missouri.

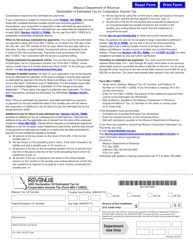

Q: When is Form MO-1120ES due?

A: Form MO-1120ES is due on the 15th day of the 4th, 6th, 9th, and 12th months of the tax year.

Q: What happens if I don't file Form MO-1120ES?

A: Failure to file Form MO-1120ES or pay the estimated tax may result in penalties and interest.

Q: Are there any additional forms or schedules that need to be filed with Form MO-1120ES?

A: Generally, no additional forms or schedules need to be filed with Form MO-1120ES, unless specific circumstances apply.

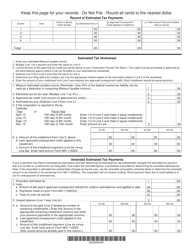

Q: Can I make changes to a filed Form MO-1120ES?

A: Yes, changes can be made to a filed Form MO-1120ES by filing an amended return using Form MO-1120X.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-1120ES by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.