This version of the form is not currently in use and is provided for reference only. Download this version of

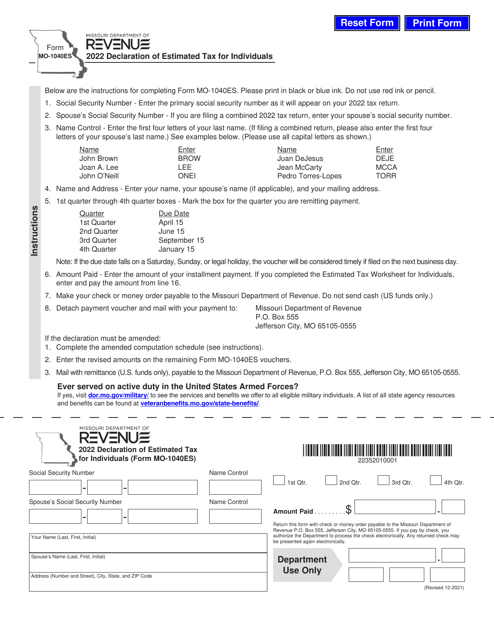

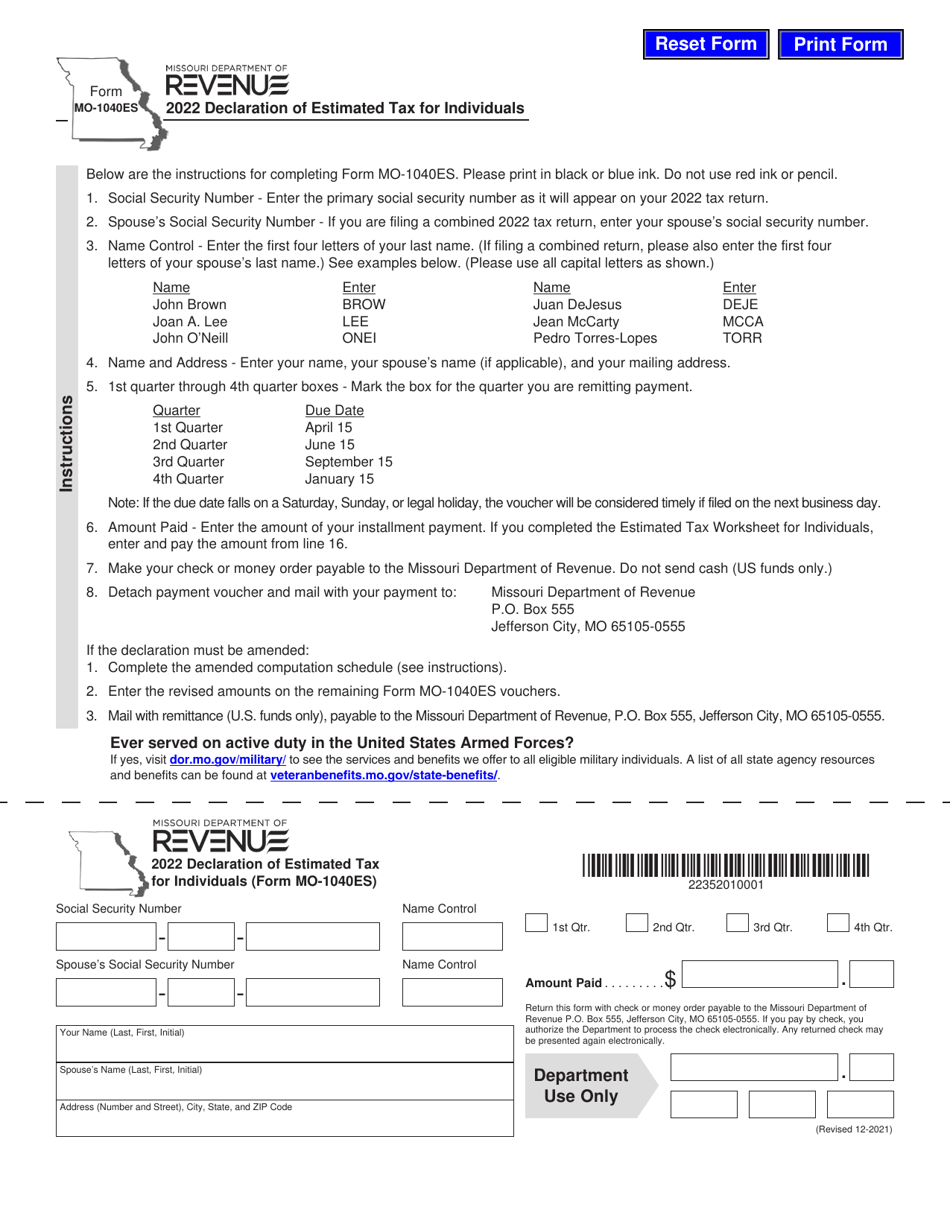

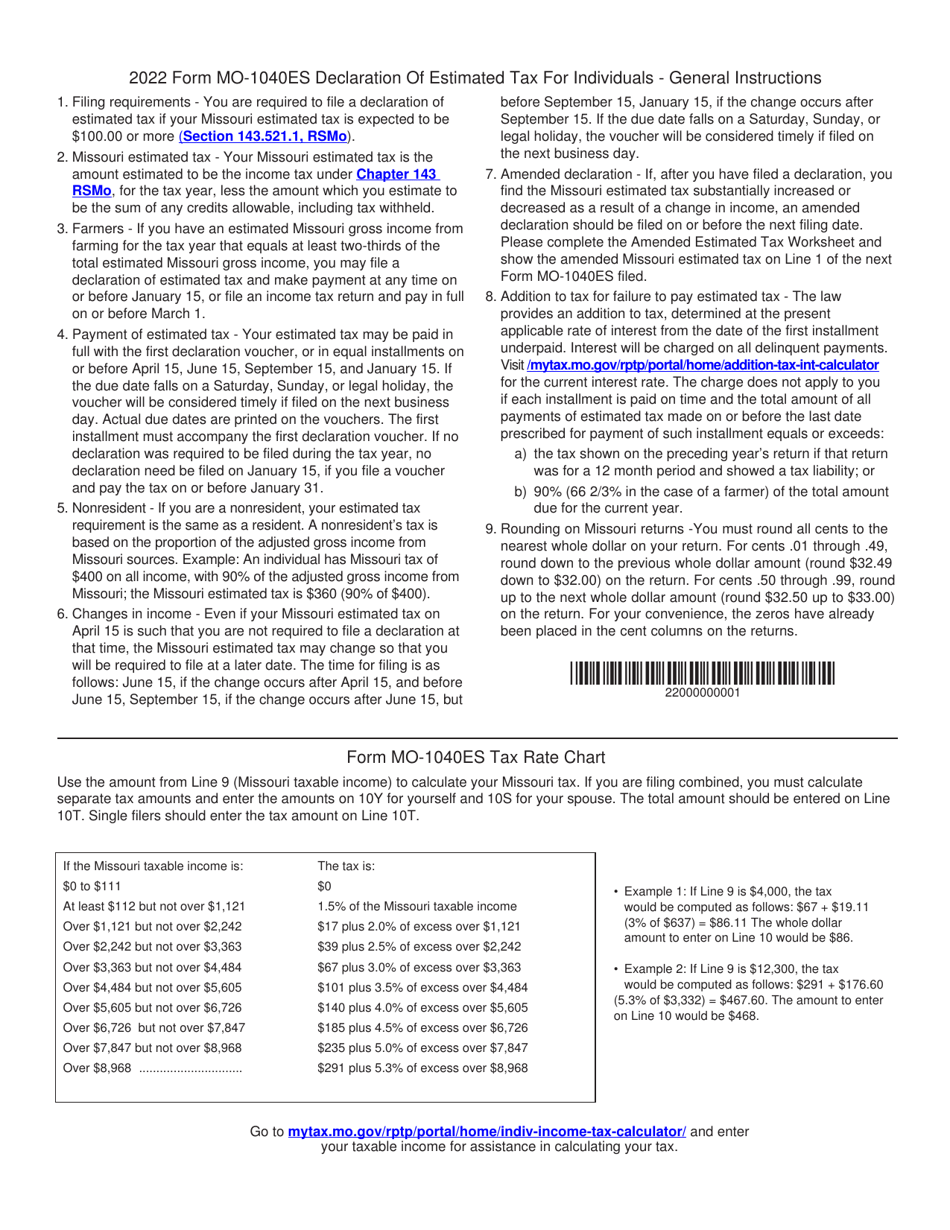

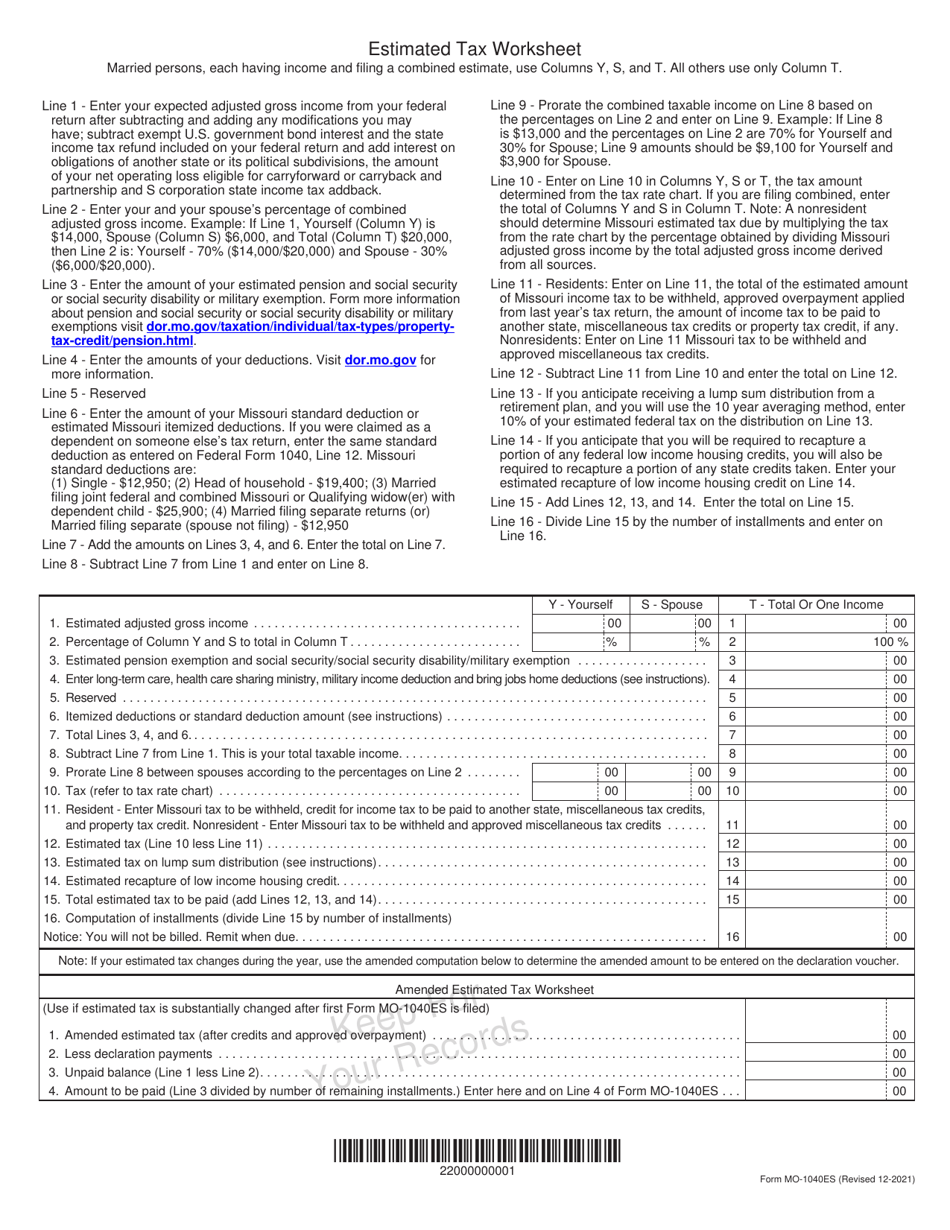

Form MO-1040ES

for the current year.

Form MO-1040ES Declaration of Estimated Tax for Individuals - Missouri

What Is Form MO-1040ES?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MO-1040ES form?

A: The MO-1040ES form is the Declaration of Estimated Tax for Individuals in Missouri.

Q: Who needs to fill out the MO-1040ES form?

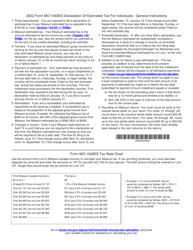

A: Individuals in Missouri who expect to owe at least $150 in state income tax for the year must fill out the MO-1040ES form.

Q: What is the purpose of the MO-1040ES form?

A: The purpose of the MO-1040ES form is to report and pay estimated state income tax throughout the year.

Q: When is the deadline to file the MO-1040ES form?

A: The MO-1040ES form is typically due on April 15th of each year.

Q: What happens if I don't file the MO-1040ES form?

A: If you don't file the MO-1040ES form or underpay your estimated tax, you may be subject to penalties and interest.

Form Details:

- Released on December 1, 2021;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-1040ES by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.